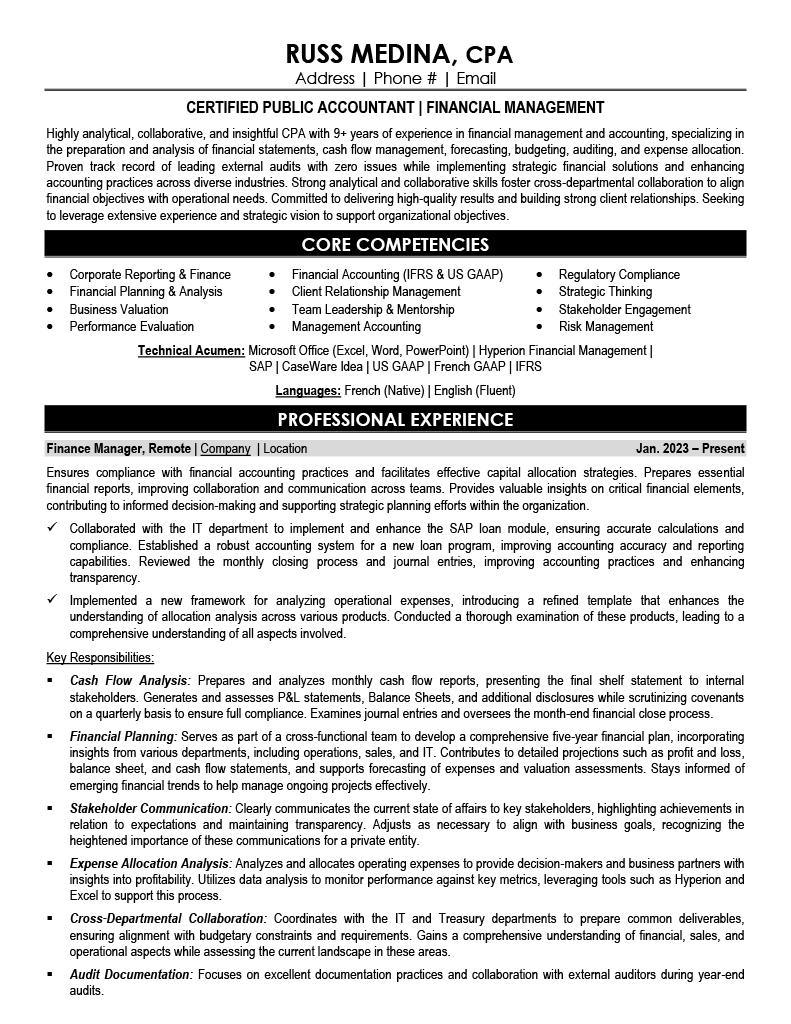

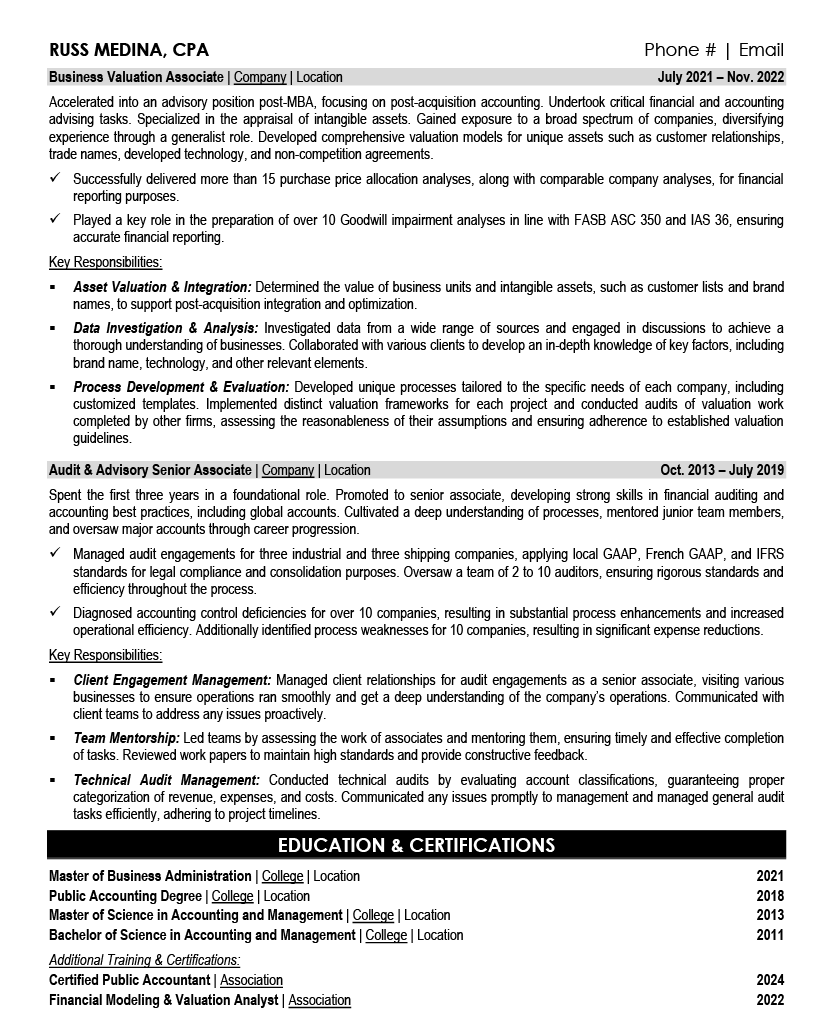

Numbers tell stories, but most cost accountant resumes read like dry spreadsheets. Your expertise goes far beyond basic calculations and data entry, yet showing that value on paper remains a constant challenge.

Are you struggling to translate your financial impact into compelling resume content? You need a document that showcases both your technical skills and your strategic contributions to the bottom line.

Resume Target specializes in helping cost accountants transform complex achievements into clear, powerful statements. We'll help you create a resume that speaks directly to hiring managers and demonstrates your ability to drive financial efficiency and business growth.

Behind every successful business decision lies the precise calculations of a Cost Accountant who helps companies understand exactly where their money goes, including their crucial role in installing and managing systems that track financial and budgetary data.

As a Cost Accountant, you'll dive deep into the numbers, analyzing everything from raw material expenses to labor costs, helping businesses optimize their operations and maximize profitability through detailed financial analysis and reporting.

Whether you're just starting out or looking to advance your career, the path of a Cost Accountant offers numerous opportunities to grow into senior positions, specialize in specific industries, or even transition into broader financial management roles.

Let's talk about the exciting earning potential in cost accounting! As businesses focus more on financial efficiency, your expertise as a Cost Accountant is becoming increasingly valuable. The field offers impressive compensation that grows substantially with your experience and specialization.

Figures from: Salary.com

Starting as a Cost Accountant opens doors to diverse financial leadership roles. With the right certifications and experience, you can progress from analyzing costs to directing entire financial strategies.

To accelerate your career growth, you'll need to master both technical expertise and leadership capabilities that go beyond basic accounting skills.

- Advanced Cost Analysis Software Proficiency - Enterprise Resource Planning (ERP) Systems - Financial Modeling and Forecasting - Strategic Communication and Team LeadershipLaunch your cost accounting career by combining a bachelor's degree in accounting or finance with hands-on experience in cost analysis, budgeting, and financial reporting systems.

To build your path toward becoming a cost accountant, you'll need to develop key competencies including data analysis, problem-solving, and communication abilities through progressive experience.

Requirements from Franklin University

With 62% of companies actively hiring finance roles, cost accountants are finding opportunities across both coasts and midwest.

Figures from Accounting.com

Struggling to translate your knack for numbers, cost analysis expertise, and financial acumen into a compelling resume that catches a hiring manager's eye? This comprehensive, section-by-section guide will show you exactly how to create a professional cost accountant resume that highlights your achievements and demonstrates your value to potential employers.

If you're like most Cost Accountants, translating your daily expertise with budgets, variance analysis, and cost control systems into a compelling resume summary can feel more challenging than reconciling a complex general ledger.

While you excel at tracking expenses and identifying cost-saving opportunities, showcasing these valuable skills to hiring managers requires a different approach - one that quickly demonstrates how your financial acumen and analytical abilities can positively impact their bottom line.

How would you describe your overall approach to cost analysis and financial control systems that sets you apart from other cost accounting professionals?

Reason: This helps establish your professional identity and methodology, allowing you to showcase your unique perspective on cost accounting that employers value. It sets the tone for your entire resume by highlighting your core professional philosophy.

What combination of technical accounting expertise and industry-specific cost management knowledge best defines your professional toolkit?

Reason: This question helps you articulate your blend of hard and soft skills specifically relevant to cost accounting, from ERP systems to manufacturing cost analysis, giving employers a clear picture of your professional capabilities.

How would you characterize your ability to bridge the gap between complex cost accounting data and actionable business insights for stakeholders?

Reason: This prompts you to highlight your communication and analytical abilities in translating technical information into business value, which is a crucial differentiator for senior cost accounting roles.

As a Cost Accountant, your resume needs to showcase both your technical accounting expertise and your analytical capabilities, from variance analysis to production cost optimization.

Your skill set should reflect your ability to handle day-to-day cost accounting tasks like standard costing and inventory valuation, while also highlighting strategic competencies such as implementing cost control measures and developing financial forecasting models.

Showcase your financial expertise by organizing your work history into three powerful sections: a concise role overview that sets the stage, measurable achievements that highlight your cost-saving wins, and core responsibilities that demonstrate your mastery of cost accounting fundamentals.

Many Cost Accountants struggle to translate their daily financial analysis and cost-saving initiatives into compelling resume achievements that capture attention. Transform your complex cost management victories into clear, quantifiable wins by connecting your actions directly to improved profitability, reduced expenses, and enhanced operational efficiency.

The responsibilities section demonstrates how Cost Accountants drive financial efficiency and maintain cost control systems beyond basic bookkeeping. Your duties should clearly show how you connect detailed cost analysis to broader business operations while making technical accounting work understandable to non-financial stakeholders.

Your education and professional certifications are crucial proof points of your expertise in cost accounting and financial analysis. Prioritize your most relevant credentials, especially those focused on cost management, manufacturing accounting, and ERP systems, listing them in reverse chronological order.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing cost accounting positions.

While many candidates stop at customizing their cover letter, successful cost accountant job seekers know that personalizing their resume for each role is what truly sets them apart in this competitive field.

By strategically incorporating specific cost accounting keywords, systems, and responsibilities from each job posting, your tailored resume will not only sail through ATS screening but will also immediately show hiring managers you're the perfect match for their accounting team.

Ready to turn your resume into your secret weapon? Let's make every word count and show employers you're the cost accounting expert they've been searching for!

Don't let a lack of work history hold you back from launching your career as a Cost Accountant!

Your academic background in accounting, combined with your analytical skills and any relevant internships or class projects, can create a compelling case for employers.

Focus on highlighting your knowledge of cost accounting principles, proficiency with accounting software, and any experience with financial analysis or budgeting.

For more guidance on structuring your resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications effectively.

Your resume summary is your chance to showcase your fresh accounting knowledge, internship experiences, and technical proficiencies that make you an ideal candidate for cost accounting roles.

Focus on highlighting your relevant coursework, any cost analysis projects, and your understanding of accounting software to demonstrate your readiness to add value from day one.

"Detail-oriented and analytical Cost Accountant with strong academic foundation in cost analysis, managerial accounting, and ERP systems. Completed internship at manufacturing firm analyzing production costs and variance reports, resulting in 15% improvement in cost tracking accuracy. Proficient in SAP, Excel, and cost allocation methodologies, with proven ability to support data-driven decision-making. Seeking to leverage academic excellence and practical experience to contribute to a dynamic organization's cost control initiatives."

Now's your chance to showcase the specialized accounting knowledge and analytical skills you've developed through your academic journey!

Don't just list your degree - highlight relevant coursework like "Advanced Cost Analysis"or "Managerial Accounting,"and feature impactful projects where you applied cost allocation methods or developed budgeting systems.

The following courses are common for a Cost Accountant degree/certification: Introduction to Cost Accounting, Cost Management, Cost Accounting and Analysis, Cost Accounting Fundamentals, Managerial Accounting, and Cost Accounting: Decision Making.Relevant Coursework: Introduction to Cost Accounting | Cost Management | Cost Accounting and Analysis | Cost Accounting Fundamentals | Managerial Accounting | Cost Accounting: Decision Making

Key Projects:

Manufacturing Cost Analysis Project: Developed comprehensive cost analysis framework for a mock manufacturing company to optimize production costs and improve profit margins.

Budget Optimization Study: Collaborated with a team of four to analyze and restructure budgeting processes for a simulated retail chain.

Leverage your academic training, internship experience, and technical proficiencies to create a compelling skills section that showcases your readiness for cost accounting responsibilities while incorporating relevant accounting software and analytical capabilities.

As an entry-level Cost Accountant, your foundation in these essential skills positions you well for a career in cost accounting, where opportunities for growth and specialization continue to expand as businesses increasingly focus on cost management and efficiency.

When you're deep in the details of variance analysis and cost allocation methods all day, it can feel impossible to translate your complex financial impact into clear, compelling resume language that hiring managers will actually understand.

At Resume Target, we specialize in crafting resumes for accounting professionals just like you, transforming detailed cost control achievements into powerful success stories.

Our expert writers have helped hundreds of cost accountants showcase their value by highlighting key wins like process improvement savings and budget variance reductions in ways that make hiring managers take notice.

With companies increasingly focused on controlling costs in today's economic climate, now is the perfect time to upgrade your resume - let's connect today to help you stand out in this competitive market.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services