Numbers tell compelling stories, but most actuarial resumes read like dry statistical reports. Your complex analytical achievements deserve better than bland bullet points.

Are you struggling to translate your technical expertise into language that hiring managers understand? A well-crafted actuarial resume bridges the gap between complex risk analysis and clear business value.

Resume Target specializes in helping actuaries showcase their impact beyond the calculations. We'll help you transform your statistical achievements and modeling expertise into compelling proof that you're the right candidate for the role.

In a world full of uncertainties, actuaries are the financial fortune-tellers who help businesses navigate risk, using advanced mathematics to estimate the probability and economic cost of events like natural disasters, accidents, or health issues.

These analytical experts combine statistical analysis with financial theory to design insurance policies, determine premium rates, and ensure companies maintain enough cash reserves to handle future claims - essentially turning complex risk scenarios into actionable business strategies.

If you're passionate about mathematics and enjoy solving complex puzzles, the path to becoming an actuary offers a rewarding career trajectory that includes professional certifications, specialized expertise development, and opportunities to shape how businesses and institutions manage risk in our ever-changing world.

Let's talk about what's really exciting in the actuarial field - your earning potential! As a professional who combines mathematical expertise with business acumen, you're looking at a career path that can take you from entry-level positions all the way to executive roles, with impressive compensation increases along the way. And guess what? Your earning potential grows significantly as you gain experience and specialized certifications!

Figures from: Bureau of Labor Statistics

Starting as an actuarial trainee, your path to becoming a certified actuary combines professional exams with hands-on experience. With dedication and continuous learning, you can progress from entry-level to leadership roles while earning prestigious certifications.

Beyond foundational mathematics, successful actuaries combine technical expertise with business acumen and strong communication abilities to advance their careers.

- Advanced Statistical Analysis and Risk Modeling - Predictive Analytics and Data Mining - Financial Modeling and Valuation - Strategic Communication and LeadershipBreaking into the actuarial field starts with passing initial certification exams while pursuing relevant internships or entry-level analyst positions that build your mathematical and statistical analysis capabilities.

To launch your actuarial career, you'll need to develop strong analytical problem-solving abilities through a combination of academic preparation, professional exams, and hands-on experience.

Requirements from Society of Actuaries

From insurance hubs in the Northeast to emerging tech centers nationwide, actuarial careers span diverse sectors.

Figures from U.S. Bureau of Labor Statistics

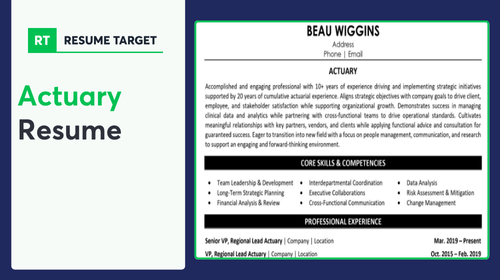

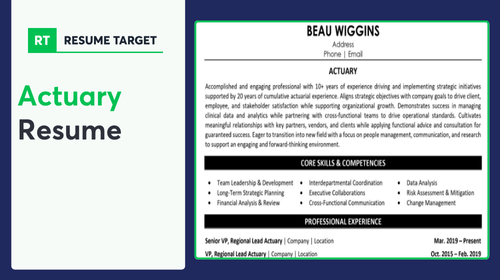

Struggling to calculate the perfect formula for your actuary resume that will capture your risk analysis expertise, statistical prowess, and technical skills all in one document? Follow our comprehensive, section-by-section guide that will help you build a data-driven resume that showcases your actuarial achievements.

As an actuary who excels at analyzing complex data and calculating risk, you might find it challenging to distill your impressive technical abilities into a compelling resume summary.

While you're skilled at using statistical models and financial metrics to predict future outcomes, translating your actuarial expertise into a concise personal marketing statement requires a different approach that helps hiring managers quickly understand your unique value proposition.

How would you describe your unique blend of actuarial expertise across different risk domains (life, health, property, etc.) and what makes your analytical approach distinctive in the industry?

Reason: This helps establish your professional identity and specialization within the actuarial field, allowing readers to immediately understand your core focus areas and what sets you apart from other actuaries.

What would you say is your highest-level contribution to risk assessment and financial modeling that demonstrates your value to potential employers in the insurance or consulting sector?

Reason: This question helps frame your overall impact and value proposition in terms that resonate with actuarial hiring managers, focusing on the big picture rather than specific metrics.

How do you combine your technical actuarial skills with business acumen to translate complex statistical analyses into actionable insights for stakeholders?

Reason: This helps articulate your ability to bridge the gap between technical actuarial work and business value, which is a crucial differentiator in modern actuarial roles.

As an actuary, you need to showcase both your advanced statistical analysis capabilities and your practical business acumen, from complex risk modeling to insurance product development.

Your resume should highlight your technical proficiency with actuarial software like Excel, R, and SAS, while also emphasizing your ability to translate complex data into actionable business recommendations that non-technical stakeholders can understand.

Showcase your actuarial expertise by organizing your experience into three powerful sections: a concise role overview that sets the stage, quantifiable achievements that highlight your risk assessment and statistical analysis wins, and core responsibilities that demonstrate your technical and analytical capabilities.

Many actuaries struggle to translate complex statistical analyses and risk assessments into clear, compelling achievements that resonate with hiring managers. Transform your technical expertise into powerful success stories by connecting your risk models and statistical innovations to measurable improvements in profitability, loss ratios, and business growth.

The responsibilities section demonstrates how actuaries transform complex statistical analysis into actionable business decisions. Your role description should clearly show how you use mathematical expertise to assess risk and create financial value, while making these technical concepts accessible to non-actuarial professionals.

As an Actuary, your credentials from professional actuarial societies are crucial for career advancement and demonstrating your expertise in risk assessment and statistical analysis. Start with your highest actuarial designation, followed by your educational background, making sure to highlight any specialized coursework in mathematics, statistics, or financial mathematics.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing actuarial positions.

While many candidates focus solely on customizing their cover letters, successful actuaries know that personalizing their resume for each specific role is equally crucial in today's competitive job market.

By strategically incorporating role-specific keywords and highlighting relevant actuarial experiences, your customized resume will not only sail through ATS systems but will also demonstrate to hiring managers that you understand their exact needs and have the precise statistical and analytical skills they're seeking.

Ready to turn your resume into your secret weapon? Let's make every word count and show employers why you're the actuarial expert they've been searching for!

Don't let a lack of actuarial experience hold you back - your analytical skills and education can open doors to this rewarding career.

Instead of dwelling on unrelated work history, showcase your mathematics degree, actuarial exams passed, and any relevant internships or data analysis projects that demonstrate your technical capabilities.

Focus on highlighting your mathematical prowess, statistical software skills, and progress toward actuarial certification.

For more guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to ensure you're positioning yourself effectively for actuarial roles.

Your actuarial resume summary is your chance to showcase your mathematical prowess, exam progress, and analytical capabilities that make you an ideal candidate for this challenging field.

Focus on highlighting your relevant coursework, internships, and any progress toward actuarial exams to demonstrate your commitment to the profession.

"Detail-oriented and analytical aspiring Actuary with strong mathematical foundation and successful completion of Exam P and FM. Leveraging internship experience at Regional Insurance Group analyzing risk models and statistical data, plus advanced Excel and R programming skills. Demonstrated excellence in probability and statistics coursework, maintaining 3.9 GPA in Mathematics major. Seeking to apply strong quantitative abilities and growing actuarial expertise to an entry-level position while pursuing additional certifications."

Now's your chance to showcase the rigorous mathematical and statistical training that sets you apart as an actuary candidate!

Transform your academic achievements into compelling content by highlighting relevant coursework like Advanced Statistics and Risk Theory, plus include any significant projects where you applied actuarial concepts to real-world scenarios.

Here are some courses common to a degree/certification for Actuaries: 1. Finance [2] 2. Microeconomics [2] 3. Macroeconomics [2] 4. Calculus (three semesters) [2] 5. Linear Algebra (one semester) [2] 6. Calculus-based probability and statistics (two semesters) [2] 7. Introduction to the Theory of Probability [1] 8. Mathematics of Investment [1] 9. Corporate Finance [1] 10. Calculus I [1] 11. Calculus II [1] 12. Calculus III [1] 13. Applied Stochastic Processes for Financial Models [1] 14. Statistical Inference and Regression Analysis [1] 15. Forecasting of Time Series Data [1] 16. Introduction to Stochastic Processes [1] 17. Life Contingencies [1]Relevant Coursework: Calculus-based Probability | Statistical Inference | Mathematics of Investment | Life Contingencies | Financial Models | Time Series Analysis

Key Projects:

Mortality Rate Analysis Project: Developed comprehensive statistical models to analyze mortality patterns across different demographic groups using 10 years of historical data, resulting in more accurate risk assessment models for life insurance policies.

Insurance Portfolio Optimization Study: Collaborated with a team of four to evaluate and optimize an insurance company's portfolio risk management strategies, leading to recommendations that could potentially reduce risk exposure by 15%.

Leverage your academic achievements, internship experiences, and technical certifications by showcasing the precise mathematical and analytical abilities you've developed through your actuarial studies and exam preparations.

As an entry-level actuary, your combination of technical expertise and analytical capabilities positions you well for a rewarding career in this growing field, where demand for qualified professionals continues to rise steadily.

Let's face it - translating complex statistical models, risk assessments, and actuarial analyses into language that resonates with both technical and non-technical hiring managers can feel like solving an impossible equation.

At Resume Target, we specialize in crafting resumes for insurance industry actuaries that strike the perfect balance between technical expertise and business impact.

Our deep understanding of the actuarial career path means we know exactly how to showcase your progression through exams, certifications, and increasing responsibilities in a way that speaks directly to what insurance companies are looking for.

With the insurance industry's growing focus on predictive analytics and emerging risks, now is the perfect time to ensure your resume positions you as a forward-thinking actuary - let's get started with a free consultation today.