Balancing complex claims investigations with strict deadlines can be overwhelming, but writing about it is even harder. Many claims adjusters struggle to translate their detailed work into compelling resume achievements.

Are you finding it challenging to showcase your claims handling expertise on paper? Your resume needs to demonstrate both your analytical skills and your ability to resolve claims efficiently while maintaining customer satisfaction.

Resume Target specializes in helping claims adjusters transform their daily responsibilities into powerful success stories. We'll show you how to craft a resume that highlights your investigation skills, settlement ratios, and customer service wins to land more interviews.

When disaster strikes, claims adjusters step in as the essential bridge between insurance companies and policyholders, investigating and evaluating insurance claims that can range from fender-benders to major natural disasters - with responsibilities spanning from property damage assessment to fraud detection.

As a claims adjuster, you'll wear multiple hats - part detective, part negotiator, and part analyst - as you investigate incidents, interview witnesses, review police and medical records, inspect property damage, and determine fair settlement amounts that protect both the insurance company and the policyholder.

Whether you're interested in specializing in auto claims, property damage, or medical claims, the field offers diverse career paths with opportunities to advance into senior adjusting positions, specialty claims handling, or claims management roles - making it an excellent choice for detail-oriented professionals who enjoy problem-solving and helping people through challenging situations.

Let's talk about the exciting earning potential in claims adjusting! Your career path as a Claims Adjuster offers impressive growth opportunities, with compensation increasing substantially as you gain experience and expertise. And guess what? If you specialize in complex claims or work in high-demand locations, you can boost your earning potential even further!

Figures from: Vintti

Starting as a Claims Adjuster opens doors to rewarding career growth. Beginning with supervised small claims handling, you can advance to managing complex cases and leading teams as you gain expertise.

To accelerate your career growth, you'll need to master both technical expertise and professional soft skills that set you apart in the insurance industry.

- Insurance Policy Analysis - Claims Investigation Techniques - Risk Assessment - Negotiation SkillsBreaking into claims adjusting starts with entry-level positions at insurance companies or third-party administrators, where you'll learn the fundamentals of claims processing and policy interpretation.

To advance in this field, you'll need to develop key competencies including strong communication and analytical skills that will help you evaluate claims effectively and interact professionally with clients.

Requirements from Adjust This

From sunny Florida to bustling New York, claims adjusters are in high demand across insurance carriers and government agencies.

Figures from U.S. Bureau of Labor Statistics

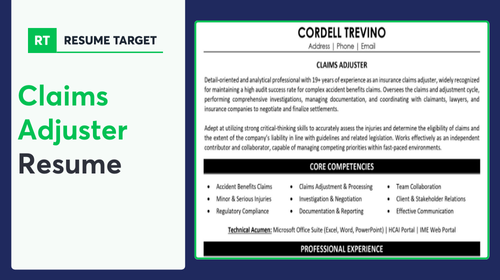

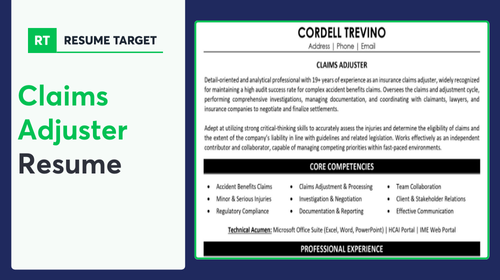

Struggling to translate your experience investigating claims, negotiating settlements, and managing complex cases into a compelling resume that catches employers' attention? This comprehensive, section-by-section guide will show you exactly how to build a professional claims adjuster resume that highlights your expertise and gets you more interviews.

As a claims adjuster, you know how to analyze complex situations and make solid decisions, yet summarizing your own career achievements can feel more challenging than investigating the toughest claim.

While you excel at evaluating damages, negotiating settlements, and managing policyholder relationships, translating these valuable skills into a compelling summary that catches a hiring manager's attention requires a different kind of expertise.

How would you characterize your overall approach to claims management and what distinguishes you from other adjusters in terms of your investigation and resolution style?

Reason: This helps establish your professional identity and core value proposition as a claims professional, setting the tone for your entire resume. It encourages you to articulate your unique methodology and professional philosophy.

What combination of insurance lines and claim types have you handled throughout your career that best showcase your versatility as an adjuster?

Reason: This question helps you frame your broad expertise and specializations in a way that demonstrates comprehensive industry knowledge, making your summary more appealing to employers seeking specific coverage experience.

How would you describe your balance of technical claims expertise with customer service skills and stakeholder management abilities?

Reason: This prompts you to highlight the crucial dual nature of claims adjustment work - combining analytical skills with interpersonal abilities, which is often a key differentiator for successful adjusters.

As a claims adjuster, your role requires a unique blend of analytical abilities, customer service expertise, and insurance industry knowledge that must be clearly conveyed to potential employers.

From technical skills like claims processing software and policy interpretation to essential soft skills such as negotiation and investigation techniques, you'll need to showcase both your specialized expertise and day-to-day operational capabilities.

Showcase your claims handling expertise by organizing your experience into three powerful sections: a concise role overview that sets the stage, measurable achievements that highlight your settlement success rates, and core responsibilities that demonstrate your investigative and negotiation abilities.

Many Claims Adjusters struggle to effectively showcase their success in balancing customer service excellence with accurate loss assessments and cost containment. Transform your experience into compelling metrics by connecting your claims handling expertise to settlement ratios, customer satisfaction scores, and documented cost savings that demonstrate your direct impact on the bottom line.

The responsibilities section demonstrates how Claims Adjusters evaluate, negotiate, and resolve insurance claims while ensuring fair settlements. Your duties should highlight both technical expertise and customer service skills, showing how you contribute to the insurance company's risk management and customer satisfaction goals.

Your credentials demonstrate your expertise in claims assessment and insurance regulations, so list your most relevant certifications first. As a Claims Adjuster, highlighting your state licensing and professional designations from recognized insurance organizations will strengthen your resume's impact.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your base resume into a powerful job-landing tool.

While many insurance professionals focus solely on customizing their cover letters, tailoring your Claims Adjuster resume for each position is equally crucial for standing out in this competitive field.

A customized resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that your claims handling experience and skills align perfectly with their specific insurance company's needs.

Ready to turn your resume into your secret weapon? Let's make every application count by crafting a targeted Claims Adjuster resume that proves you're the perfect candidate for each position!

Don't let a lack of experience hold you back from launching your Claims Adjuster career! Your path to success starts with showcasing your analytical mindset, customer service background, and relevant coursework.

Even without direct claims experience, you can create an impressive resume by highlighting your education, communication skills, and any insurance-related projects or internships.

Focus on highlighting your attention to detail, investigation abilities, and customer service expertise to make your resume stand out.

For more guidance on crafting the perfect entry-level resume, check out the Student Resume Writing Guide to get started.

Your resume summary is your chance to showcase your analytical abilities, customer service skills, and relevant coursework that align perfectly with a claims adjuster role.

Focus on highlighting your attention to detail, problem-solving capabilities, and any insurance-related projects or internships that demonstrate your readiness to excel in this field.

"Detail-oriented and analytical professional with foundational knowledge in insurance claims processing and risk assessment through academic coursework and internship experience. Demonstrated strong investigative abilities and customer service skills through handling 50+ mock claims during insurance certification training. Proficient in insurance software platforms and documentation procedures, with exceptional communication skills developed through relevant coursework. Seeking to leverage strong analytical capabilities and customer-focused approach to contribute effectively as an entry-level Claims Adjuster."

Now's your chance to showcase the educational foundation that prepared you for success in insurance claims - whether that's your degree, industry certifications, or specialized training programs!

Don't just list basic credentials - highlight relevant coursework like Insurance Law or Risk Management, and feature impactful projects where you analyzed complex claims scenarios or mastered claims processing software.

1. The names of courses common to a degree/certification for Claims Adjusters include various insurance topics, mathematics relevant to claims adjusting, and specific skills training. Additionally, certain property and casualty insurance courses are included.Relevant Coursework: Insurance Law & Regulations | Property & Casualty Insurance | Claims Investigation Methods | Risk Assessment & Management | Insurance Policy Analysis | Loss Adjustment Principles

Key Projects:

Insurance Claims Simulation Project: Led a comprehensive mock claims processing initiative involving multiple types of property damage scenarios. Developed systematic approaches to claims evaluation while maintaining compliance with state regulations.

Multi-Party Liability Assessment Case Study: Collaborated with a team of 4 to investigate and resolve a complex multi-vehicle accident scenario involving commercial and personal insurance policies.

Transform your academic knowledge, internship experience, and technical training into a compelling skills section that showcases your readiness to evaluate insurance claims, investigate incidents, and deliver excellent customer service.

As an entry-level Claims Adjuster, your combination of analytical abilities and customer service skills positions you well for a rewarding career in the growing insurance industry, where your expertise will continue to develop with each claim you handle.

Let's face it - translating your complex claims handling experience and customer service skills into measurable achievements can feel like filing a complicated claim without any documentation.

At Resume Target, we specialize in crafting resumes for insurance professionals that showcase both your technical expertise and your people skills.

Our team has helped hundreds of claims adjusters highlight their unique blend of analytical abilities and customer advocacy, turning detailed case histories into powerful success stories that insurance companies want to see.

With insurance companies actively seeking skilled adjusters right now, don't let an outdated resume hold you back - contact us today to transform your experience into opportunities.