Sorting through complex claims data is your daily work, but describing your impact leaves you stuck. Many Claims Examiners struggle to translate detailed analysis into compelling career achievements.

Are you finding it hard to showcase your true value on paper? Your resume needs to highlight both your technical expertise and your money-saving decisions that protect company interests.

At Resume Target, we help Claims Examiners transform complex work into clear success stories. We know how to present your analytical skills and financial impact in ways that catch hiring managers' attention.

As the financial gatekeepers of the insurance industry, claims examiners serve as critical decision-makers who review and validate insurance claims, particularly during high-volume periods following natural disasters when accuracy and efficiency are paramount.

Your role as a claims examiner involves meticulously analyzing claim documentation, medical records, and policy guidelines to determine whether claims are justified and payable, while also identifying potential fraud and ensuring that both claimants and adjusters have followed proper procedures.

Whether you're interested in specializing in health insurance validation, life insurance assessment, or property damage evaluation, the claims examination field offers diverse career paths with opportunities to advance into senior examiner positions, claims management, or specialized fraud investigation roles.

Let's talk about what's exciting in the Claims Examiner field! Your earning potential as a Claims Examiner can be quite impressive, with opportunities to significantly increase your income as you gain experience and specialize in areas like medical or disability claims. The field offers a clear path for growth, making it an attractive career choice for detail-oriented professionals.

Figures from: Salary.com

Starting as a Claims Examiner means handling small claims under supervision, but your career can grow into managing complex cases and specializing in areas like fraud investigation or health insurance claims.

Beyond basic claim processing abilities, advancing in this field requires a strategic combination of technical expertise and interpersonal finesse.

- Claims Management Software Proficiency - Legal and Regulatory Compliance Knowledge - Risk Assessment and Analysis - Advanced Communication and NegotiationLaunch your claims examiner career by combining a bachelor's degree in business or insurance with entry-level insurance experience, while obtaining relevant certifications to demonstrate your expertise in claims processing.

To excel in this field, you'll need to develop key competencies including strong analytical skills that will help you evaluate complex claims and make informed decisions.

Requirements from Zippia

From bustling insurance hubs in Florida to government offices nationwide, Claims Examiner roles span both private and public sectors.

Figures from U.S. Bureau of Labor Statistics

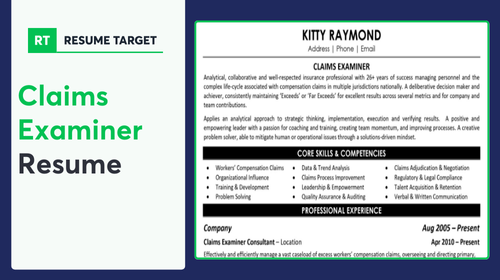

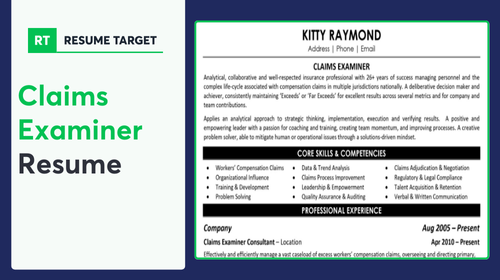

Struggling to showcase your claims processing expertise, policy knowledge, and investigative skills in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you create a claims examiner resume that highlights your most impressive achievements and core competencies.

As a Claims Examiner, you know how to analyze complex cases and make sound decisions, yet summarizing your own career achievements can feel more challenging than reviewing a stack of complicated claims.

While you excel at investigating facts, evaluating coverage, and making accurate determinations that protect both claimants and companies, translating these specialized skills into a compelling summary requires a strategic approach that speaks directly to what hiring managers are seeking.

How would you characterize your overall approach to risk assessment and claims resolution across your career as a Claims Examiner?

Reason: This helps frame your professional identity and philosophy, allowing you to showcase your strategic mindset in claims management. It sets the tone for your entire summary by establishing your core professional value.

What types of claims environments and insurance sectors have you worked in, and how has this breadth of experience shaped your expertise as a Claims Examiner?

Reason: This question helps you articulate your versatility and depth of industry knowledge, which is crucial for a summary that needs to quickly establish credibility and scope of expertise.

How would you describe your balance of technical claims knowledge with customer service and stakeholder management abilities?

Reason: This prompts you to address the dual nature of claims examination work, combining analytical skills with interpersonal abilities - a key differentiator that employers look for in senior claims professionals.

As a Claims Examiner, your role requires a unique blend of analytical expertise, regulatory knowledge, and customer service abilities that need to be clearly showcased on your resume.

From mastering claims processing software and understanding insurance policies to conducting thorough investigations and maintaining compliance standards, your skills section should highlight both your technical capabilities and your ability to handle day-to-day claims operations.

Showcase your claims processing expertise by organizing your experience into three powerful sections: a concise role overview that sets the stage, measurable achievements that highlight your investigation and settlement successes, and core responsibilities that demonstrate your technical knowledge of claims procedures.

Many Claims Examiners struggle to effectively showcase their cost-saving measures and risk mitigation successes beyond basic claims processing metrics. Transform your experience into compelling achievements by connecting your investigative expertise and decision-making skills to measurable reductions in losses, improved accuracy rates, and enhanced customer satisfaction scores.

The responsibilities section demonstrates how Claims Examiners evaluate and process insurance claims beyond basic paperwork handling. This section must clearly show both technical expertise and decision-making abilities while connecting your daily work to the company's risk management and customer service goals.

Your education and professional certifications demonstrate your expertise in claims examination and insurance industry knowledge. Lead with your most relevant credentials, especially those focused on claims adjusting, risk assessment, or insurance-specific certifications that showcase your technical competency.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your base resume into a powerful job-landing tool.

While many candidates stop at customizing their cover letter, successful Claims Examiner professionals know that personalizing their resume for each position is what truly sets them apart in this competitive field.

By strategically incorporating specific claims processing terminology, insurance industry keywords, and role-specific requirements from each job posting, your customized resume will not only sail through ATS systems but will also immediately show hiring managers you're the perfect match for their claims department.

Ready to turn your resume into your secret weapon? Let's make every application count by tailoring your experience to exactly what employers are looking for in their next Claims Examiner!

Don't let a lack of experience hold you back from launching your career as a Claims Examiner!

Your path to success starts with showcasing your relevant education, analytical abilities, and any insurance-related coursework or internships that demonstrate your potential.

Focus on highlighting your attention to detail, knowledge of insurance principles, and strong communication skills to make your resume stand out.

For more guidance on crafting the perfect entry-level resume, check out the Student Resume Writing Guide to get started.

Your resume summary is your chance to showcase your analytical mindset, attention to detail, and relevant coursework or internship experience in insurance or risk assessment.

Focus on highlighting your strong organizational abilities and any customer service experience that demonstrates your readiness to handle claims processing responsibilities.

"Detail-oriented and methodical professional with foundational experience in claims processing and insurance documentation through academic projects and internships. Demonstrated success in analyzing complex information, maintaining accurate records, and providing exceptional customer service in fast-paced environments. Leverages strong analytical skills and insurance industry knowledge to efficiently evaluate claims and ensure compliance with policy guidelines. Seeking to apply strong organizational abilities and customer-focused approach as an entry-level Claims Examiner."

Now's your chance to showcase the educational foundation that prepared you for a successful claims examination career - from industry-specific certifications to relevant coursework in insurance principles and risk assessment!

Don't just list your degree - highlight those key insurance courses, compliance training programs, and analytical projects that demonstrate your claims expertise, like that complex case study analysis from your Insurance Law course.

Insufficient data available despite thorough search.Relevant Coursework: Insurance Law | Risk Management | Business Administration | Claims Processing | Healthcare Administration | Insurance Policy Analysis

Key Projects:

Claims Processing Simulation Project: Developed and executed a comprehensive claims assessment protocol for a simulated health insurance company, resulting in 95% accuracy rate in claims determinations.

Insurance Policy Analysis Case Study: Led a team of 4 students in reviewing complex insurance policies to determine coverage gaps and compliance issues.

Leverage your educational background, internship experiences, and technical training to showcase the precise skills that insurance companies seek in entry-level Claims Examiners, making your resume stand out to hiring managers.

As an aspiring Claims Examiner, highlighting these foundational skills demonstrates your readiness to step into this growing field, where attention to detail and analytical capabilities are highly valued by insurance companies actively seeking fresh talent.

Let's face it - translating your complex claims investigation experience and regulatory knowledge into a clear, compelling story isn't easy when you're staring at a blank page.

At Resume Target, we specialize in crafting resumes for insurance professionals that showcase both your technical expertise and your impact on the bottom line.

Our deep understanding of the claims examination field means we know exactly how to position your experience with multi-line claims handling, fraud detection, and regulatory compliance in a way that catches hiring managers' attention.

With insurance companies actively seeking skilled claims professionals right now, don't let an outdated resume hold you back - schedule your free consultation today to transform your career story into one that opens doors.