Cold calling prospects is tough, but writing a sales resume that lands interviews can feel even harder. Getting noticed in a sea of insurance sales resumes takes more than just listing your policies sold.

Are you struggling to showcase your sales achievements in a way that grabs attention? Your resume needs to tell the story of not just what you sold, but how you built relationships and solved client problems that led to those sales.

Resume Target specializes in helping insurance sales professionals stand out from the competition. We know how to transform your sales numbers and client success stories into a compelling narrative that makes hiring managers want to meet you.

As trusted financial protection advisors, Insurance Sales Representatives play a vital role in helping individuals and businesses safeguard their futures by customizing insurance programs to meet individual client needs.

Your role goes far beyond simply selling policies - you'll analyze clients' current coverage, identify gaps in protection, and craft personalized insurance solutions that provide peace of mind while building lasting relationships with the people and businesses you serve.

Whether you're just starting out or looking to advance your insurance career, this dynamic field offers multiple paths for growth, from specializing in specific insurance products to moving into agency leadership roles where you can mentor new representatives and expand your market impact.

Let's talk about the exciting earning potential in insurance sales! Your career as an Insurance Sales Representative offers impressive income opportunities, with compensation packages that can grow substantially based on your performance and expertise. And guess what? When you factor in commission structures and specializations like health insurance sales, your earning potential becomes even more attractive.

Figures from: U.S. Bureau of Labor Statistics

Starting as an Insurance Sales Representative opens doors to rewarding career growth. With the right skills and dedication, you can progress from entry-level positions to leadership roles while increasing your earning potential.

Beyond basic sales abilities, advancing in insurance sales requires a powerful combination of technical expertise, relationship-building prowess, and digital marketing savvy.

- Product Knowledge and Risk Assessment - Insurance Regulations and Compliance - Digital Marketing and CRM Systems - Client Relationship ManagementBreaking into insurance sales is achievable through entry-level positions like customer service representative or sales assistant roles, which provide foundational experience while you earn required licenses.

To excel in your insurance sales career path, you'll need to develop essential skills including effective communication and strong client relationship building, which form the backbone of successful insurance sales.

Requirements from Insurance Business Magazine

From bustling Texas agencies to Florida brokerages, insurance sales jobs thrive across both Sun Belt states and major metros.

Figures from U.S. Bureau of Labor Statistics

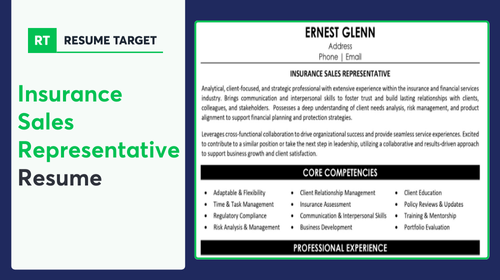

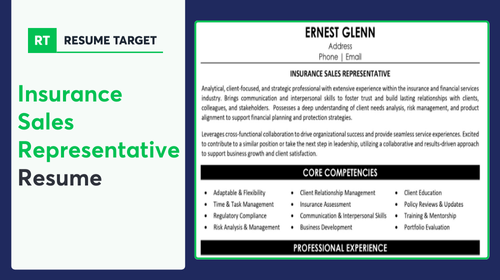

Struggling to showcase your sales achievements, client relationships, and insurance expertise in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you create a powerful insurance sales representative resume that highlights your success stories and industry knowledge.

As an insurance sales professional, you know how to present complex policies in simple terms to clients, yet summarizing your own career achievements can feel surprisingly challenging.

While you excel at building relationships and closing deals, translating those valuable sales skills and insurance expertise into a compelling written summary requires a different approach that will instantly grab hiring managers' attention and showcase your revenue-generating potential.

How would you describe your overall approach to building and maintaining client relationships in the insurance industry, and what makes your client service philosophy unique?

Reason: The foundation of insurance sales success lies in relationship building, and highlighting your distinct approach helps differentiate you from other candidates. This sets the tone for your entire resume by establishing your core professional identity.

What combination of insurance products and market segments have you specialized in throughout your career, and how has this shaped your expertise?

Reason: Insurance employers want to quickly understand your product knowledge depth and target market experience. This helps them assess fit while demonstrating your industry-specific expertise.

How would you characterize your overall sales style and what key strengths have consistently driven your success in insurance sales?

Reason: This helps articulate your sales personality and core competencies in a way that resonates with insurance industry hiring managers. It provides context for your achievements while highlighting transferable skills.

As an insurance sales professional, your resume needs to showcase both your sales expertise and your deep understanding of insurance products and regulations.

From mastering CRM systems and policy documentation to demonstrating relationship-building abilities and closing techniques, your skills section should balance technical insurance knowledge with core sales competencies.

Showcase your sales success by organizing your experience into three powerful sections: a compelling role overview that highlights your market focus, quantifiable achievements that demonstrate your sales performance, and core responsibilities that underscore your expertise in insurance products and client relationship management.

Many Insurance Sales Representatives struggle to distinguish themselves beyond basic policy sales numbers and client acquisition metrics. Transform your experience into compelling proof of value by connecting your sales achievements to revenue growth, retention rates, and cross-selling success that directly impact the bottom line.

The responsibilities section demonstrates how you connect clients with vital insurance products while building lasting relationships and meeting business targets. Your role bridges customer needs with company solutions, making complex insurance concepts accessible while driving revenue growth.

Your insurance credentials and educational background demonstrate your expertise and commitment to the field. Focus on listing your state insurance licenses, professional certifications, and any relevant degrees that showcase your knowledge of insurance products and sales techniques.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful sales tool that speaks directly to insurance industry employers.

While many insurance sales professionals focus solely on customizing their cover letters, tailoring your resume for each specific insurance sales position is equally crucial for standing out in this competitive field.

A customized insurance sales resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that you understand their unique market needs and can deliver the sales results they're seeking.

Ready to turn your resume into your most powerful sales asset? Let's make every word count and show employers why you're their next top-performing insurance sales representative!

Don't let a lack of sales experience hold you back - your potential to succeed as an Insurance Sales Representative goes beyond traditional work history!

Your customer service background, combined with relevant coursework and any sales-focused projects or internships, can demonstrate your readiness to excel in insurance sales.

Focus on highlighting your communication abilities, customer relationship skills, and understanding of insurance products to create a compelling resume.

For detailed guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to ensure you're showcasing your potential in the best possible light.

Your resume summary is your chance to showcase your customer service background, sales aptitude, and relevant coursework in business or finance - even without direct insurance industry experience.

Focus on transferable skills like relationship building, communication abilities, and any sales achievements from other roles or academic projects.

"Motivated and client-focused professional with foundational knowledge in insurance products and 1+ year of customer service experience. Demonstrated track record of exceeding sales targets in retail environment, with strong interpersonal communication skills and insurance licensing coursework completed. Proven ability to build lasting customer relationships and explain complex concepts in simple terms. Eager to leverage consultative sales approach and financial services knowledge to help clients protect their assets and achieve peace of mind."

Now's your chance to showcase the educational foundation that makes you a knowledgeable and trustworthy insurance professional!

Don't just list your degree - highlight relevant coursework like "Risk Management"or "Financial Planning,"and include any insurance licensing programs, sales certifications, or client communication workshops that demonstrate your expertise and commitment to the field.

unavailableRelevant Coursework: Business Administration | Risk Management | Insurance Principles | Marketing Fundamentals | Sales Techniques | Financial Planning

Key Projects:

Insurance Market Analysis Project: Conducted comprehensive market research and developed strategic sales approaches for different insurance products targeting specific demographic segments.

Client Portfolio Management Simulation: Led a team of four in a semester-long insurance portfolio management simulation, achieving 125% of target sales goals.

Leverage your academic background, sales training, and customer service experience to create a compelling skills section that showcases your readiness to excel in insurance sales, incorporating both technical knowledge and interpersonal abilities.

As an aspiring Insurance Sales Representative, your combination of foundational insurance knowledge and sales abilities positions you well for a rewarding career in an industry that continues to grow and offer excellent advancement opportunities.

Let's be honest - translating your sales achievements and relationship-building skills into compelling resume content can feel overwhelming, especially when you're trying to stand out in the competitive insurance industry.

At Resume Target, we specialize in crafting resumes that showcase both your sales performance metrics and your client relationship expertise, having helped hundreds of insurance professionals land their dream roles.

Our deep understanding of the insurance industry means we know exactly how to position your unique combination of sales prowess and product knowledge to catch a hiring manager's attention.

With insurance companies actively expanding their sales teams this quarter, now is the perfect time to transform your resume into a powerful career tool - schedule your free consultation today to get started.