Risk assessment is your expertise, but assessing how to present yourself on paper feels like a gamble. Many insurance underwriters struggle to translate their analytical skills into compelling resume content.

Are you finding it challenging to showcase both your technical abilities and business impact? Your resume needs to demonstrate your risk evaluation prowess while highlighting the revenue and loss prevention results you've delivered.

At Resume Target, we understand how to position insurance underwriters for success in today's competitive market. We help you transform complex underwriting metrics and achievements into clear, powerful statements that catch hiring managers' attention.

As the financial gatekeepers of the insurance industry, insurance underwriters make the crucial decisions that can protect both individuals and companies from devastating losses, while ensuring insurance companies remain profitable by evaluating risk factors and determining appropriate coverage amounts and premiums.

Using sophisticated software tools and analytical expertise, these professionals dive deep into applications, medical records, and financial documents to assess risk levels and make informed decisions about who gets coverage and at what cost - essentially acting as both detective and judge in the insurance approval process.

Whether you're interested in specializing in life, health, or property insurance, the path to becoming an insurance underwriter offers clear advancement opportunities, from entry-level analyst positions to senior underwriting roles where you'll handle complex cases and help shape company policy.

Let's talk about the exciting earning potential in insurance underwriting! Your career path as an underwriter offers impressive income growth opportunities, with entry-level positions providing a solid foundation and senior roles commanding substantial compensation packages. And guess what? Specializing in areas like credit intermediation can boost your earning potential even higher!

Figures from: U.S. Bureau of Labor Statistics

Starting as an insurance underwriter opens doors to rewarding career growth. With experience and certifications, you can progress from supervised work to managing complex portfolios and leading underwriting teams.

Beyond basic underwriting knowledge, developing these key skills will accelerate your career advancement and open doors to senior positions.

- Risk assessment and analysis - Financial modeling and forecasting - Advanced policy evaluation - Strategic decision-making and leadershipBreaking into insurance underwriting often starts with entry-level insurance roles like claims assistant or customer service representative, where you'll gain essential industry knowledge while working toward underwriter positions.

To advance in this field, you'll need to develop key competencies including strong analytical skills and detail-oriented thinking that will help you evaluate insurance applications and assess risks effectively.

Requirements from Teal HQ

From Texas to New York, insurance carriers and brokerages are leading the charge in hiring underwriters nationwide.

Figures from U.S. Bureau of Labor Statistics

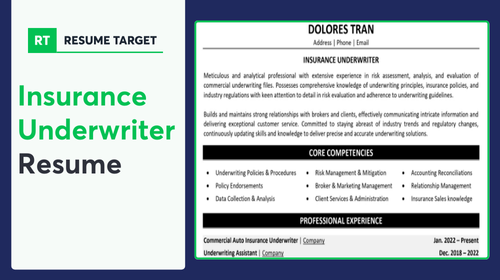

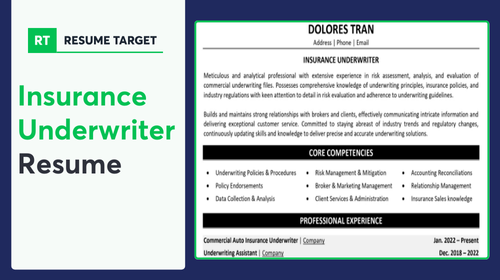

Struggling to translate your risk assessment expertise and analytical skills into a compelling insurance underwriter resume that catches a hiring manager's attention? This comprehensive, section-by-section guide will show you exactly how to showcase your underwriting achievements, risk evaluation experience, and industry knowledge in a format that hiring managers love.

As an insurance underwriter, you excel at analyzing risk and making data-driven decisions, but condensing your professional value into a few powerful sentences can feel like an overwhelming task.

While you're skilled at evaluating applications and determining coverage terms, translating your analytical expertise and industry knowledge into a compelling summary requires a different approach - one that helps hiring managers quickly recognize your ability to balance risk assessment with business growth.

How would you characterize your risk assessment philosophy and its impact on maintaining a profitable book of business throughout your underwriting career?

Reason: This helps frame your overall approach to the fundamental purpose of underwriting and demonstrates strategic thinking. Opening with your risk management perspective immediately signals to hiring managers that you understand the core mission of an underwriter.

What combination of insurance products and industries have you specialized in, and how has this shaped your expertise as an underwriter?

Reason: This question helps you articulate your specific market value and niche expertise, which is crucial for employers looking for underwriters with relevant industry experience. It also demonstrates the breadth and depth of your insurance knowledge.

How do you balance analytical precision with relationship management in your role as an underwriter across stakeholders like brokers, clients, and internal teams?

Reason: This helps you articulate your dual competency in both the technical and interpersonal aspects of underwriting. It shows potential employers that you understand the modern underwriter's role requires both quantitative skills and relationship-building abilities.

As an insurance underwriter, you need to showcase both your analytical abilities to assess risk and your technical proficiency with industry-specific software and underwriting tools.

Your resume should highlight your expertise in evaluating insurance applications, using actuarial data, and making informed decisions about policy terms, while also demonstrating your knowledge of compliance regulations and customer service capabilities.

Showcase your risk assessment expertise and decision-making prowess by organizing your underwriting experience into three powerful sections: a concise role overview that sets the context, quantifiable achievements that highlight your portfolio management success, and core responsibilities that demonstrate your technical underwriting capabilities.

Many Insurance Underwriters struggle to effectively demonstrate how their risk assessment decisions directly impact company profitability and portfolio performance. Transform your experience into compelling metrics by connecting your underwriting judgment to reduced loss ratios, improved premium revenue, and enhanced portfolio quality that senior management values.

The responsibilities section demonstrates how Insurance Underwriters evaluate and analyze risk beyond basic application review. Your duties should show both technical expertise and business judgment while explaining how your risk assessment decisions impact company profitability and growth.

Your education and professional certifications are crucial proof points that demonstrate your expertise in risk assessment and underwriting principles. As an Insurance Underwriter, you should highlight your relevant degrees and industry-recognized certifications, particularly those from organizations like The Institutes and the Insurance Institute of America.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your base resume into a powerful tool for landing insurance underwriting positions.

While many candidates stop at customizing their cover letter, successful insurance underwriters know that personalizing their resume for each role is what truly sets them apart in this competitive field.

By strategically incorporating specific underwriting terminology, risk assessment metrics, and industry-specific skills from each job posting, your resume will not only sail through ATS systems but will also demonstrate to hiring managers that you're precisely the underwriting professional they're seeking.

Ready to turn your resume into your secret weapon? Let's make every application count by tailoring your experience to exactly what insurance companies are looking for!

Don't let a lack of experience hold you back from launching your career as an Insurance Underwriter!

Your path to success starts with showcasing your analytical skills, risk assessment knowledge, and relevant coursework or internships that demonstrate your understanding of insurance principles.

Focus on highlighting your attention to detail, mathematical aptitude, and decision-making capabilities in your resume.

For more guidance on crafting the perfect entry-level resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your resume summary is your chance to showcase your analytical skills, risk assessment abilities, and relevant coursework that makes you an ideal candidate for underwriting positions.

Focus on highlighting your attention to detail, mathematical aptitude, and any internships or projects that demonstrate your understanding of insurance principles.

"Detail-oriented and analytical professional with foundational knowledge in insurance risk assessment and financial analysis through specialized coursework and internship experience. Demonstrated strong mathematical aptitude through completion of actuarial studies and risk management projects, with proven ability to evaluate complex data sets. Possesses excellent communication skills developed through collaborative academic projects and customer service roles. Seeking to leverage strong analytical capabilities and risk assessment knowledge as an Entry-Level Insurance Underwriter to contribute to effective policy evaluation and risk management."

Now's your chance to showcase the educational foundation that prepared you for a successful underwriting career - from your degree to specialized insurance certifications!

Don't just list your credentials - highlight relevant coursework like Risk Assessment and Actuarial Mathematics, plus any capstone projects where you analyzed real policy applications or created underwriting guidelines for specific insurance products.

Insufficient data available despite thorough search.Relevant Coursework: Risk Management | Business Statistics | Financial Analysis | Insurance Law | Actuarial Mathematics | Business Ethics

Key Projects:

Risk Assessment Portfolio Analysis: Developed comprehensive risk analysis framework for a simulated commercial property portfolio worth $10M, creating standardized evaluation criteria and risk scoring system.

Commercial Insurance Policy Review Project: Collaborated with a team of four to evaluate and optimize underwriting guidelines for small business insurance policies.

Leverage your academic background, internship experiences, and technical training to showcase the precise underwriting and analytical capabilities that insurance companies seek in entry-level talent.

As an aspiring Insurance Underwriter, your combination of analytical skills and insurance knowledge positions you well for a growing field where detailed risk assessment and sound decision-making are highly valued.

Let's face it - translating your risk assessment expertise and complex decision-making processes into a compelling career story isn't easy, especially when you're juggling multiple policy types and regulatory requirements in your daily work.

At Resume Target, we specialize in crafting powerful resumes for insurance professionals like you, having helped countless underwriters showcase their technical expertise and business acumen.

Our deep understanding of the insurance industry means we know exactly how to highlight your risk evaluation skills, loss ratio improvements, and portfolio management achievements in ways that catch hiring managers' attention.

With insurance companies actively reshaping their underwriting teams for the digital age, now is the perfect time to transform your resume into a powerful career tool - schedule your free consultation with our insurance industry experts today.