Standing out in the competitive mortgage industry takes more than just closing deals. Many mortgage brokers struggle to showcase their true value beyond basic sales numbers.

Are you finding it hard to capture your full expertise on paper? Your resume needs to highlight both your financial knowledge and your ability to guide clients through complex decisions.

Resume Target specializes in helping mortgage brokers transform their experience into compelling career stories. We know how to showcase your loan volumes, client relationships, and problem-solving skills in ways that grab hiring managers' attention.

In today's complex lending landscape, mortgage brokers serve as your personal financial matchmaker, connecting you with the most suitable lenders and loan products for your unique situation.

These financial professionals dive deep into your financial profile, analyzing everything from credit scores to income documentation, then leverage their extensive network of lenders to negotiate terms and secure mortgage options that might otherwise be out of reach.

Whether you're a first-time homebuyer or seasoned property investor, understanding the career path of mortgage brokers can help you appreciate how their expertise develops over time - from mastering lending regulations to building relationships with top financial institutions that benefit their clients.

Let's talk about what makes a career as a Mortgage Broker so financially rewarding! Your earning potential in this dynamic field can be substantial, especially when you build strong industry connections and work in thriving real estate markets. And guess what? Your compensation grows along with your expertise and client portfolio.

Figures from: Investopedia

Starting as a loan officer, your mortgage broker career can lead to exciting senior positions like branch manager or regional director. Success comes from mastering both technical expertise and relationship building.

Beyond basic lending knowledge, advancing in mortgage brokering requires a sophisticated blend of technical expertise and interpersonal finesse.

- Financial Analysis and Underwriting - Regulatory Compliance Knowledge - Advanced CRM and Loan Software Proficiency - Strategic Relationship BuildingBreaking into mortgage brokering typically starts with entry-level positions in loan processing or financial services, where you'll learn the fundamentals while earning an average starting salary of $35,000-$45,000.

To advance in this field, you'll need to develop key competencies including research skills and marketing know-how, which will help you transition from entry-level positions to full broker status.

Requirements from Mortgage Bankers Association

From bustling NYC to growing Atlanta, mortgage broker opportunities span major metro hubs with strong real estate markets.

Figures from PropStream

Struggling to showcase your loan origination success, client relationships, and financial expertise in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will walk you through creating a powerful mortgage broker resume that highlights your achievements and industry knowledge.

If you're like most mortgage brokers, crafting the perfect resume summary feels more challenging than closing a complex loan deal - but it doesn't have to be that way.

While you excel at analyzing financial data and matching clients with ideal lending solutions, translating these valuable skills into a compelling written summary requires a different approach that speaks directly to what hiring managers want to see.

How would you describe your unique blend of financial expertise and client relationship management that sets you apart from other mortgage professionals?

Reason: This helps frame your professional identity and establishes your value proposition by combining both technical and interpersonal aspects of mortgage brokering, which are equally crucial in this field.

What would you say is your overarching approach to guiding clients through the mortgage process, from initial consultation to closing?

Reason: This question helps articulate your professional philosophy and methodology, showing potential employers how you manage the end-to-end mortgage process and handle client relationships.

How do you leverage your knowledge of various loan products, lender relationships, and market insights to benefit both clients and lending institutions?

Reason: This helps showcase your broad understanding of the mortgage industry ecosystem and positions you as a valuable intermediary who can balance the needs of multiple stakeholders.

As a mortgage broker, you need to showcase both your financial expertise and your ability to guide clients through complex lending processes, making it crucial to highlight the right mix of technical and interpersonal abilities.

Your skills section should demonstrate your knowledge of mortgage products, financial analysis capabilities, and relationship-building strengths, from loan origination software proficiency to client communication expertise.

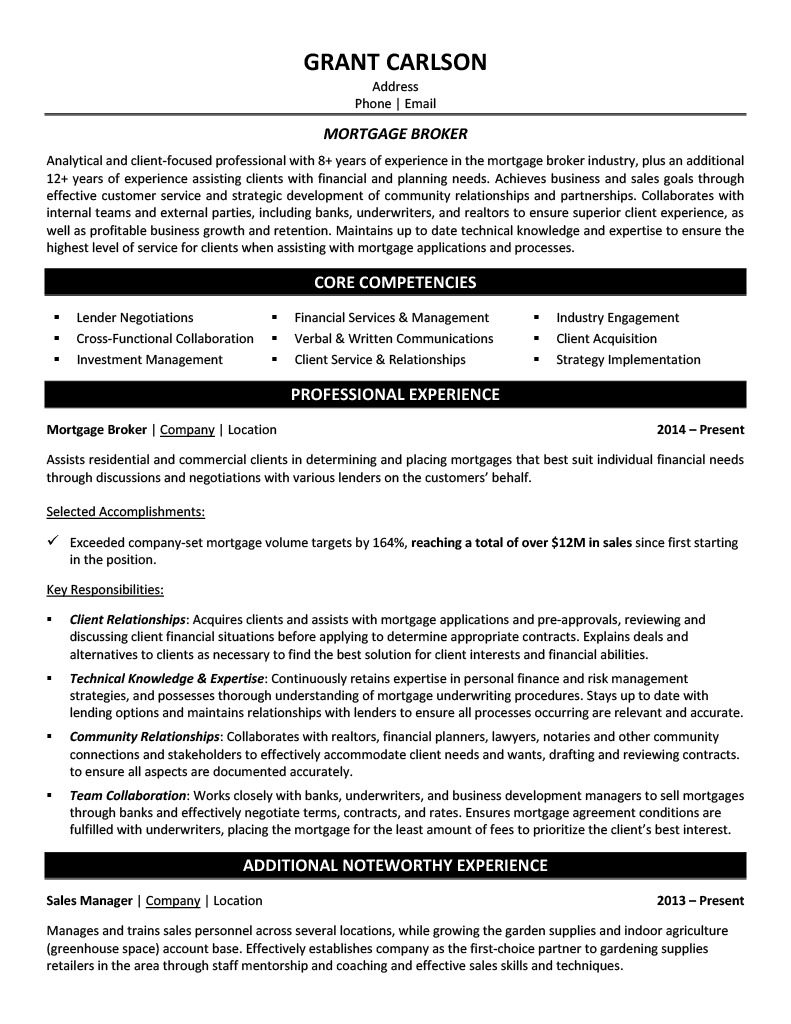

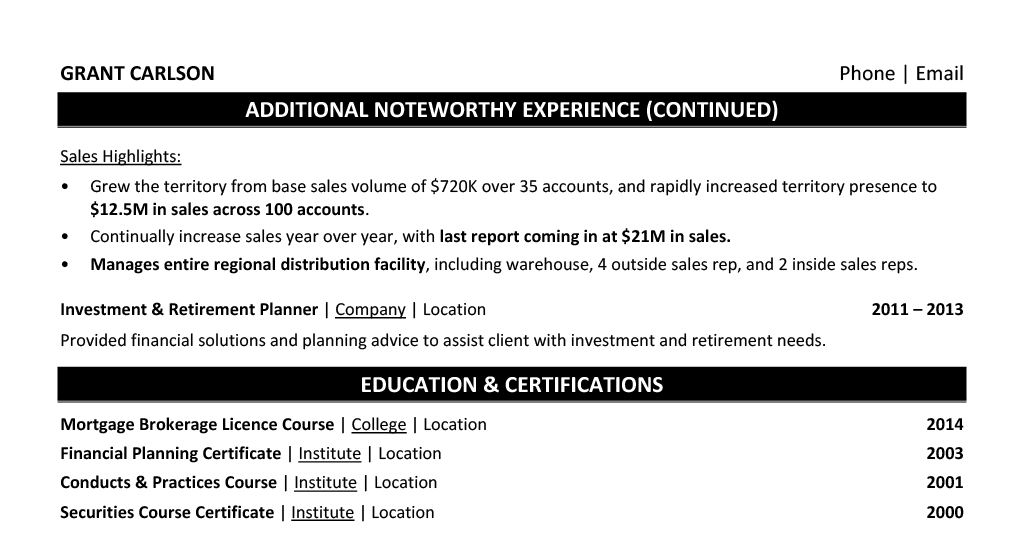

Showcase your mortgage expertise by organizing your experience into three powerful sections: a concise role overview that positions you in the industry, measurable achievements that highlight your loan closure rates and client portfolio growth, and core responsibilities that demonstrate your mastery of lending processes.

Many mortgage brokers struggle to effectively showcase their loan volume and client success metrics in a way that stands out to employers and partners. Transform your experience into compelling proof points by connecting your funding achievements, client satisfaction rates, and portfolio growth to specific revenue impacts and market share gains.

A strong responsibilities section demonstrates how Mortgage Brokers connect clients with optimal lending solutions while ensuring regulatory compliance. Your duties should highlight both your financial expertise and your ability to guide clients through complex mortgage processes, showing how you contribute to successful property transactions.

Your mortgage broker credentials demonstrate your expertise in loan origination and financial analysis to potential clients and employers. Prioritize your most recent licenses and certifications first, especially those required by NMLS (Nationwide Multistate Licensing System), followed by relevant education and professional development achievements.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing mortgage broker positions.

While many financial professionals focus solely on customizing their cover letters, tailoring your resume for specific mortgage broker roles is equally crucial for showcasing your lending expertise and client relationship skills.

A customized mortgage broker resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that you understand their unique business needs and can deliver the exact lending solutions they're seeking.

Ready to stand out in the competitive mortgage industry? Let's transform your resume into a targeted marketing document that proves you're the mortgage broker they've been looking for!

Don't let a lack of direct experience hold you back from launching your career as a Mortgage Broker!

Your previous customer service roles, combined with your relevant coursework in finance and real estate, can create a compelling story for potential employers.

Focus on highlighting your analytical abilities, communication skills, and any internships or projects that demonstrate your understanding of mortgage lending principles.

The key elements to emphasize are your financial knowledge, customer relationship abilities, and understanding of lending regulations.

For more guidance on structuring your resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your resume summary is your chance to showcase your fresh perspective, financial knowledge, and customer service abilities that make you an ideal candidate for a mortgage broker position.

Focus on highlighting relevant coursework, internships, and any customer-facing experience that demonstrates your ability to help clients achieve their homeownership goals.

"Detail-oriented and client-focused professional with foundational knowledge in mortgage lending and real estate finance through specialized coursework and internship experience. Demonstrated track record of excellence in customer service and relationship building, with strong analytical abilities and knowledge of loan qualification requirements. Proven ability to explain complex financial concepts in simple terms while maintaining high ethical standards. Seeking to leverage financial acumen and interpersonal skills to help clients achieve their homeownership dreams as a Mortgage Broker."

Now's your chance to showcase the financial and real estate education that sets you apart as a qualified mortgage professional!

Transform your coursework and certifications into compelling content by highlighting relevant classes like "Mortgage Lending Fundamentals"or "Real Estate Finance,"along with any specialized training in loan origination software and compliance regulations.

The common courses for mortgage broker education include Federal Law, Ethics, and Non-Traditional Mortgage Lending [1, 2]. Electives and state-specific courses are also typical [1, 2]. Relevant degree programs include Finance, Accounting, and Business Management [3].Relevant Coursework: Federal Mortgage Law | Financial Ethics | Non-Traditional Mortgage Lending | Business Management | Real Estate Finance | Risk Assessment

Key Projects:

Mortgage Application Analysis Project: Developed a comprehensive loan assessment framework to evaluate mortgage applications using industry-standard criteria and risk assessment tools.

Loan Portfolio Management Simulation: Collaborated with a team of four to manage a simulated mortgage portfolio worth $10M, focusing on risk mitigation and client relationship management.

Leverage your educational background, financial certifications, and internship experiences to create a compelling skills section that showcases your readiness to excel in mortgage brokerage and financial services.

As an aspiring Mortgage Broker, highlighting these foundational skills demonstrates your potential to connect clients with suitable mortgage solutions while positioning yourself for growth in this dynamic financial services field.

Let's face it - translating your complex deal-making expertise and relationship-building skills into compelling resume content can feel as challenging as closing a tough loan in today's market.

At Resume Target, we specialize in crafting resumes that showcase both your technical mortgage expertise and your client success stories, helping mortgage professionals like you stand out in the competitive real estate industry.

Our proven track record includes helping hundreds of mortgage brokers land interviews at top lending institutions by highlighting their unique value proposition and deal-closing abilities.

With the real estate market constantly evolving and competition for top positions intensifying, now is the perfect time to transform your resume into a powerful marketing tool - let's connect today for a free consultation.

Impress any hiring manager with our Real estate resume writing service. We work with all career levels and types of Real estate professionals.

Learn More → Real estate Resume Writing Services