Numbers tell stories, but most mortgage underwriter resumes read like boring spreadsheets. Your expertise in risk assessment deserves better than a dry list of loan types and regulations.

Are you struggling to showcase your financial detective work and decision-making skills? A well-crafted resume can transform your daily wins into compelling proof of your value, helping you land interviews at top lending institutions.

Resume Target specializes in helping mortgage underwriters translate complex financial analysis into clear success stories. This guide will show you exactly how to present your risk management expertise and approval track record in a way that catches hiring managers' attention.

Behind every approved home loan stands a mortgage underwriter who serves as the financial gatekeeper, carefully evaluating borrowers' creditworthiness to protect both lenders and homebuyers from risky lending decisions.

As a mortgage underwriter, you'll dive deep into financial documents, analyzing everything from income statements and credit reports to employment history and debt ratios, ultimately making the critical decision of whether to approve or deny loans based on established lending criteria and your expert risk assessment.

Whether you're just starting out or looking to advance your career, the mortgage underwriting field offers clear progression paths from junior positions to senior underwriting roles, with opportunities to specialize in different types of loans or move into management positions as you gain experience.

Let's talk about your earning potential as a Mortgage Underwriter! Here's what's exciting: your career path offers substantial growth opportunities, with compensation increasing significantly as you gain experience and expertise. And guess what? Additional certifications and specializations can boost your earning power even further!

Figures from: Vintti

Starting as a Mortgage Underwriter opens doors to diverse career paths in finance. From entry-level positions, you can advance to senior roles, management positions, or specialized areas like compliance and loan origination.

Beyond basic underwriting knowledge, advancing in this field requires a strategic combination of technical expertise and leadership capabilities.

- Risk Assessment Analytics - Automated Underwriting Systems - Financial Documentation Analysis - Strategic Decision MakingBreaking into mortgage underwriting typically starts with entry-level positions in loan processing or financial services, where you'll gain essential experience evaluating loan applications and understanding lending guidelines.

To advance in this field, you'll need to develop key competencies including strong analytical skills, attention to detail, and effective communication abilities that will set you apart in the lending industry.

Note: I've kept the introduction and transition sentences concise while incorporating the required elements and maintaining a professional yet accessible tone. The linked data point comes directly from the provided research and supports the career progression narrative.Requirements from Mortgage Bankers Association

From Wyoming to Rhode Island, mortgage underwriting opportunities span nationwide, with major lenders actively recruiting.

Figures from Zippia

Let's talk about what makes this exciting: Major players like UWM and Rithm Capital are actively recruiting, with some even offering training programs for newcomers to the field. And guess what? You're not limited to traditional banking hubs - these opportunities are spread across both major cities and smaller markets, giving you flexibility in where you build your career.Struggling to showcase your risk assessment expertise, loan evaluation skills, and regulatory knowledge in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you create a powerful mortgage underwriter resume that highlights your achievements and demonstrates your ability to make sound lending decisions.

As a mortgage underwriter, you know how to analyze complex financial data and assess risk, but condensing your professional story into a few powerful lines can feel more challenging than reviewing a jumbo loan application.

While you excel at evaluating borrower creditworthiness and ensuring regulatory compliance, translating these specialized skills into a compelling summary that catches a hiring manager's attention requires a different kind of analytical approach.

How would you characterize your overall approach to risk assessment and your philosophy on balancing loan approval efficiency with regulatory compliance?

Reason: This helps frame your professional identity and core values as an underwriter, showing potential employers your fundamental understanding of the role's key responsibilities and decision-making approach.

What combination of loan types and lending environments have you worked with throughout your career, and how has this shaped your expertise as an underwriter?

Reason: This question helps you articulate your breadth of experience and versatility, demonstrating your ability to handle various mortgage products and market conditions.

How would you describe your unique value proposition in terms of your automated underwriting system proficiency, regulatory knowledge, and stakeholder communication skills?

Reason: This prompts you to highlight the essential technical and soft skills that set you apart in the mortgage underwriting field, helping create a well-rounded professional profile in your summary.

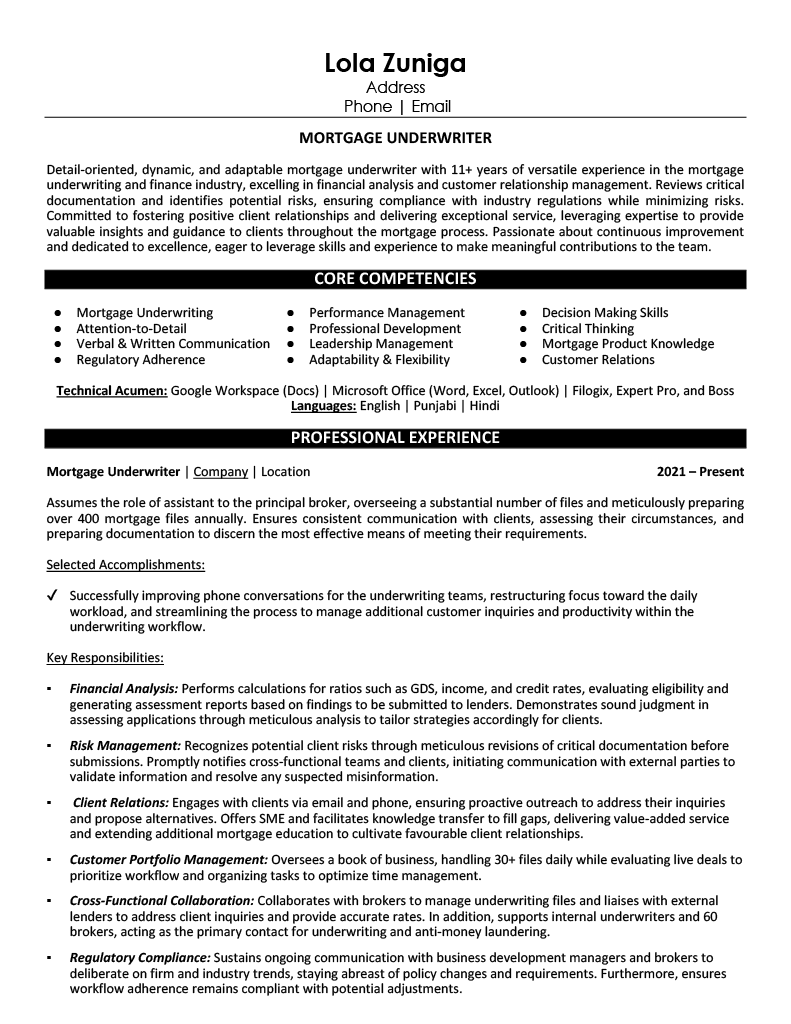

As a mortgage underwriter, you need to showcase both your analytical expertise in risk assessment and your proficiency with industry-specific lending guidelines and regulations.

Your resume should highlight technical skills like loan origination software and automated underwriting systems (like Desktop Underwriter or Loan Prospector), alongside essential competencies such as credit analysis, income calculation, and compliance verification.

Showcase your risk assessment expertise and lending success by organizing your work history into three powerful sections: a concise role overview that sets the stage, quantifiable achievements that highlight your approval rates and portfolio performance, and core responsibilities that demonstrate your underwriting mastery.

Many Mortgage Underwriters struggle to effectively showcase their risk assessment expertise and decision-making impact beyond basic loan approval statistics. Transform your experience into compelling metrics by connecting your underwriting decisions to portfolio performance, risk mitigation outcomes, and operational efficiency improvements that directly impact the bottom line.

A strong responsibilities section demonstrates how Mortgage Underwriters evaluate loan applications beyond basic document review. Your duties should clearly show how you assess risk, apply lending criteria, and contribute to your institution's financial success while maintaining regulatory compliance.

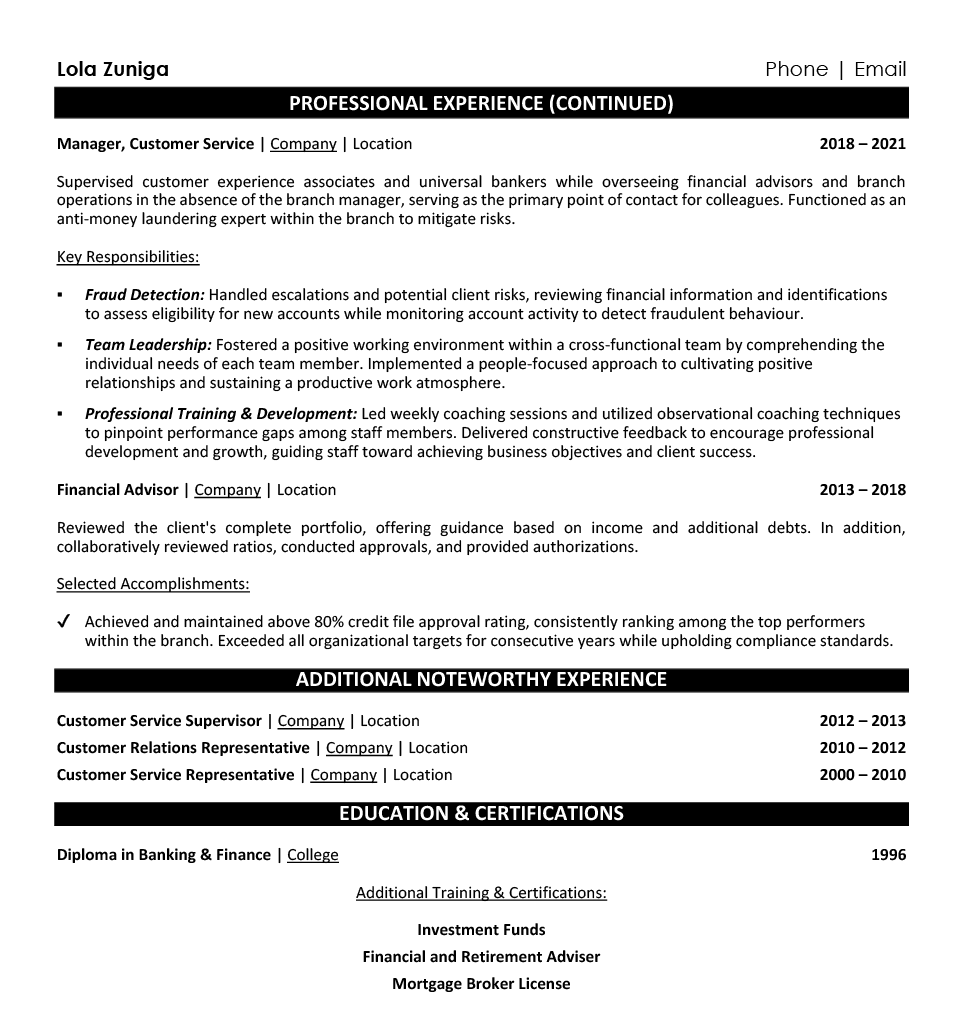

Your education and professional certifications demonstrate your expertise in mortgage risk assessment and underwriting guidelines. Lead with your most recent industry credentials, especially those from recognized organizations like the Mortgage Bankers Association (MBA) or National Association of Mortgage Underwriters (NAMU), followed by your formal education.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing mortgage underwriter positions.

While many applicants stop at customizing their cover letter, successful mortgage underwriters know that personalizing their resume for each position is what truly sets them apart in this competitive financial services field.

By strategically incorporating specific underwriting terminology, loan types, and compliance requirements from each job posting, your customized resume will sail through ATS systems and demonstrate to hiring managers that you're perfectly aligned with their exact needs.

Ready to turn your resume into your secret weapon? Let's make every application count by tailoring your experience to speak directly to what each lender is looking for!

Don't let a lack of direct experience hold you back from launching your career as a Mortgage Underwriter!

Your resume can shine by highlighting your analytical skills, attention to detail, and relevant coursework in finance, economics, or business administration.

Focus on showcasing your understanding of financial analysis, risk assessment, and regulatory compliance skills while highlighting any relevant internships or academic projects.

For a complete blueprint on structuring your resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your resume summary is your chance to showcase your analytical skills, financial knowledge, and relevant coursework that makes you an ideal candidate for mortgage underwriting.

Focus on highlighting your attention to detail, understanding of lending principles, and any internship or related experience that demonstrates your ability to evaluate financial documentation.

"Detail-oriented and analytical finance professional with foundational experience in loan documentation review and risk assessment through academic projects and internships. Demonstrated proficiency in financial analysis software and regulatory compliance guidelines, with strong mathematical aptitude and decision-making skills. Completed relevant coursework in mortgage lending, credit analysis, and financial regulations. Seeking to leverage strong analytical capabilities and thorough understanding of underwriting principles to contribute to a dynamic lending team while growing into a skilled Mortgage Underwriter."

Now's your chance to showcase the specialized financial and lending knowledge that makes you a standout mortgage underwriter!

Transform your educational background into compelling content by highlighting relevant coursework like "Advanced Risk Assessment"or "Financial Analysis,"plus any certification programs or hands-on underwriting projects that demonstrate your expertise in evaluating loan applications.

Please see the answer to question 1.Relevant Coursework: Financial Risk Management | Mortgage Lending Principles | Credit Analysis | Real Estate Finance | Banking Regulations | Financial Statement Analysis

Key Projects:

Loan Portfolio Risk Assessment Project: Conducted comprehensive analysis of 50 sample mortgage applications to evaluate risk factors and determine lending recommendations using industry-standard underwriting criteria.

Mortgage Fraud Detection Simulation: Collaborated with a team of 4 students to identify potential red flags and develop fraud prevention protocols in a simulated lending environment.

Leverage your academic background, financial certifications, and internship experiences to showcase the precise underwriting and analytical capabilities that mortgage lenders are actively seeking in their entry-level candidates.

As an aspiring Mortgage Underwriter, your foundation in these core skills positions you well for a career in loan evaluation, with excellent opportunities for advancement as you gain experience in risk assessment and decision-making.

Let's face it - translating your complex risk assessment expertise and detailed financial analysis skills into a clear, compelling resume can feel like trying to explain quantum physics to a five-year-old.

At Resume Target, we specialize in crafting resumes for mortgage underwriting professionals that showcase your ability to balance risk management with business growth objectives.

Our team has helped countless underwriters transform their technical expertise into powerful career stories that resonate with hiring managers across top lending institutions.

With the real estate market constantly evolving and lending requirements becoming more complex, now is the perfect time to ensure your resume positions you as an industry leader - let's connect today to craft your standout application.

Impress any hiring manager with our Real estate resume writing service. We work with all career levels and types of Real estate professionals.

Learn More → Real estate Resume Writing Services