Numbers tell stories, but many accountants struggle to tell their own career story effectively. Your technical expertise deserves more than just a list of job duties on paper.

Are you finding it challenging to translate your financial achievements into compelling resume content? A well-crafted accounting resume needs to balance technical proficiency with clear, measurable business impact.

Resume Target specializes in helping accountants showcase both their technical mastery and business value. This guide will show you exactly how to transform your accounting experience into a powerful resume that lands interviews.

As your financial GPS, a Financial Planner guides you through life's money milestones, using their expertise to help you navigate everything from buying your first home to planning for retirement, while operating under a fiduciary standard that legally requires them to put your interests first.

These money-savvy professionals analyze your entire financial picture, creating customized roadmaps that incorporate investment strategies, tax planning, insurance needs, and retirement goals - all while adjusting your plan as life throws its inevitable curveballs.

Whether you're interested in becoming a Financial Planner yourself or working with one, understanding the career path reveals how these professionals evolve from number-crunching newcomers to trusted financial advisors who can handle complex wealth management strategies and help clients achieve their dreams.

Let's talk about what's exciting in the financial planning field - your earning potential can grow substantially as you gain experience and expertise! From entry-level positions to executive roles, this career path offers impressive income opportunities that reward your professional development and client relationship skills.

Figures from: Vintti Financial Planning

Starting as a junior advisor, you can build your career in financial planning over 2-3 years. With experience, you can either launch your own firm or work your way up to partner status at established companies.

To excel beyond basic financial planning, you'll need to master both technical expertise and people skills that set top performers apart.

- Investment Analysis and Portfolio Management - Tax Strategy and Estate Planning - Risk Assessment and Insurance Planning - Client Relationship Management and CommunicationBreaking into financial planning starts with entry-level positions at financial services firms, where you'll learn the fundamentals while working alongside experienced advisors and building client relationship skills.

To advance in your financial planning career, you'll need to develop both technical expertise and strong communication skills, which are consistently ranked among the most crucial capabilities for success in this field.

Requirements from Investopedia

From Wall Street to Main Street, financial planning careers thrive in both major financial hubs and growing markets.

Figures from U.S. Bureau of Labor Statistics

Struggling to showcase your financial leadership, strategic planning abilities, and accounting expertise in a way that catches a CFO's attention? This comprehensive, section-by-section guide will help you craft a controller resume that highlights your achievements in financial management, regulatory compliance, and team leadership while speaking directly to what employers are looking for.

As a financial professional who masterfully handles complex data and reporting, you might find it challenging to distill your extensive controller experience into a few powerful sentences that capture your true value.

While you excel at analyzing financial statements and maintaining regulatory compliance, translating those high-level skills into compelling resume language that resonates with CFOs and hiring managers requires a different kind of precision - one that showcases both your technical expertise and leadership abilities.

How would you characterize your overall financial leadership philosophy and its impact on organizational growth across your career as a Controller?

Reason: This helps frame your executive narrative and demonstrates your strategic mindset beyond just technical expertise. Recruiters want to understand your leadership approach and how it shapes organizational success.

What combination of technical accounting expertise and business acumen best defines your value proposition as a Controller?

Reason: This question helps you articulate your unique blend of hard and soft skills that make you an effective Controller. It allows you to position yourself as both a technical expert and business partner.

How have you evolved your approach to financial controls and reporting as technology and compliance requirements have changed throughout your career?

Reason: This helps showcase your adaptability and contemporary knowledge while highlighting your experience with modern financial systems and regulatory requirements. It positions you as a forward-thinking finance leader rather than just a traditional accountant.

As a financial controller, you need to showcase both your strategic financial leadership abilities and your hands-on accounting expertise, making it crucial to strike the right balance in your skills presentation.

Your skills section should highlight your proficiency in financial software systems like SAP or Oracle, demonstrate your knowledge of GAAP and regulatory compliance, while also emphasizing your ability to lead teams and drive process improvements.

Examples of Controller Skills: - Financial Planning & Analysis - Budget Management - Internal Controls - Month-End Close Process - Risk Management - Team Leadership - GAAP Compliance - Cash Flow Management - Cost Reduction - Financial Reporting - Audit Oversight - Strategic Planning - Process Improvement - Variance Analysis - ERP Systems (SAP, Oracle, NetSuite) - Regulatory Compliance - Financial Forecasting - P&L Management - Tax Planning - Staff Development Technical Skills: Excel (Advanced) | SAP | Oracle Financials | QuickBooks | Microsoft Dynamics | Power BIShowcase your financial leadership impact by organizing your experience into three powerful sections: a concise role overview highlighting your scope of authority, measurable achievements that demonstrate your financial stewardship, and core responsibilities that underscore your expertise in corporate finance and accounting operations.

Many Controllers struggle to effectively demonstrate their dual impact on both financial accuracy and strategic business growth. Transform your achievements into compelling metrics by connecting your financial oversight to improved profitability, risk management success, and operational efficiency gains.

The responsibilities section demonstrates how Controllers drive financial strategy and maintain organizational health beyond basic accounting tasks. Your role needs to be presented clearly to show hiring managers how you connect financial oversight to business success and regulatory compliance.

Your education and professional certifications demonstrate your expertise in financial management and accounting principles. As a Controller, highlighting your CPA license and relevant advanced degrees shows potential employers you have the technical knowledge and credentials needed to oversee complex financial operations.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing staff accountant positions.

While many candidates make the mistake of using the same generic resume for every application, successful staff accountants know that personalizing their resume for each role is just as crucial as customizing their cover letter.

By carefully aligning your resume's keywords and achievements with each specific staff accountant job description, you'll not only sail through ATS screening systems but also immediately show hiring managers that you're the ideal candidate who understands their exact needs.

Ready to stand out from the crowd of applicants? Let's turn your resume into a laser-focused document that speaks directly to employers and lands you those crucial interviews!

Don't let a lack of professional experience hold you back from launching your Staff Accountant career! Your accounting degree, relevant coursework, and internship experience can create a compelling story that showcases your potential.

Focus on highlighting your knowledge of accounting principles, proficiency with accounting software, and any hands-on experience through class projects or internships.

For more detailed guidance on crafting your resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your resume summary is your chance to showcase your fresh accounting knowledge, internship experiences, and relevant coursework that makes you an ideal candidate for a staff accountant position.

Focus on highlighting your technical skills, academic achievements, and any hands-on experience you've gained through internships or volunteer work to demonstrate your readiness for this role.

"Detail-oriented and analytical recent accounting graduate with comprehensive knowledge of GAAP principles and financial reporting procedures. Gained practical experience through a 6-month internship at a regional CPA firm, maintaining 100% accuracy in account reconciliations and assisting with month-end closings. Proficient in QuickBooks, Excel, and various accounting software platforms. Seeking to leverage strong academic foundation and internship experience to contribute to a growing accounting team while pursuing CPA certification."

Now's your chance to showcase the strong accounting foundation you've built through your academic journey - make every qualification count!

Transform your educational background into compelling content by highlighting relevant coursework like Advanced Financial Accounting or Cost Analysis, plus any hands-on projects where you applied GAAP principles or mastered accounting software.

Courses common to a degree/certification for Staff Accountants include Financial Accounting, Auditing Principles, Business Taxation, and Business Law.Relevant Coursework: Financial Accounting | Auditing Principles | Business Taxation | Business Law | Cost Accounting | Advanced Financial Reporting

Key Projects:

Financial Statement Analysis Project: Led a comprehensive analysis of a Fortune 500 company's financial statements to evaluate financial health and provide strategic recommendations for improvement.

Internal Control System Design: Collaborated with a team of four to design and propose an internal control system for a mid-sized retail business.

Leverage your academic training, internship experience, and technical proficiencies to create a compelling skills section that showcases your readiness for a Staff Accountant position through your knowledge of accounting principles, software competencies, and analytical capabilities.

As an aspiring Staff Accountant, highlighting these foundational skills demonstrates your capability to contribute immediately to an organization's financial operations while positioning yourself for growth into more advanced accounting roles.

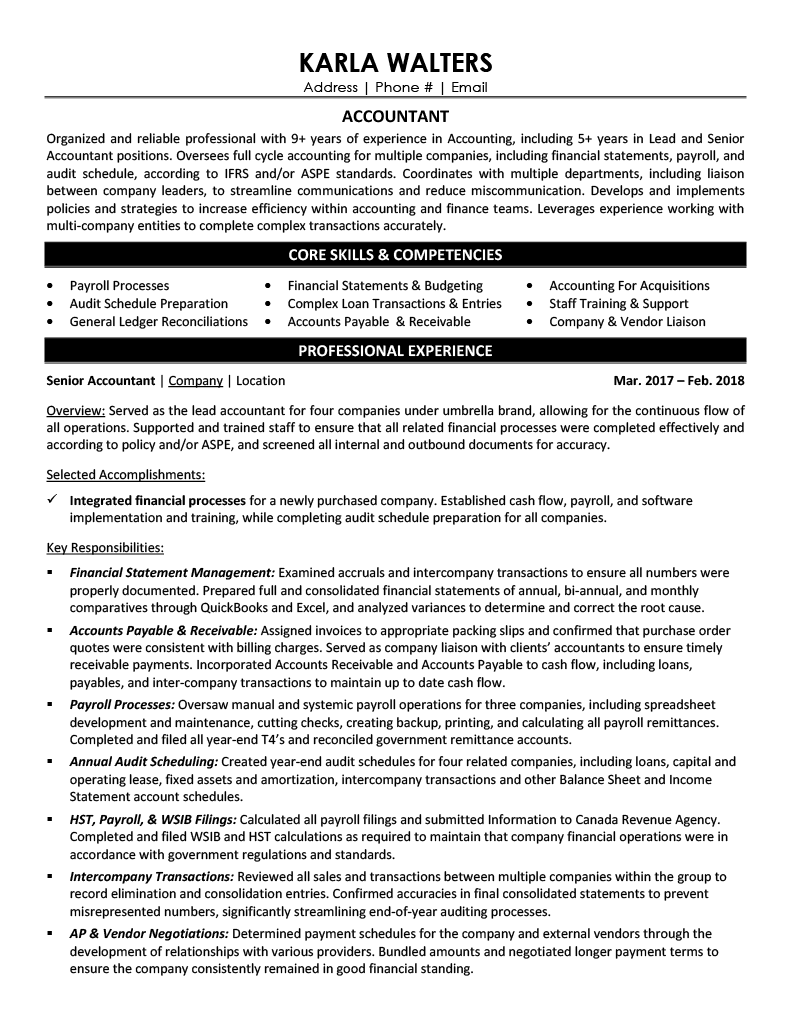

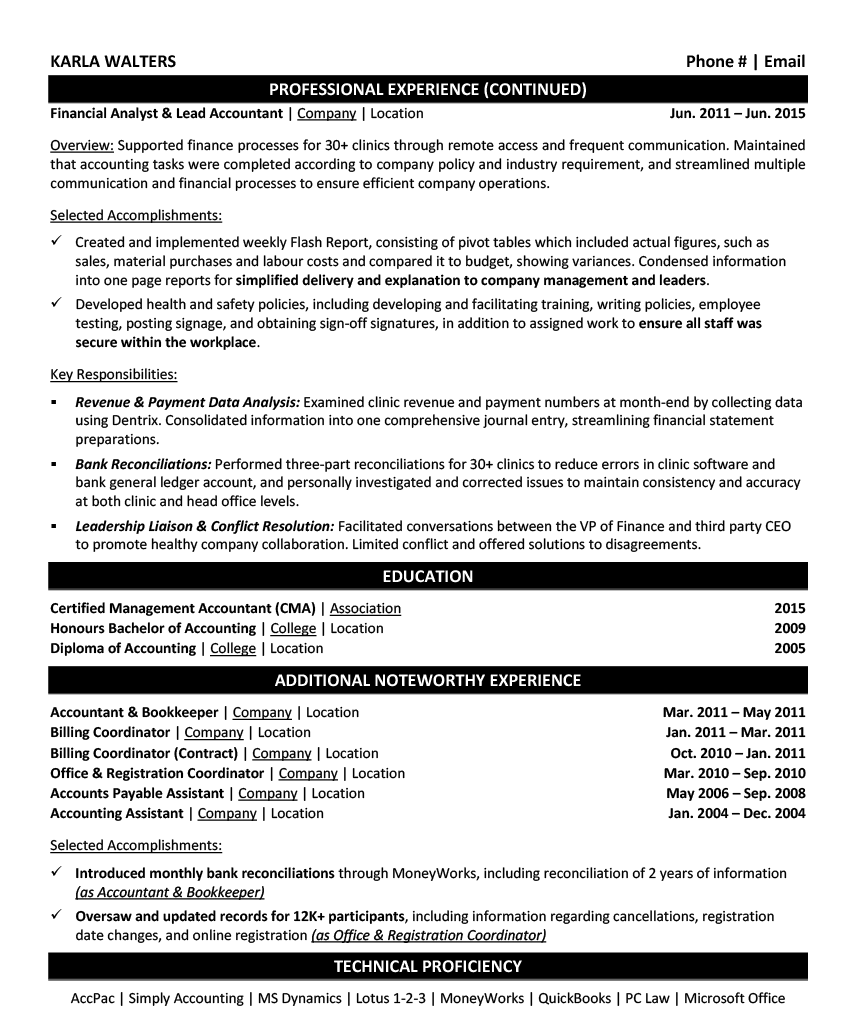

Let's face it - translating your daily number-crunching expertise and technical accounting skills into compelling resume content can feel like trying to balance an impossible ledger.

At Resume Target, we specialize in crafting resumes that showcase both your technical accounting prowess and your business impact, helping professionals like you stand out in a competitive field.

Our proven track record includes helping hundreds of staff accountants land interviews at top firms by highlighting their unique combination of analytical skills and practical experience.

With year-end hiring cycles approaching and firms actively seeking fresh talent, now is the perfect time to transform your resume from a basic transaction log into a powerful career asset - let's connect for a free consultation today.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services