We Dive Into Your Responsibilities

What accounts and entities do you manage? We probe the scope and complexity.

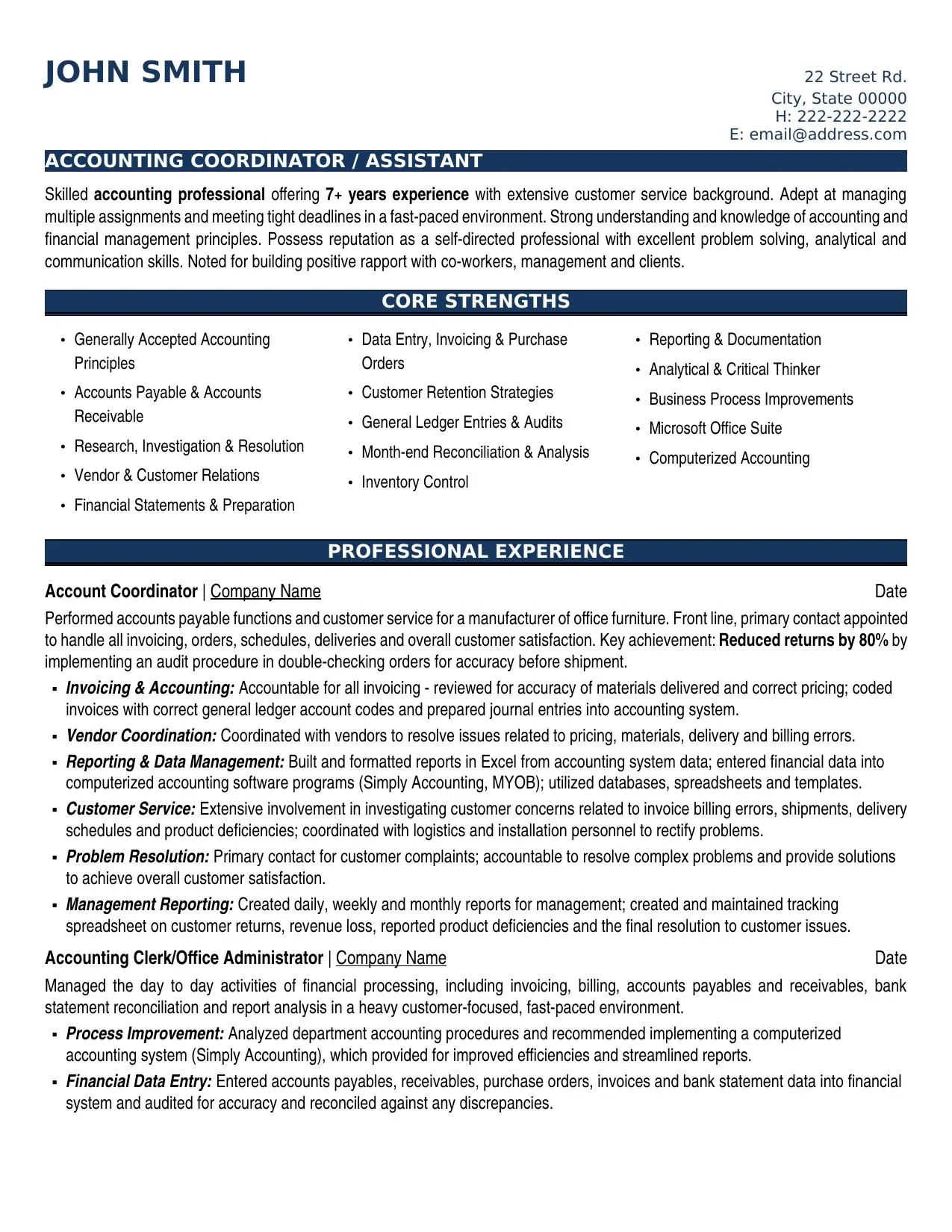

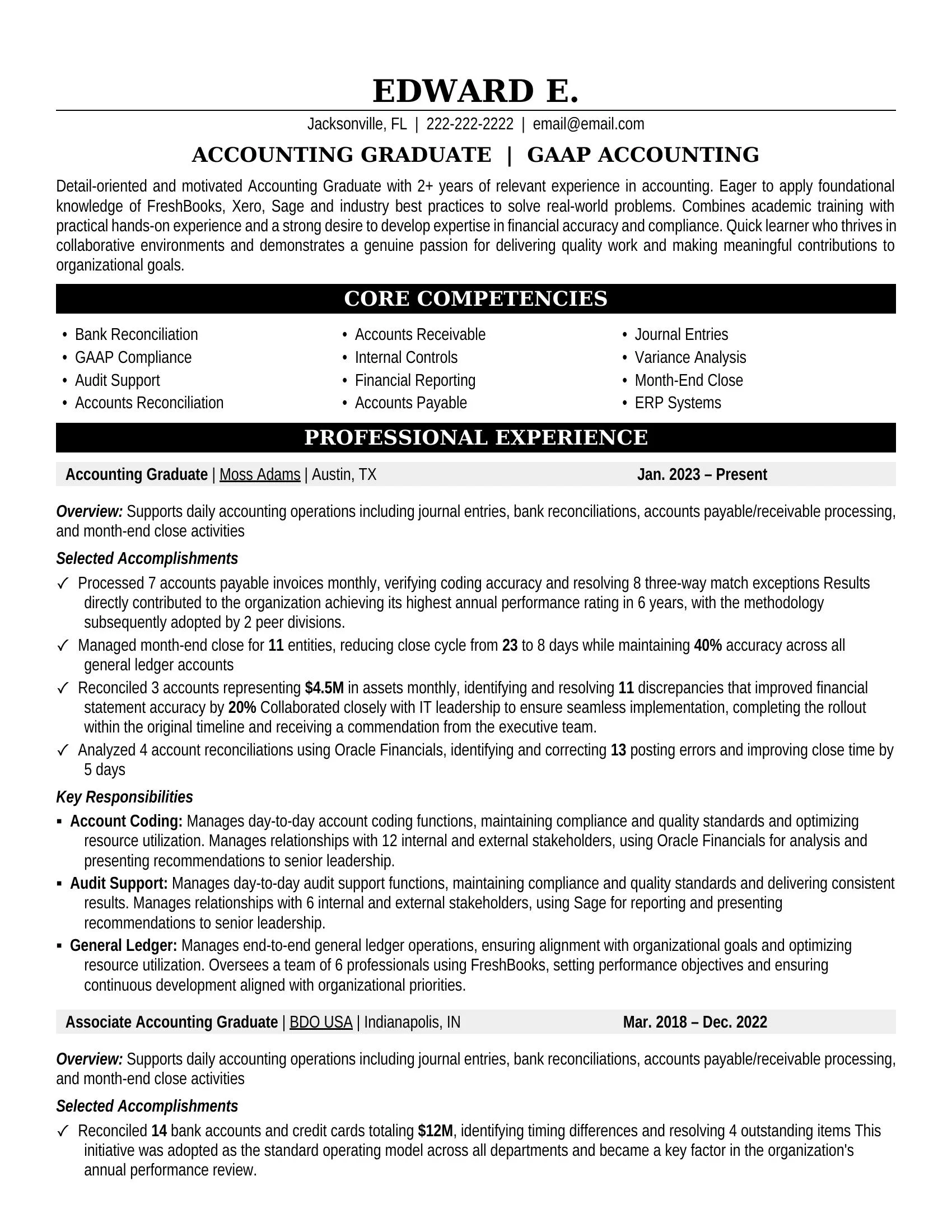

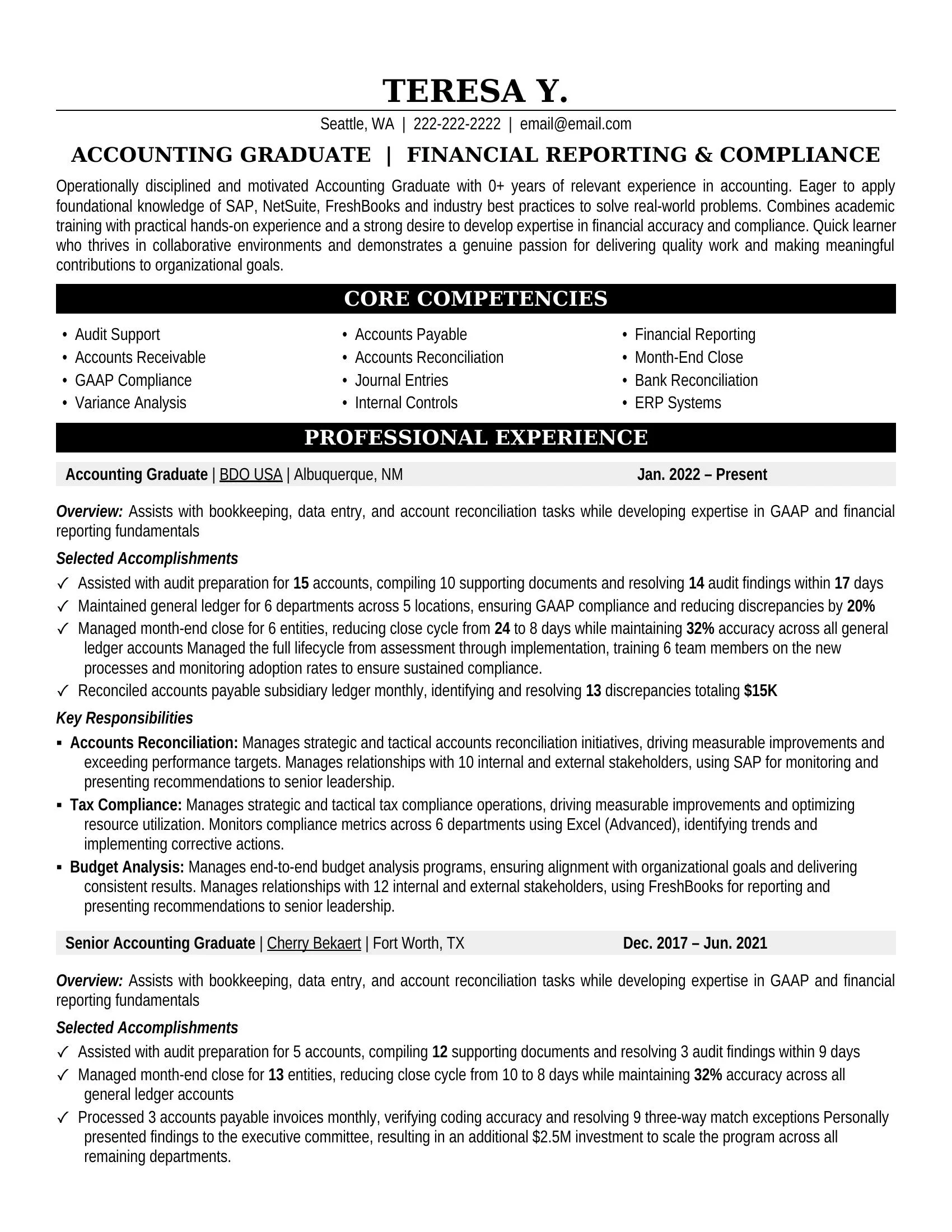

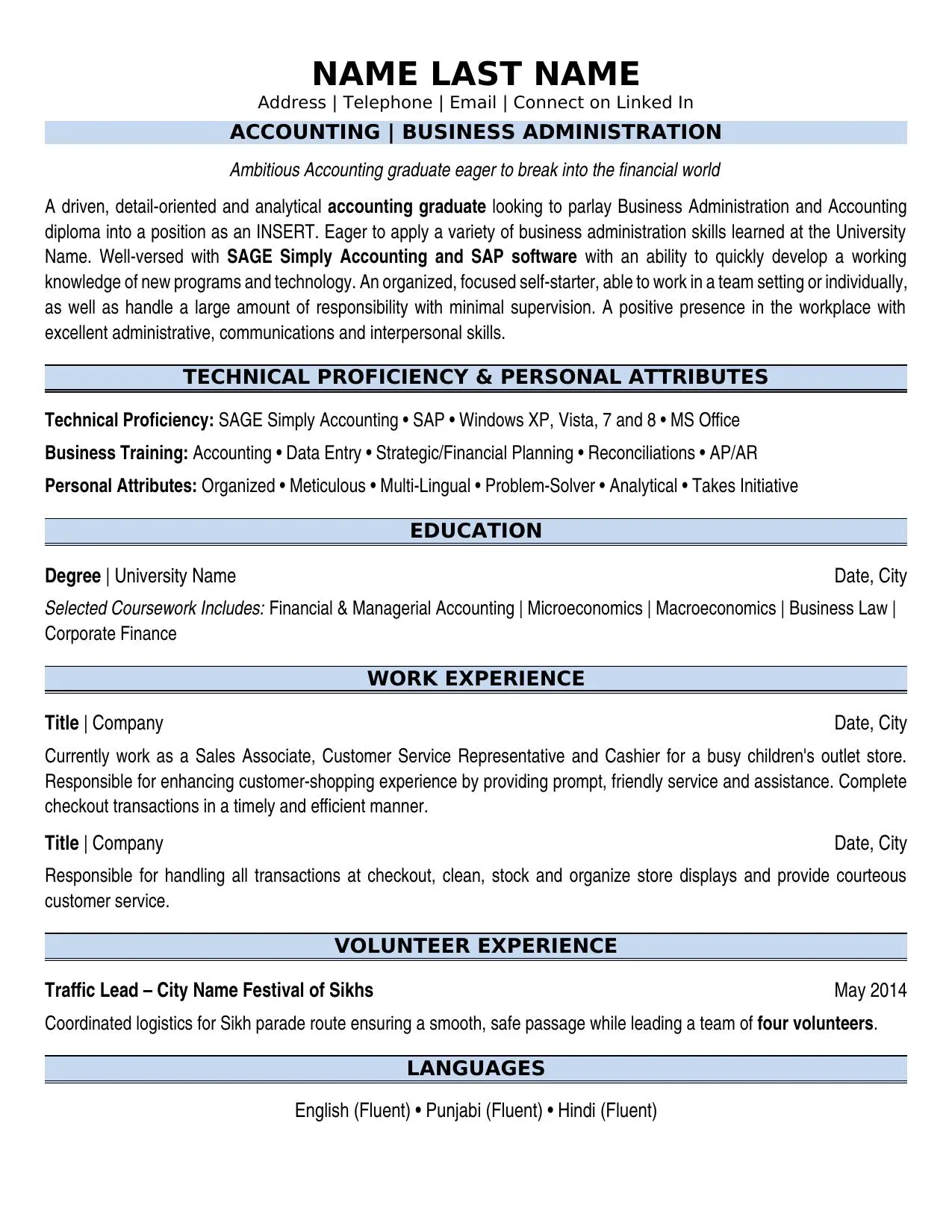

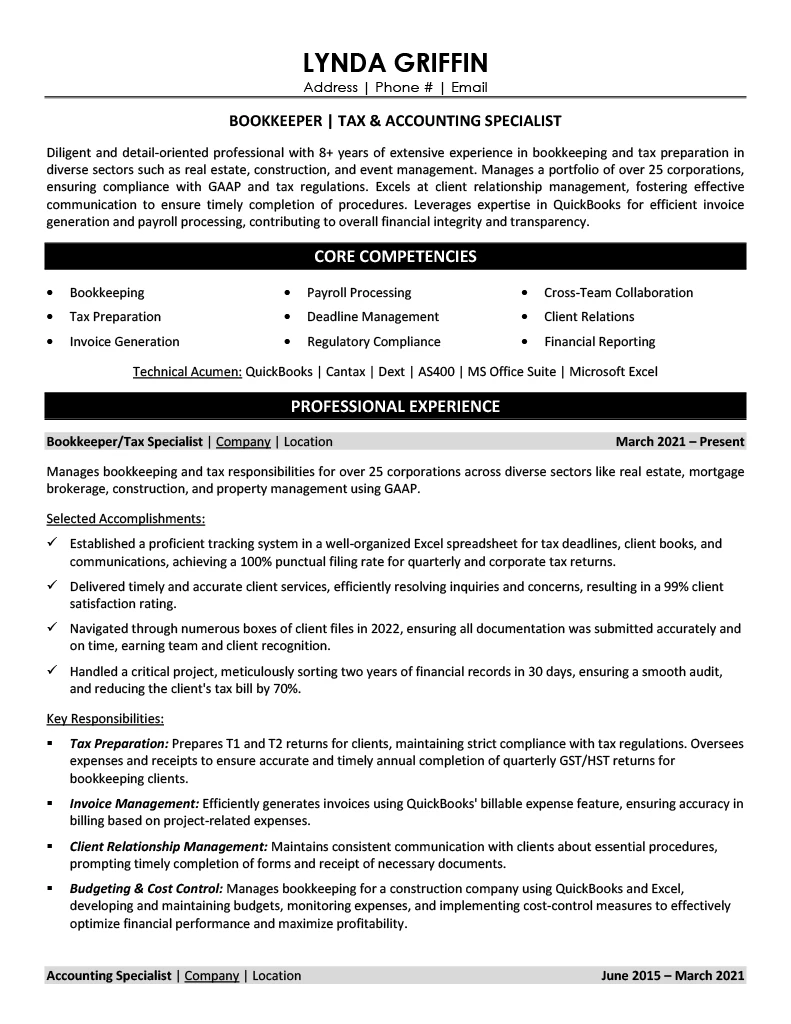

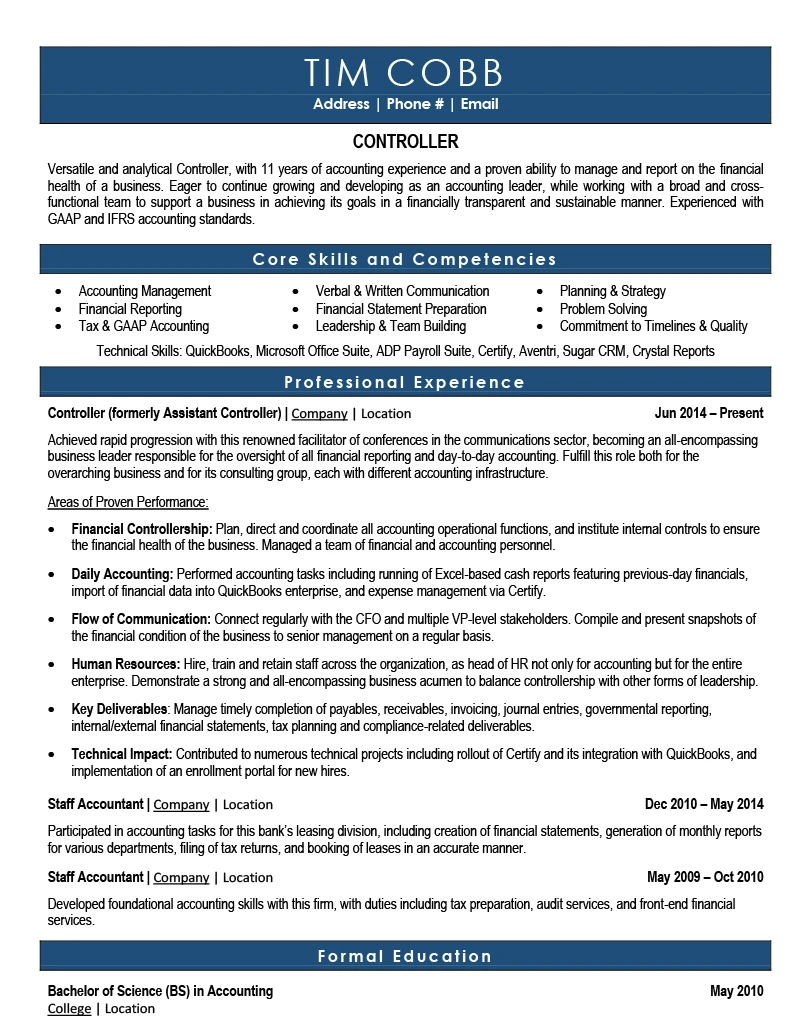

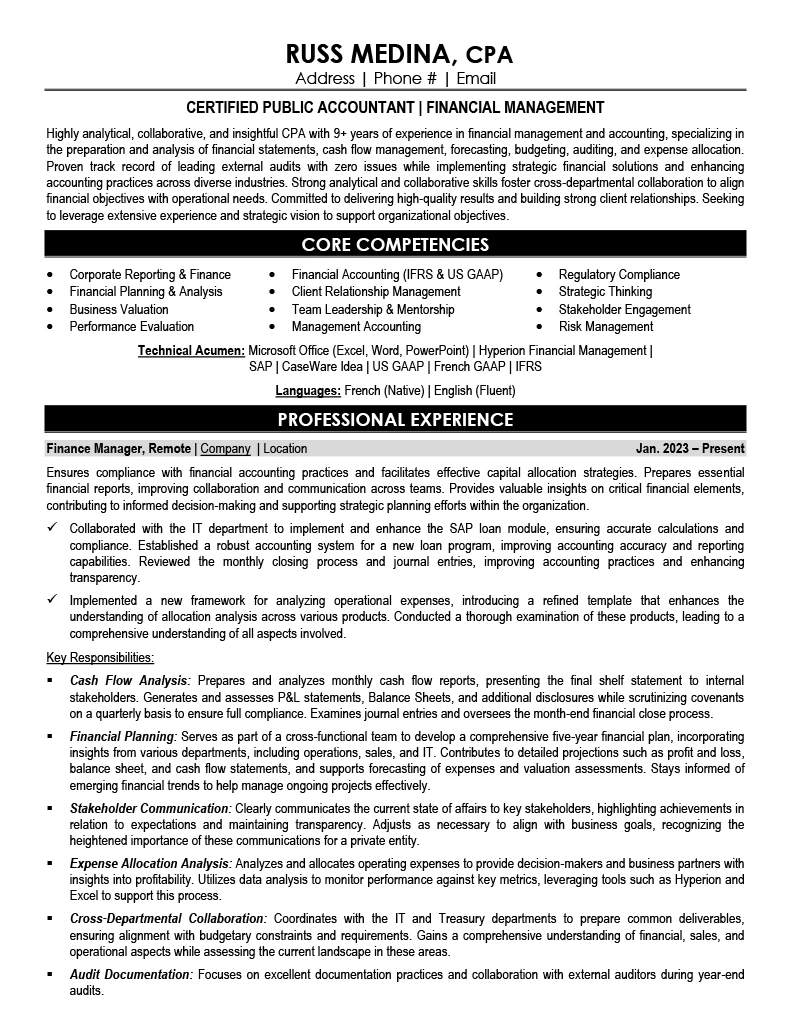

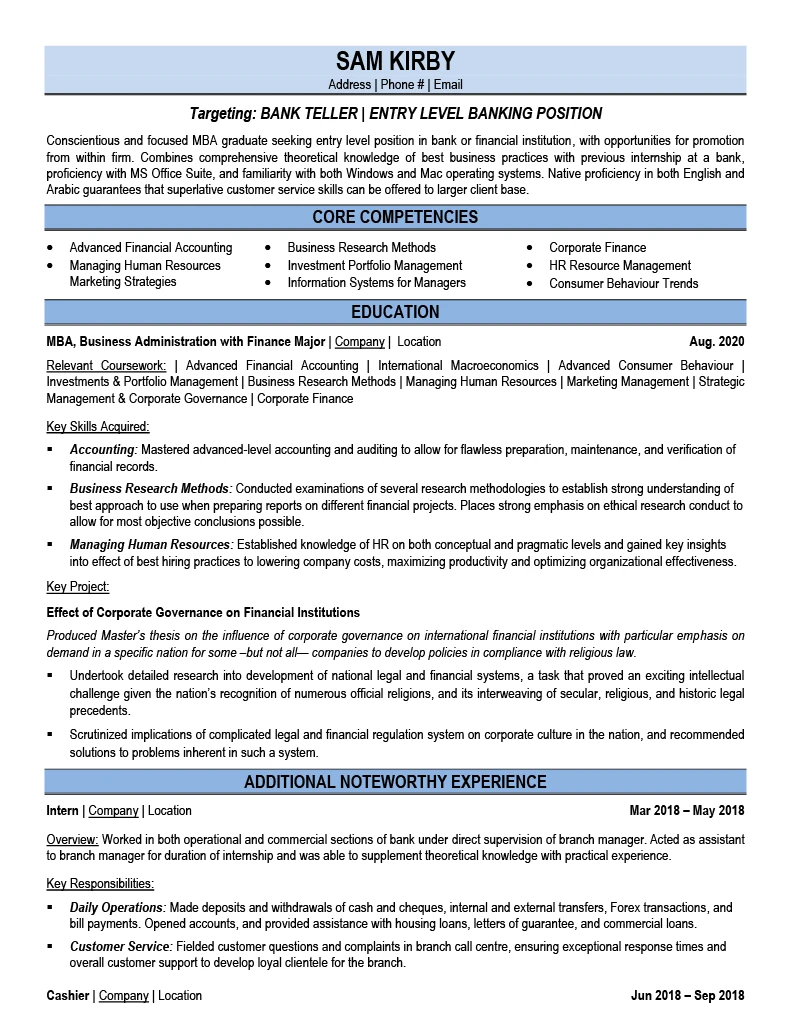

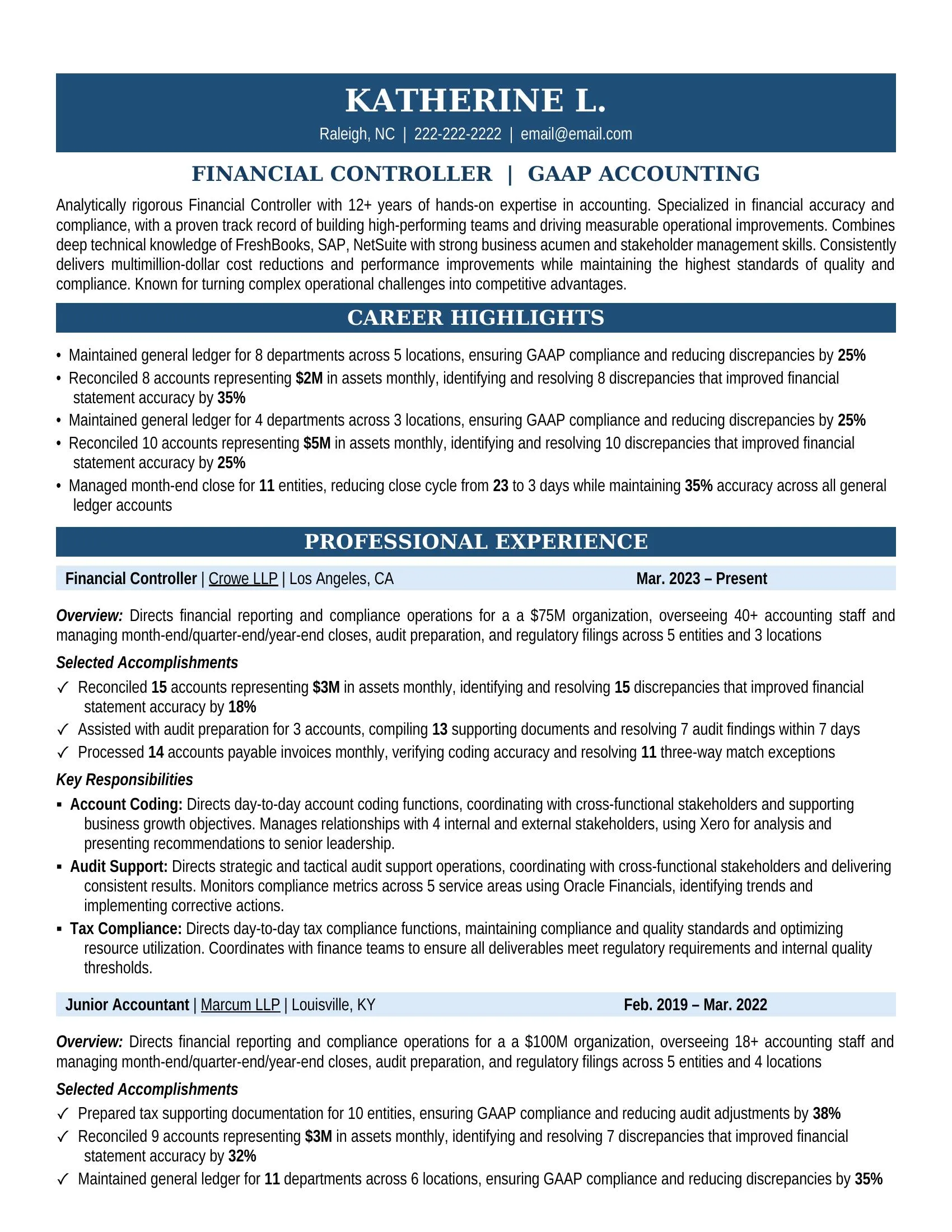

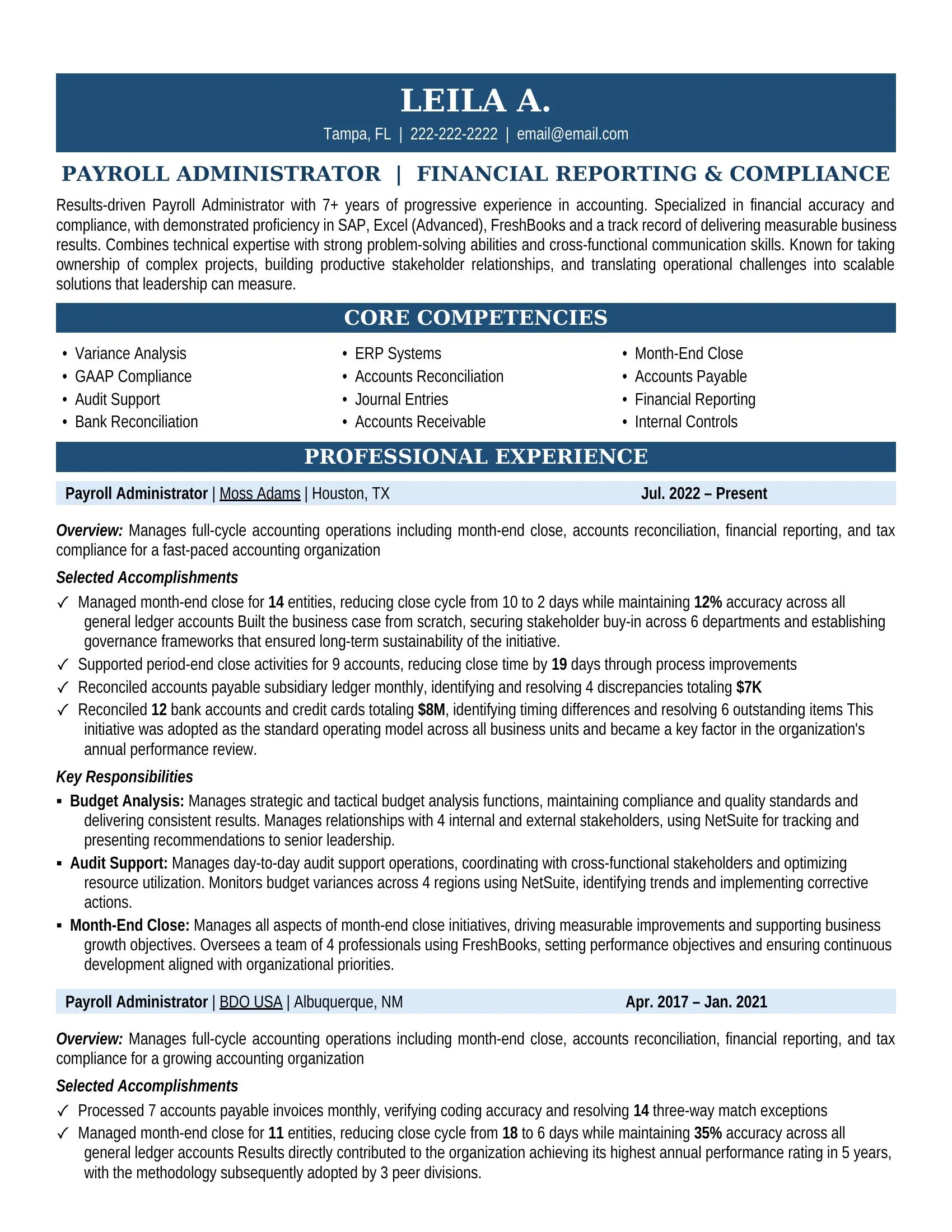

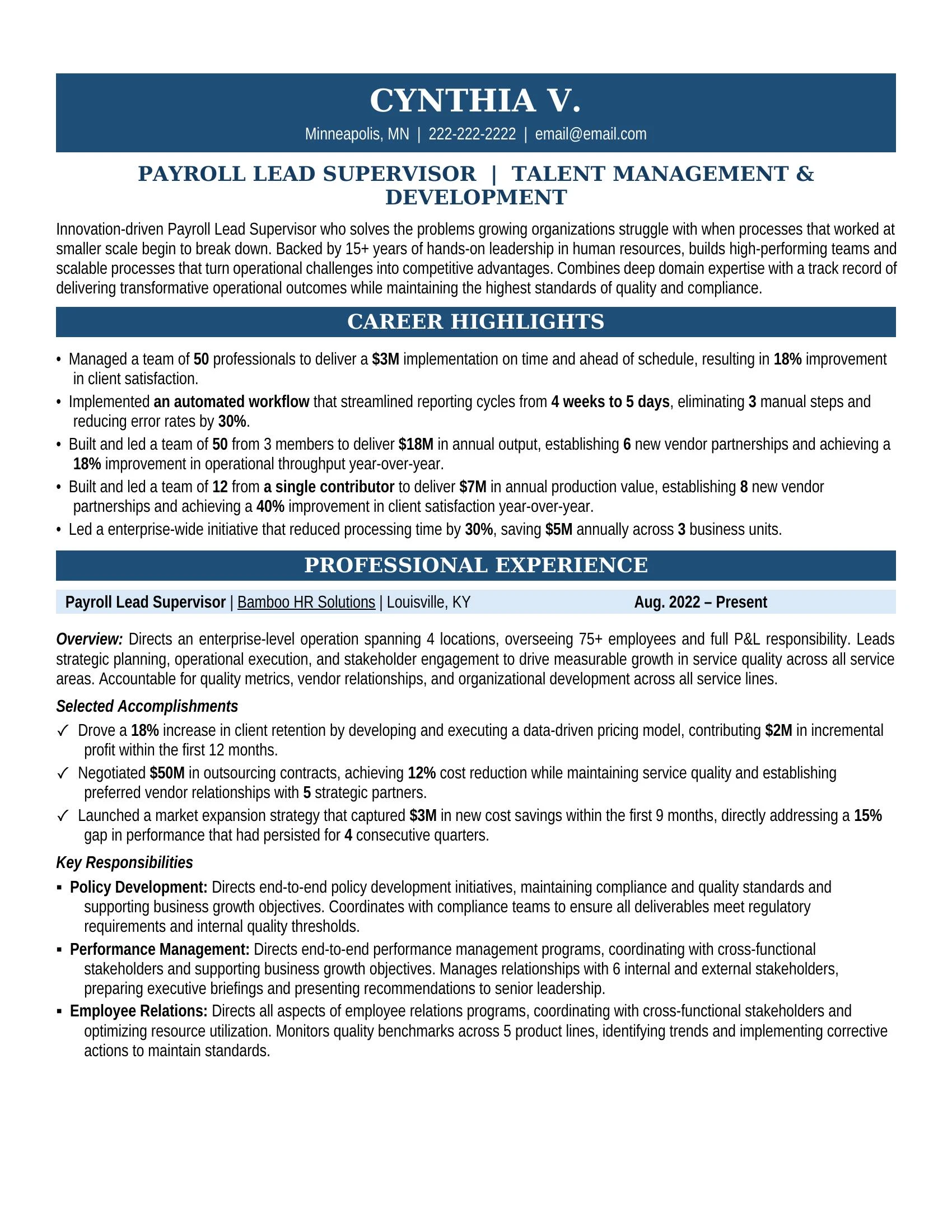

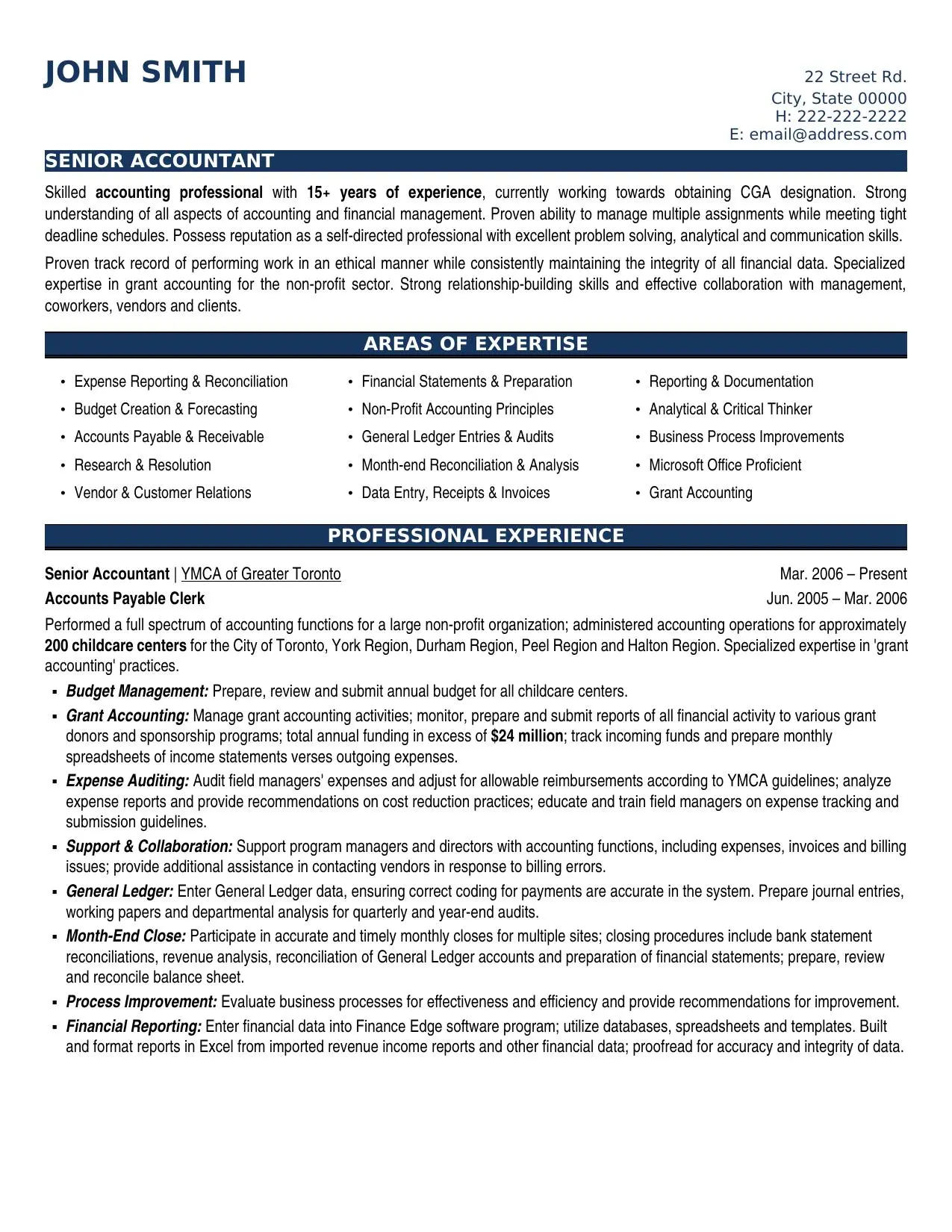

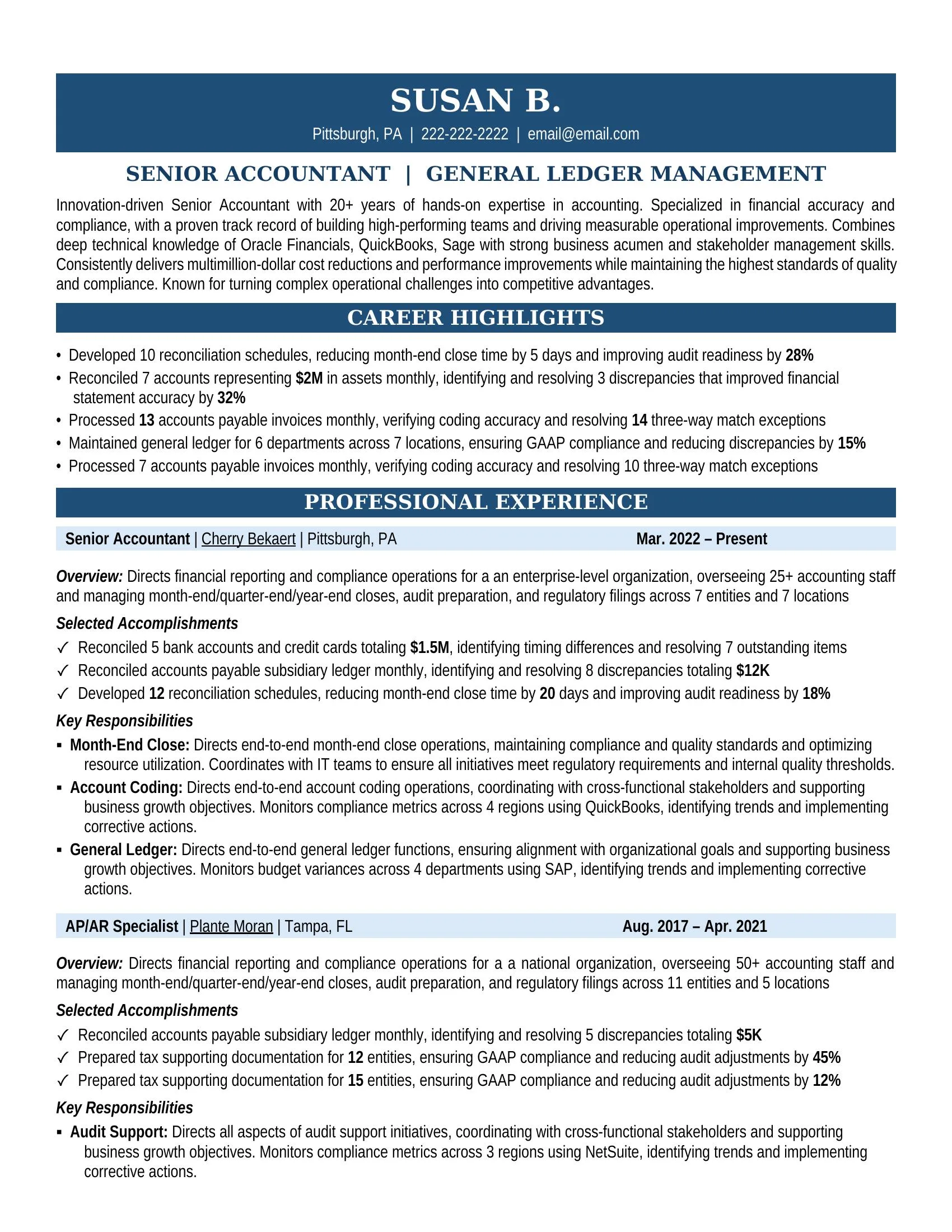

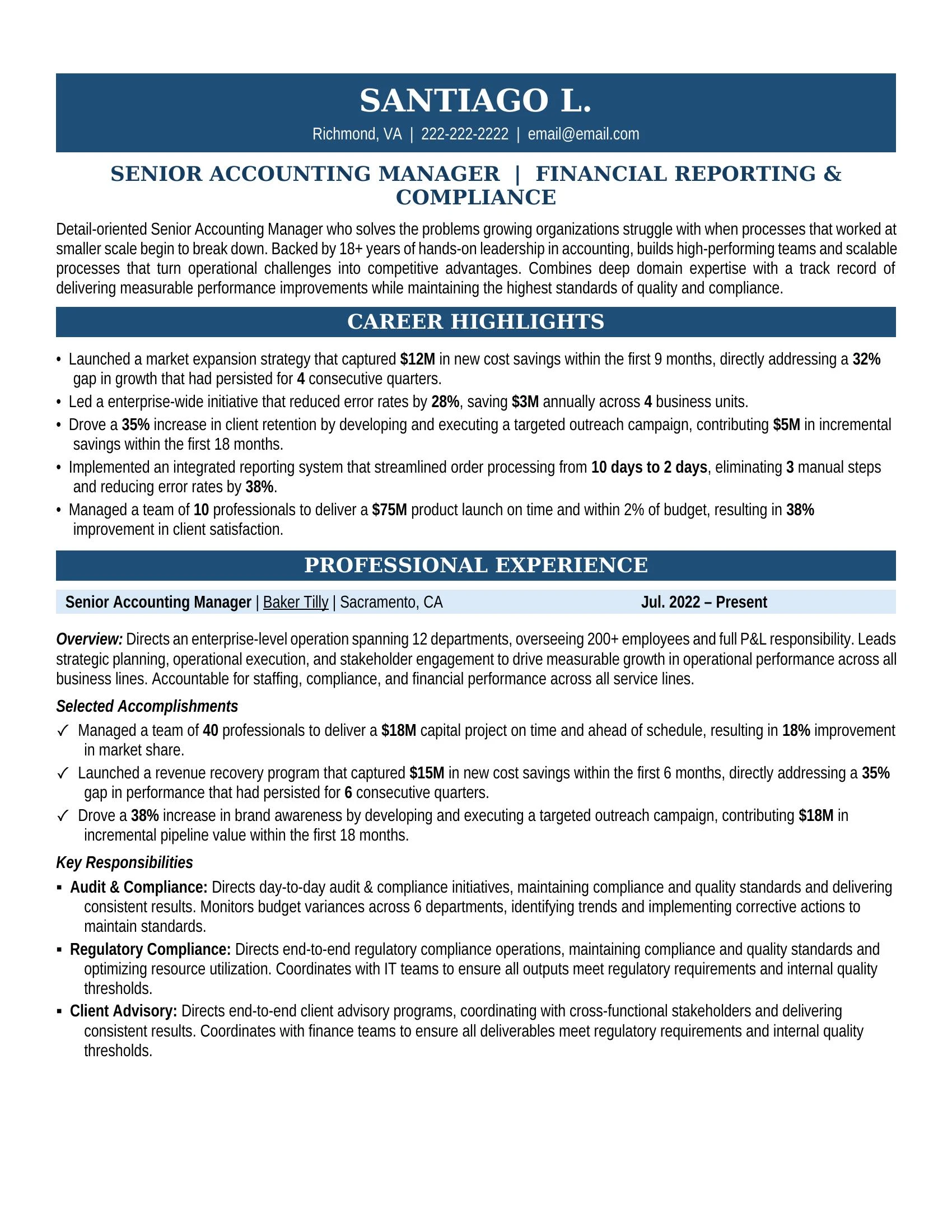

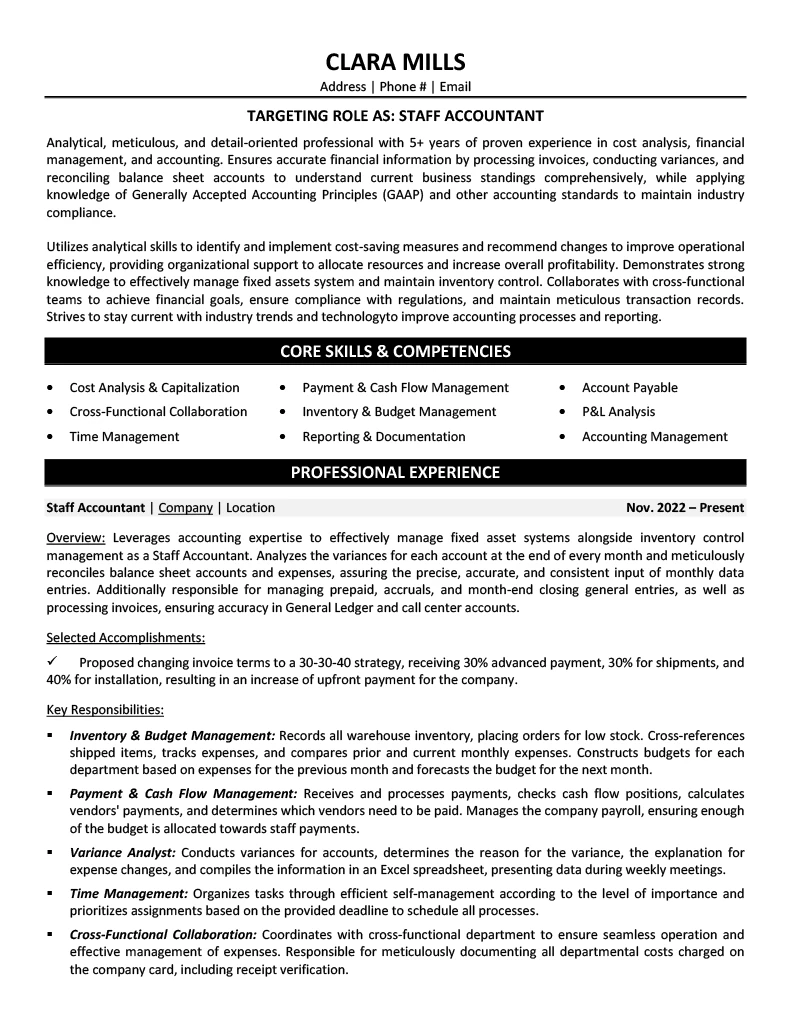

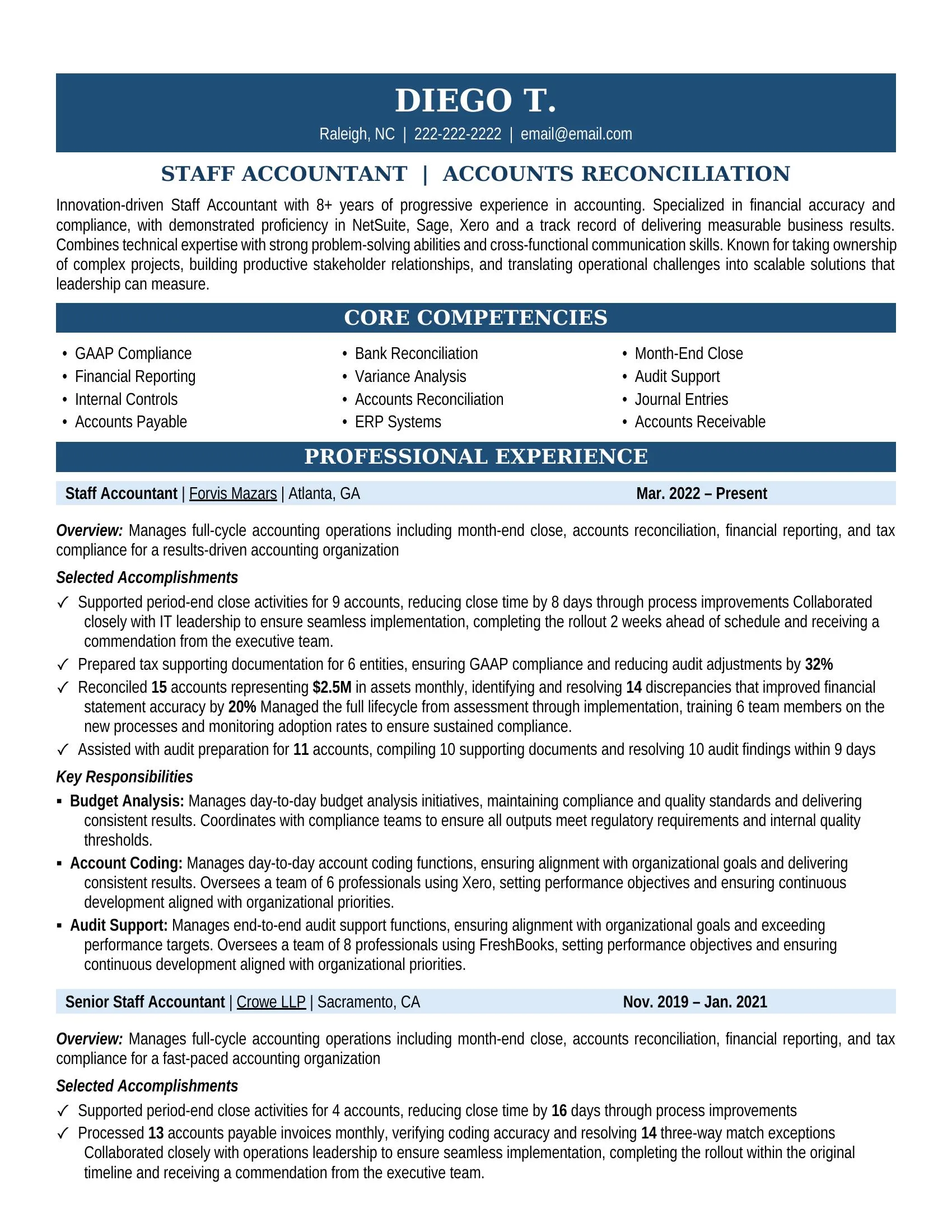

"Tell me about the size of the GL you maintain..."25+ Accounting Resume Examples

In Accounting, you're competing with 660 applicants per search

You're Not Rejected.

— You're Overlooked —

We fix your accounting resume with one conversation

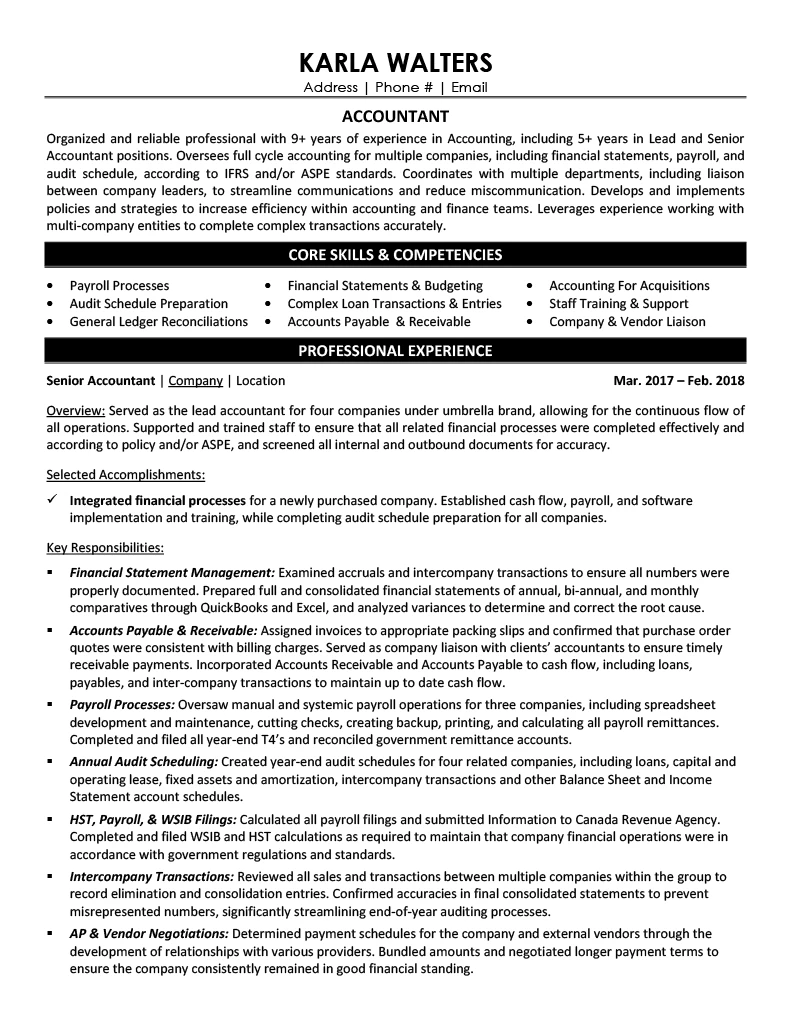

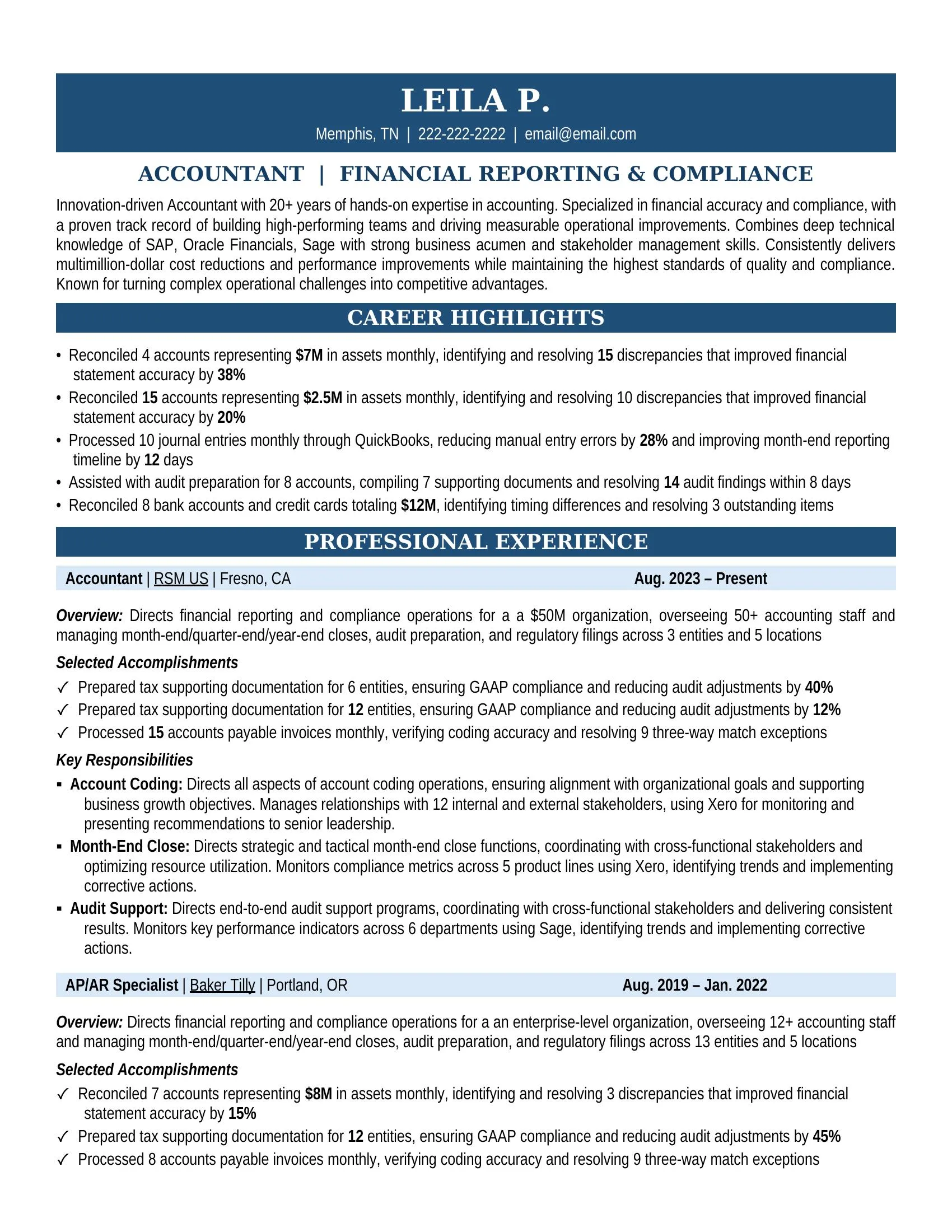

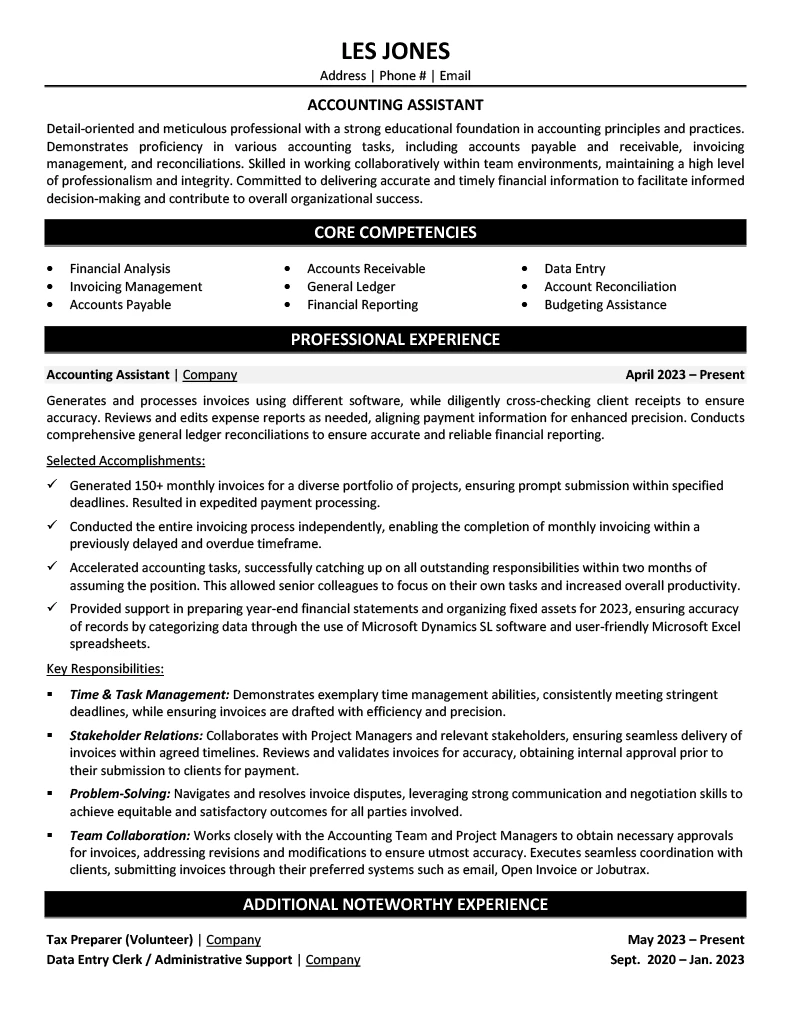

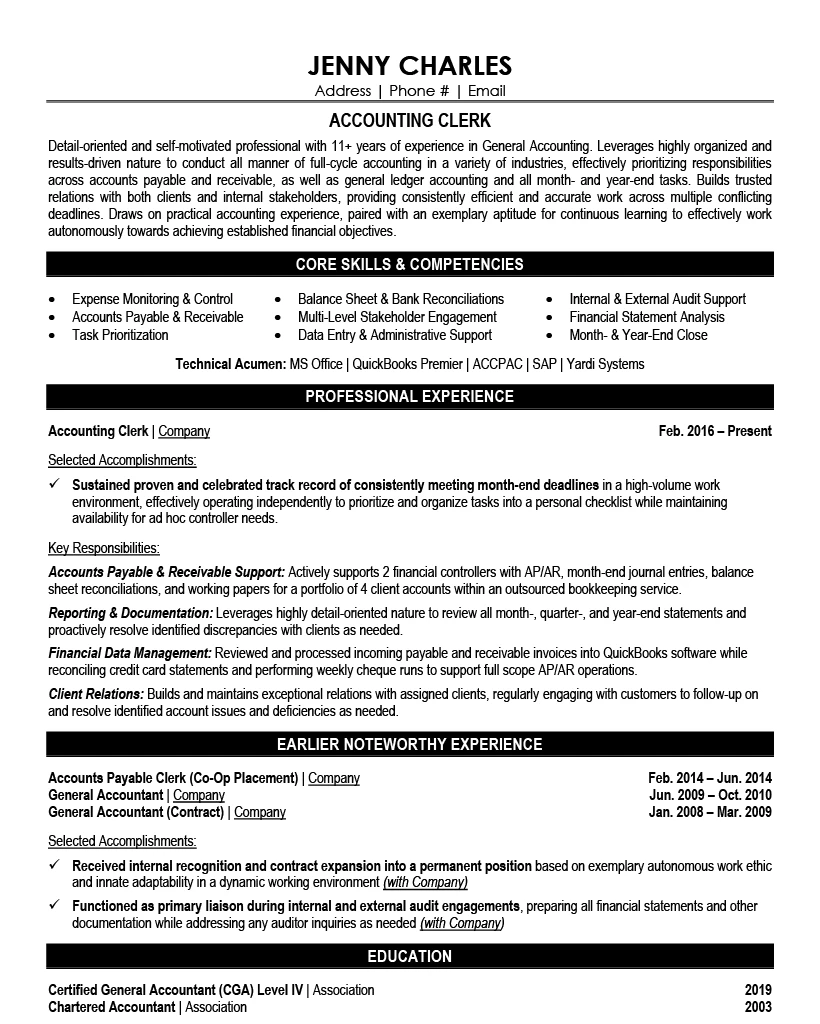

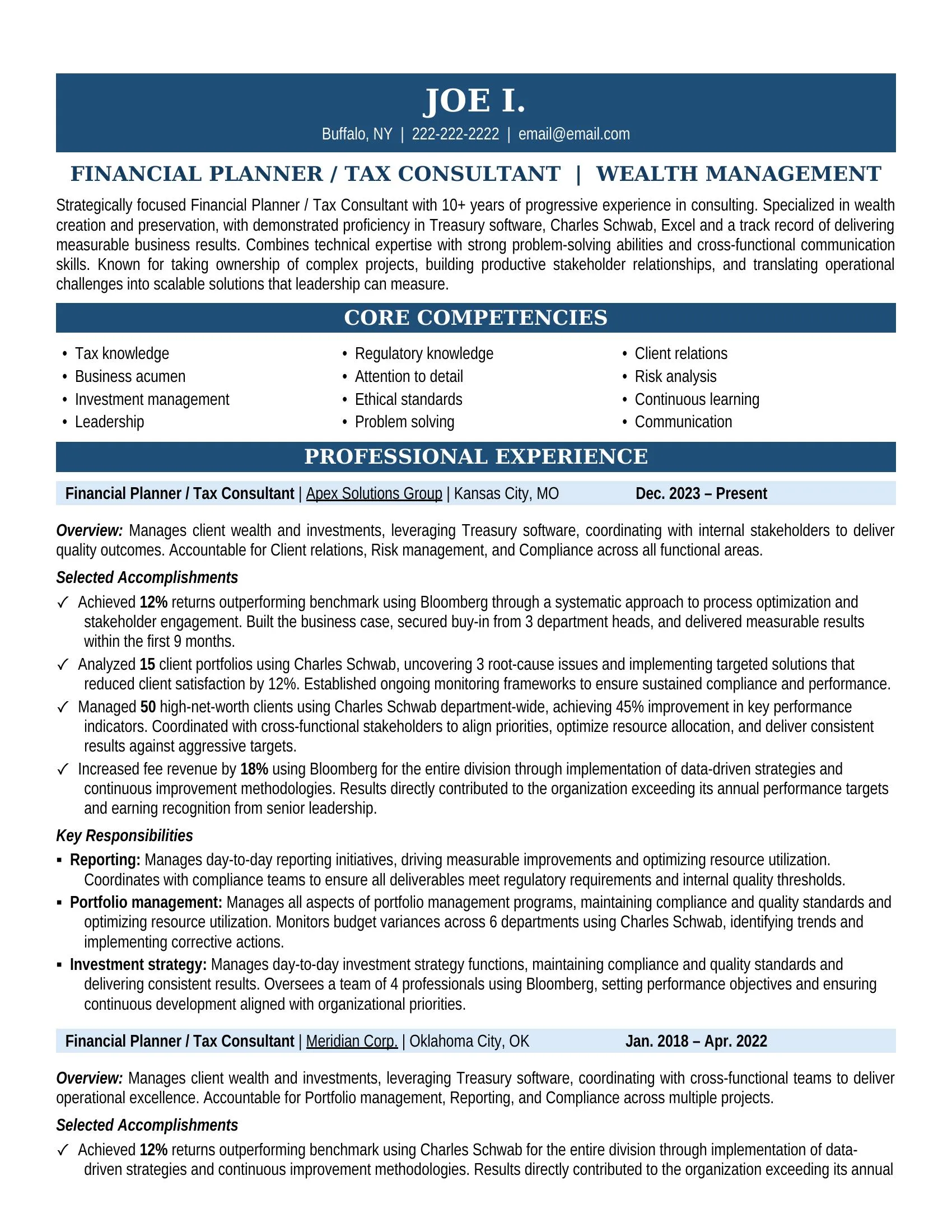

The strongest accounting resumes lead with measurable impact — close cycle reductions, audit outcomes, and system implementations — not duties. Hiring managers at firms like Deloitte, PwC, and Grant Thornton scan for CPA credentials, ERP proficiency (NetSuite, SAP, Oracle), and proof of process improvement. Every resume sample on this page was built through a 1-on-1 interview that extracted the specific financial outcomes that differentiate candidates in a field averaging 660 competitors per job search.

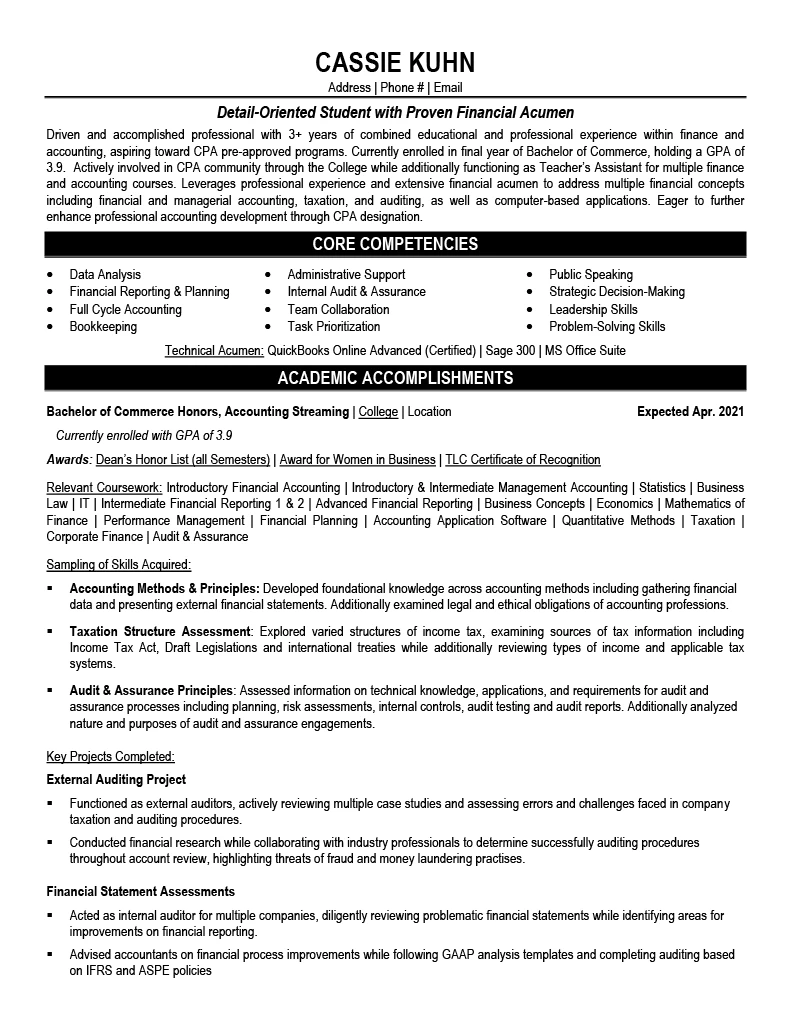

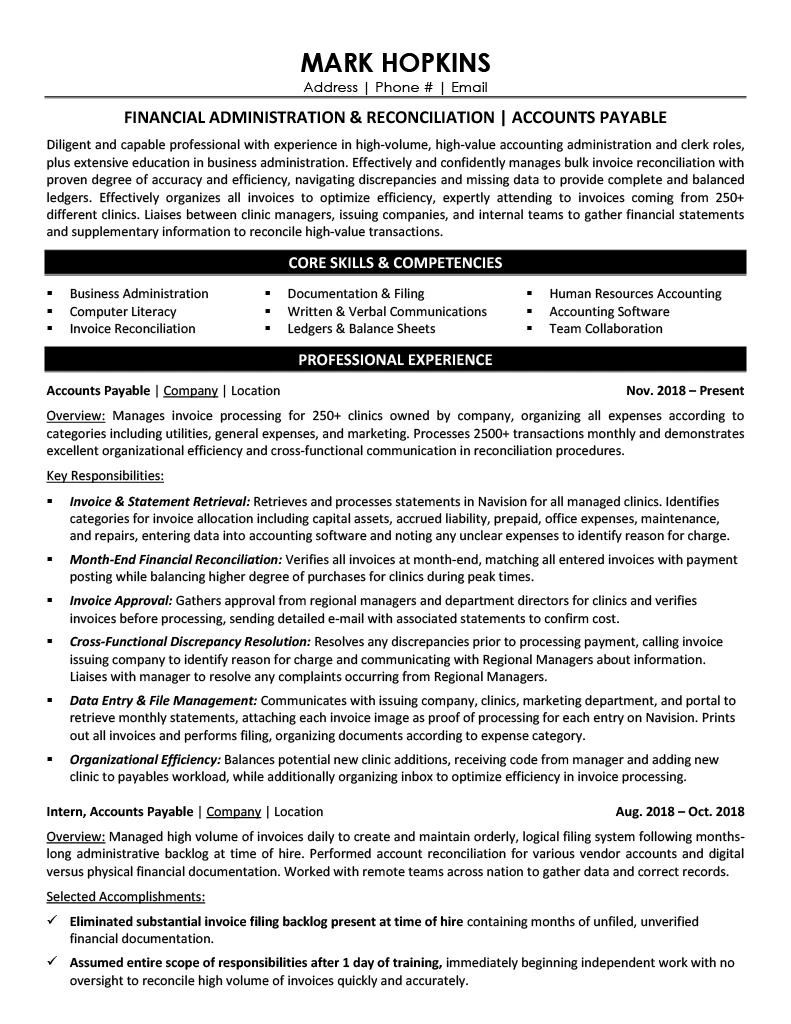

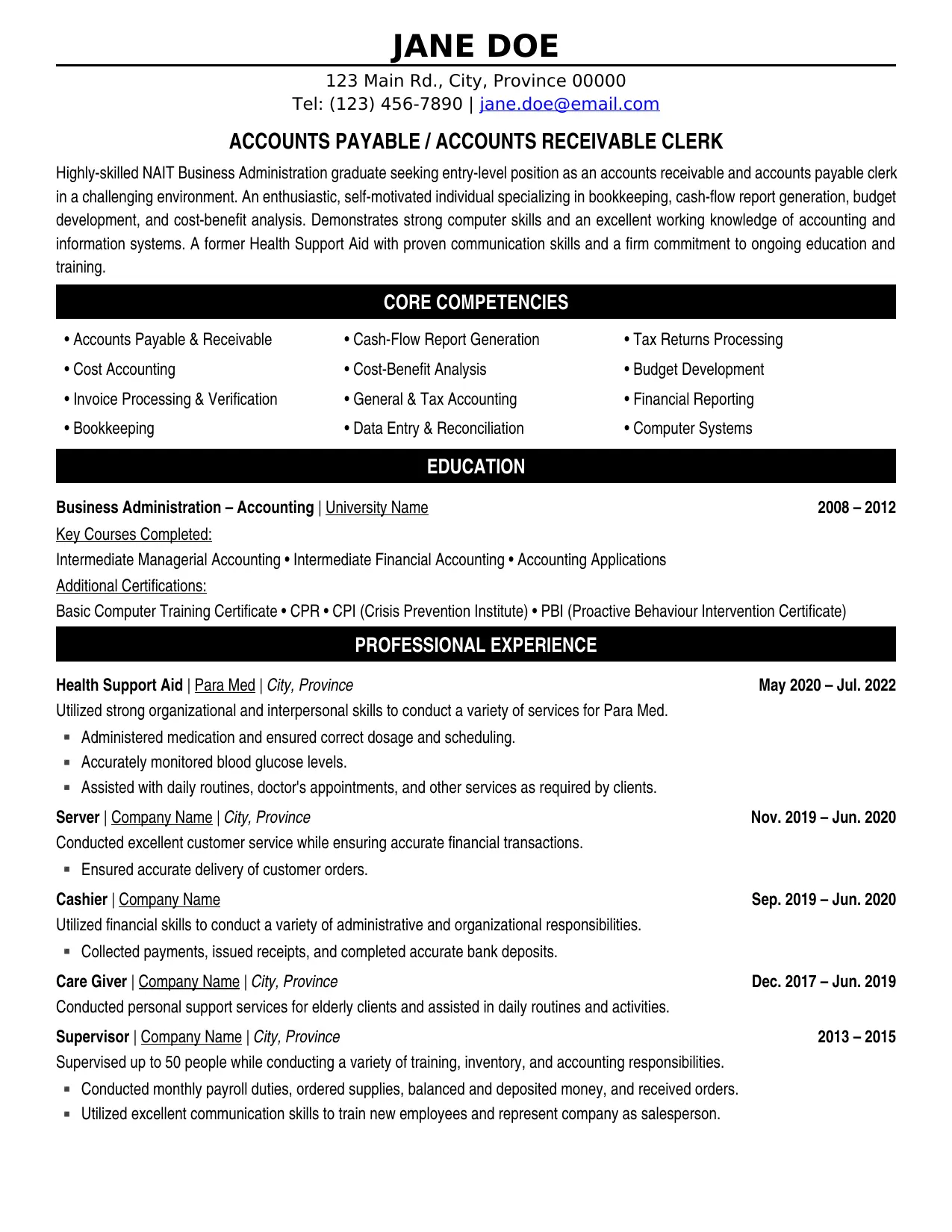

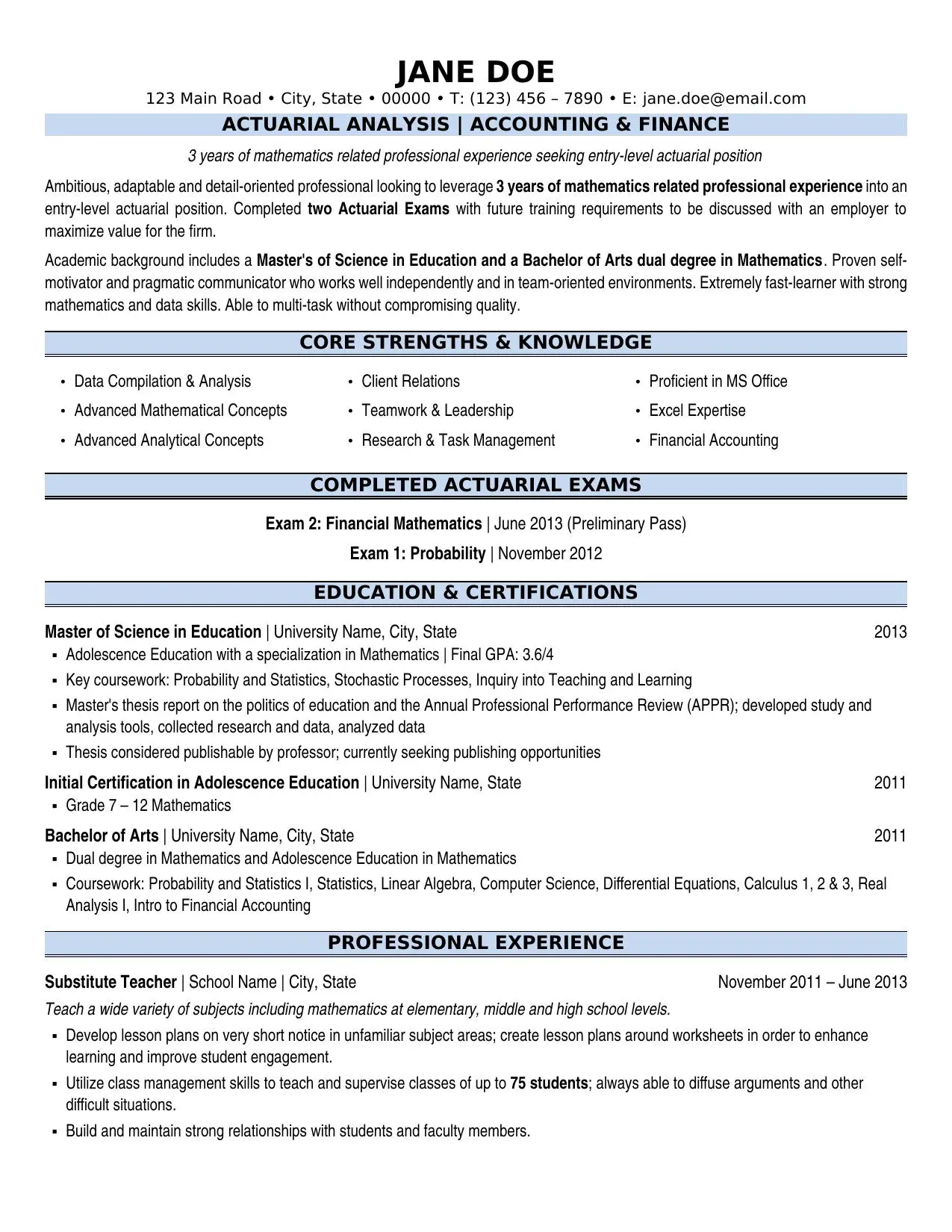

Each accounting resume sample below was written through our 1-on-1 interview process. Click any accounting resume example to see the full sample and learn how we transformed their experience into proof.

When a hiring manager reads your accounting resume, they should think:

"This person has solved the exact problems we're facing."

What accounts and entities do you manage? We probe the scope and complexity.

"Tell me about the size of the GL you maintain..."What process improvements? Close cycle reductions? We connect your work to time and cost savings.

"How did you streamline the month-end close?"What ERP systems, accounting software, and standards? This is where your expertise becomes visible.

"Walk me through the reconciliation process you built..."What teams did you manage? What audit findings did you resolve? What controls did you implement?

"How did you prepare for and pass the external audit?"See how our interview process uncovered achievements and turned them into interview-winning proof.

Get Your Accounting Resume Written

Accounting jobs average 33 applicants per position. You're competing against 660 candidates. Our accounting resume examples show how to stand out.

Data based on LinkedIn job postings. Updated Dec 2, 2025.

Here's the math most job seekers don't do:

Your accounting resume must stand out against 660 professionals.

What makes you different is the story behind the projects.

Get Your Accounting Resume WrittenAccounting Professionals Using Our Resume Templates Work At

Every accounting resume example on this page was written through our 1-on-1 interview process. We extract achievements you'd never think to include.

We identify keywords and achievements that get accounting resumes noticed.

Targeted questions about your accounting projects and results.

Transform responsibilities into quantified achievements.

ATS-optimized resume in 3 business days + 14-day revisions.

80% of accounting positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

When you purchase our Resume Distribution service, your resume goes to 400+ recruiters specializing in accounting — included in Advanced & Ultimate packages.

| Agency | Location |

|---|---|

|

HA

Hays Specialist Recruitment

|

Nationwide |

|

RA

Randstad Staffing Agency

|

Nationwide |

|

KE

Kelly Services Workforce Solutions

|

Nationwide |

|

MA

ManpowerGroup Talent Solutions

|

Nationwide |

|

AD

Adecco HR Services

|

Nationwide |

Accounting averages 33 applicants per position across 25,451 active job postings — but the number varies significantly by market. New York City is the most competitive at 41 applicants per role across 1,462 openings. Chicago and Dallas both sit at 34 applicants, with 1,606 and 1,403 jobs respectively. Boston is the least competitive major market at 31 applicants per opening. Specialized roles like Tax Accountant face only 26 applicants — substantially less than the broader average. But even at 33 per position, if you apply to 20 jobs in a typical 30-day search, you're one of roughly 660 candidates those hiring managers are evaluating. At that volume, a resume that says "prepared financial statements" disappears — one that says "reduced close cycle from 12 to 5 days" gets called.

Because a questionnaire can't tell the difference between a Controller managing month-end close for a $50M division and one running a $500M multi-entity consolidation across 5 subsidiaries — both would write "managed financial reporting." Our 1-on-1 interview is a live conversation with a writer who knows to ask: What was the revenue or assets under your scope? How many entities did you consolidate? What was your close cycle — and did you improve it? What audit outcomes did you drive? What systems did you implement or optimize? These are the details that hiring managers at firms like Deloitte, PwC, and Grant Thornton actually evaluate. A questionnaire captures job titles. An interview captures the SOX compliance program you managed across 3 business units with zero material weaknesses for 4 consecutive years.

They're screening for proof that you've improved outcomes — not just maintained processes. Specifically: close cycle performance (did you reduce month-end from 12 days to 5?), audit results (zero material weaknesses, clean opinions, SOX compliance track records), revenue and assets managed (a $50M division tells a different story than a $500M portfolio), system implementations (NetSuite, SAP, Oracle — did you lead the migration or just use the software?), cost savings and error reductions (the $95K in early payment discounts you negotiated, the 60% reduction in manual entries). CPA certification is table stakes at the senior level. The question your resume needs to answer isn't what you managed — it's what you improved.

It matters enormously — and it's one of the most common transitions our accounting writers handle. A Big 4 Senior Auditor moving to an industry Controller role needs a completely different resume than a Staff Accountant making a lateral move within corporate accounting. Public accounting experience — audit methodology, client management, busy season intensity — positions differently than corporate experience with close processes, FP&A, and system ownership. Government and nonprofit professionals face an additional layer: GASB vs GAAP, fund accounting, grant compliance — all of which need to be translated for private sector hiring managers who may not understand the complexity. During your interview, our writers identify where you've been and where you're targeting, then position your experience so the transition reads as a logical next step, not a career pivot.

Our accounting resume packages are based on career level and interview depth — from a 30-minute early career session to a 90-minute executive interview. When evaluating price, consider what the number actually buys. A company charging $99: after the company takes its margin, the writer earns $40-60 — enough for about 45 minutes of total work including writing. That's a questionnaire reformat that produces "prepared financial statements and reconciliations." Our Professional-level interview alone is 60 minutes, followed by job posting analysis, drafting, and revisions — producing "reduced month-end close from 12 to 5 days for $50M division while managing SOX compliance across 3 business units." View current packages and pricing.

We offer a 90-Day Interview Guarantee. If you don't land interviews within 90 days of receiving your final accounting resume, we rewrite it free of charge. We can make this guarantee because our interview-based process produces resumes built on quantified outcomes — the close cycle improvements, audit results, and system implementations that accounting hiring managers respond to. Browse the resume samples on this page to see the quality of work we deliver.