Numbers tell stories, but most CPA resumes read like bland financial statements. Your expertise goes far beyond basic bookkeeping, yet your current resume might not show your true value.

Are you struggling to translate complex financial achievements into compelling resume content? You need a resume that showcases both your technical expertise and your business impact in clear, powerful terms that hiring managers understand.

At Resume Target, we help CPAs transform their career stories into interview-winning resumes. We know how to highlight your financial acumen, regulatory knowledge, and bottom-line contributions in language that resonates with employers and gets results.

As your financial GPS, a Financial Planner guides you through life's money milestones, using their expertise to help you navigate everything from buying your first home to planning for retirement, while operating under a fiduciary standard that legally requires them to put your interests first.

These money-savvy professionals analyze your entire financial picture, creating customized roadmaps that incorporate investment strategies, tax planning, insurance needs, and retirement goals - all while adjusting your plan as life throws its inevitable curveballs.

Whether you're interested in becoming a Financial Planner yourself or working with one, understanding the career path reveals how these professionals evolve from number-crunching newcomers to trusted financial advisors who can handle complex wealth management strategies and help clients achieve their dreams.

Let's talk about what's exciting in the financial planning field - your earning potential can grow substantially as you gain experience and expertise! From entry-level positions to executive roles, this career path offers impressive income opportunities that reward your professional development and client relationship skills.

Figures from: Vintti Financial Planning

Starting as a junior advisor, you can build your career in financial planning over 2-3 years. With experience, you can either launch your own firm or work your way up to partner status at established companies.

To excel beyond basic financial planning, you'll need to master both technical expertise and people skills that set top performers apart.

- Investment Analysis and Portfolio Management - Tax Strategy and Estate Planning - Risk Assessment and Insurance Planning - Client Relationship Management and CommunicationBreaking into financial planning starts with entry-level positions at financial services firms, where you'll learn the fundamentals while working alongside experienced advisors and building client relationship skills.

To advance in your financial planning career, you'll need to develop both technical expertise and strong communication skills, which are consistently ranked among the most crucial capabilities for success in this field.

Requirements from Investopedia

From Wall Street to Main Street, financial planning careers thrive in both major financial hubs and growing markets.

Figures from U.S. Bureau of Labor Statistics

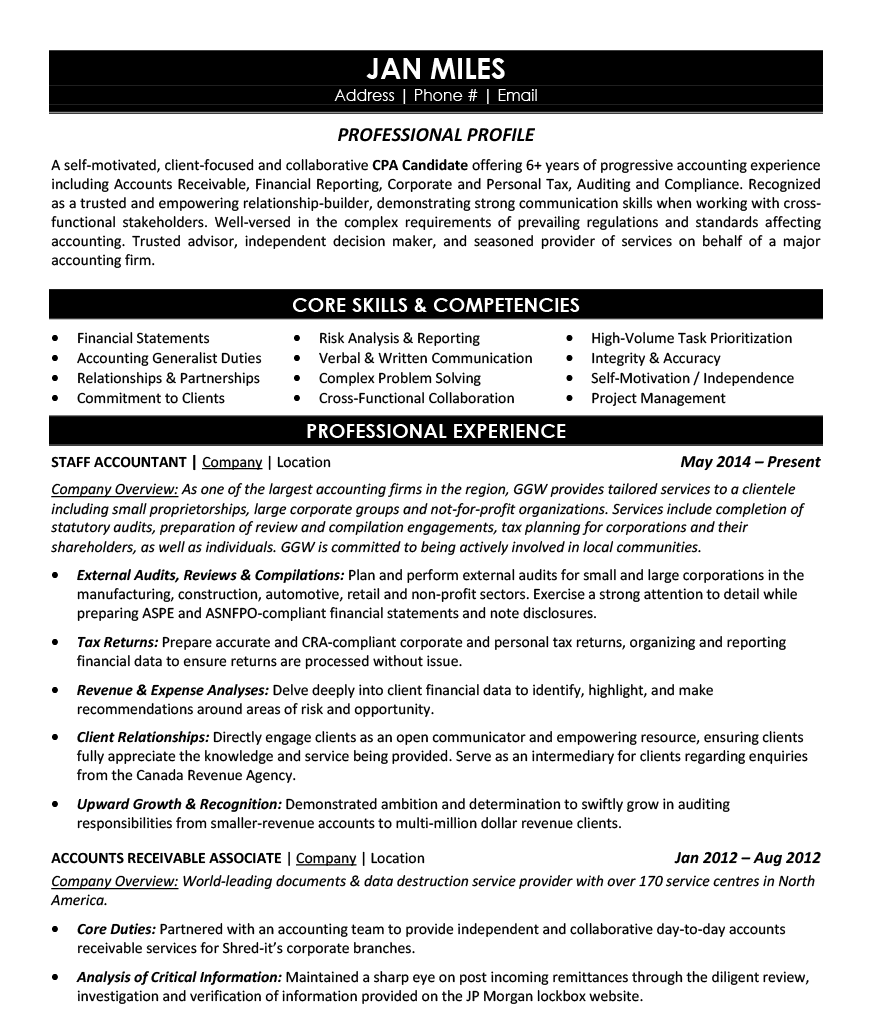

Struggling to showcase your accounting expertise, CPA certification, and financial acumen in a way that catches employers' attention? This comprehensive, section-by-section guide will help you create a professional CPA resume that highlights your qualifications and achievements in public accounting.

As a numbers expert who can spot the smallest discrepancy in complex financial statements, you might find it challenging to summarize your professional value in just a few sentences.

While you excel at analyzing financial data and ensuring compliance with ever-changing regulations, translating these technical skills into compelling career highlights requires a different kind of precision - one that helps hiring managers quickly understand your unique value as a CPA.

How would you characterize your overall approach to financial compliance and risk management across your career as a CPA?

Reason: This helps frame your professional identity and establishes your fundamental value proposition as a CPA. It allows you to articulate your guiding philosophy in handling sensitive financial matters and regulatory compliance.

What combination of accounting specializations and industries have shaped your expertise as a CPA?

Reason: This question helps you synthesize your broad professional experience into a coherent narrative, highlighting your versatility and depth of knowledge across different accounting domains and business sectors.

How would you describe your balance of technical accounting expertise with client relationship management in your role as a CPA?

Reason: This prompts you to address both the technical and interpersonal aspects of your role, showing potential employers that you understand the dual nature of modern CPA work in serving clients while maintaining professional standards.

As a CPA, you need to showcase both your technical accounting expertise and your ability to handle complex financial responsibilities that employers value most.

Your skills section should balance specialized knowledge like GAAP compliance and tax regulations with essential competencies like financial analysis, audit procedures, and proficiency in accounting software like QuickBooks or SAP.

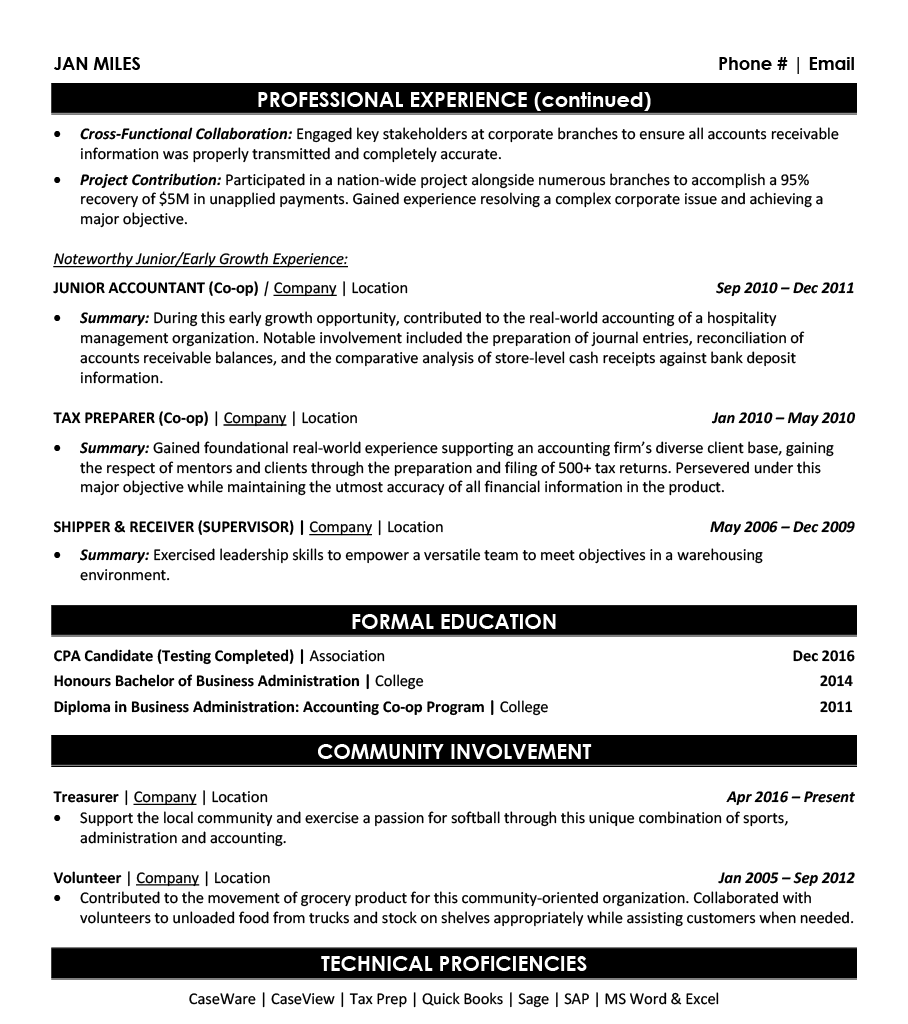

Showcase your financial expertise by organizing your CPA experience into three powerful sections: a concise role overview that establishes your accounting scope, measurable achievements that highlight your impact on bottom-line results, and core responsibilities that demonstrate your technical and regulatory competencies.

Many CPAs struggle to translate complex financial processes and regulatory compliance work into clear, compelling achievements that executives understand. Transform your technical expertise into powerful success stories by connecting your accounting initiatives directly to cost savings, risk reduction, and improved business efficiency metrics.

A strong responsibilities section demonstrates how CPAs do more than just crunch numbers and file taxes. Your role involves complex financial analysis, regulatory compliance, and strategic decision-making that directly impacts business success. Frame your duties in ways that showcase both technical expertise and business value.

Your CPA license and relevant accounting certifications should take center stage at the top of your education section. Make sure to highlight your bachelor's degree in accounting or related field, followed by any specialized certifications that demonstrate your expertise in areas like tax preparation, auditing, or financial analysis.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your CPA resume from good to exceptional.

While many accounting professionals focus solely on customizing their cover letters, tailoring your resume for each CPA position is equally crucial for showcasing your specific financial expertise and technical qualifications.

A customized CPA resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that your accounting skills and experience align perfectly with their firm's needs and culture.

Ready to stand out in the competitive accounting field? Let's transform your resume into a powerful tool that proves you're the financial expert they've been searching for!

Don't let a lack of professional experience hold you back from launching your CPA career!

Your accounting degree, internships, and relevant coursework can create a compelling story that showcases your potential.

Focus on highlighting your understanding of accounting principles, software proficiency, and any hands-on experience from class projects or volunteer work.

Your entry-level CPA resume should emphasize your educational achievements, technical skills, and internship experiences while demonstrating your attention to detail and analytical capabilities.

For a detailed framework on how to structure your resume, check out our Student Resume Writing Guide for expert tips and examples.

Your resume summary is your chance to showcase your fresh CPA certification, academic excellence, and internship experiences in a way that immediately captures attention.

Focus on highlighting your technical accounting skills, relevant software proficiency, and any hands-on experience gained through internships or academic projects.

"Detail-oriented and analytical Certified Public Accountant with recent CPA licensure and comprehensive academic training in tax preparation, auditing, and financial reporting. Demonstrated excellence through a 4.0 GPA in Advanced Accounting coursework and successful completion of two Big 4 accounting internships. Proficient in QuickBooks, SAP, and advanced Excel functions, with experience preparing financial statements and conducting internal audits during internships. Seeking to leverage strong technical foundation and passion for accuracy to contribute valuable insights as an entry-level CPA."

Now's your chance to showcase the rigorous academic preparation that equipped you for CPA success - from your accounting degree through your professional certification!

Transform your educational journey into compelling content by highlighting specialized coursework like Advanced Tax Theory and Financial Statement Analysis, plus any hands-on projects where you applied GAAP principles or tax code expertise.

The CPA exam has three core sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG). The 33 semester hours of accounting MUST include courses in cost or managerial accounting, financial accounting and reporting, taxation, and auditing.Relevant Coursework: Financial Accounting and Reporting | Auditing and Attestation | Taxation and Regulation | Cost Accounting | Managerial Accounting | Business Ethics and Law

Key Projects:

Financial Statement Analysis Capstone: Led comprehensive analysis of Fortune 500 company's financial statements to evaluate financial health and compliance with accounting standards. Developed detailed report with recommendations for stakeholders.

Corporate Tax Planning Simulation: Collaborated with four-member team to develop tax optimization strategy for mid-sized manufacturing client, resulting in identification of $250,000 in potential tax savings.

Leverage your academic training, internship experience, and technical certifications by showcasing the precise accounting and analytical skills that employers seek in entry-level CPAs, ensuring your resume reflects both your educational foundation and practical capabilities.

As an entry-level CPA, your combination of technical knowledge and analytical capabilities positions you well for a rewarding career in public accounting, with excellent opportunities for advancement and specialization in various financial sectors.

Let's face it - translating years of complex financial expertise, regulatory knowledge, and analytical skills into a compelling resume can feel like trying to balance an impossible ledger.

At Resume Target, we specialize in crafting powerful resumes for CPAs that showcase both your technical mastery and business impact.

Our expert writers understand how to position your audit experience, tax expertise, and advisory capabilities in a way that resonates with top accounting firms and corporate employers.

With tax season winding down and hiring cycles ramping up at major firms, now is the perfect time to transform your career trajectory - schedule your free consultation today to get started.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services