Numbers tell the story, but most comptroller resumes fail to add up to success. Your financial expertise deserves more than just a list of duties and responsibilities.

Are you struggling to translate complex financial oversight into compelling resume content? A strategically crafted resume can showcase your ability to drive financial performance and lead high-stakes decisions.

Resume Target specializes in helping comptrollers transform their career achievements into powerful success stories. We know how to present your financial leadership and strategic vision in language that catches attention and lands interviews.

As the financial backbone of organizations, comptrollers serve as high-level guardians of fiscal responsibility, with duties ranging from conducting performance and financial audits to overseeing multi-billion dollar pension funds.

In this strategic leadership role, you'll combine advanced financial expertise with management skills to direct accounting operations, ensure regulatory compliance, and develop robust financial controls that protect your organization's assets and support its growth objectives.

Whether you're just starting your journey in financial management or looking to advance to this executive-level position, understanding the comptroller career path reveals exciting opportunities to shape organizational strategy and drive financial excellence.

Let's talk about what's exciting in the world of comptroller careers! Your expertise in financial oversight and management can lead to an impressive compensation package, with opportunities to earn well above average as you gain experience. And guess what? The field offers particularly attractive prospects if you specialize in government or nonprofit sectors.

Figures from: William & Mary Online

Ready to climb the corporate finance ladder? A Comptroller career offers clear progression from entry-level accountant to top financial executive, with opportunities to advance through experience and credentials.

Beyond basic accounting knowledge, advancing in your Comptroller career requires mastering both technical expertise and leadership capabilities.

- Advanced Financial Analysis and Reporting - Strategic Budget Management - Risk Assessment and Compliance - Executive Communication and LeadershipLaunch your comptroller career by starting in entry-level accounting roles while developing core financial management skills, pursuing relevant certifications, and gaining hands-on experience with financial reporting and analysis.

To build your path to becoming a comptroller, you'll need to master essential competencies including advanced financial management and audit planning while progressing through increasingly responsible positions.

Requirements from Accounting.com

From tech hubs to manufacturing centers, comptroller roles span diverse sectors with strong demand in CA, IL, and NY.

Figures from Zippia

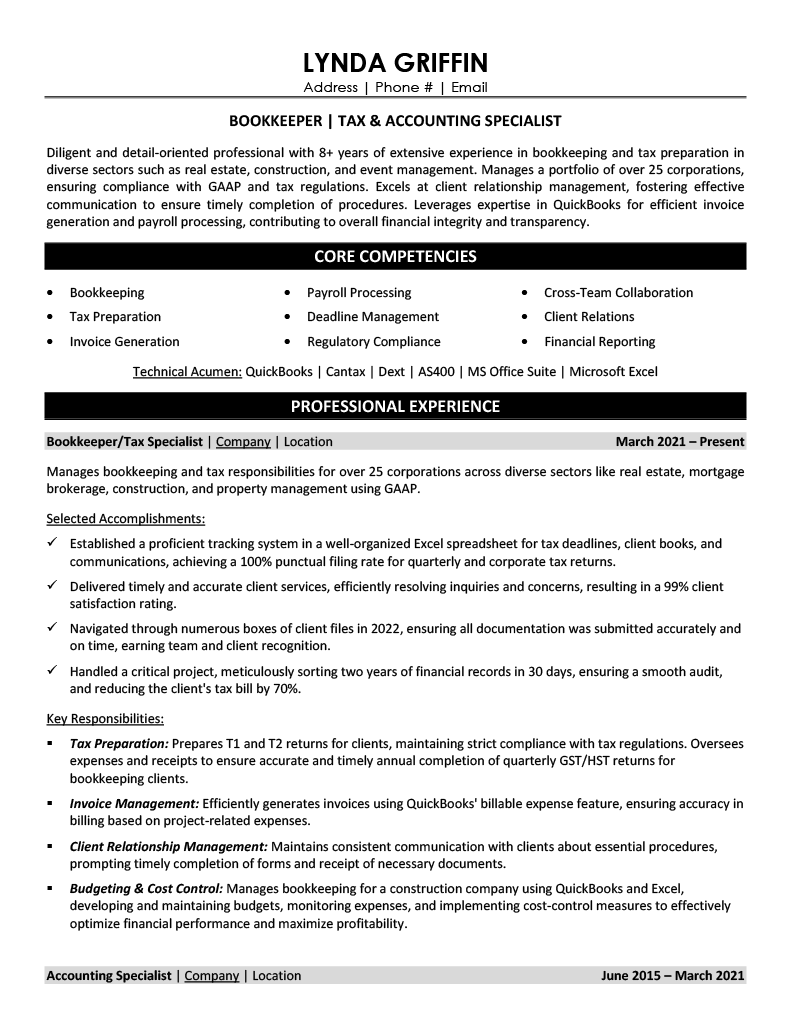

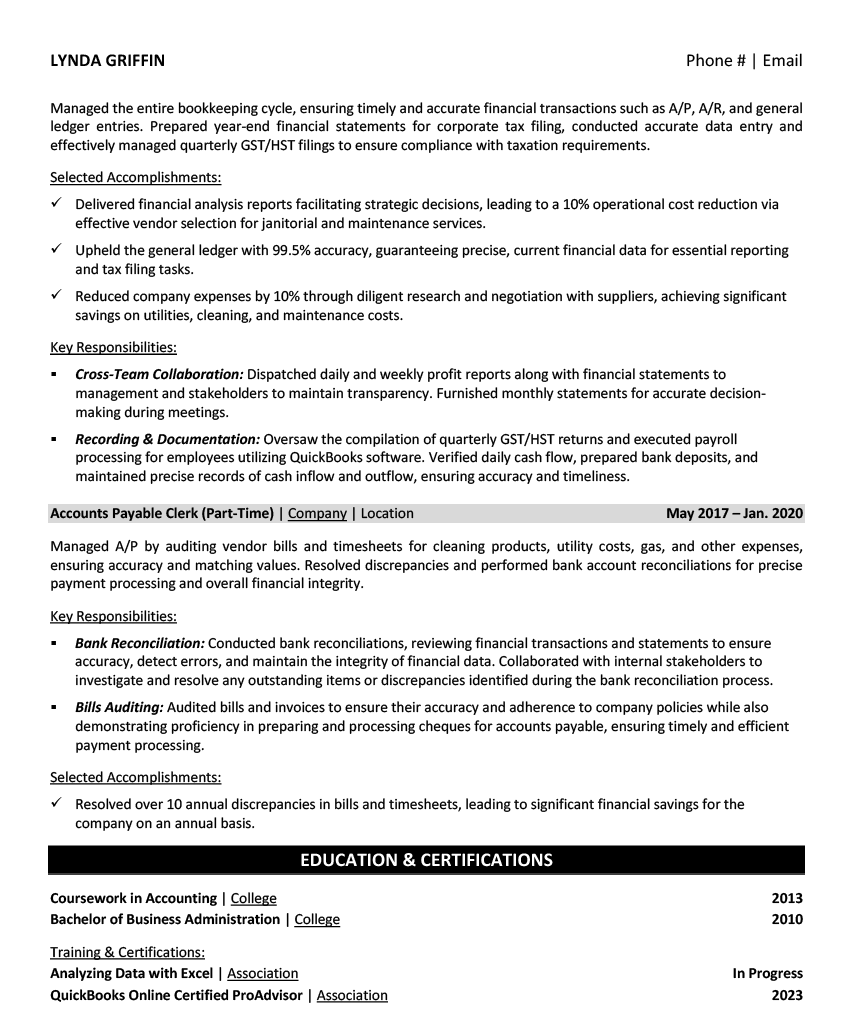

Struggling to showcase your financial leadership and strategic expertise in a way that truly captures your impact as a comptroller? This comprehensive, section-by-section guide will walk you through crafting a powerful comptroller resume that highlights your financial oversight abilities, regulatory compliance experience, and strategic decision-making skills.

As a financial leader who oversees complex accounting operations, crafting the perfect resume summary can feel as challenging as balancing a multi-entity ledger during year-end closing.

While you excel at analyzing financial data and steering organizational strategy, translating your high-level oversight abilities and strategic financial planning expertise into a compelling summary requires a different kind of precision - one that speaks directly to what hiring managers need in their next comptroller.

How would you characterize your overall financial leadership philosophy and its impact on organizational growth across your career?

Reason: This helps frame your executive summary from a strategic perspective, showing potential employers how your financial management approach creates lasting organizational value beyond just numbers.

What unique combination of financial oversight, regulatory compliance, and operational expertise best defines your value as a Comptroller?

Reason: This question helps you articulate your distinctive blend of skills that set you apart from other financial executives, focusing on the core competencies most critical to the Comptroller role.

How have you evolved your approach to financial controls and reporting systems as technology and compliance requirements have changed throughout your career?

Reason: This prompts you to demonstrate adaptability and forward-thinking leadership in your summary, showing how you stay current with industry changes while maintaining strong financial governance.

As a comptroller, you need to demonstrate both high-level financial leadership abilities and detailed technical expertise, making your skills section particularly crucial for catching employers' attention.

Your resume should showcase your mastery of financial oversight and reporting systems like SAP or Oracle, while also highlighting strategic planning abilities and regulatory compliance expertise that distinguish you from regular accountants.

Showcase your financial leadership impact by organizing your experience into three powerful sections: a high-level role overview that positions you as a strategic leader, quantifiable achievements that demonstrate your fiscal oversight success, and core responsibilities that highlight your expertise in corporate financial management and regulatory compliance.

Many Comptrollers struggle to effectively demonstrate how their financial oversight and strategic decisions directly impact organizational success and bottom-line growth. Transform your experience into compelling metrics by connecting your financial leadership to cost savings, revenue growth, and operational efficiency improvements that showcase your value as a strategic business partner.

A strong responsibilities section demonstrates how Comptrollers manage financial operations and strategic decision-making beyond basic accounting tasks. Your role description should clearly show how you oversee financial health, ensure regulatory compliance, and drive business growth through fiscal leadership.

Your education and professional certifications are crucial elements that validate your expertise in financial management and accounting oversight. As a Comptroller, you should highlight your advanced degrees in finance or accounting, along with relevant certifications that demonstrate your mastery of financial controls and regulatory compliance.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume from good to exceptional.

While many financial professionals focus solely on customizing their cover letters, tailoring your comptroller resume for each position is crucial for showcasing your precise match with the organization's financial leadership needs.

A customized resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that your financial oversight experience and leadership style align perfectly with their organizational requirements.

Ready to stand out from other comptroller candidates? Let's transform your resume into a powerful tool that proves you're the financial leader they've been searching for!

Don't let a lack of direct experience hold you back from pursuing your dream comptroller position! Your journey to becoming a financial leader starts with showcasing your relevant education, accounting knowledge, and analytical capabilities.

Even without years of experience, you can create an impressive resume by highlighting your academic achievements, internships, and demonstrated financial management skills.

Focus on showcasing your accounting expertise, leadership potential, and technical proficiencies in financial software and systems.

For detailed guidance on structuring your resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your summary section is your chance to showcase your strong financial acumen, academic excellence, and any relevant internship experiences that demonstrate your readiness for a comptroller position.

Focus on highlighting your analytical capabilities, leadership potential, and deep understanding of financial controls and regulatory compliance to stand out as a promising candidate.

"Detail-oriented and analytical finance professional with comprehensive academic training in accounting, financial management, and regulatory compliance. Leveraged internship experience at regional accounting firm to develop expertise in financial reporting, budget analysis, and internal controls. Demonstrated leadership abilities through successful management of student accounting association and completion of CPA examination. Seeking to apply strong financial acumen and fresh perspective to drive operational efficiency as an entry-level comptroller."

Now's your chance to showcase the robust financial education that prepared you for comptroller excellence - highlight those advanced accounting courses, financial management certifications, and specialized training that set you apart!

Don't just list your degree - bring your educational journey to life by featuring relevant coursework like Advanced Financial Reporting and Corporate Tax Strategy, along with any capstone projects where you demonstrated mastery of accounting systems and regulatory compliance.

Common courses for a Comptroller degree/certification include classes in accounting, business, finance, or public administration focusing on auditing, financial accounting, and taxation, along with specific certifications like CTCD and ACC.Relevant Coursework: Advanced Financial Accounting | Government Auditing Principles | Corporate Taxation | Financial Management Systems | Internal Control Frameworks | Strategic Business Planning

Key Projects:

Financial Control Systems Analysis: Developed a comprehensive internal control framework for a simulated multi-division corporation, resulting in identification and resolution of key control weaknesses.

Municipal Budget Reform Initiative: Collaborated with a team of four to create a modernized budgeting and reporting system for a mock city government entity.

Leverage your academic background, internship experiences, and technical certifications to create a compelling skills section that showcases your readiness to oversee financial operations and manage accounting processes.

As an aspiring Comptroller, your foundation in financial management and accounting principles positions you well for a career path that offers increasing responsibility and leadership opportunities in corporate financial oversight.

Let's face it - trying to showcase your strategic financial leadership while also highlighting your hands-on accounting expertise feels like trying to balance two sets of books (the legal way, of course!).

At Resume Target, we specialize in crafting resumes for senior financial leaders like you, having helped countless comptrollers transform their complex responsibilities into compelling career stories.

Our deep understanding of the accounting industry means we know exactly how to position your cost-saving initiatives, process improvements, and team leadership achievements to catch a CFO's attention.

With year-end approaching and companies finalizing their Q1 hiring budgets, now is the perfect time to upgrade your resume - schedule your free consultation today to start your journey toward your next senior financial role.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services