Numbers tell a story, but most payroll accountant resumes read like a boring data dump. Your expertise goes far beyond processing paychecks, yet showing that value on paper remains a challenge.

Are you struggling to make your payroll contributions stand out to employers? A strategic resume can transform your daily tasks into compelling achievements that showcase your impact on company operations and employee satisfaction.

Resume Target specializes in helping payroll professionals translate complex responsibilities into clear, powerful statements. We'll help you craft a resume that speaks directly to hiring managers and lands more interviews in today's competitive market.

Behind every successful payday, there's a payroll accountant ensuring that every employee's compensation is accurately calculated, properly taxed, and disbursed on time while maintaining compliance with federal, state, and local regulations.

As a payroll accountant, you'll serve as the financial backbone of your organization, managing everything from basic paycheck calculations to complex tax withholdings, while maintaining detailed records of employee benefits, leave balances, and pension contributions.

Whether you're just starting your journey in payroll accounting or looking to advance your career, this field offers numerous opportunities to grow from handling basic payroll processing to designing comprehensive compensation packages and managing entire payroll departments.

Let's talk about what's exciting in the Payroll Accountant field - your earning potential is looking bright! As companies continue expanding their payroll needs, professionals like you can expect competitive compensation packages that reward your expertise in managing organizational finances and ensuring accurate employee payments.

Figures from: U.S. Bureau of Labor Statistics

Starting as a Payroll Accountant opens doors to diverse financial career paths. With the right skills and certifications, you can progress from processing payroll to managing entire financial departments.

Beyond basic accounting knowledge, advancing in payroll requires mastery of specialized skills and continuous professional development.

- Advanced Payroll Processing Systems - Tax Compliance and Reporting - Financial Data Analysis - Strategic Communication and LeadershipLaunch your payroll accounting career by starting in entry-level positions like accounts payable clerk or payroll assistant, while pursuing relevant certifications and gaining hands-on experience with payroll software and processes.

To advance in your payroll accounting career, you'll need to master key technical skills like payroll processing and Microsoft Excel, while developing essential soft skills such as attention to detail and accuracy.

Requirements from American Payroll Association

From bustling financial hubs to growing business centers, payroll accounting roles span both coasts and key metro areas.

Figures from U.S. Bureau of Labor Statistics

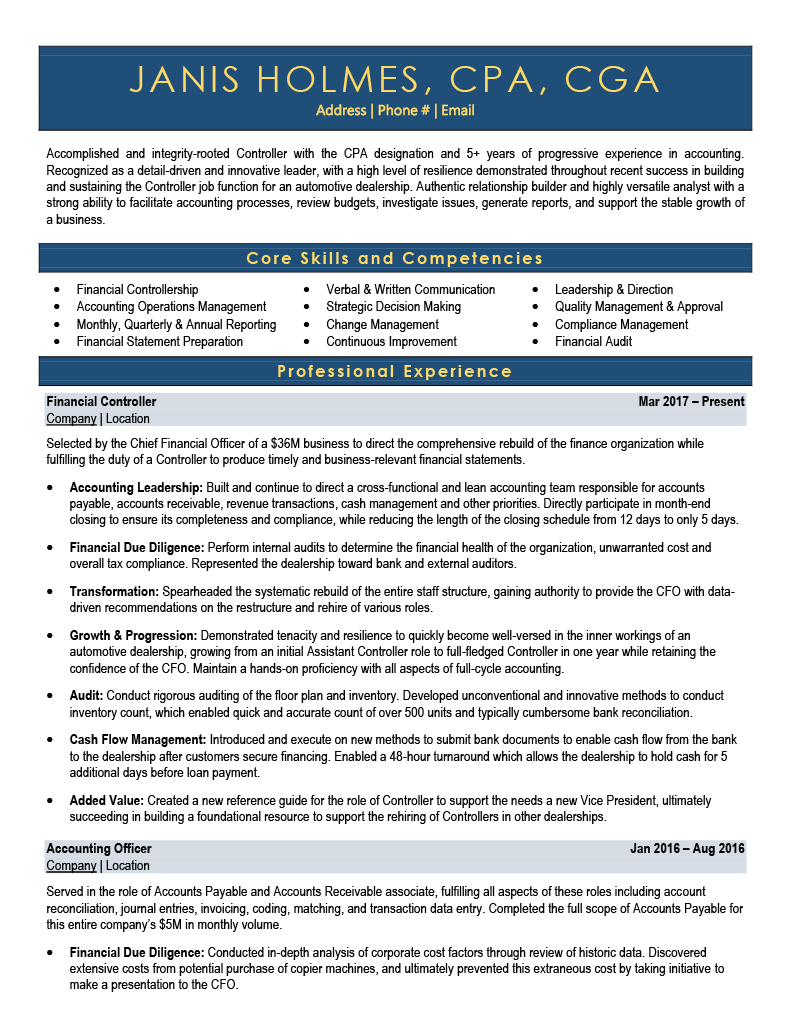

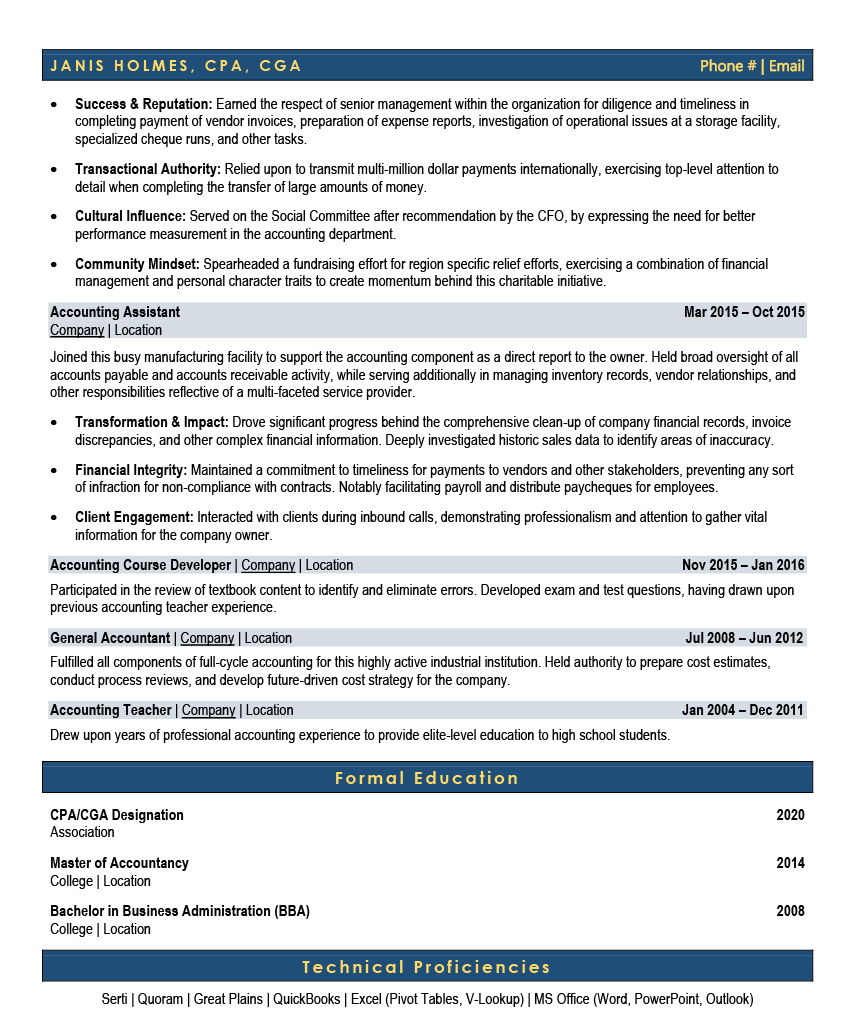

Struggling to showcase your payroll expertise, accounting skills, and financial accuracy in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will walk you through creating a professional payroll accountant resume that highlights your most impressive achievements and core competencies.

As a payroll accountant, you know the importance of accuracy and attention to detail, yet summarizing your own professional story can feel more challenging than reconciling a complex payroll batch.

While you excel at managing payroll systems, tax compliance, and ensuring thousands of employees get paid correctly and on time, translating these valuable skills into a compelling summary that catches a hiring manager's attention requires a different kind of precision.

How would you characterize your overall approach to payroll compliance and accuracy across the different organizations you've served?

Reason: This helps frame your professional identity and establishes your fundamental value proposition as a payroll professional, setting the tone for your entire summary.

What combination of payroll systems, tax regulations, and multi-state compliance expertise best defines your professional toolkit?

Reason: This question helps you articulate your technical foundation and regulatory knowledge, which are crucial elements that employers look for in a payroll summary statement.

How would you describe your role in bridging payroll operations with broader finance functions and employee services?

Reason: This helps you position yourself as a strategic team player who understands the interconnected nature of payroll with other business functions, demonstrating broader value beyond technical skills.

As a payroll accountant, you need to demonstrate both your technical expertise with payroll systems and your attention to compliance and accuracy in handling employee compensation.

Your skills section should showcase your proficiency with payroll software and tax regulations, while also highlighting your ability to manage deadlines, maintain confidentiality, and coordinate with multiple departments.

Examples of Payroll Accountant Skills: - Payroll Processing & Administration - Tax Compliance (Federal, State, Local) - Multi-State Payroll Management - Wage Garnishments - Benefits Administration - Quarter-End/Year-End Reporting - W-2 and 1099 Processing - Time & Attendance Systems - Payroll Reconciliation - Employee Data Management - Regulatory Compliance - Audit Support - Journal Entries - Variance Analysis Technical Skills: ADP Workforce Now | Workday | QuickBooks | UltiPro | Kronos | SAP | Excel (Advanced)Showcase your payroll expertise by organizing your experience into three powerful sections: a concise role overview that sets the stage, measurable achievements that highlight your impact on accuracy and efficiency, and core responsibilities that demonstrate your mastery of payroll operations.

Many Payroll Accountants struggle to demonstrate their value beyond basic transaction processing and compliance duties. Transform your routine payroll activities into powerful achievements by connecting your accuracy rates, process improvements, and cost savings to measurable business impacts that showcase your strategic contribution.

The responsibilities section demonstrates how Payroll Accountants maintain accurate financial records while ensuring timely employee compensation. Your duties should highlight both technical expertise and your role in maintaining compliance while supporting overall business operations.

Your education and professional certifications demonstrate your expertise in payroll processing and accounting principles. Prioritize your most relevant credentials first, especially those from recognized organizations like the American Payroll Association (APA) or accounting certifications that showcase your financial knowledge.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing payroll accounting positions.

While many candidates stop at customizing their cover letter, successful payroll accountants know that personalizing their resume for each role is what truly sets them apart in this detail-oriented field.

By carefully aligning your resume's keywords and achievements with each job description, you'll not only sail through ATS screening systems but also demonstrate to hiring managers that you understand their specific payroll needs and compliance requirements.

Ready to stand out from other candidates? Let's turn your resume into a laser-focused presentation that proves you're the payroll expert they've been searching for!

Don't let a lack of professional payroll experience hold you back! Your journey to becoming a Payroll Accountant can start with highlighting your accounting coursework, relevant software skills, and any internship or classroom projects involving payroll processing.

Focus on showcasing your attention to detail, knowledge of tax regulations, and proficiency with accounting software to make your resume stand out.

For more guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to help you highlight your strongest qualifications.

Your resume summary is your chance to showcase your fresh accounting knowledge, internship experiences, and technical proficiency in payroll software and tax regulations.

Focus on highlighting your relevant coursework, any hands-on experience with payroll systems during internships, and your attention to detail with numbers and compliance.

"Detail-oriented and analytical Payroll Accountant with foundational experience through internships and academic projects in payroll processing and tax compliance. Proficient in ADP, QuickBooks, and Excel, with demonstrated accuracy in processing mock payrolls for 100+ employees during university practicum. Completed coursework in advanced tax accounting and employment law, maintaining a 3.8 GPA. Seeking to leverage strong mathematical aptitude and technical skills to ensure accurate and timely payroll operations while maintaining strict compliance with federal and state regulations."

Now's your chance to showcase the accounting knowledge and specialized payroll training that makes you a standout candidate!

Don't just list your degree - highlight relevant coursework like Advanced Payroll Systems and Tax Accounting, plus any certification programs or hands-on projects where you managed mock payroll cycles or mastered popular payroll software.

Insufficient data available despite thorough search.Relevant Coursework: Payroll Tax Accounting | Financial Accounting Principles | Business Law | Advanced Excel Applications | Compensation Management | Employee Benefits Administration

Key Projects:

Payroll System Implementation Simulation: Led a comprehensive project to simulate the transition from manual to automated payroll processing for a mid-sized company with 200 employees, resulting in a theoretical 40% reduction in processing time.

Multi-Company Payroll Audit Project: Conducted a mock internal audit of payroll processes for three fictional companies, identifying compliance gaps and proposing solutions to minimize risk exposure.

Leverage your academic training, internship experience, and technical proficiencies to create a compelling skills section that showcases your ability to handle payroll processes, tax regulations, and accounting software with precision and accuracy.

As an entry-level Payroll Accountant, your foundation in these essential skills positions you well for a career in this growing field, where attention to detail and technical knowledge are highly valued by employers seeking fresh talent.

Let's face it - translating your daily payroll processing expertise and complex compliance knowledge into compelling resume achievements can feel like trying to balance an impossible ledger.

At Resume Target, we specialize in crafting resumes for payroll professionals that showcase both your technical precision and your business impact, having helped countless accountants transform their careers in today's evolving financial landscape.

Our deep understanding of payroll systems, tax regulations, and industry requirements ensures your experience shines through in language that both hiring managers and ATS systems understand.

With year-end closing approaching and companies actively hiring payroll talent, now is the perfect time to upgrade your resume - connect with us today for a free consultation to discuss your career goals.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services