Financial expertise is crucial, but most Controller resumes read like basic transaction logs. Numbers tell only half your leadership story.

Are you struggling to showcase your full strategic value beyond the basic accounting functions? Your resume needs to demonstrate both your financial mastery and your business transformation abilities.

Resume Target helps Controllers translate complex financial achievements into clear business impacts. We'll show you how to craft a resume that speaks to both CFOs and CEOs, positioning you as the strategic leader you truly are.

As a crucial first step into the financial world, Finance Interns play a vital role in keeping organizations' monetary wheels turning by handling essential tasks like month-end financial reports, journal entries, and bank reconciliations.

In this dynamic role, you'll work alongside seasoned finance professionals, learning to navigate everything from accounts payable processing to financial analysis, while developing the practical skills that textbooks alone can't teach.

Whether you're dreaming of becoming a Financial Analyst, Investment Banker, or Chief Financial Officer, your internship experience serves as the foundation for a rewarding career in finance, opening doors to countless opportunities in this ever-evolving field.

Let's talk about what's exciting in the Finance Intern world! Your career path as a Finance Intern opens doors to impressive earning potential, with compensation reflecting your growing expertise and contributions to the financial sector. And guess what? Your earning power can significantly increase as you gain experience and build your professional portfolio.

Figures from: Salary.com

Starting as a Finance Intern opens doors to exciting career growth in corporate finance. From analyst positions to executive roles, your path can lead to becoming a CFO with the right experience and qualifications.

Building a successful finance career requires mastering both technical expertise and leadership capabilities that go beyond basic number-crunching.

- Advanced Excel and Financial Modeling - Risk Analysis and Management - Business Intelligence Software Proficiency - Strategic Communication and LeadershipBreaking into finance as an intern starts with building foundational skills in accounting, economics, or business administration while pursuing relevant coursework or certification programs.

To position yourself for success, you'll need to develop strong Excel proficiency and financial modeling skills while building your professional network and analytical capabilities.

Requirements from Corporate Finance Institute

From Wall Street to Silicon Valley, finance internships span major metro hubs with NYC leading at 26% of opportunities.

Figures from MIT Sloan School of Management

Struggling to showcase your financial expertise, team leadership, and strategic planning skills in a way that truly captures your value as an accounting manager? This comprehensive, section-by-section guide will help you create a powerful resume that highlights your achievements and speaks directly to what employers are looking for.

If you're like most accounting managers, translating your daily achievements of managing complex financial operations and team leadership into a compelling resume summary can feel as challenging as closing the books during year-end.

While you excel at analyzing data, managing staff, and ensuring regulatory compliance, capturing these valuable skills in a concise summary that catches a hiring manager's attention requires a different kind of precision - one that showcases both your technical expertise and leadership abilities in a way that resonates with potential employers.

How would you characterize your overall approach to financial leadership and what distinguishes your management style in overseeing accounting operations?

Reason: This helps frame your executive presence and leadership philosophy, allowing you to establish your professional identity as an Accounting Manager right from the start of your resume.

What combination of technical accounting expertise and operational improvements have you consistently brought to your organizations throughout your career?

Reason: This question helps you articulate your unique value proposition by combining both the technical and strategic aspects of your role, showing how you're more than just a number cruncher.

How would you describe your ability to balance regulatory compliance with business growth objectives while leading accounting teams?

Reason: This enables you to highlight your strategic thinking and ability to align accounting functions with broader business goals, which is crucial for modern Accounting Manager roles.

As an Accounting Manager, your resume needs to showcase both your technical accounting expertise and your leadership capabilities, from GAAP compliance and financial reporting to team supervision and process improvement.

Your skills section should balance high-level strategic abilities like budget forecasting and internal controls with essential technical proficiencies such as ERP systems and month-end close procedures.

Showcase your financial leadership impact by organizing your experience into three powerful sections: a concise role overview highlighting your scope of responsibility, measurable achievements that demonstrate your accounting expertise, and core responsibilities that reflect your management capabilities.

Many Accounting Managers struggle to translate complex financial operations and leadership initiatives into compelling resume achievements that executives understand. Transform your daily accounting wins into powerful metrics by connecting cost reductions, process improvements, and team leadership to bottom-line results that showcase your strategic value.

The responsibilities section demonstrates how Accounting Managers drive financial success beyond basic bookkeeping tasks. Your role needs to be presented clearly to show hiring managers how you maintain financial health while leading teams and implementing strategic initiatives.

Your education and professional certifications demonstrate your expertise in financial management and accounting principles. As an Accounting Manager, prioritize your most relevant credentials first, especially those focused on advanced accounting, financial analysis, and management skills.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your financial expertise into a powerful job-winning document.

While many finance professionals focus solely on customizing their cover letters, tailoring your Controller resume for each position is equally crucial for showcasing your specific accounting leadership abilities and financial management strengths.

By strategically incorporating keywords and requirements from each job posting, your customized Controller resume will not only navigate through ATS systems successfully but will also demonstrate to hiring managers that you understand their unique business needs and financial control requirements.

Ready to stand out from other financial candidates? Let's turn your Controller resume into a laser-focused tool that proves you're the exact financial leader they're searching for!

Don't let a lack of experience hold you back from launching your career as a Controller! Your journey into financial leadership can start strong by showcasing your academic achievements, internships, and analytical capabilities.

Focus on highlighting your accounting knowledge, financial analysis skills, and any leadership experience you've gained through projects or campus activities.

For a detailed roadmap to crafting your resume, check out the Student Resume Writing Guide to ensure you're including all the essential elements that hiring managers look for.

Your resume summary is your chance to showcase your academic excellence in finance, accounting certifications, and any relevant internship experiences that demonstrate your analytical capabilities.

Focus on highlighting your technical proficiencies with financial software, your understanding of GAAP principles, and your proven ability to handle complex financial data with precision.

"Detail-oriented and analytical finance professional with comprehensive academic training and internship experience in corporate accounting and financial management. Proficient in advanced Excel, SAP, and QuickBooks, with demonstrated success in financial reporting and variance analysis during Big 4 internship. Completed CPA examination and seeking to leverage strong accounting foundation and technical expertise to drive financial excellence as an entry-level Controller. Known for exceptional organizational skills and ability to streamline financial processes while maintaining strict accuracy standards."

Now's your chance to showcase the strong financial and accounting foundation that makes you an excellent Controller candidate!

Don't just list your degree - highlight relevant coursework like Advanced Financial Accounting and Corporate Finance, plus any case studies or capstone projects where you analyzed financial statements, implemented controls, or managed audit processes.

Insufficient data available despite thorough search.Relevant Coursework: Advanced Financial Accounting | Corporate Finance | Management Control Systems | Business Analytics | Cost Accounting | Financial Risk Management

Key Projects:

Financial Process Optimization Study: Led a comprehensive analysis of a mock company's financial reporting system to identify inefficiencies and implement automated solutions, resulting in a 30% reduction in processing time.

Corporate Budget Analysis Simulation: Collaborated with a team of four to analyze and restructure a multi-division company's budgeting process, delivering recommendations that projected 15% cost savings.

Leverage your academic background in accounting, internship experiences, and technical proficiencies to create a compelling skills section that showcases your readiness to excel in financial management and corporate accounting responsibilities.

As an entry-level Controller, your foundation in accounting principles combined with your technical abilities positions you well for growth into senior financial leadership roles, where you can make significant impacts on organizational success and financial strategy.

Let's be honest - translating your complex financial oversight responsibilities and strategic leadership into compelling resume content can feel overwhelming, especially when you need to balance technical expertise with executive presence.

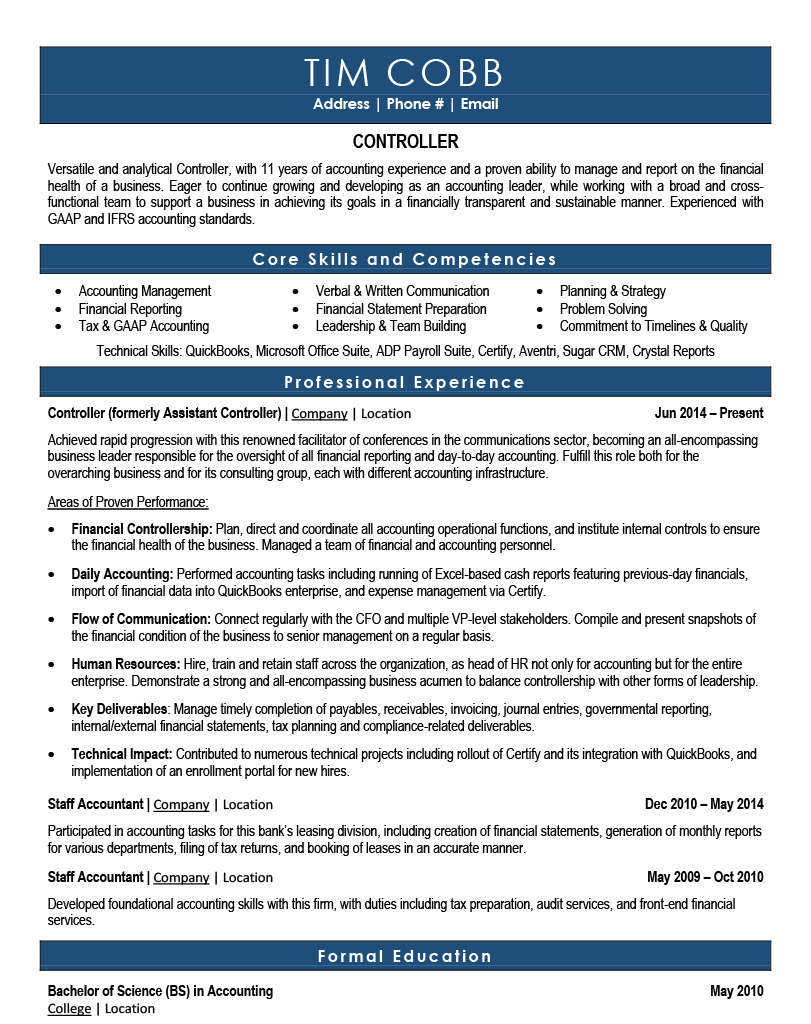

That's where Resume Target's accounting industry expertise makes the difference - we understand how to position your controllership experience, from technical accounting mastery to C-suite collaboration, in language that resonates with hiring managers.

Our proven track record includes helping controllers like you step into CFO and VP Finance roles by highlighting the perfect mix of strategic and hands-on capabilities.

With companies actively seeking strategic financial leadership in today's economic climate, now is the time to ensure your resume positions you as the solution they need - let's connect today to transform your resume into a powerful career advancement tool.

Impress any hiring manager with our accounting resume writing service. We work with all career levels and types of accounting professionals.

Learn More → Accounting Resume Writing Services