Numbers and transactions fill your day, but describing your banking career can feel like balancing an impossible equation. Many bank clerks struggle to showcase their true value beyond basic transaction processing.

Are you finding it hard to stand out in a sea of banking applications? Your resume needs to highlight both your technical abilities and your customer service excellence. The right presentation can transform your application from just another file to a top interview prospect.

At Resume Target, we understand how to position bank clerks for career advancement. We translate your daily responsibilities into powerful achievements that showcase your accuracy, efficiency, and ability to handle both money and people effectively.

As the financial frontline warriors of the banking industry, bank clerks handle over 1,000 customer interactions and transactions daily, ensuring your money moves exactly where it needs to go with precision and security.

From processing your deposits and withdrawals to helping you open new accounts and navigate loan applications, these financial professionals combine customer service expertise with mathematical accuracy to keep the banking system running smoothly.

If you're interested in launching a career in banking, the role of a bank clerk offers a solid foundation with clear pathways to advance into specialized banking positions, management roles, or even investment services - let's explore how you can get started in this stable and rewarding field.

Let's talk about the exciting earning potential in bank clerk positions! Your career in banking can start with competitive entry-level compensation and grow significantly as you gain experience. And guess what? Location plays a huge role - with some states offering particularly attractive packages that could really accelerate your financial growth.

Figures from: Talent.com

Starting as a Bank Clerk opens doors to diverse banking career opportunities. With the right skills and experience, you can progress from handling transactions to managing entire banking operations.

Beyond basic transaction processing, advancing in your banking career requires a blend of technical expertise and interpersonal finesse.

- Banking Software Proficiency - Financial Transaction Systems - Regulatory Compliance Knowledge - Customer Relationship Management - Problem-Solving Abilities - Communication Excellence - Cash Handling Accuracy - Team LeadershipBreaking into banking starts with entry-level positions that combine customer service skills with financial knowledge, allowing you to learn core banking operations while gaining valuable industry experience.

To advance in your banking career, you'll need to develop key competencies including exceptional communication skills that will help you interact effectively with both customers and colleagues.

Requirements from American Bankers Association

From bustling financial hubs to growing regional centers, bank clerk roles are thriving across finance and insurance sectors.

Figures from ZipRecruiter

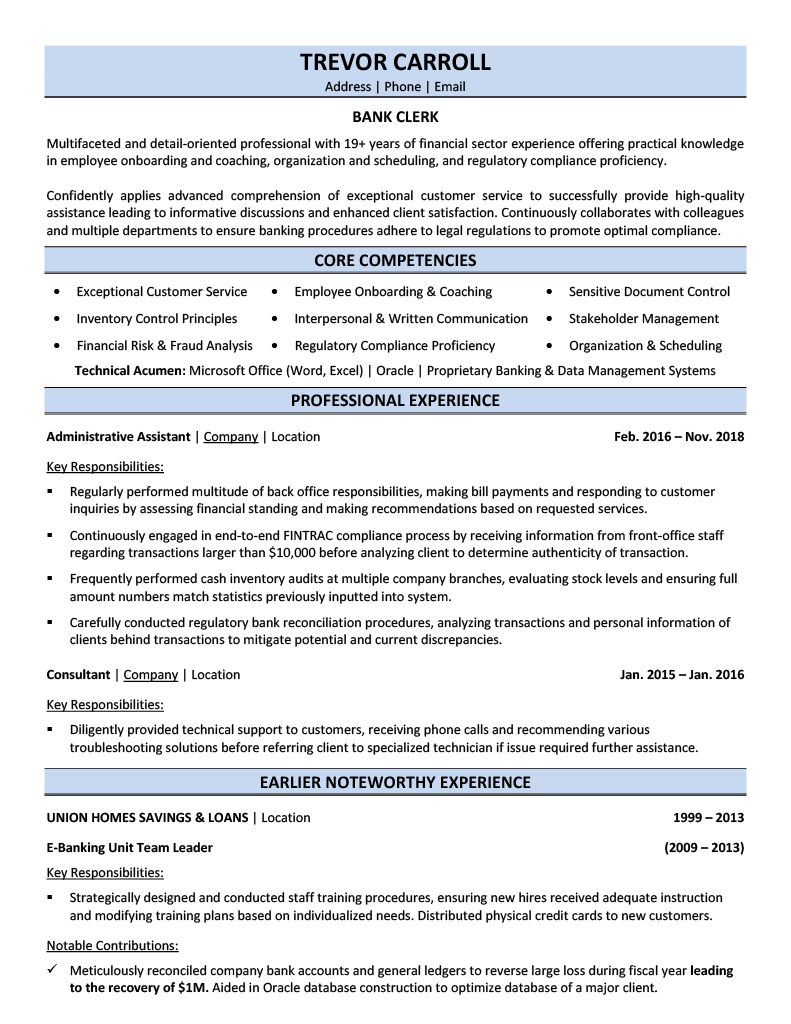

Struggling to showcase your financial accuracy, customer service skills, and banking expertise in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will walk you through creating a professional bank clerk resume that highlights your most valuable qualifications.

Writing a compelling resume summary can feel overwhelming when you spend your days managing transactions and providing excellent customer service rather than crafting career narratives.

While you excel at maintaining accurate records, handling deposits, and ensuring regulatory compliance, translating these valuable banking skills into a powerful summary that catches a hiring manager's attention requires a different kind of precision.

How would you describe your overall banking service philosophy and approach to maintaining both accuracy and customer satisfaction in your daily operations?

Reason: This helps frame your professional identity and shows potential employers how you balance the technical and interpersonal demands of banking work. It sets the tone for your entire resume by establishing your core professional values.

What combination of financial software proficiencies and regulatory compliance knowledge best represents your banking toolkit?

Reason: Banking technology and compliance are fundamental to the role, and highlighting your broad expertise in these areas immediately signals your readiness for the position. This creates a foundation for more detailed examples later in the resume.

How would you characterize your experience level in handling diverse banking transactions and your ability to adapt to different banking environments?

Reason: This helps articulate your versatility and depth of experience in banking operations, showing potential employers the scope of your capabilities and adaptability. It demonstrates your readiness to handle various banking scenarios.

As a bank clerk, you need to showcase both your technical banking abilities and customer service excellence, but fitting everything from cash handling to compliance knowledge on your resume can be challenging.

Your skills section should balance essential daily operational skills like transaction processing and account maintenance with high-value competencies such as fraud detection, banking software proficiency, and regulatory compliance.

Examples of Bank Clerk Skills: - Cash Handling & Management - Transaction Processing - Customer Account Services - Banking Software (Core Banking Systems) - Regulatory Compliance - Fraud Detection & Prevention - Customer Service Excellence - Data Entry & Record Keeping - Cross-Selling Banking Products - Cash Register Operations - Financial Document Processing - Security Procedures - Attention to Detail - Problem Resolution - Team Collaboration Technical Skills: Fiserv | Oracle FLEXCUBE | FIS | Temenos T24 | Microsoft Office Suite | Banking CRM SystemsShowcase your banking career by organizing your experience into three powerful sections: a concise role overview that sets the stage, measurable achievements that highlight your financial accuracy and customer service wins, and core responsibilities that demonstrate your banking expertise.

Many bank clerks struggle to effectively showcase their daily transactions and customer service activities in a way that demonstrates true business value. Transform routine banking operations into compelling achievements by connecting your accuracy rates, transaction volumes, and customer satisfaction metrics to concrete improvements in operational efficiency and revenue growth.

A well-crafted responsibilities section demonstrates how Bank Clerks maintain accurate financial records while delivering excellent customer service. Your duties should highlight both technical banking skills and your ability to handle sensitive transactions, showing how you contribute to the bank's operational efficiency and customer satisfaction.

Your education and certifications demonstrate your expertise in banking operations and financial services. Focus on highlighting relevant banking certifications, financial software training, and any formal education that showcases your understanding of banking procedures and regulatory compliance.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for banking positions.

While many applicants only customize their cover letters, successful bank clerk candidates know that personalizing their resume for each position is what truly sets them apart in the competitive financial services industry.

By carefully aligning your resume's keywords and achievements with specific bank clerk job descriptions, you'll not only pass through ATS systems with flying colors but also demonstrate to hiring managers that you understand exactly what they need in their next banking professional.

Ready to turn your resume into your secret weapon? Let's make sure your application rises straight to the top of that stack and lands you that banking interview!

Don't let a lack of banking experience hold you back! Starting your career as a Bank Clerk is all about showcasing your potential through your customer service background, attention to detail, and relevant coursework.

Your previous retail or office experience combined with your education in business, finance, or accounting can make you an excellent candidate for this role.

Focus on highlighting your mathematical accuracy, customer service abilities, and computer skills to create a compelling resume.

For detailed guidance on formatting and presenting your qualifications, check out the Student Resume Writing Guide to ensure your application stands out.

Your resume summary is your chance to showcase your financial knowledge, customer service abilities, and relevant coursework that makes you an ideal candidate for a banking position.

Focus on highlighting your attention to detail, cash handling experience from part-time work, and any financial software skills you've developed through coursework or internships.

"Detail-oriented and customer-focused professional with foundational banking operations knowledge and 1+ year of cash handling experience through retail roles. Demonstrated excellence in accuracy, confidentiality, and interpersonal communication through university coursework and internship at local credit union. Proficient in financial software including QuickBooks and Excel. Seeking to leverage strong mathematical aptitude and customer service skills to provide exceptional service as a Bank Clerk while ensuring precise transaction processing and regulatory compliance."

Now's your chance to showcase how your educational background has prepared you for success in banking and financial services!

Don't just list your degree - highlight relevant coursework like "Financial Mathematics"or "Banking Operations,"and include impactful projects such as cash handling simulations or accounting software training that demonstrate your readiness for bank clerk responsibilities.

Please see the answer to your question below:Relevant Coursework: Financial Accounting | Banking Operations | Business Mathematics | Customer Service Principles | Risk Management | Commercial Banking Systems

Key Projects:

Banking Operations Simulation Project: Developed and executed a comprehensive banking transaction simulation focusing on daily operations and customer service protocols in a controlled learning environment.

Customer Service Excellence Initiative: Led a team project to develop improved service protocols for handling complex customer inquiries and complaints in a banking environment.

Transform your academic knowledge, internship experience, and technical training into a compelling skills section that showcases your readiness to excel in banking operations and customer service.

As an aspiring Bank Clerk, your foundation in financial operations and attention to detail positions you perfectly for a rewarding career in banking, where opportunities for advancement are abundant as you gain experience.

Let's face it - trying to stand out in the competitive banking world while showcasing both your customer service excellence and technical accuracy isn't easy, especially when every transaction and interaction counts.

At Resume Target, we specialize in crafting resumes that highlight the unique blend of skills bank clerks need, from cash handling expertise to customer relationship management.

Our proven track record includes helping countless banking professionals like you transform their daily responsibilities into powerful achievement statements that catch hiring managers' attention.

With banks actively seeking qualified clerks who can maintain both accuracy and efficiency, now is the perfect time to upgrade your resume - contact us today to get started on your career-changing document.

Impress any hiring manager with our banking resume writing service. We work with all career levels and types of banking professionals.

Learn More → Banking Resume Writing Services