We Dive Into Your Projects

What were the projects or initiatives you worked on? We probe to understand the scope, the stakes, and the significance.

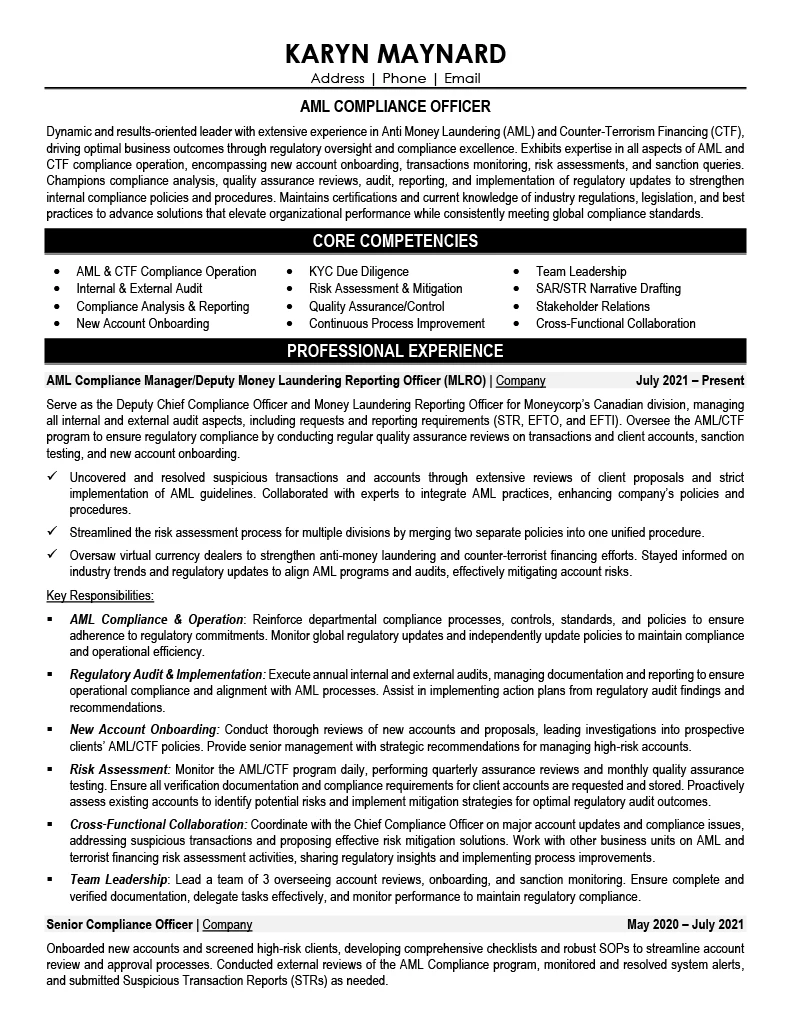

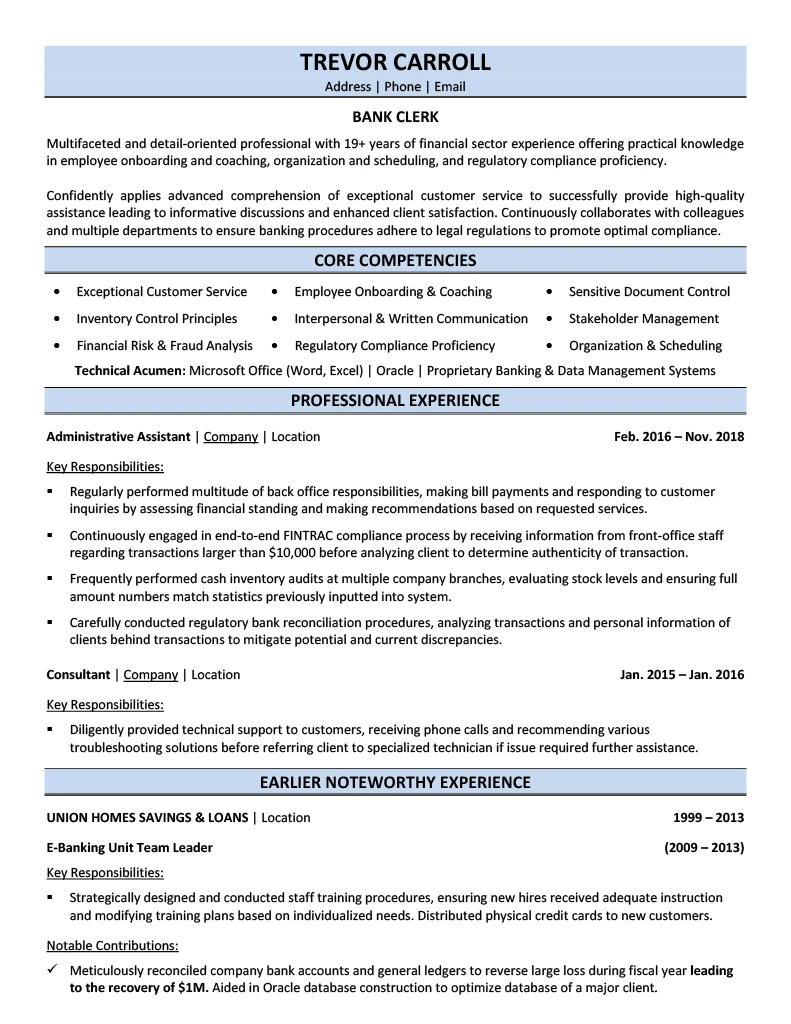

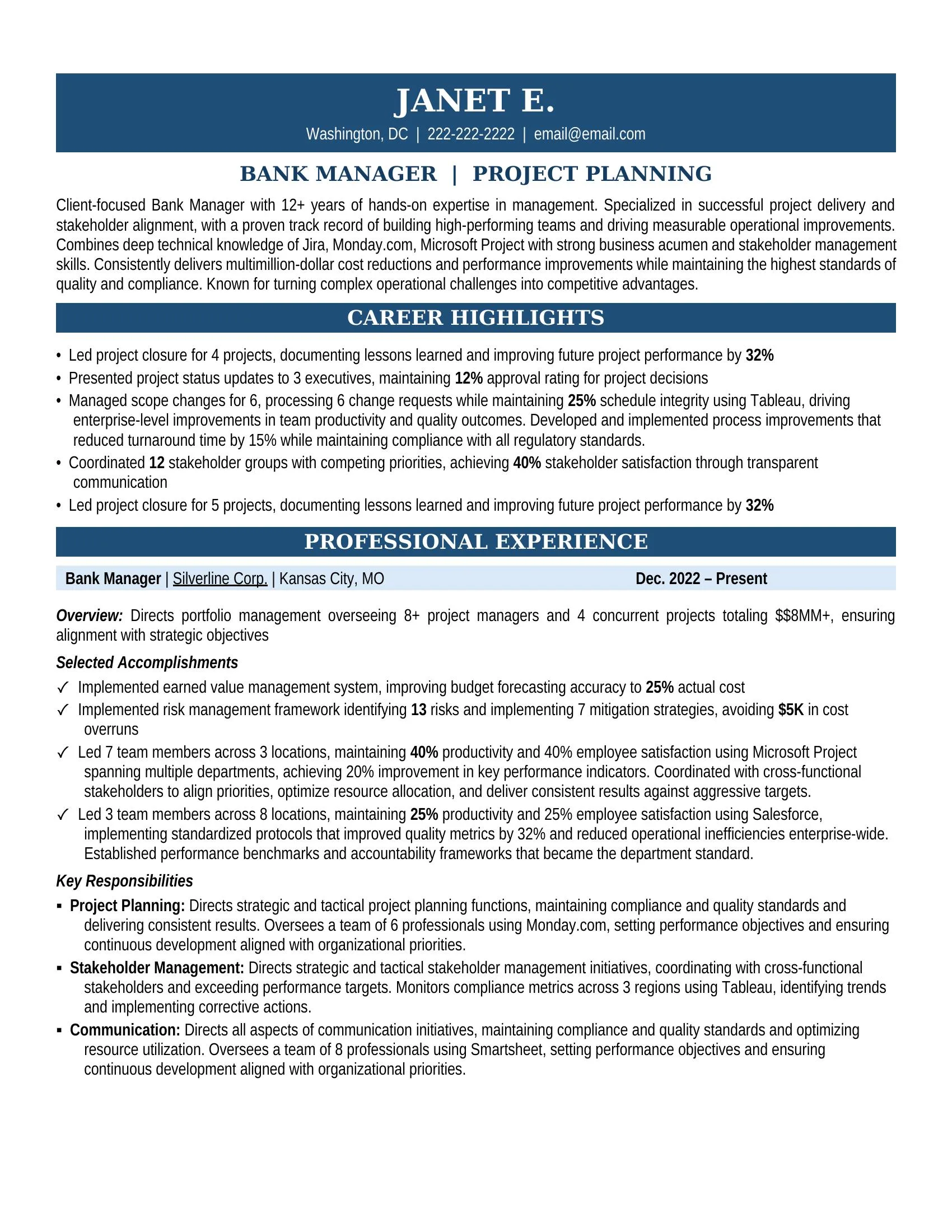

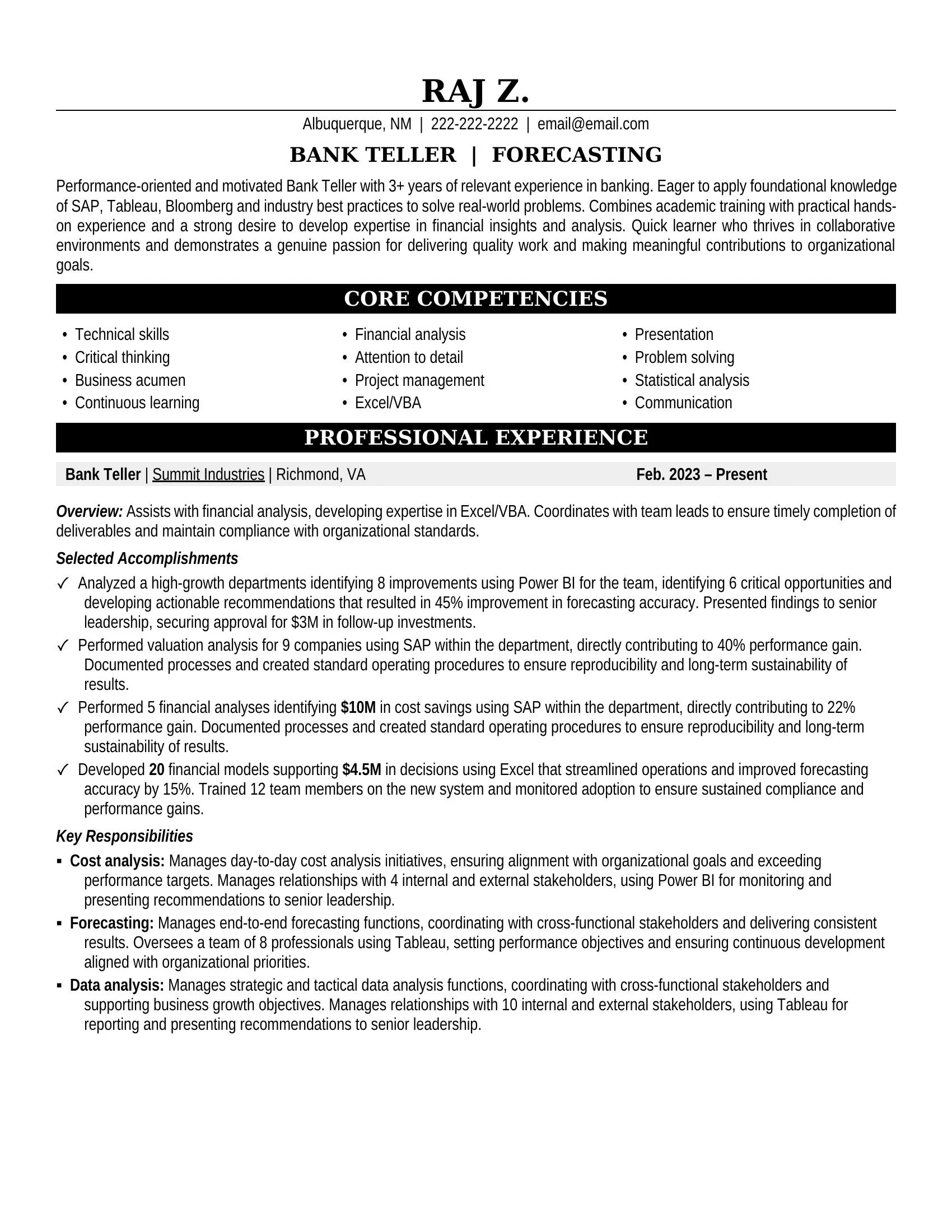

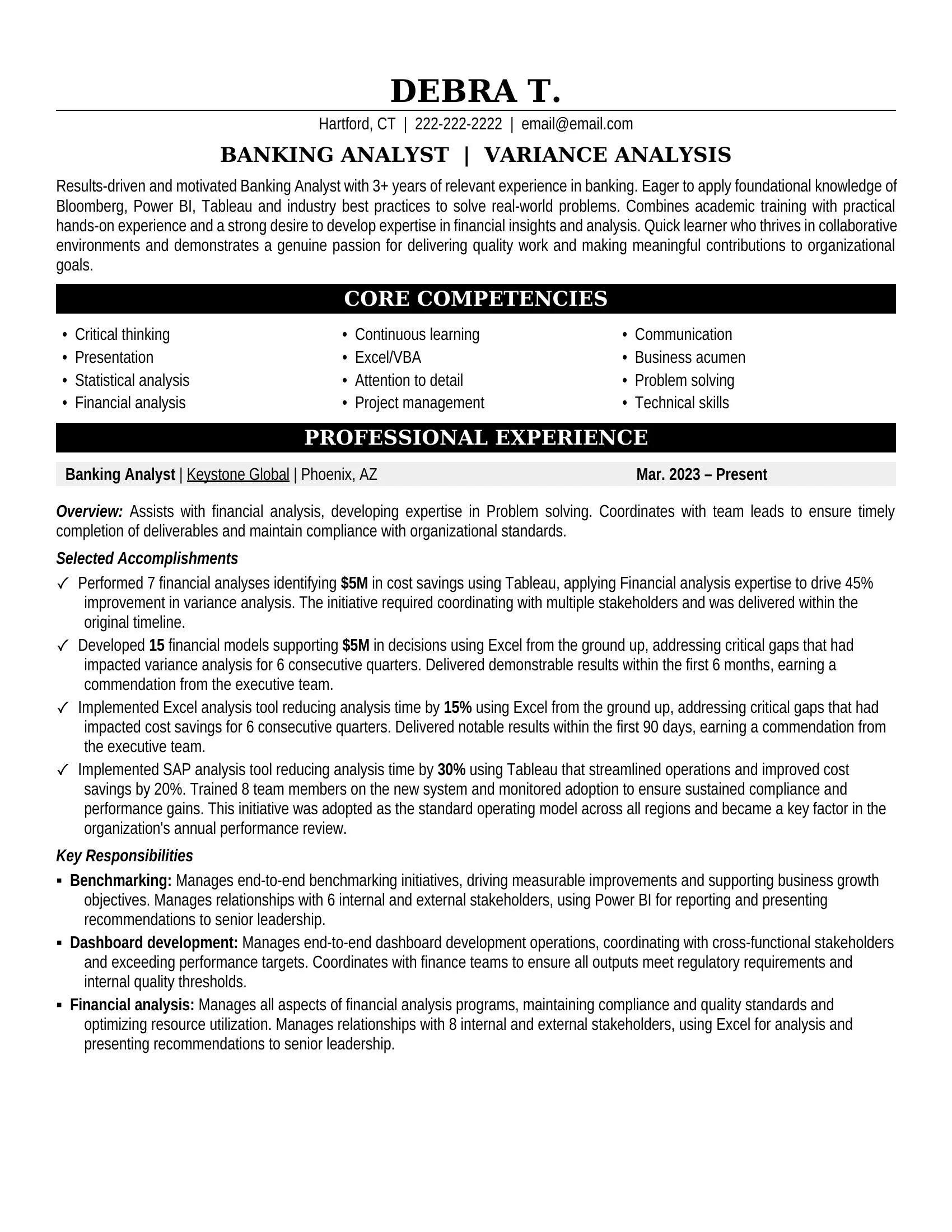

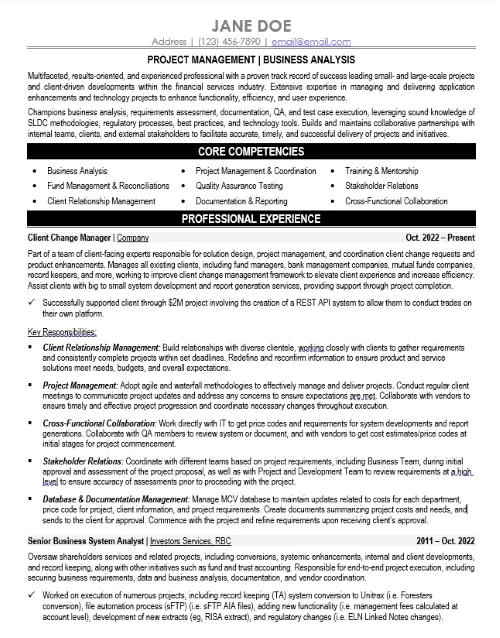

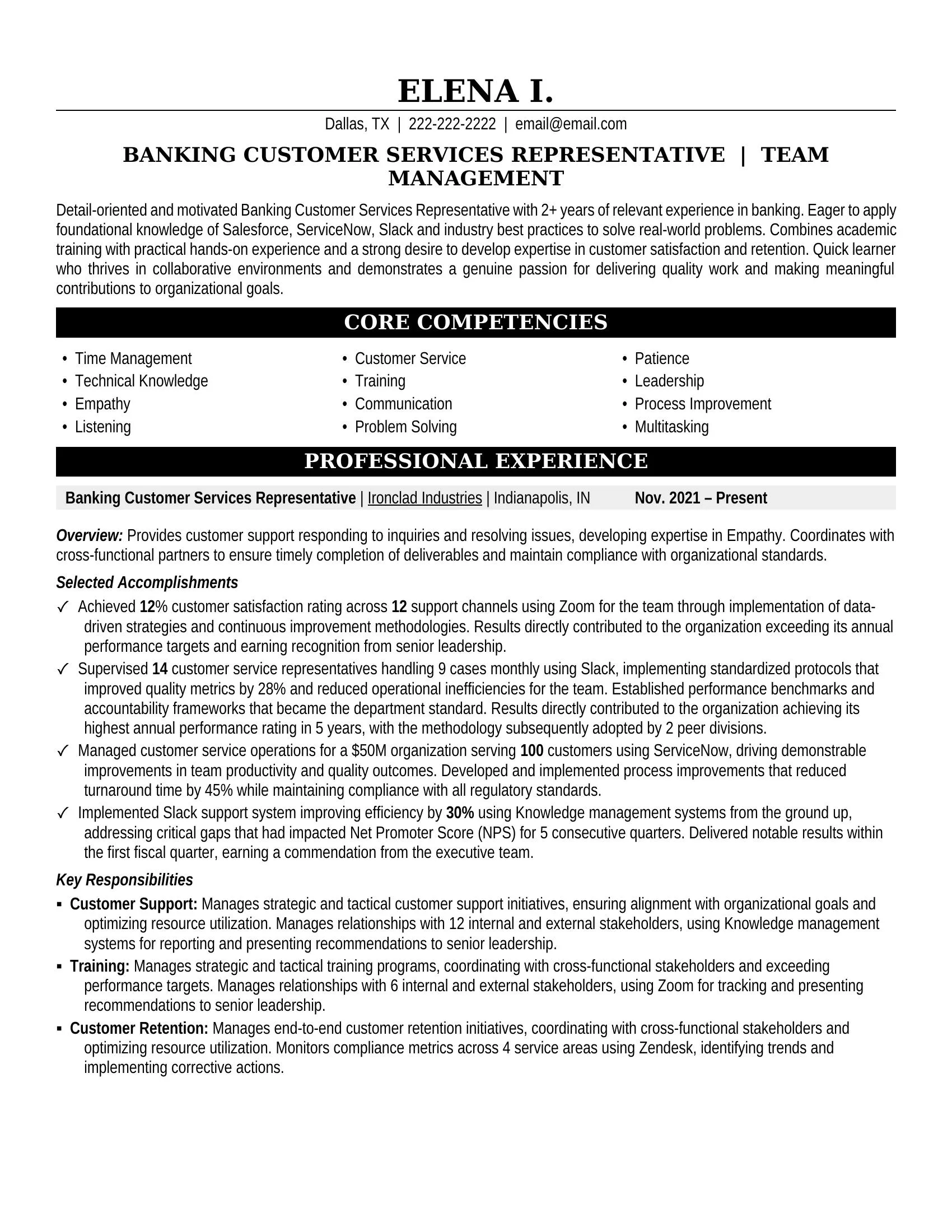

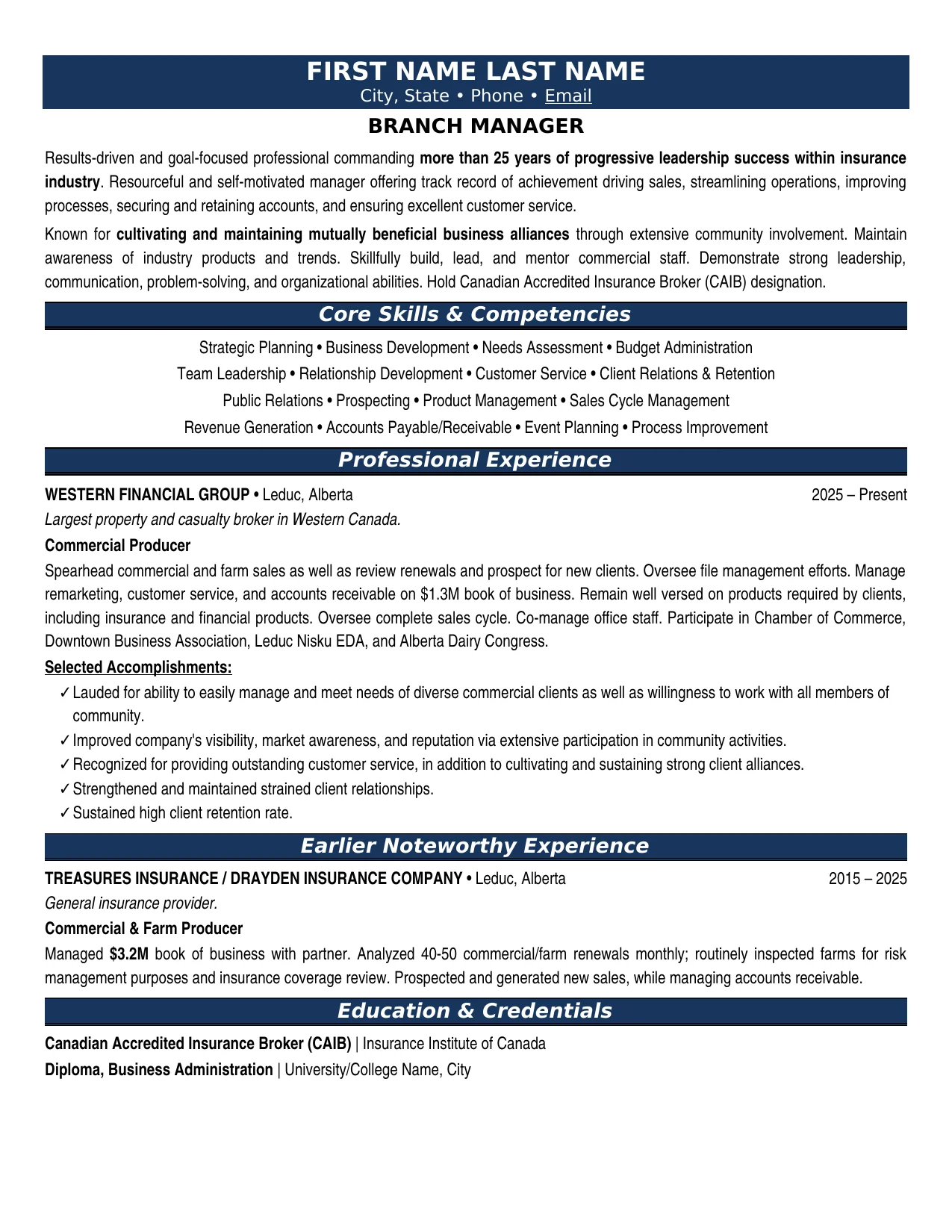

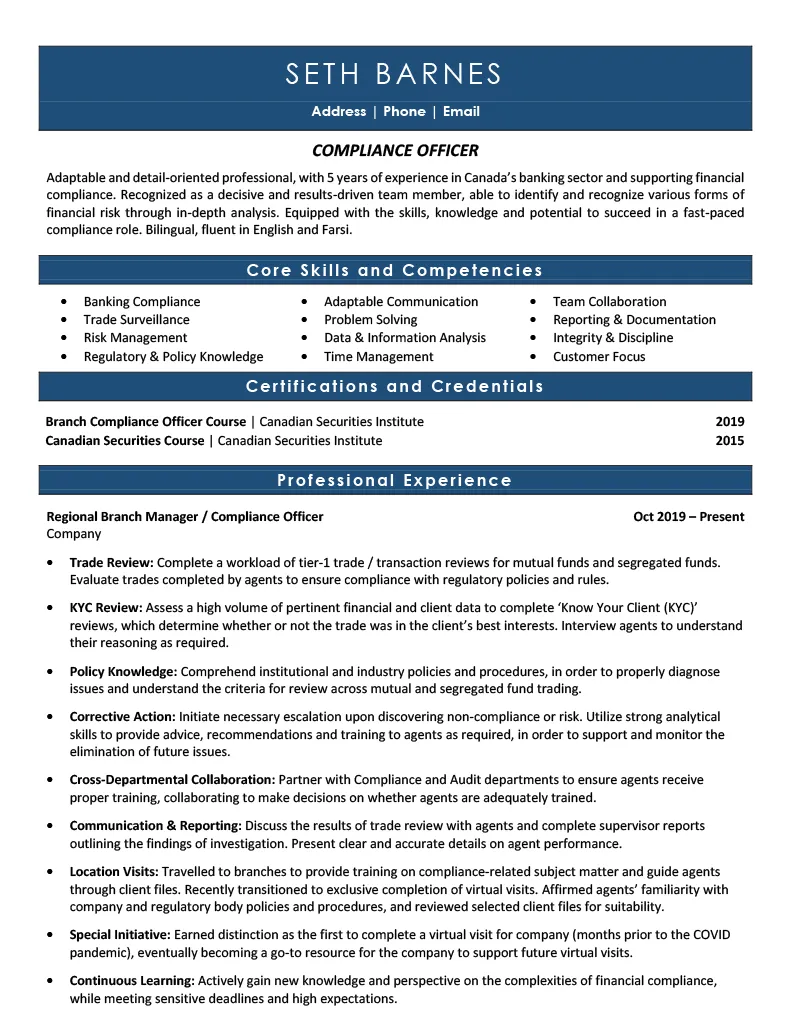

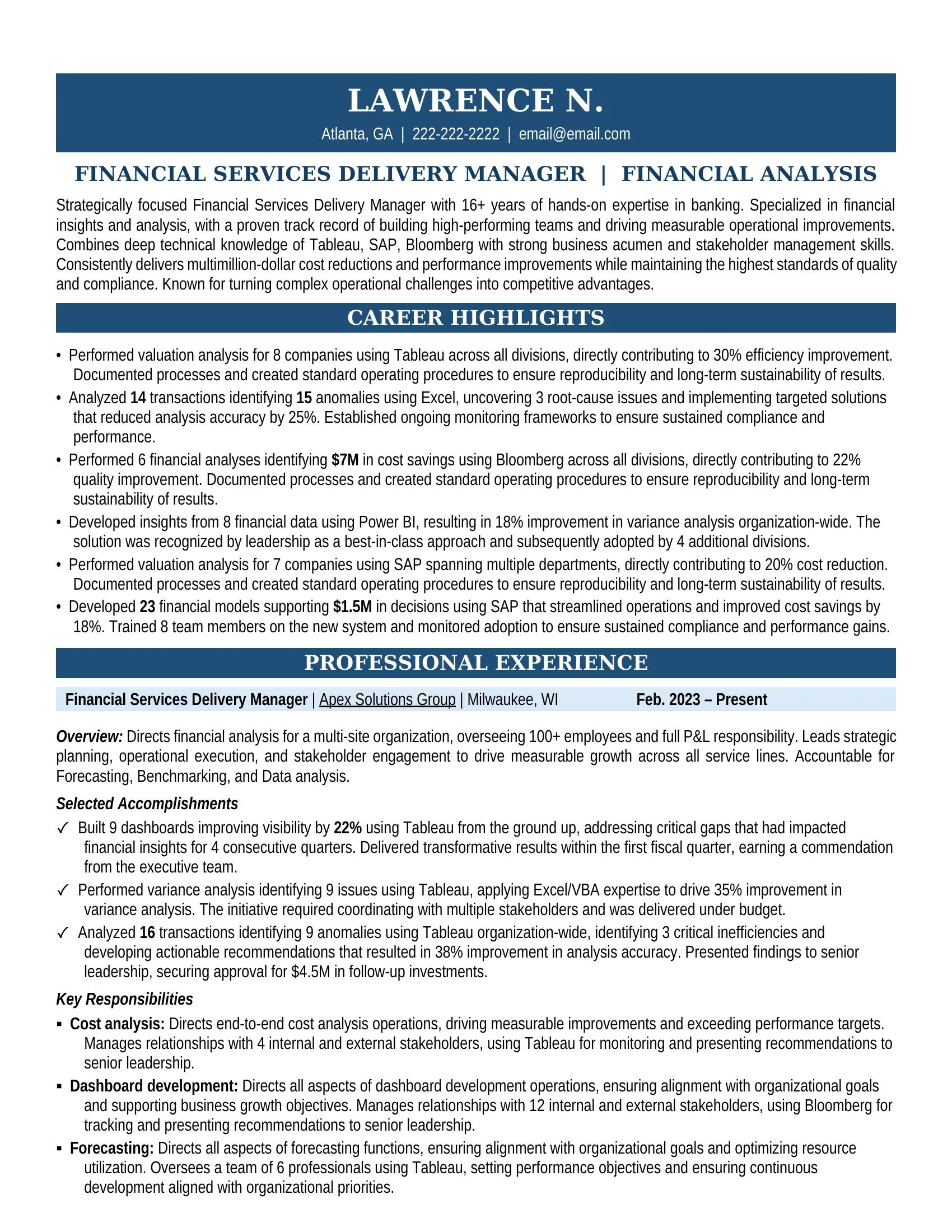

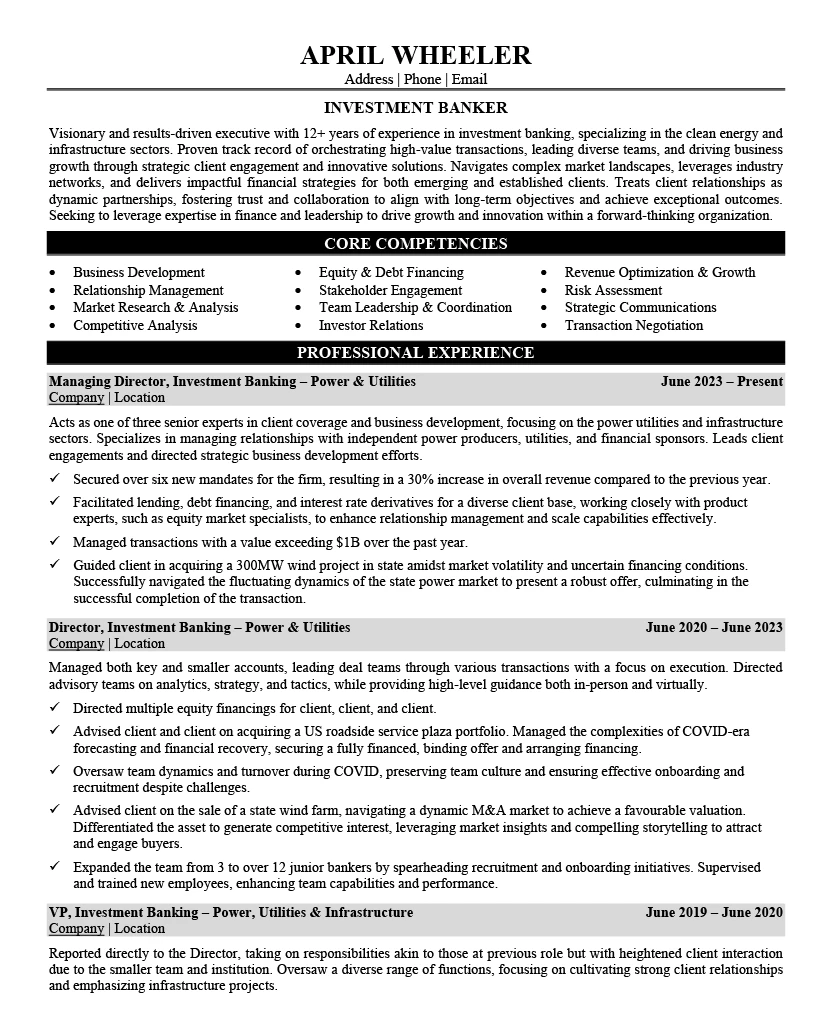

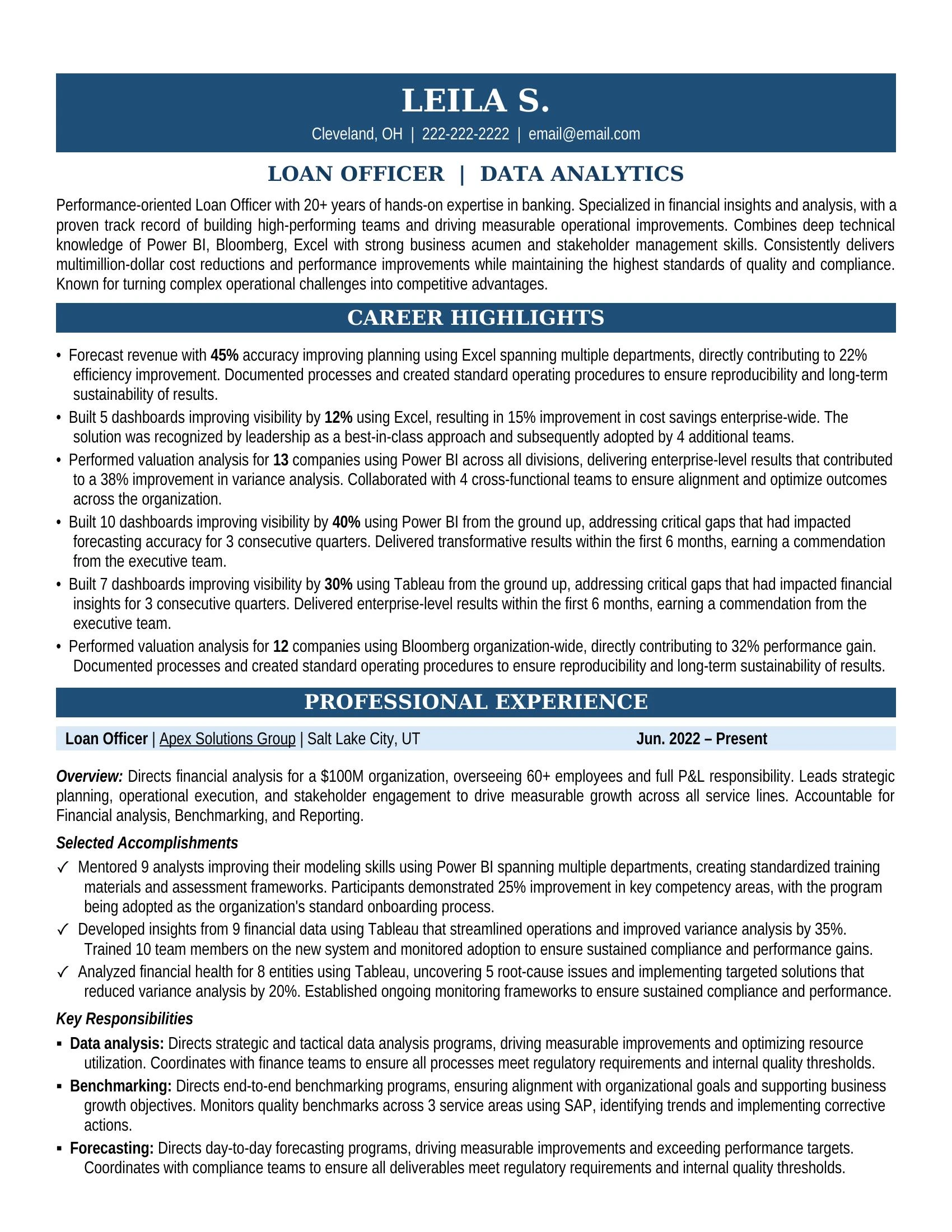

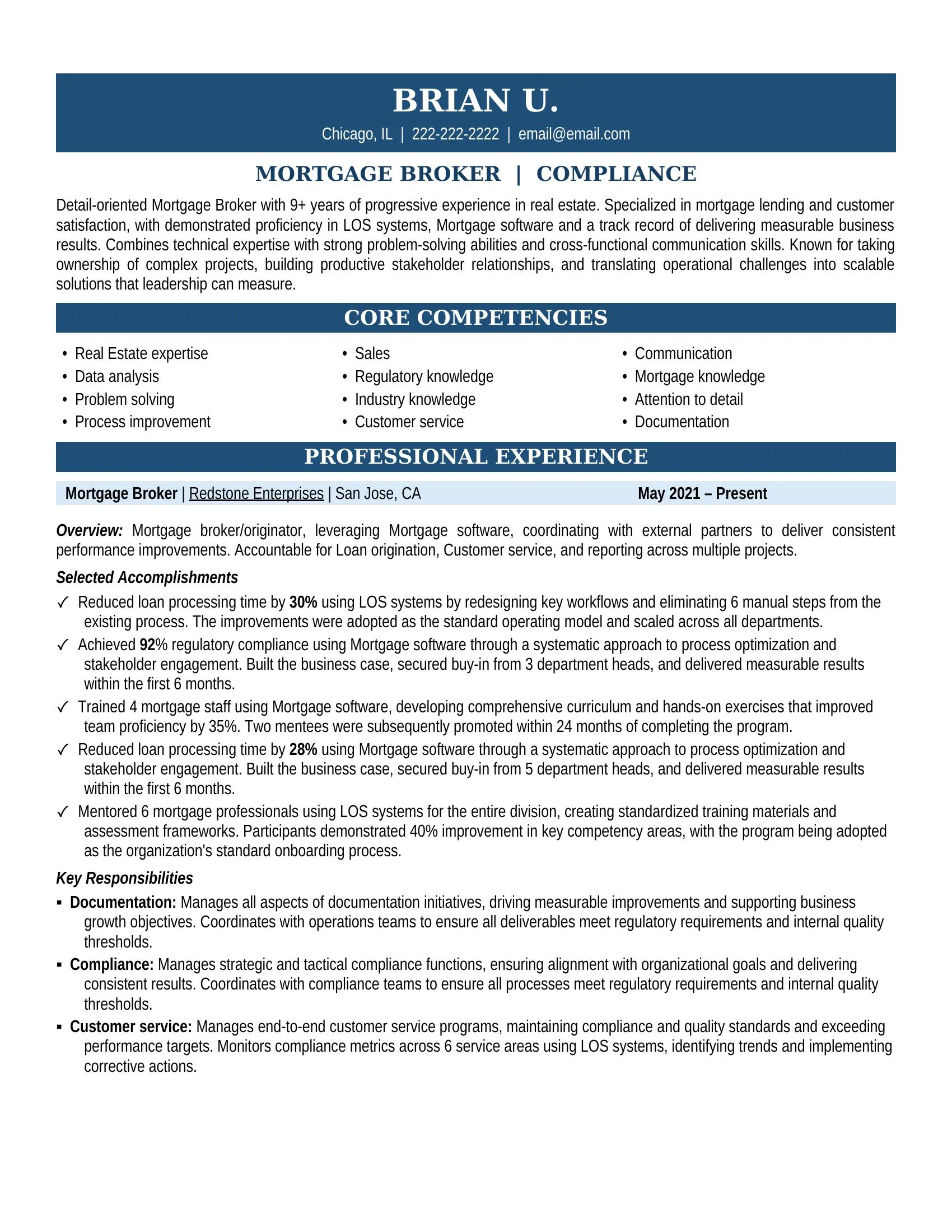

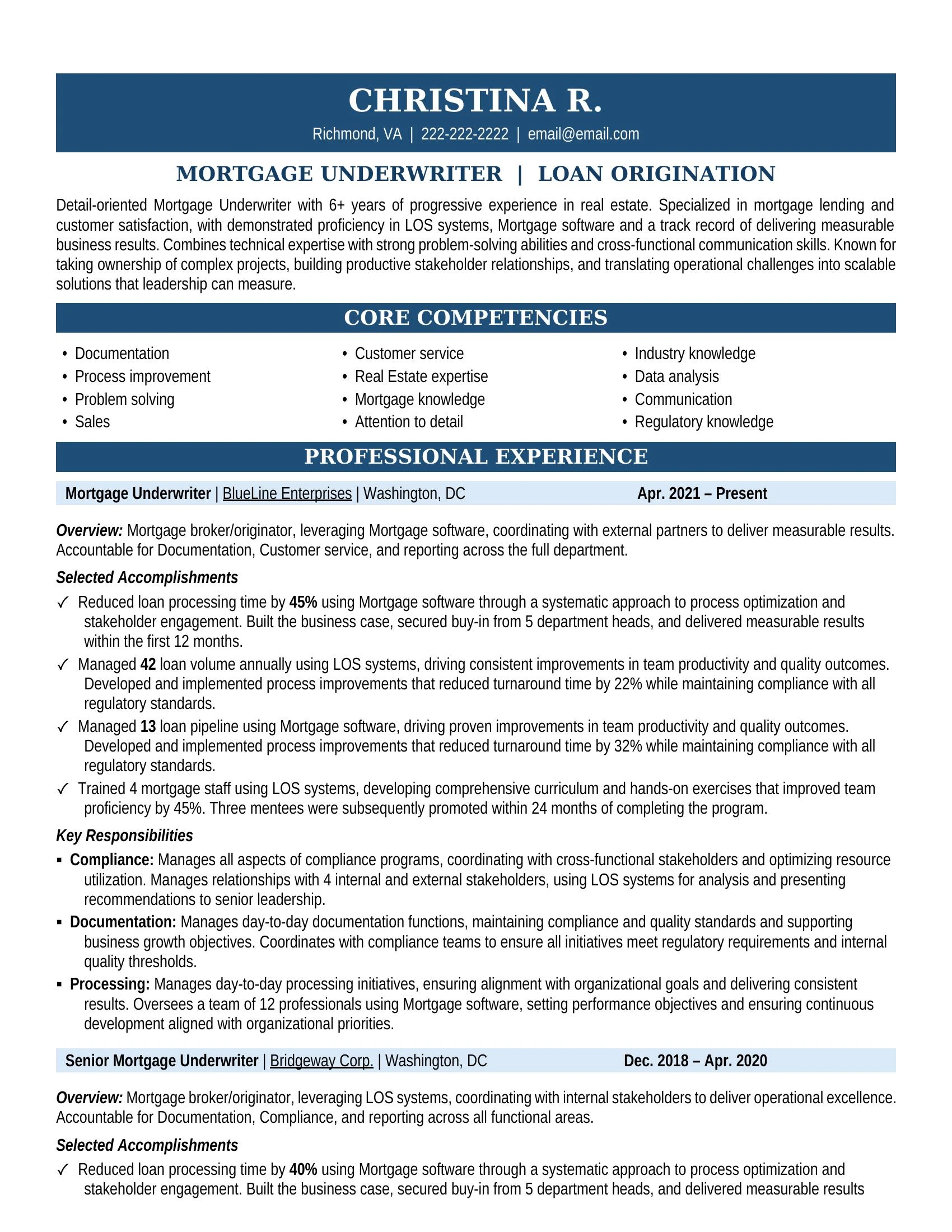

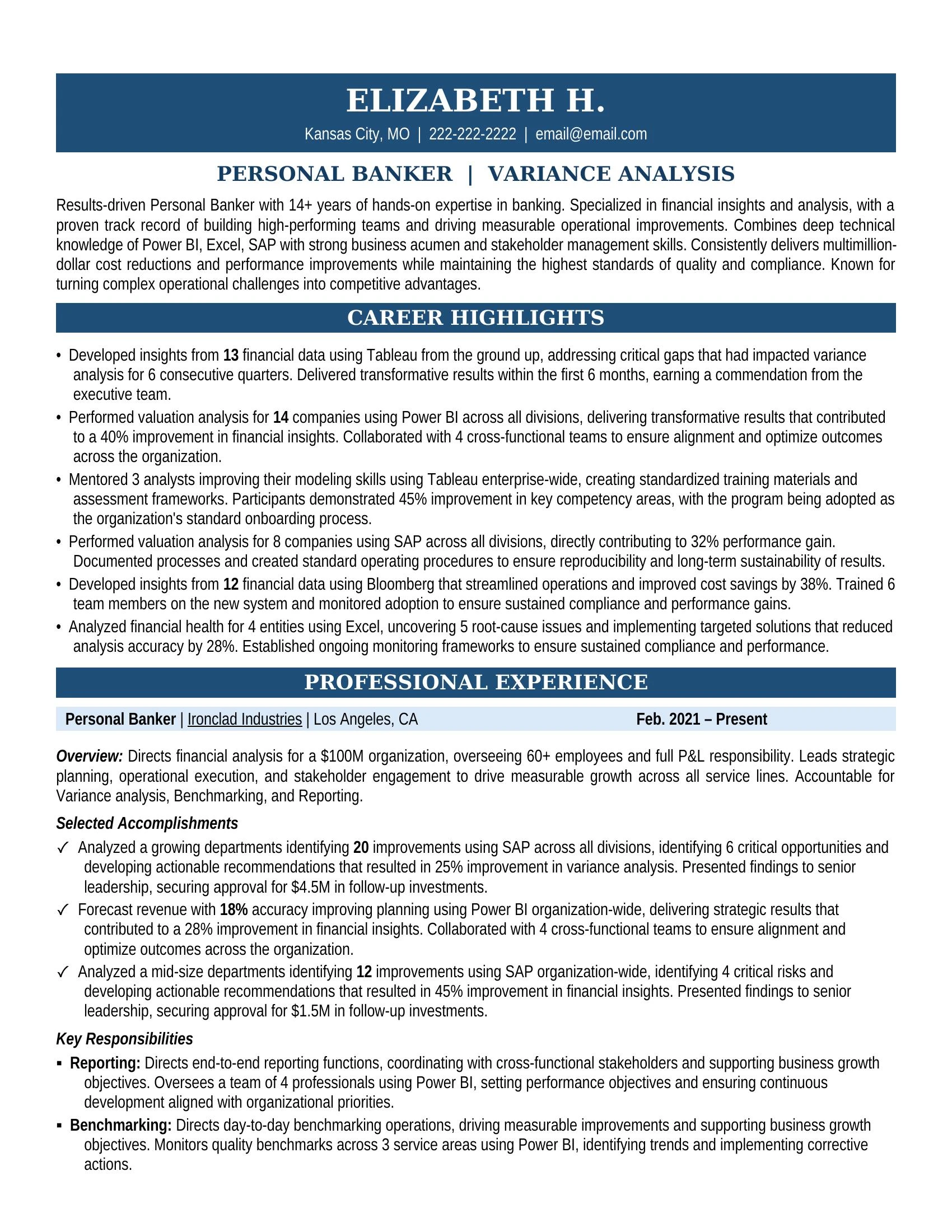

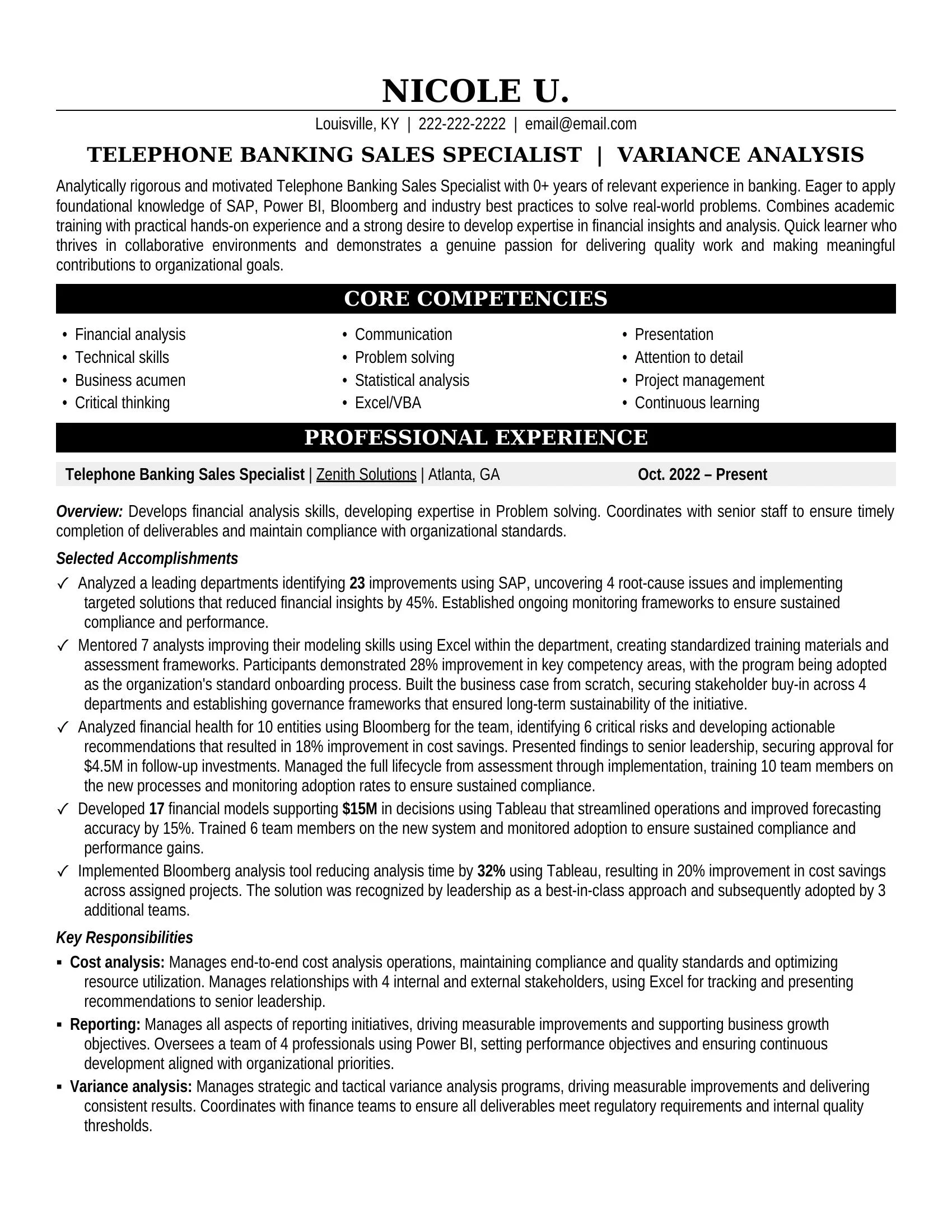

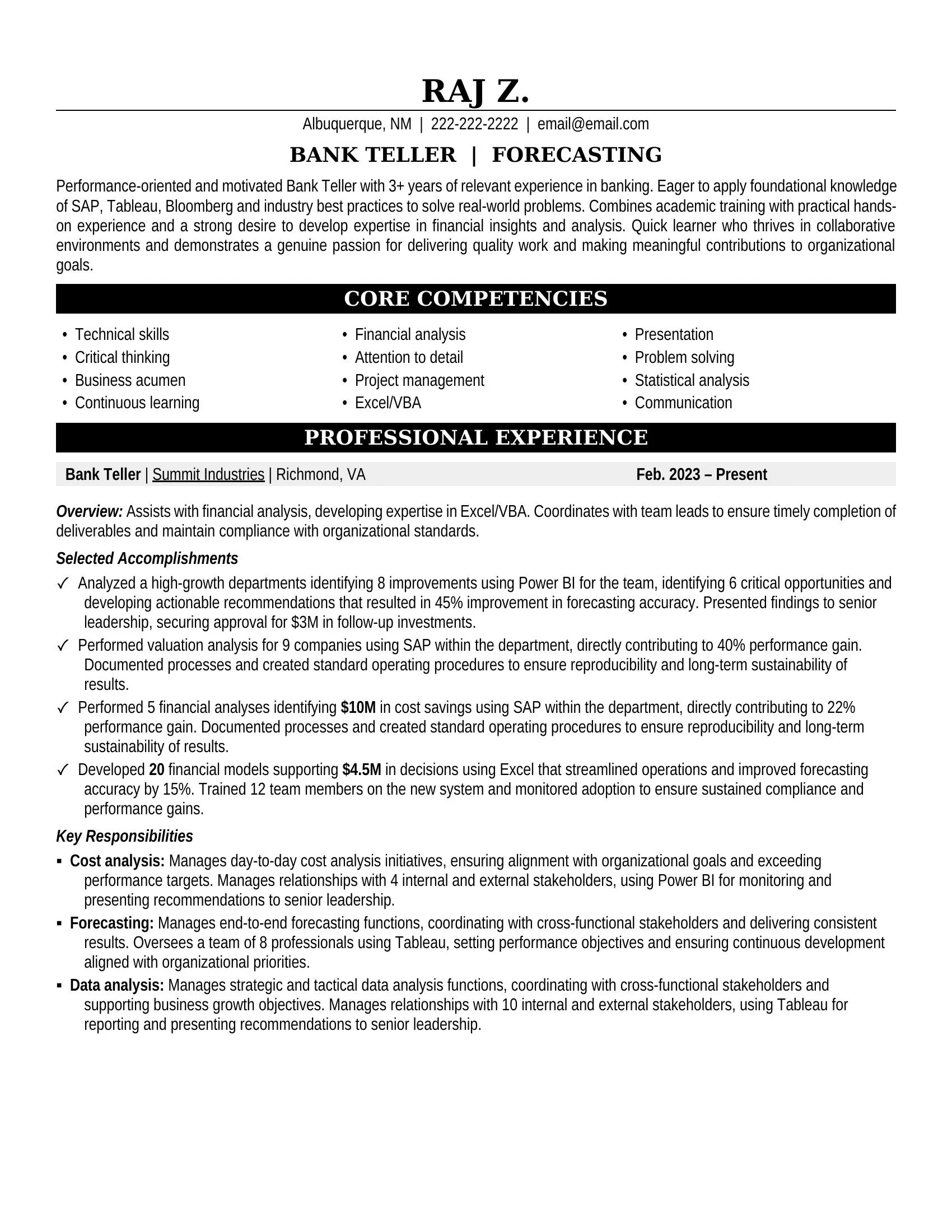

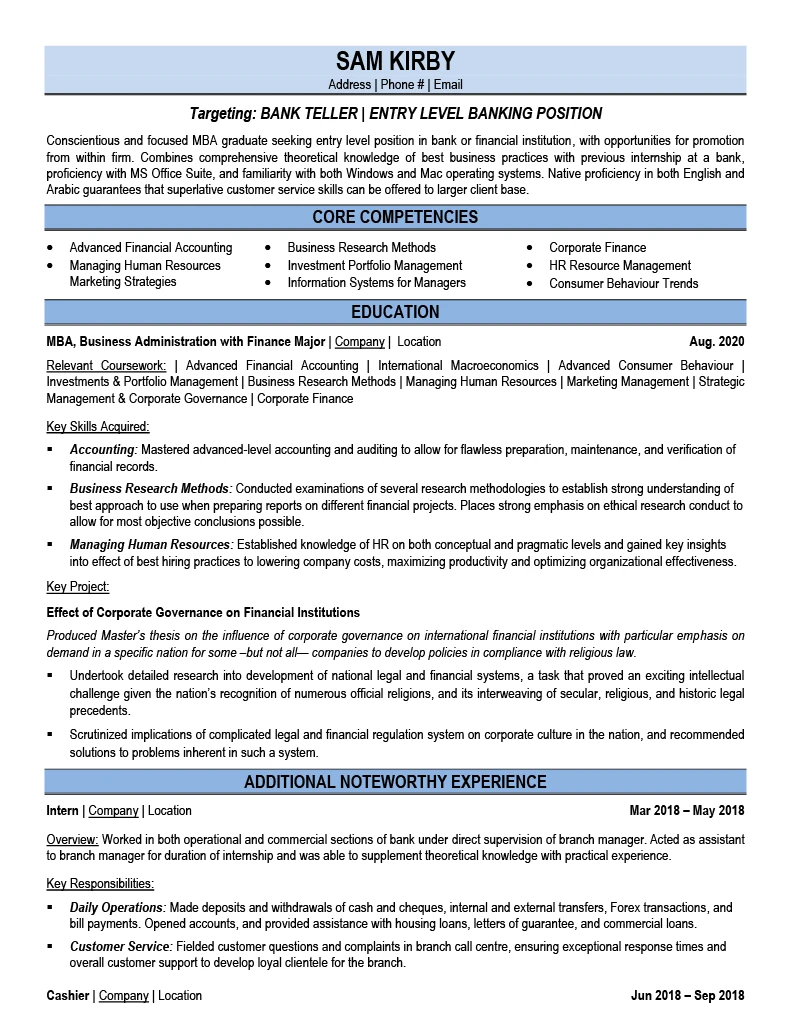

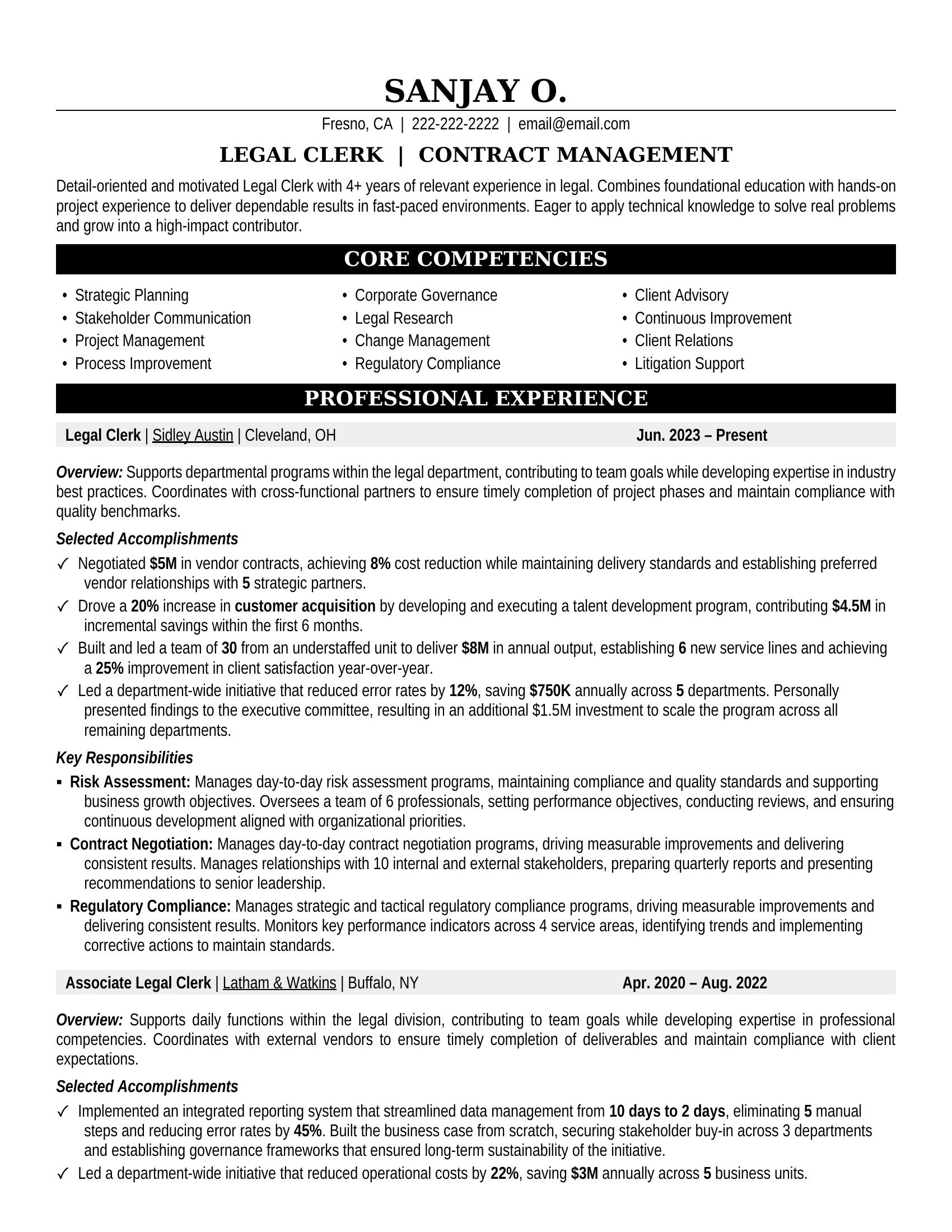

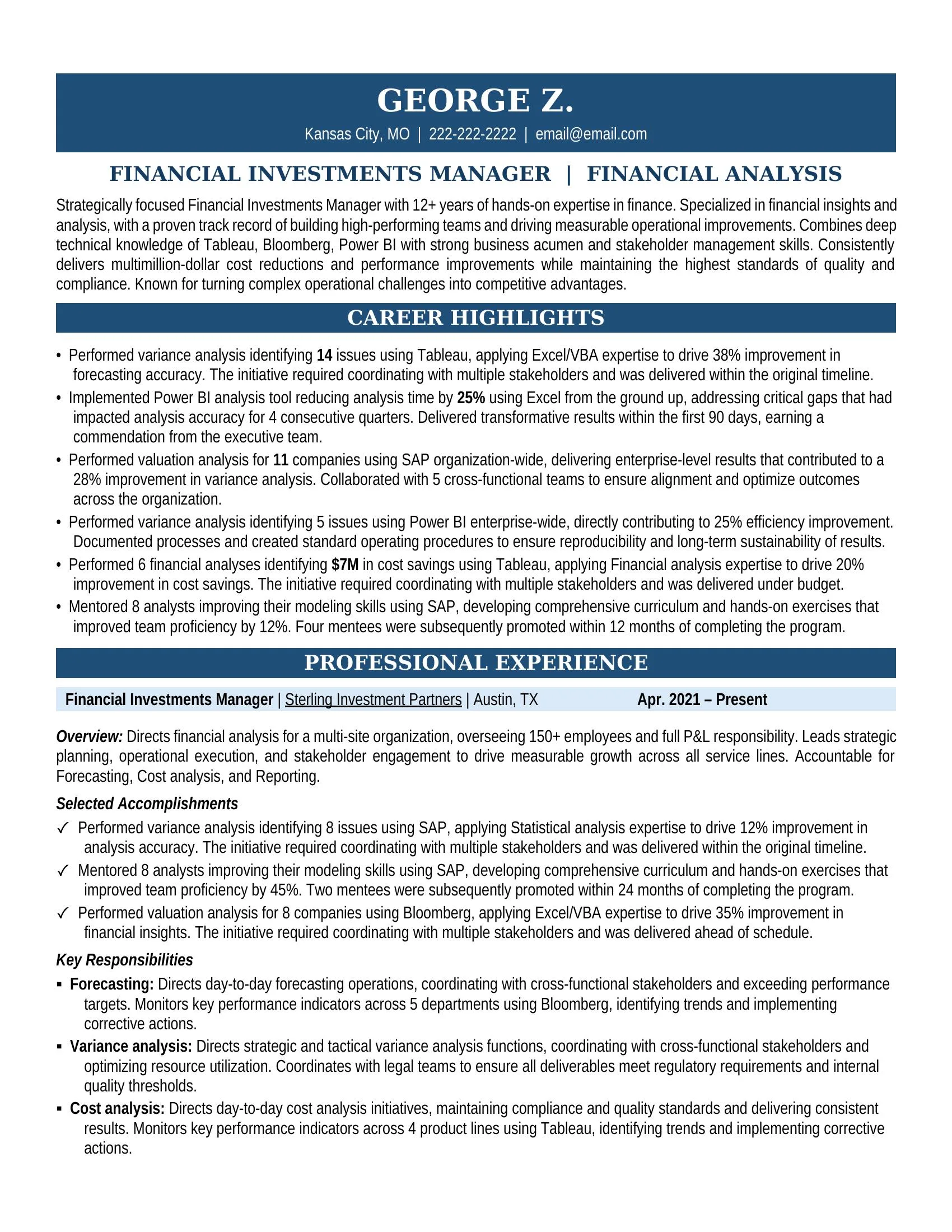

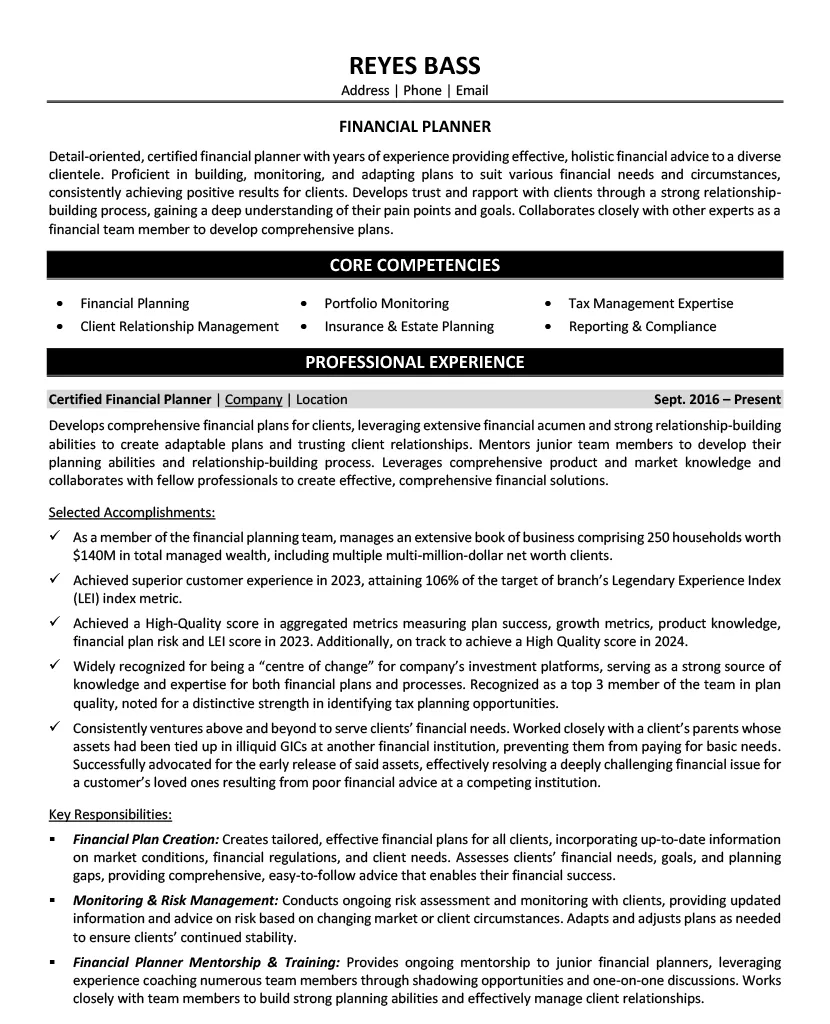

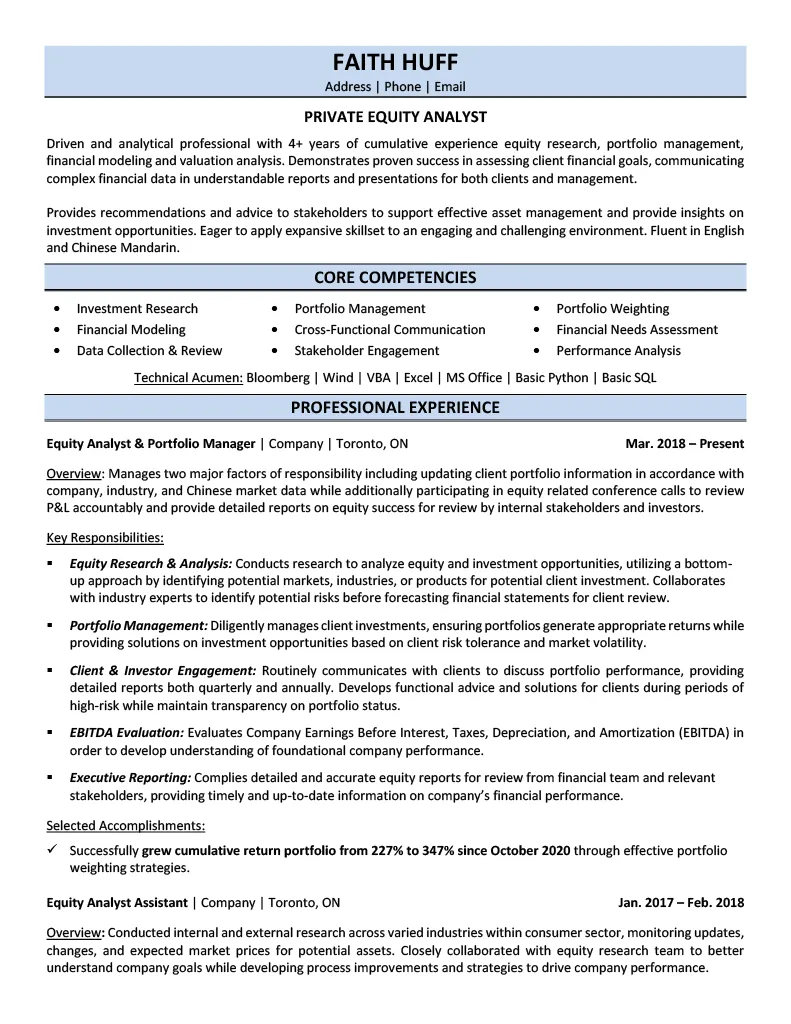

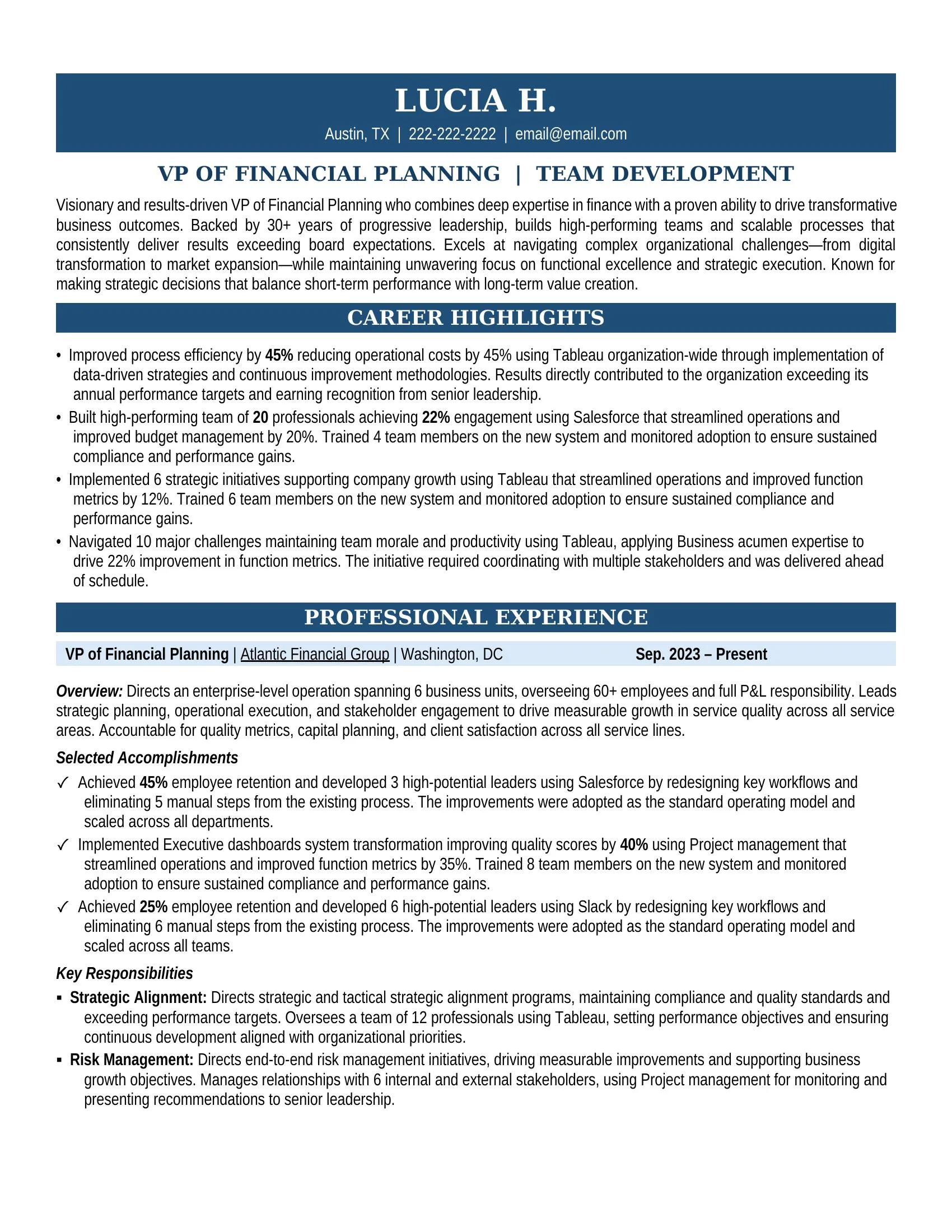

"Tell me about the biggest project you led last year..."24+ Banking Resume Examples

In Banking, you're competing with 800 applicants per search

You're Not Rejected.

— You're Overlooked —

We fix your banking resume with one conversation

The strongest banking resumes lead with portfolio performance, deal value, and operational metrics — not job titles or years in financial services. Hiring managers at institutions like JPMorgan Chase, Bank of America, and Goldman Sachs scan for AUM growth, origination volume, deposit performance, and compliance track records. Every resume sample on this page was built through a 1-on-1 interview that extracted the specific financial outcomes that differentiate candidates in a field averaging 800 competitors per job search.

Each banking resume sample below was written through our 1-on-1 interview process. Click any banking resume example to see the full sample and learn how we transformed their experience into proof.

When a hiring manager reads your banking resume, they should think:

"This person has solved the exact problems we're facing."

What were the projects or initiatives you worked on? We probe to understand the scope, the stakes, and the significance.

"Tell me about the biggest project you led last year..."What were the goals of the project? The company's objectives? We connect your work to business outcomes.

"What was the company trying to achieve with this?"What systems, processes, and strategies did you implement? This is where your expertise becomes visible.

"Walk me through how you actually made this happen..."What challenges did you face? What systems did you implement to overcome obstacles?

"What was the biggest challenge, and how did you solve it?"See how our interview process uncovered achievements and turned them into interview-winning proof.

Get Your Banking Resume Written

Banking jobs average 40 applicants per position. You're competing against 800 candidates. Our banking resume examples show how to stand out.

Data based on LinkedIn job postings. Updated Mar 4, 2026.

Here's the math most job seekers don't do:

Your banking resume must stand out against 800 professionals.

What makes you different is the story behind the projects.

Get Your Banking Resume WrittenEvery banking resume example on this page was written through our 1-on-1 interview process. We extract achievements you'd never think to include.

We identify keywords and achievements that get banking resumes noticed.

Targeted questions about your banking projects and results.

Transform responsibilities into quantified achievements.

ATS-optimized resume in 3 business days + 14-day revisions.

80% of banking positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

When you purchase our Resume Distribution service, your resume goes to 450+ recruiters specializing in banking — included in Advanced & Ultimate packages.

| Agency | Location |

|---|---|

|

HA

Hays Specialist Recruitment

|

Nationwide |

|

RA

Randstad Staffing Agency

|

Nationwide |

|

KE

Kelly Services Workforce Solutions

|

Nationwide |

|

MA

ManpowerGroup Talent Solutions

|

Nationwide |

|

AD

Adecco HR Services

|

Nationwide |

Banking averages 40 applicants per position across 5,000 active job postings — but competition varies dramatically by role. Banking Analyst positions are the most competitive at 109 applicants per opening — an entry point where hundreds of finance graduates compete for the same seats. Investment Banker roles draw 44 applicants, AML Compliance Officer positions see 42, and Bank Manager roles average 41. Even specialized roles like Loan Officer (29 applicants) and Personal Banker (25) face meaningful competition. Apply to 20 positions in a typical 30-day search and you're one of roughly 800 candidates competing. In banking, the resume that says "$1B+ in transaction value with 30% revenue increase" beats "worked on investment deals" every time.

Because banking runs on numbers that a questionnaire never asks for. A Loan Officer who "originated mortgage loans" could mean anything. Our interview uncovered one client who produced $40M+ in annual production, held licensing in 11 states, and served as a trusted Subject Matter Expert with Freddie Mac and Fannie Mae knowledge. A Bank Manager who "achieved high customer satisfaction" becomes someone with 98.50% customer satisfaction, a 12-member team, and coordination across 32 branches. Our Investment Banker sample revealed $1B+ in transaction value and a 30% revenue increase from six new mandates in clean energy and infrastructure. A questionnaire captures these as "managed loans," "led team," and "closed deals." The interview captures the full scope of what your banking career has actually produced.

They're screening for the metrics that predict performance in your specific function. For Branch and Bank Managers: deposit growth percentage, customer satisfaction scores, team size, and multi-branch coordination (our Bank Manager sample shows 98.50% satisfaction across 32 branches). For Investment Bankers: total deal value, number of mandates won, revenue generated, and sector expertise (our sample shows $1B+ transaction value). For Loan Officers: annual production volume, state licensing breadth, and product knowledge (our sample shows $40M+ production across 11 states). For Compliance Officers: program scope, regulatory framework expertise, and team oversight. For Personal Bankers: portfolio size, years exceeding targets, and team development impact (our sample shows 18+ years exceeding growth targets with $1M portfolio and 25+ mentored team members).

It matters fundamentally — these are different professions that happen to share the word "banking." Retail banking (Branch Managers, Personal Bankers, Tellers) measures success in deposit growth, customer satisfaction, cross-sell ratios, and team development. Investment banking measures deal value, mandates won, revenue generated, and sector expertise — completely different metrics and a completely different resume. Lending (Loan Officers, Mortgage Brokers, Underwriters) measures origination volume, production targets, licensing breadth, and default rates. Compliance (AML Officers, CCOs) measures program scope, regulatory examination outcomes, and risk framework effectiveness. During your interview, our writers identify your specific banking function and extract the metrics that matter in your lane — not generic "financial services" language that could describe anyone in the industry.

Our banking resume packages are based on career level and interview depth — from a 30-minute early career session to a 90-minute executive interview. When evaluating price, consider what the number actually buys. A company charging $99: after the company takes its margin, the writer earns $40-60 — enough for about 45 minutes of total work including writing. That's a questionnaire reformat that produces "managed client relationships and originated loans." Our Professional-level interview alone is 60 minutes, followed by job posting analysis, drafting, and revisions — producing "$40M+ annual production, licensed in 11 states, trusted SME for Freddie Mac and Fannie Mae compliance." View current packages and pricing.

We offer a 90-Day Interview Guarantee. If you don't land interviews within 90 days of receiving your final banking resume, we rewrite it free of charge. We can make this guarantee because our interview-based process produces resumes built on the financial metrics and operational results that banking hiring managers respond to — deal value, portfolio performance, deposit growth, and compliance outcomes. Browse the resume samples on this page to see the quality of work we deliver.