Numbers tell stories, but most Banking Analyst resumes just list duties. Your challenge is turning complex financial achievements into clear, compelling wins that hiring managers instantly understand.

Are you struggling to make your financial expertise stand out in a sea of qualified candidates? A strategically crafted resume can transform your technical skills and deal experience into powerful proof of your value.

Resume Target specializes in helping Banking Analysts showcase their quantifiable impacts. We know how to present your financial modeling, deal analysis, and market insights in language that resonates with hiring managers and recruiters.

At the intersection of high finance and strategic decision-making, Banking Analysts serve as the analytical backbone of financial institutions, where they connect businesses seeking funding with investors through comprehensive valuation analyses.

In this dynamic role, you'll dive deep into financial modeling, craft compelling investment presentations, and transform complex market data into actionable insights that guide multi-million dollar decisions.

Whether you're just starting your finance career or looking to level up your expertise, understanding the Banking Analyst career path can open doors to prestigious positions in investment banking, private equity, or corporate strategy - let's explore how you can build your future in financial services.

Let's talk about what makes a career as a Banking Analyst so exciting! Your earning potential in this dynamic field can be truly impressive, with compensation reflecting your expertise in financial analysis, market research, and strategic thinking. As you progress in your career, you'll find that your specialized skills and experience can lead to substantial income growth.

Figures from: ZipRecruiter

Starting as a Banking Analyst opens doors to rapid career growth in finance, with typical advancement to Associate roles within 2-3 years. From there, you can progress to leadership positions or transition into private equity and hedge funds.

Beyond basic financial knowledge, mastering these advanced skills will accelerate your progression in investment banking.

- Advanced Financial Modeling in Excel - Bloomberg Terminal and PitchBook Proficiency - DCF Valuation and NPV Analysis - Strategic Communication and Client ManagementBreaking into banking analysis starts with combining a finance-related degree with internships at financial institutions, while building essential technical skills through certifications and hands-on experience.

To advance in your banking career, you'll need to master both technical and soft skills, including proficiency in financial modeling tools like Bloomberg Terminal and Power BI, which will set you apart in this competitive field.

Requirements from Corporate Finance Institute

From NYC's financial hub to emerging markets in Texas, Banking Analyst roles span both traditional and tech-forward sectors.

Figures from U.S. Bureau of Labor Statistics

Struggling to translate your complex financial analysis experience, deal flow tracking, and market research skills into a compelling banking analyst resume that catches a hiring manager's attention? Follow our comprehensive section-by-section guide that will help you craft a professional resume that showcases your financial expertise and quantifiable achievements.

As a Banking Analyst, crafting the perfect resume summary can feel as complex as analyzing market trends and financial statements - but it doesn't have to be.

While you excel at dissecting financial data and providing strategic insights to clients, translating these valuable skills into a compelling summary that catches a hiring manager's attention requires a different kind of precision - one that can make the difference between landing an interview or getting lost in the applicant pool.

How would you describe your unique blend of financial analysis expertise and the specific banking sectors (commercial, investment, retail) where you've developed your professional identity?

Reason: This helps establish your professional positioning within the banking industry and immediately signals to hiring managers your core specialization area, setting the tone for your entire resume.

What would you say is your strongest contribution to banking operations when considering your combined skills in risk assessment, financial modeling, and regulatory compliance?

Reason: This question helps you articulate your value proposition by focusing on the intersection of critical banking analyst competencies, rather than individual accomplishments.

How do you bridge the gap between technical financial analysis and strategic business insights in your role as a Banking Analyst?

Reason: This helps you demonstrate your ability to translate complex financial data into actionable business intelligence, a crucial differentiator for senior-level banking positions.

As a Banking Analyst, your resume needs to showcase both your quantitative abilities and your understanding of financial markets, while demonstrating your proficiency with industry-specific tools and software.

From advanced financial modeling and valuation techniques to day-to-day skills like Bloomberg Terminal navigation and Excel macros, you'll need to strategically present your technical and soft skills to stand out in this competitive field.

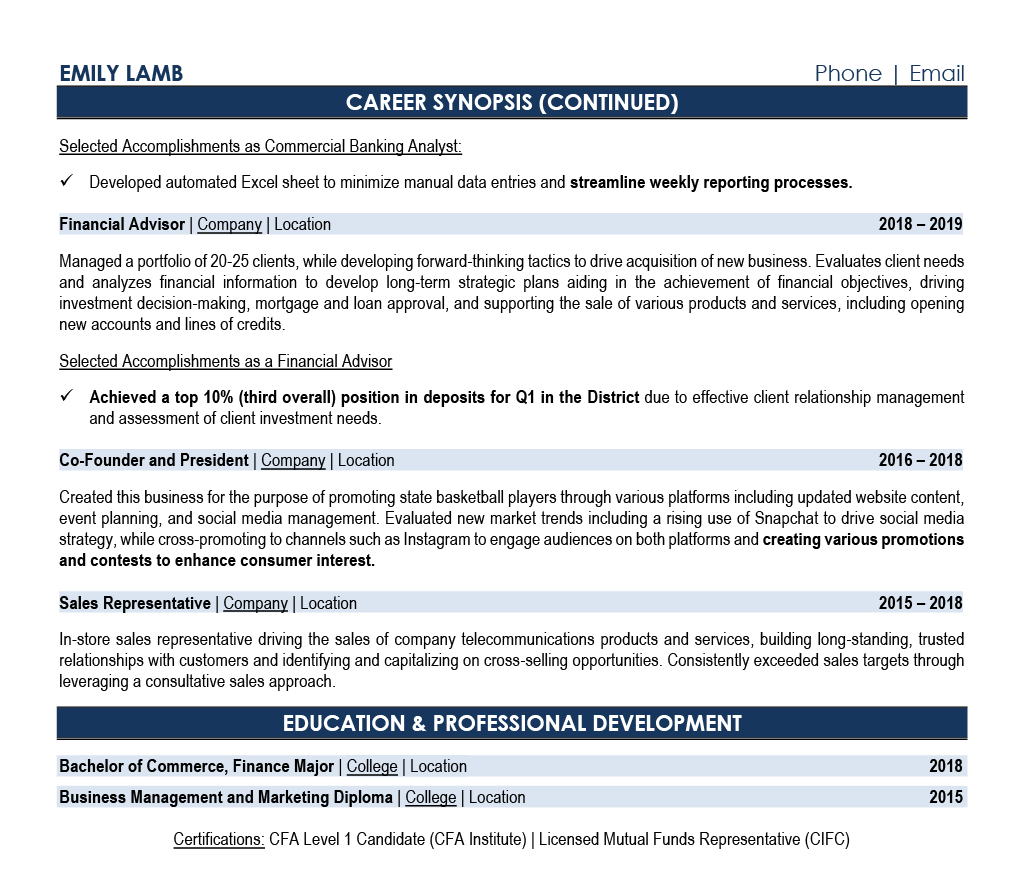

Examples of Banking Analyst Skills: Financial Modeling Valuation Analysis Due Diligence Market Research Risk Assessment Financial Statement Analysis Deal Execution Client Relations Pitch Book Creation Investment Analysis Strategic Planning Project Management Data Analytics Technical Skills: Bloomberg Terminal | Capital IQ | FactSet | Excel (Advanced) | PowerPoint | VBA Soft Skills: Attention to Detail | Time Management | Communication | Problem-Solving | Team CollaborationShowcase your financial expertise by structuring your experience into three powerful segments: a concise role overview highlighting your banking focus, quantifiable achievements that demonstrate your analytical impact, and core responsibilities that underscore your mastery of financial analysis and reporting.

Many Banking Analysts struggle to translate complex financial analyses and deal support activities into clear, quantifiable accomplishments that resonate with hiring managers. Transform your technical contributions into powerful success stories by connecting your financial modeling, valuation work, and deal execution support directly to revenue growth, cost savings, and successful transaction outcomes.

A strong responsibilities section demonstrates how Banking Analysts drive financial decision-making and support key business operations. Your role description should translate complex financial analysis into clear achievements that showcase your value to both technical and non-technical hiring managers.

Your educational background and professional certifications are crucial differentiators in the banking industry. Lead with your highest relevant degree and any specialized certifications that demonstrate your expertise in financial analysis, risk assessment, or regulatory compliance.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing banking analyst positions.

While many candidates stop at customizing their cover letter, successful banking analyst applicants know that personalizing their resume for each role is what truly sets them apart in this competitive field.

By strategically incorporating specific banking terminology, analytical skills, and financial software expertise that match each job description, your customized resume will sail through ATS systems and immediately show hiring managers you're the ideal candidate they've been seeking.

Ready to turn your resume into your secret weapon? Let's make every word count and position you as the standout banking analyst candidate you are!

Don't let a lack of experience hold you back from launching your Banking Analyst career! Your resume can shine by showcasing your relevant coursework in finance, economics, or business administration.

Transform your academic achievements, internships, and analytical projects into compelling qualifications that catch a hiring manager's eye.

Focus on highlighting your financial modeling skills, understanding of market analysis, and proficiency with banking software and Excel.

Need more guidance? The Student Resume Writing Guide offers excellent templates and examples to help structure your qualifications for banking roles.

Your resume summary is your chance to showcase your fresh financial perspective, analytical capabilities, and relevant internship experiences that make you an ideal candidate for banking roles.

Focus on highlighting your academic achievements, financial modeling skills, and any exposure to banking processes through coursework or internships to create a compelling narrative.

"Detail-oriented and analytical Banking professional with strong foundation in financial analysis and investment banking principles through academic excellence and internship experience. Proficient in financial modeling, valuation methods, and Bloomberg Terminal, with demonstrated success in completing three deal-focused projects during summer internship at regional investment bank. Leverages strong quantitative skills and market knowledge to deliver accurate financial analyses and recommendations. Seeking to apply deep understanding of banking fundamentals and fresh analytical perspective as a Banking Analyst."

Now's your chance to showcase the financial knowledge and analytical skills you gained through your education journey as a future banking professional!

Transform your academic experience into compelling content by highlighting relevant coursework like Financial Markets, Investment Analysis, or Risk Management, plus any team projects where you analyzed market trends or created financial models.

Courses common to a degree/certification for Banking Analysts: * Finance [1, 2] * Accounting [1, 2] * Statistics [2] * Economics [2] * Business Administration [2] * Computer Science [2] * Corporate Finance [2] * Financial Modeling [1] * Valuation [1] * Financial Statement Analysis [1] * Capital Markets [1] * Credit Analysis [1]Relevant Coursework: Financial Modeling | Corporate Finance | Financial Statement Analysis | Capital Markets | Credit Analysis | Business Administration

Key Projects:

Investment Portfolio Analysis Project: Developed a comprehensive investment strategy for a $10M hypothetical portfolio using modern portfolio theory and risk assessment techniques. Created detailed financial models and presented recommendations to faculty board.

Corporate Valuation Case Study: Conducted in-depth financial analysis of a public company, including complete valuation using multiple methodologies and strategic recommendations for value creation.

Leverage your academic background, internship experiences, and technical training to showcase the essential banking analysis capabilities that employers seek, demonstrating your readiness to contribute to financial operations from day one.

As an aspiring Banking Analyst, highlighting these foundational skills will position you competitively in the financial services sector, where opportunities continue to grow for analytical minds ready to tackle complex financial challenges.

Let's face it - translating complex financial models, risk assessments, and market analyses into clear, compelling achievements can feel like trying to explain quantum physics to a five-year-old.

At Resume Target, we specialize in crafting resumes for banking professionals that speak both languages - the technical precision hiring managers need and the clear business impact executives want to see.

Our team has helped hundreds of banking analysts transform their deal flow metrics and financial expertise into powerful career stories that land interviews at top institutions.

With banks actively recruiting for Q1 2024, now is the perfect time to ensure your resume matches your true potential - let's connect for a free consultation today.

Impress any hiring manager with our banking resume writing service. We work with all career levels and types of banking professionals.

Learn More → Banking Resume Writing Services