We Dive Into Your Deals

What transactions have you worked on? We probe the deal size, your role, and the complexity.

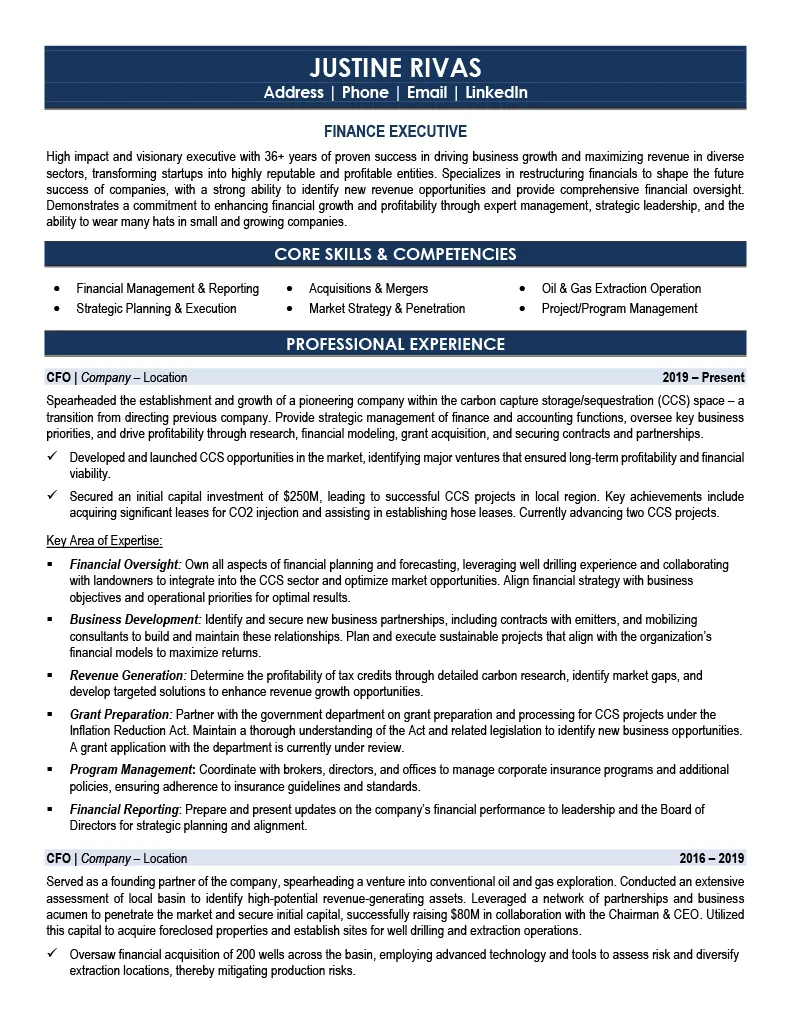

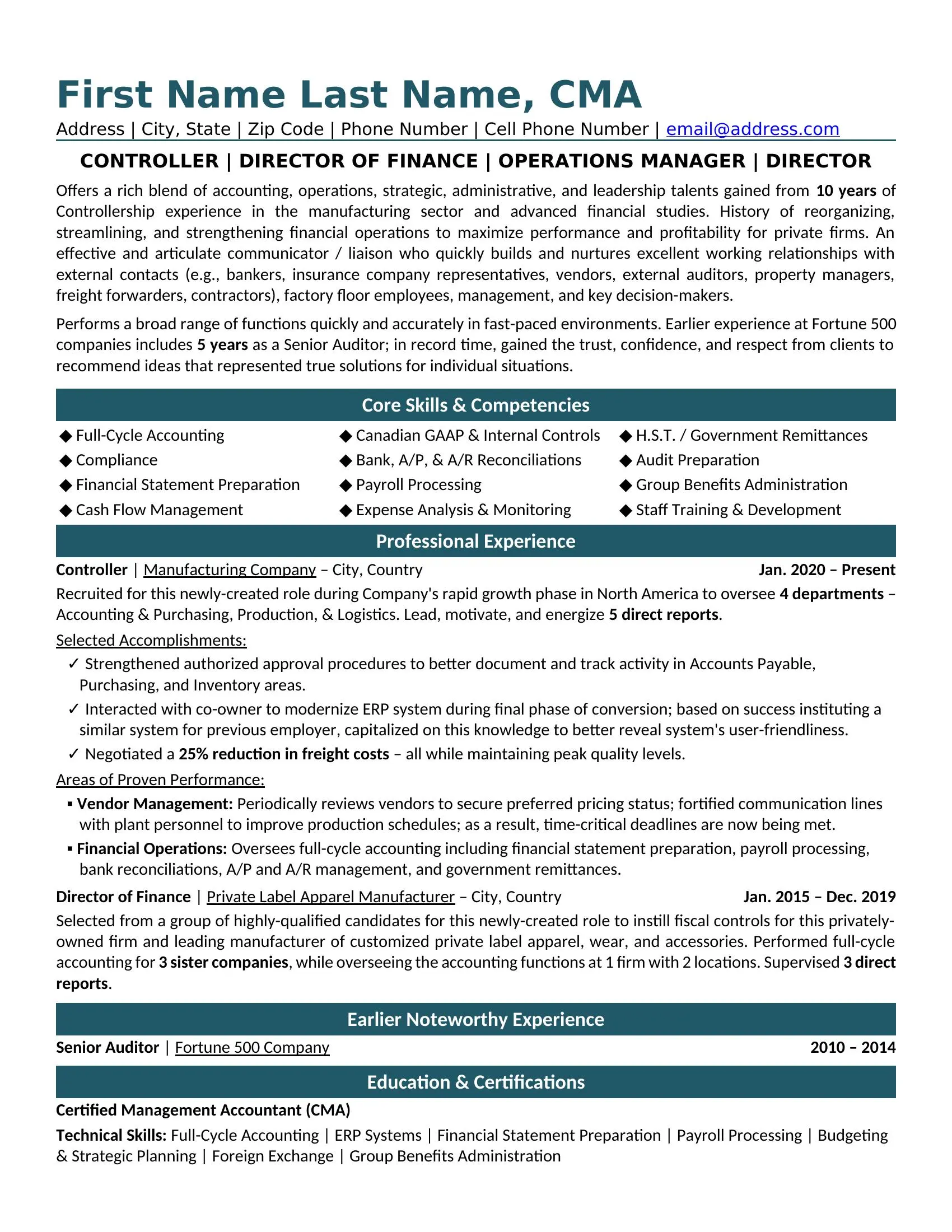

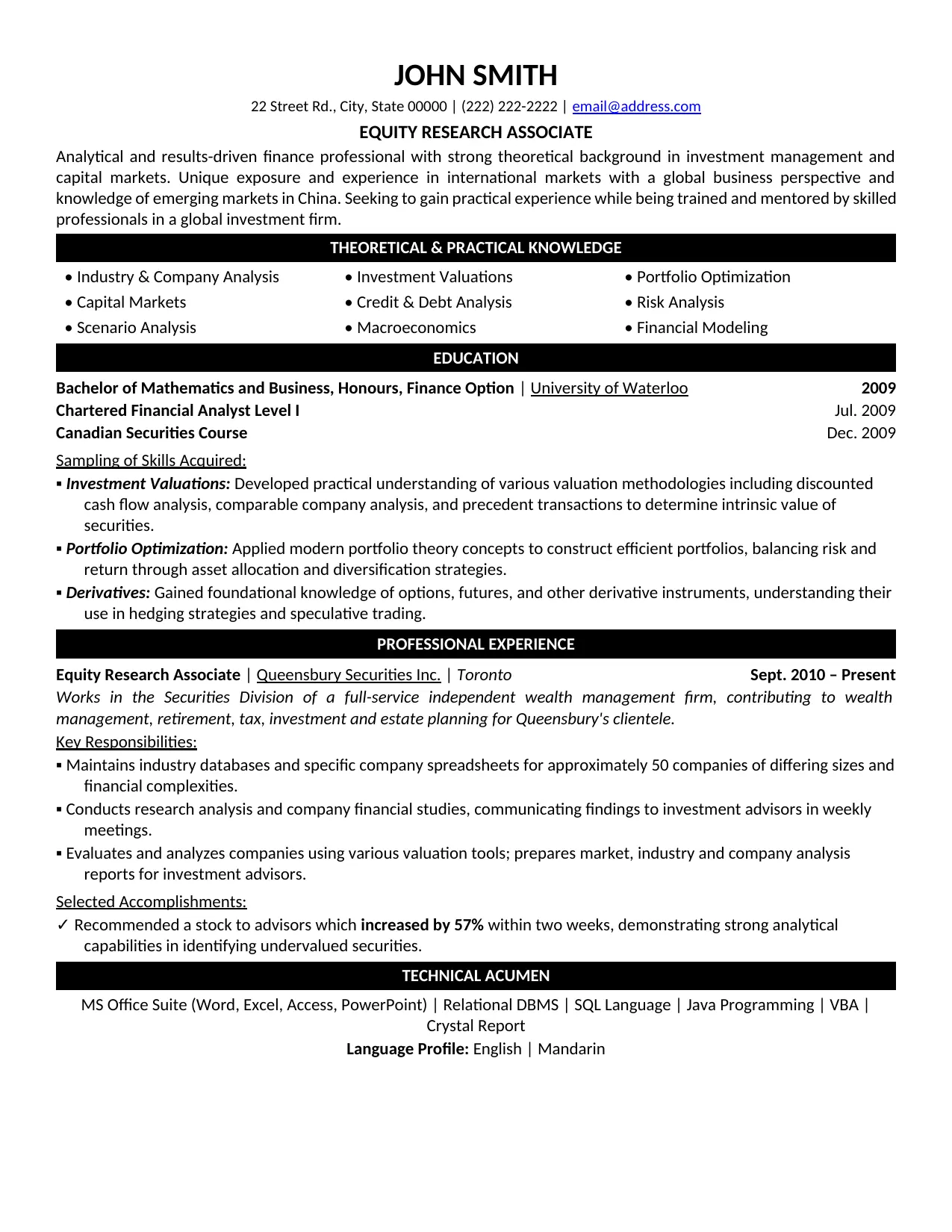

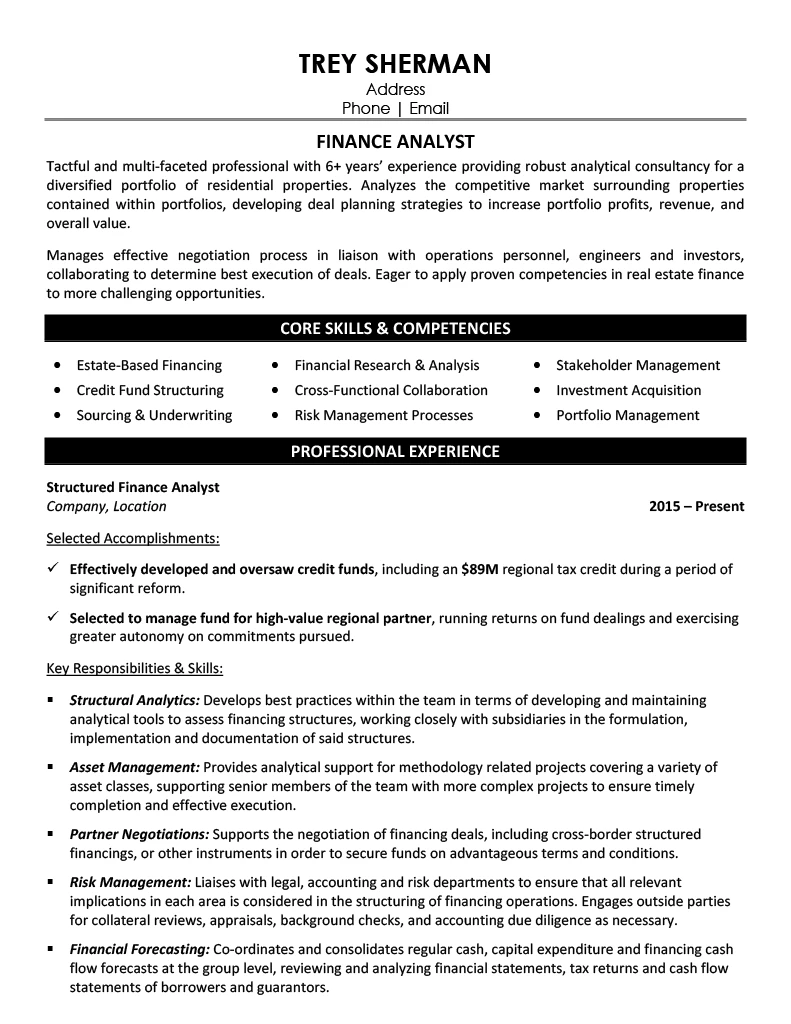

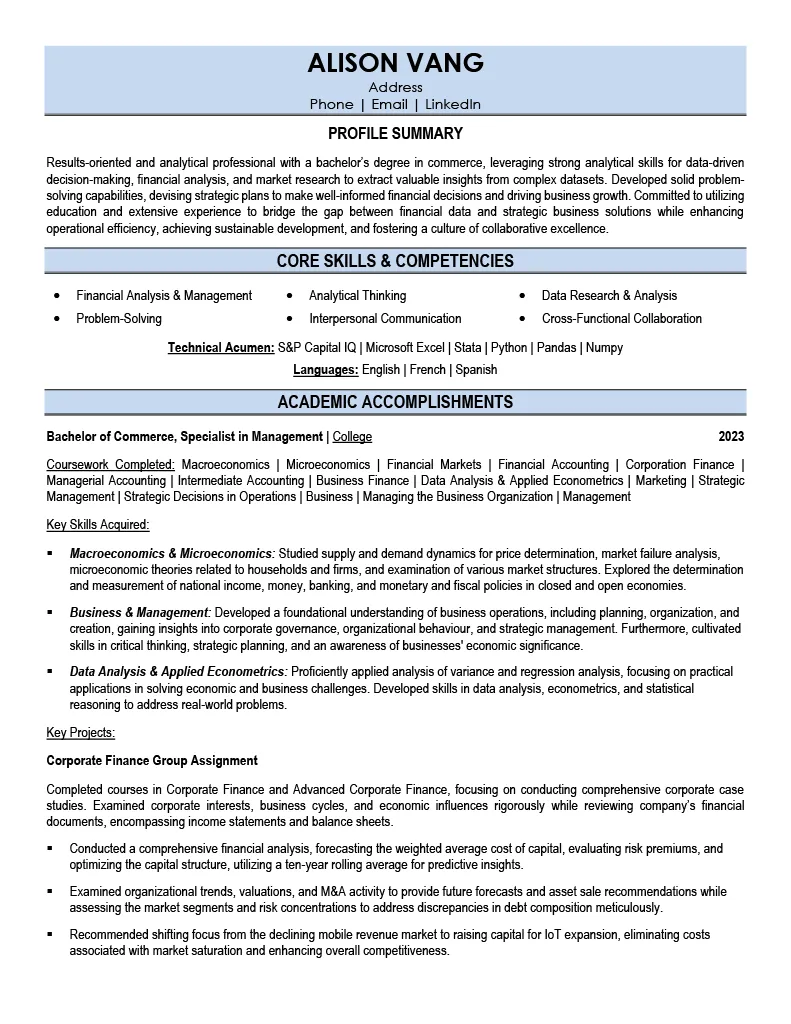

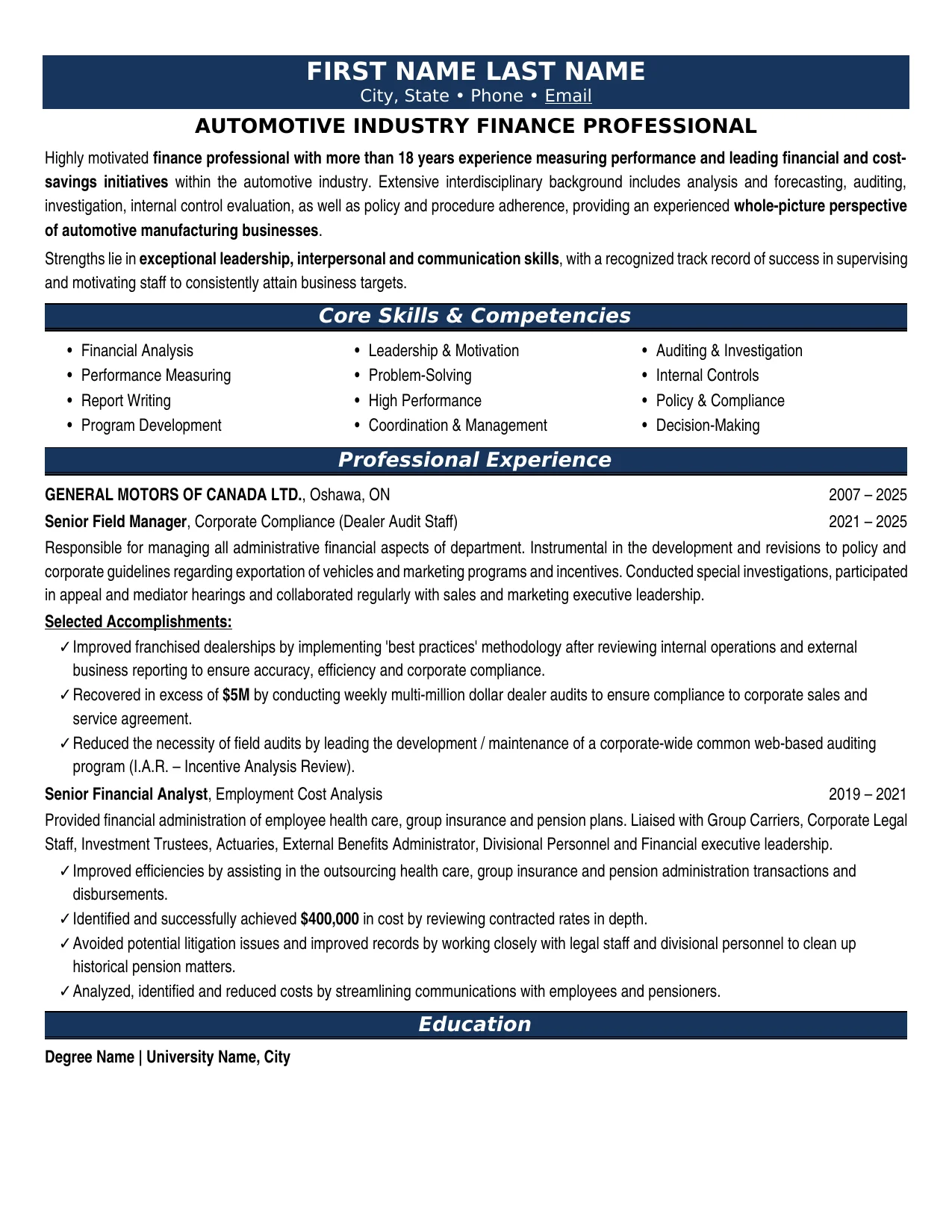

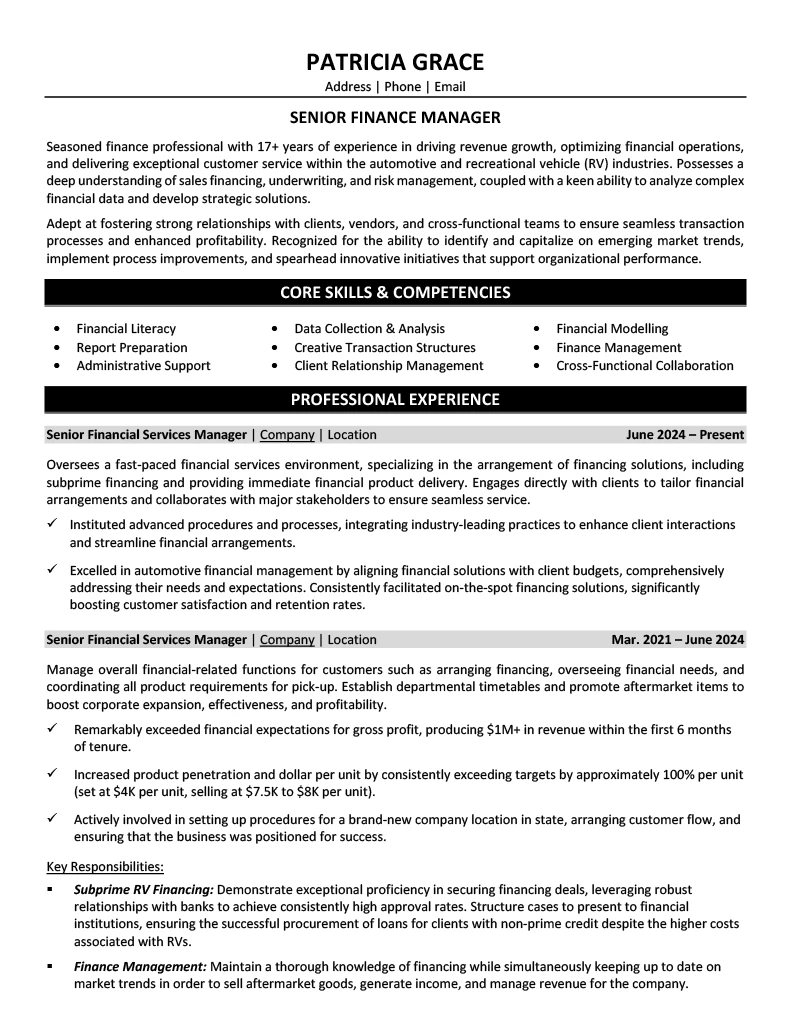

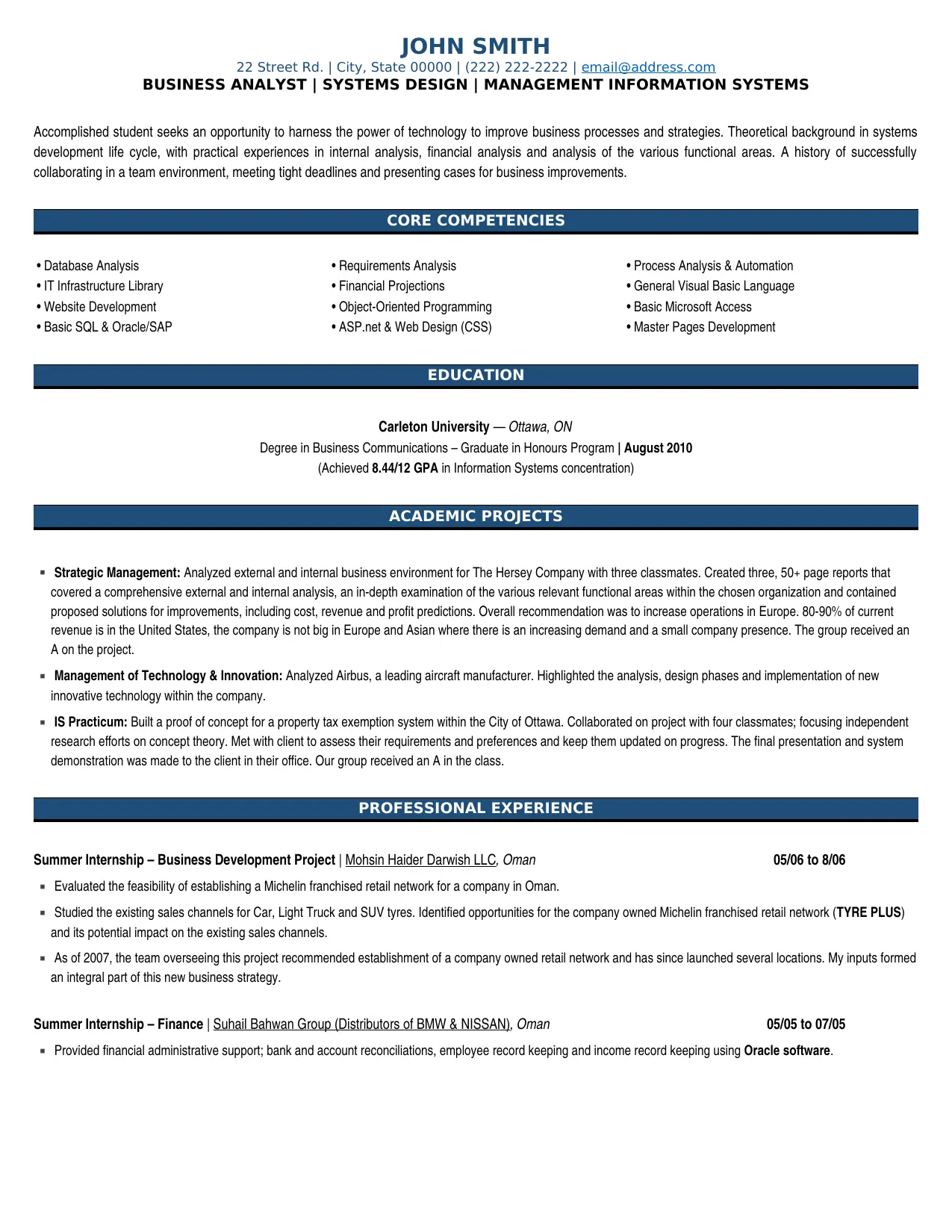

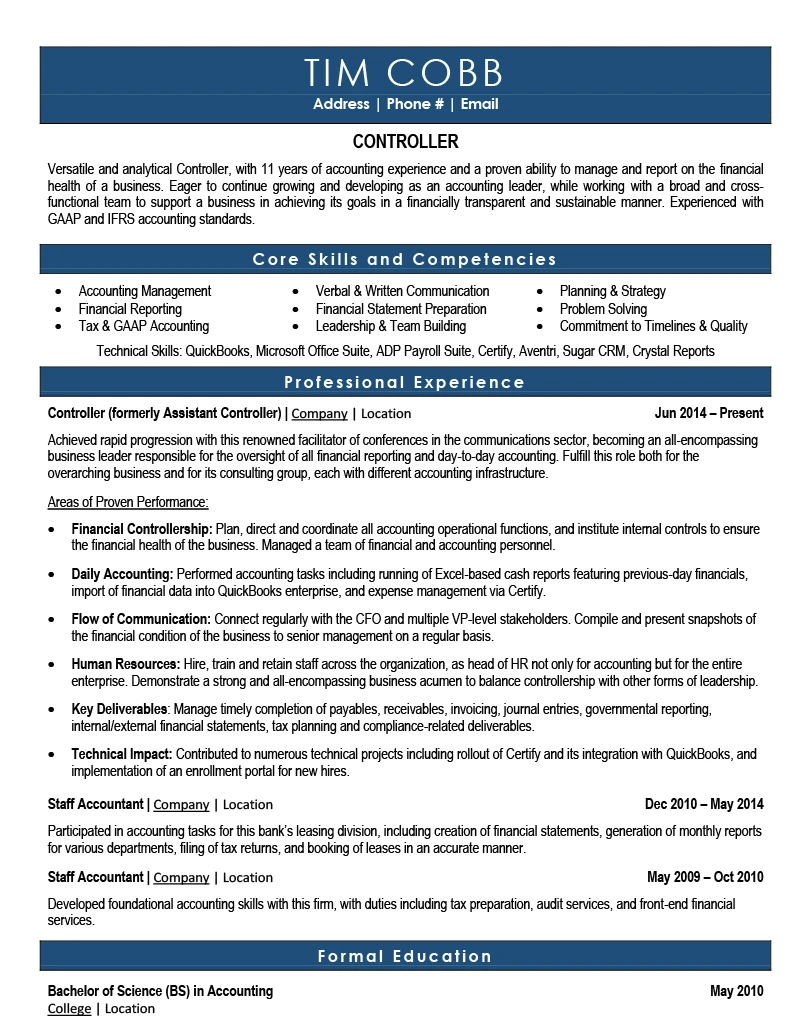

"Walk me through the largest deal you closed last quarter..."30+ Finance Resume Examples

In Finance, you're competing with 1,000 applicants per search

You're Not Rejected.

— You're Overlooked —

We fix your finance resume with one conversation

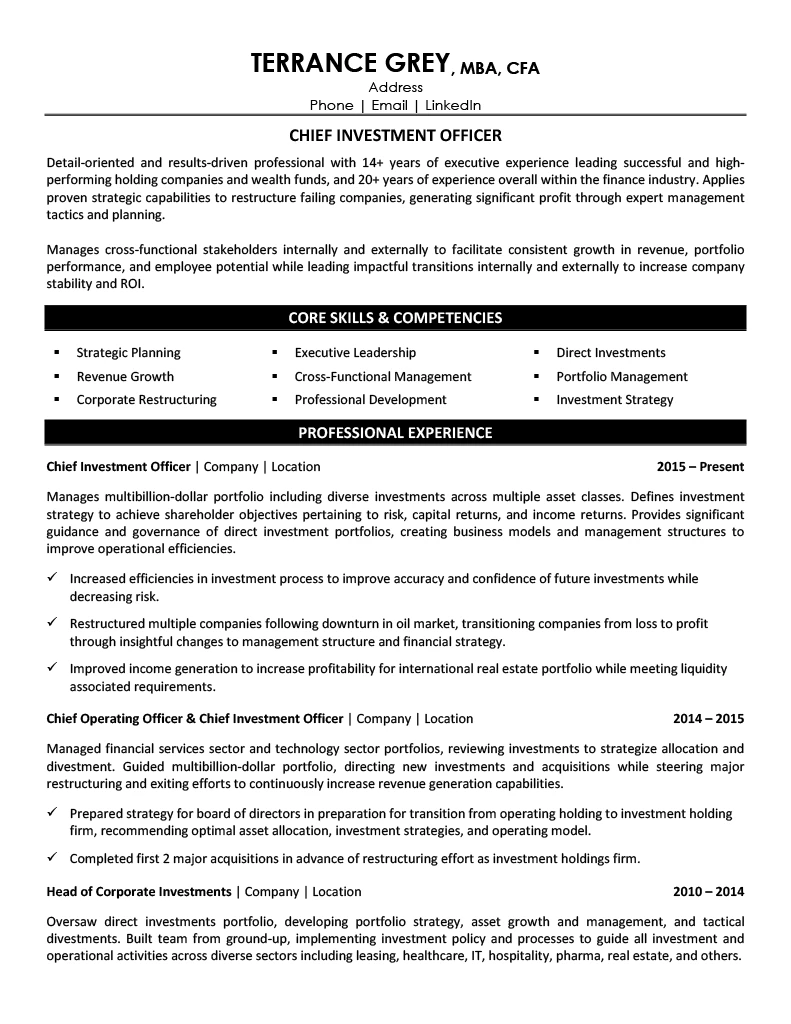

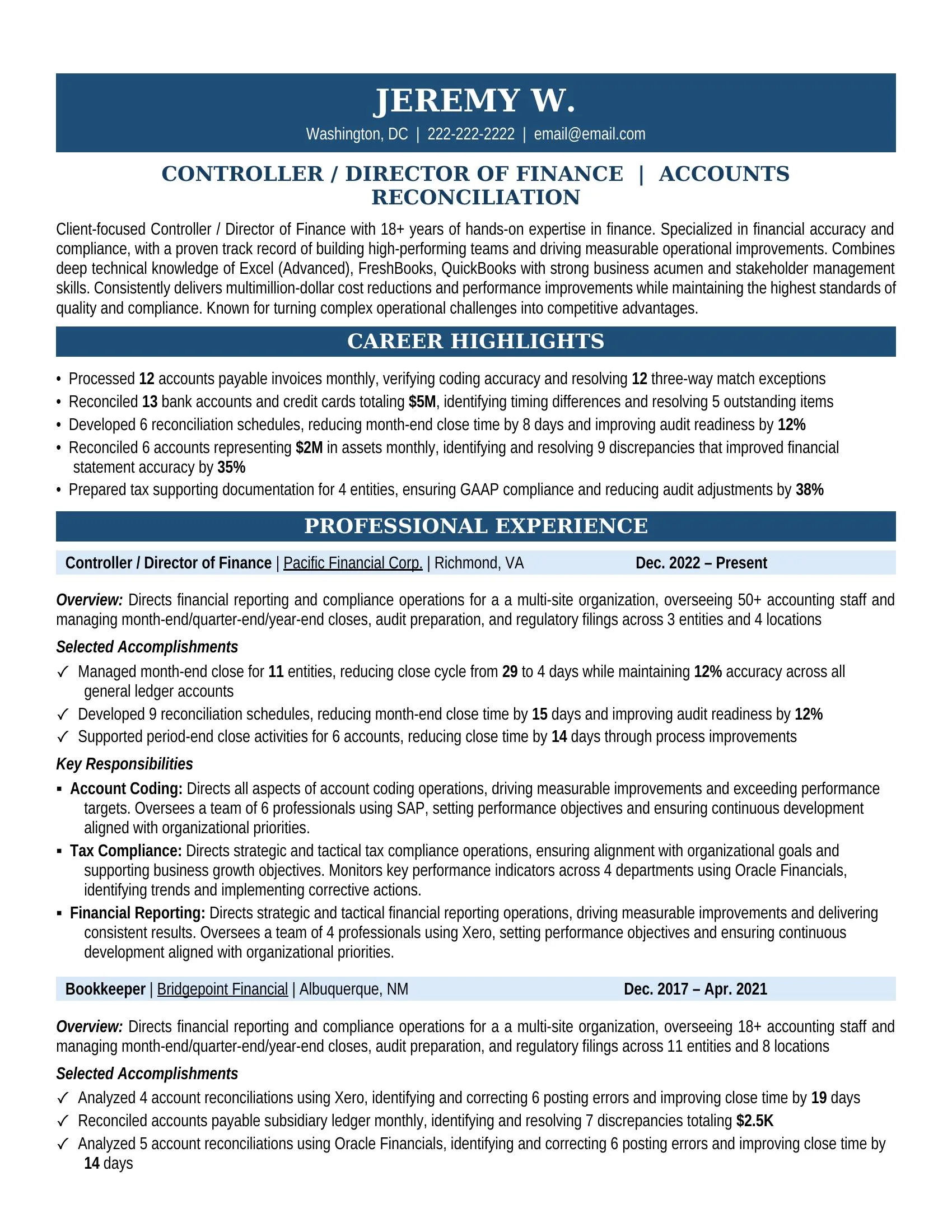

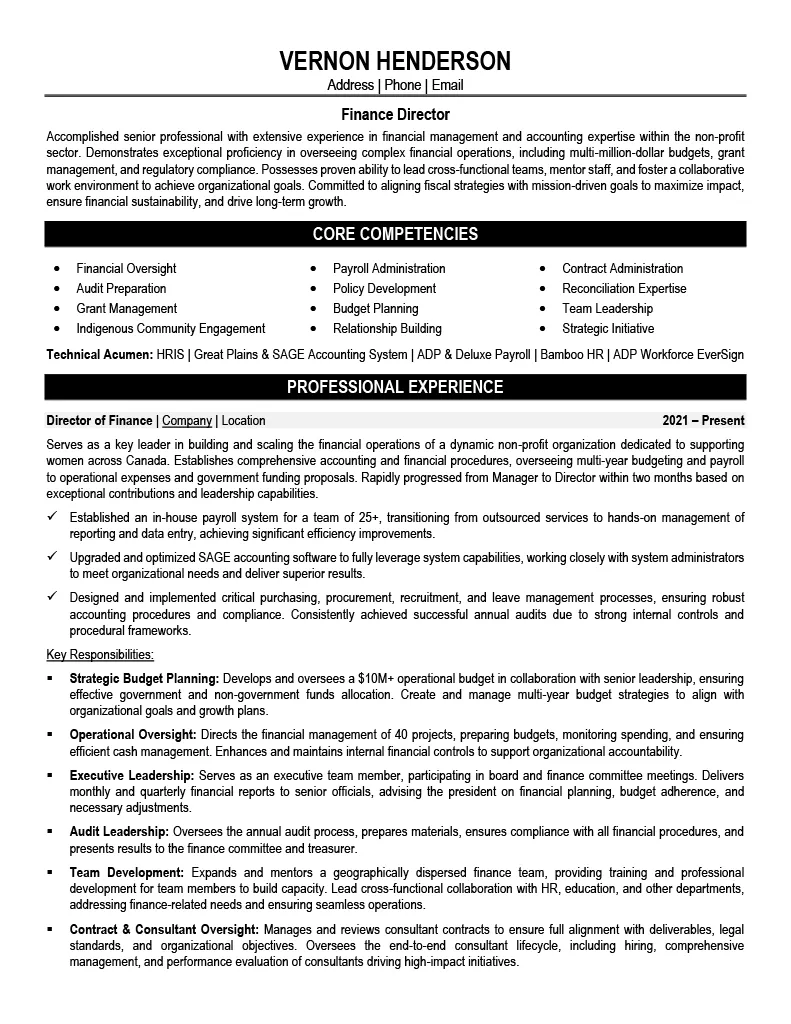

The strongest finance resumes lead with deal value, portfolio returns, and P&L impact — not responsibility descriptions or credential lists. Hiring managers at firms like Goldman Sachs, JPMorgan, and BlackRock scan for AUM scale, transaction size, returns versus benchmark, and proof that your financial work created measurable enterprise value. Every resume sample on this page was built through a 1-on-1 interview that extracted the specific deal outcomes and portfolio metrics that differentiate candidates in a field averaging 1,000 competitors per job search.

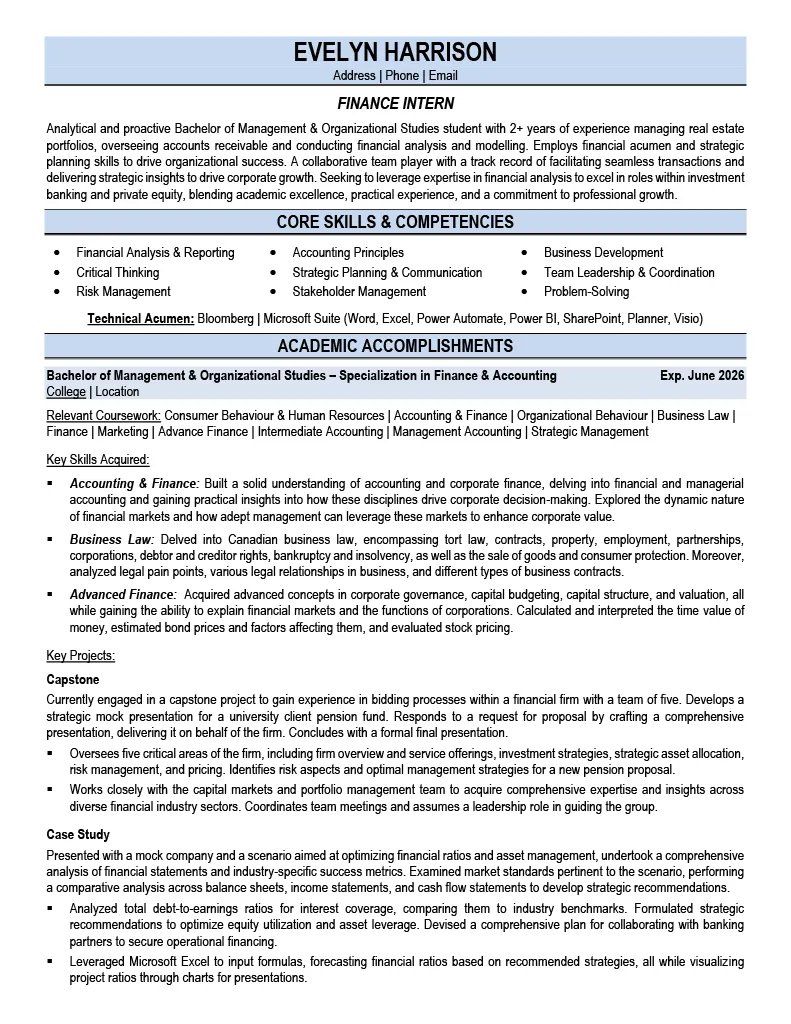

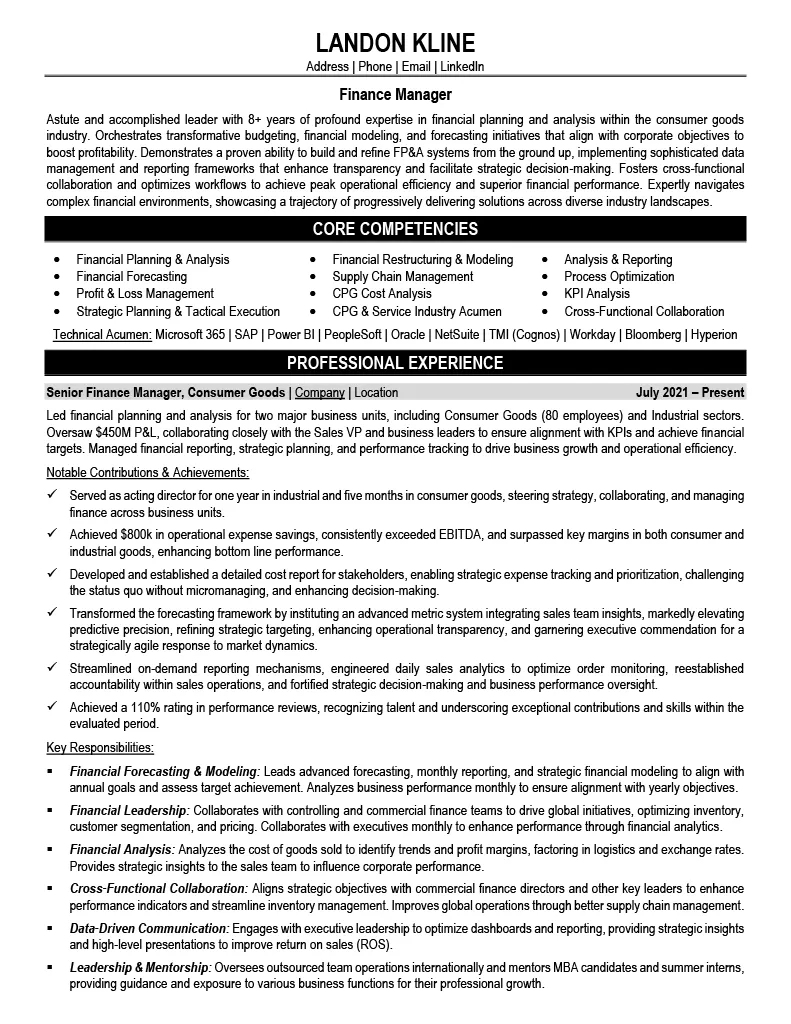

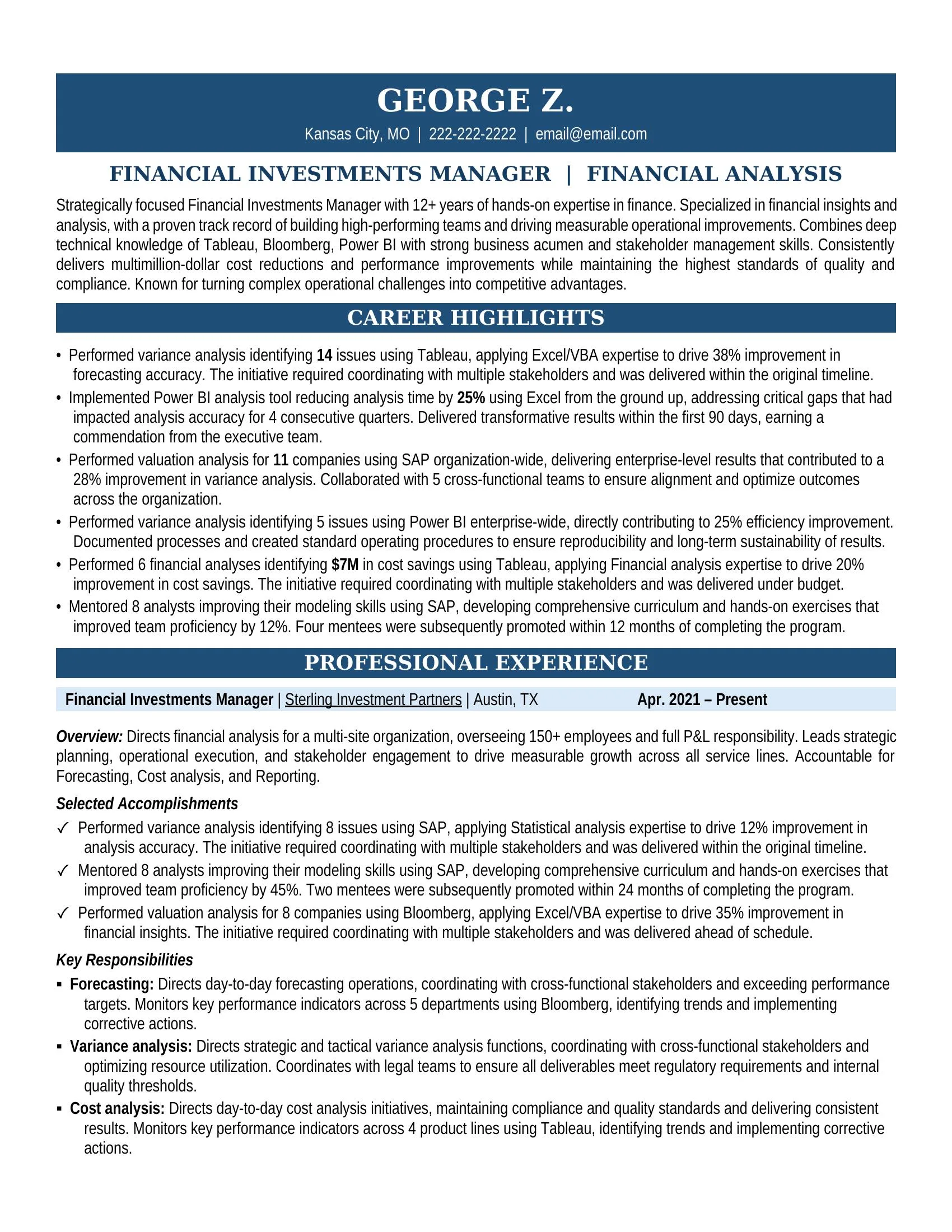

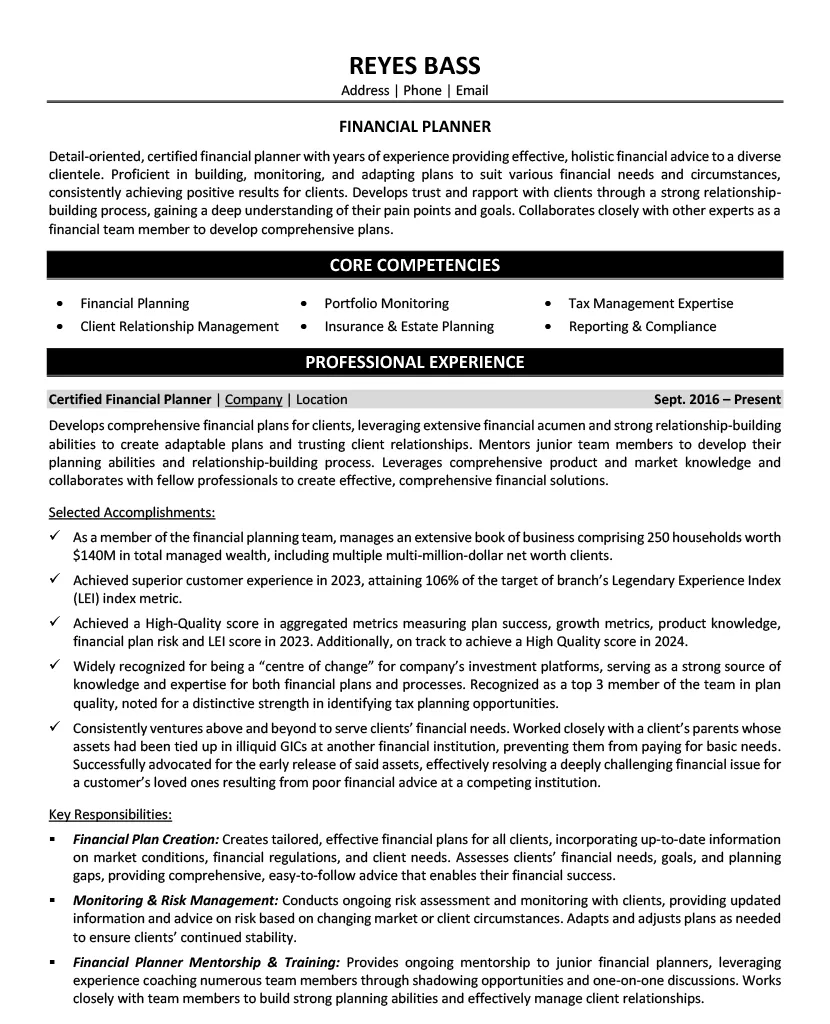

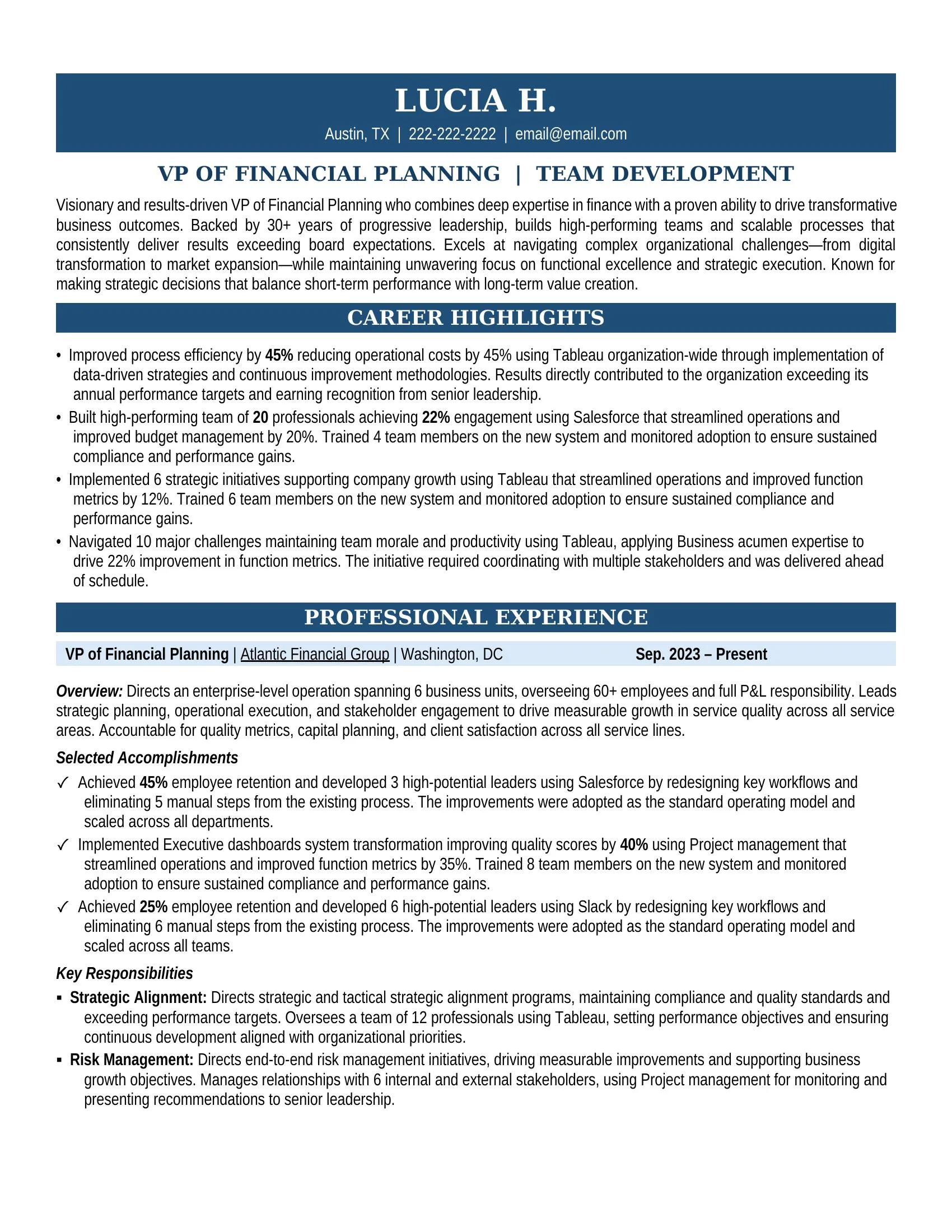

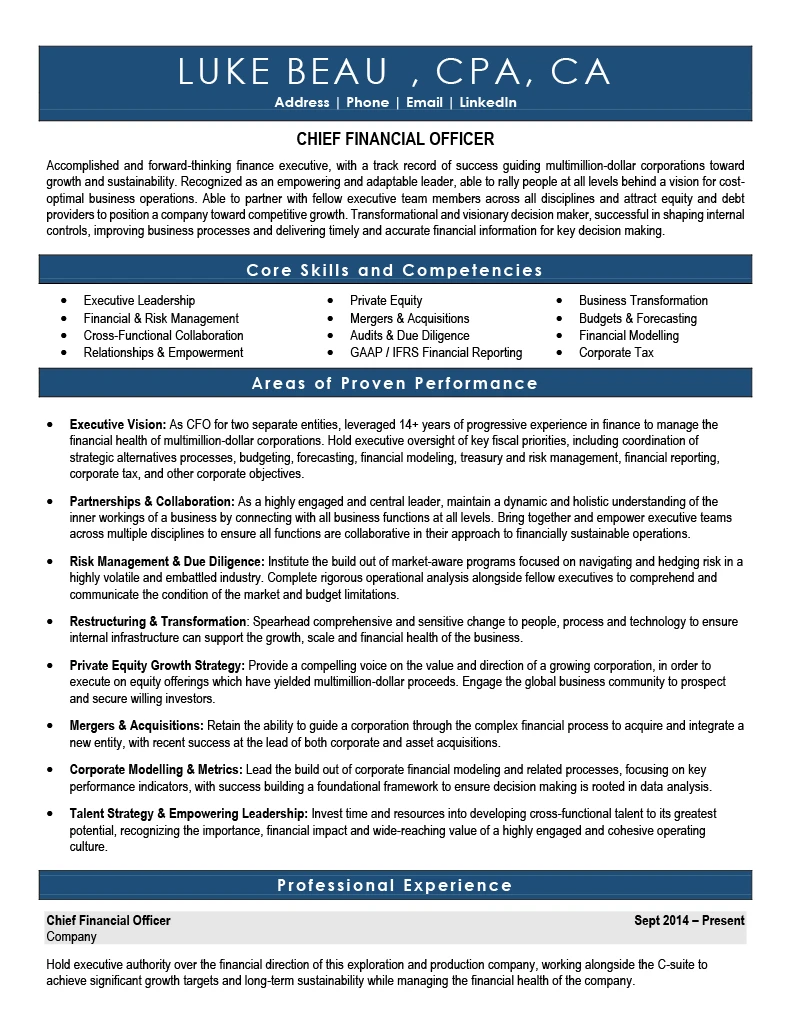

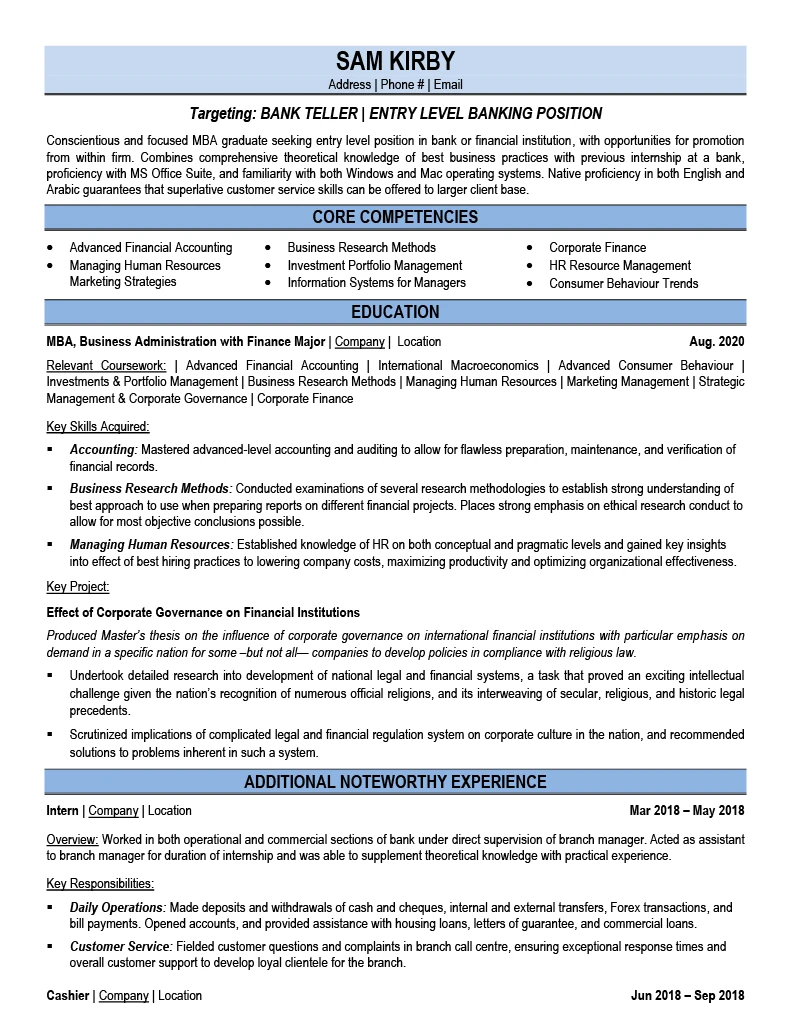

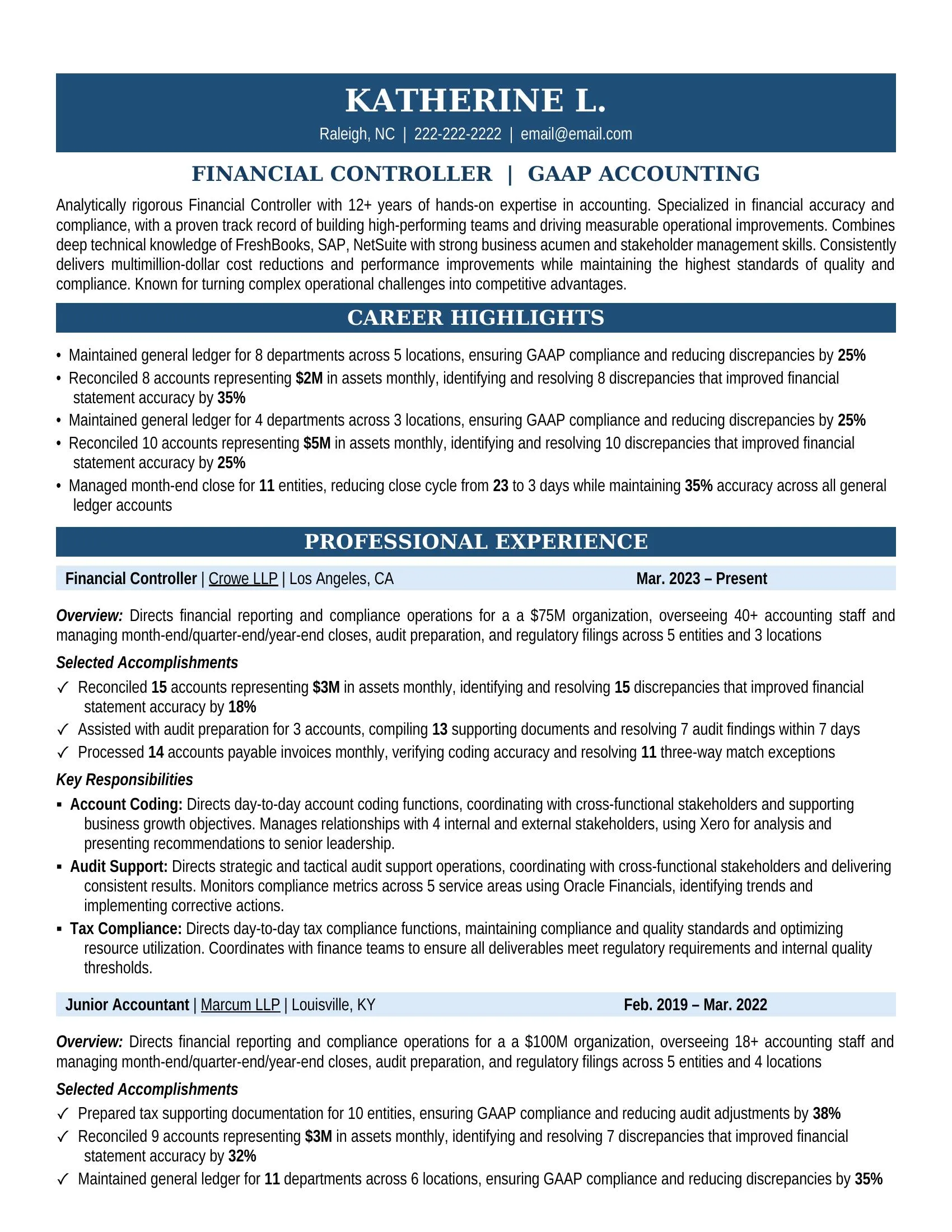

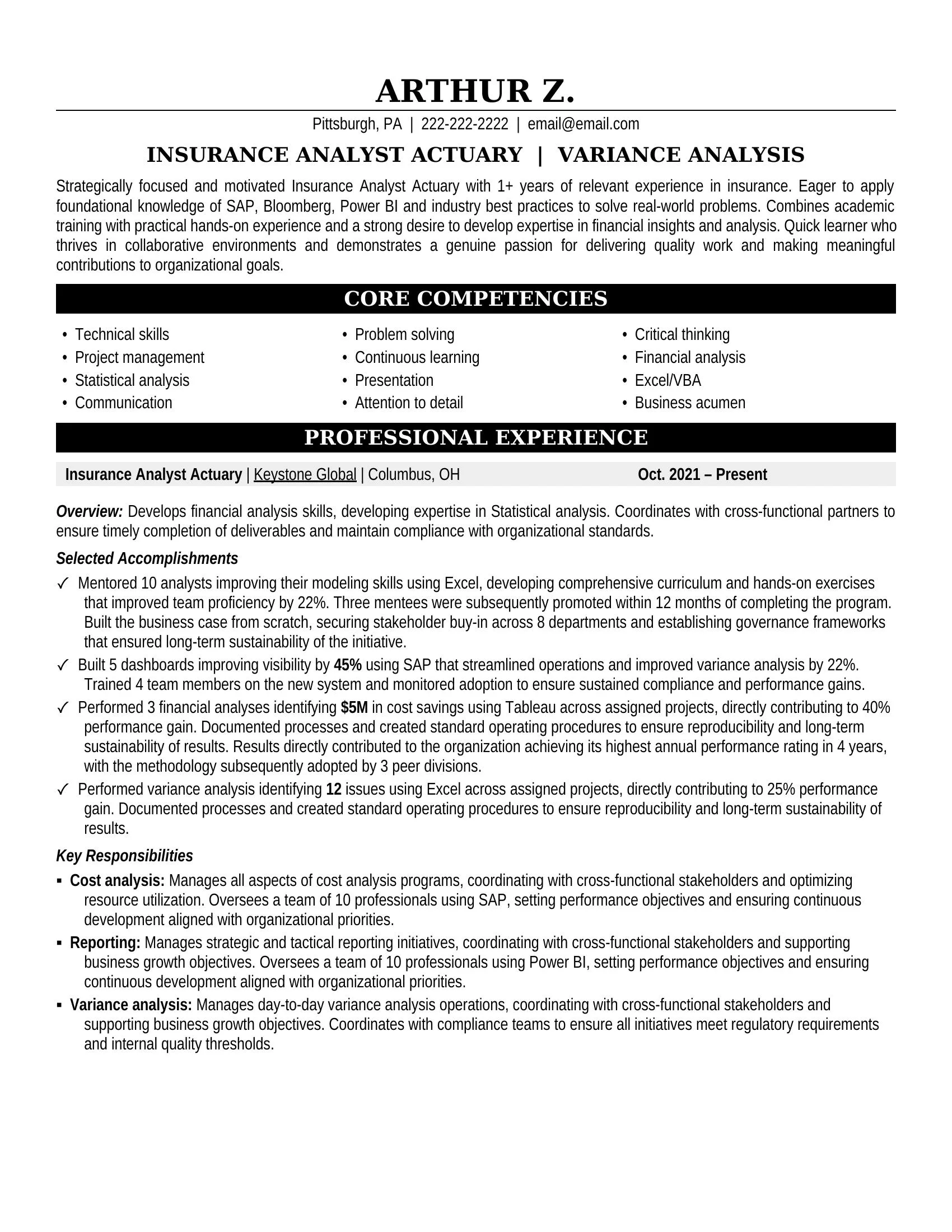

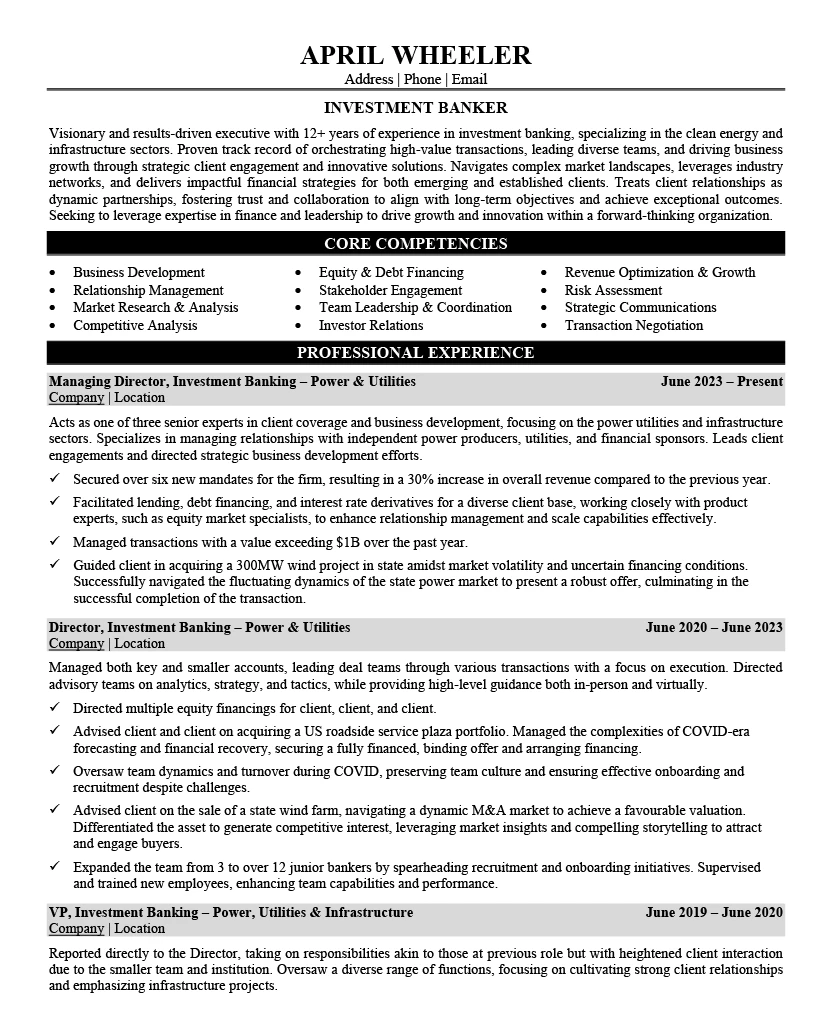

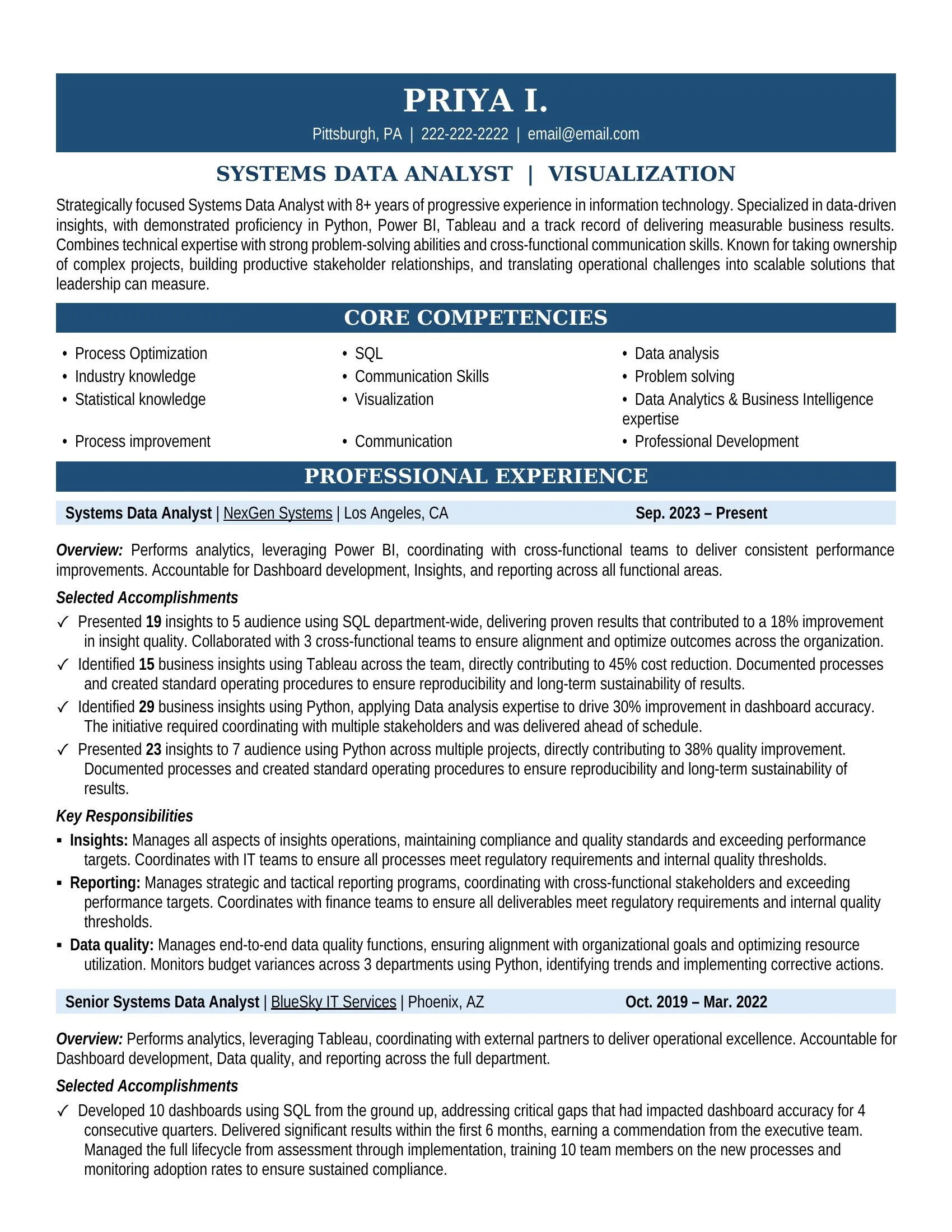

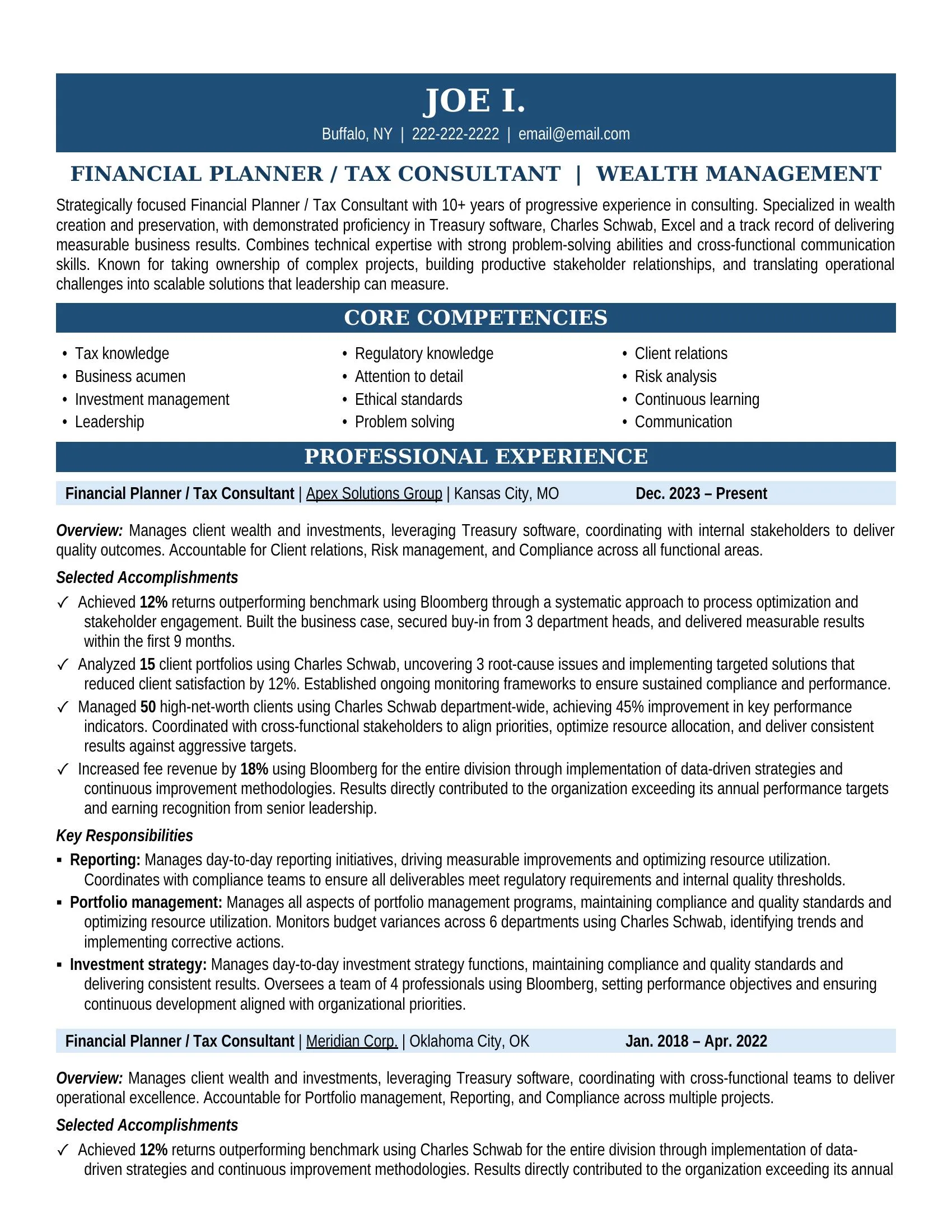

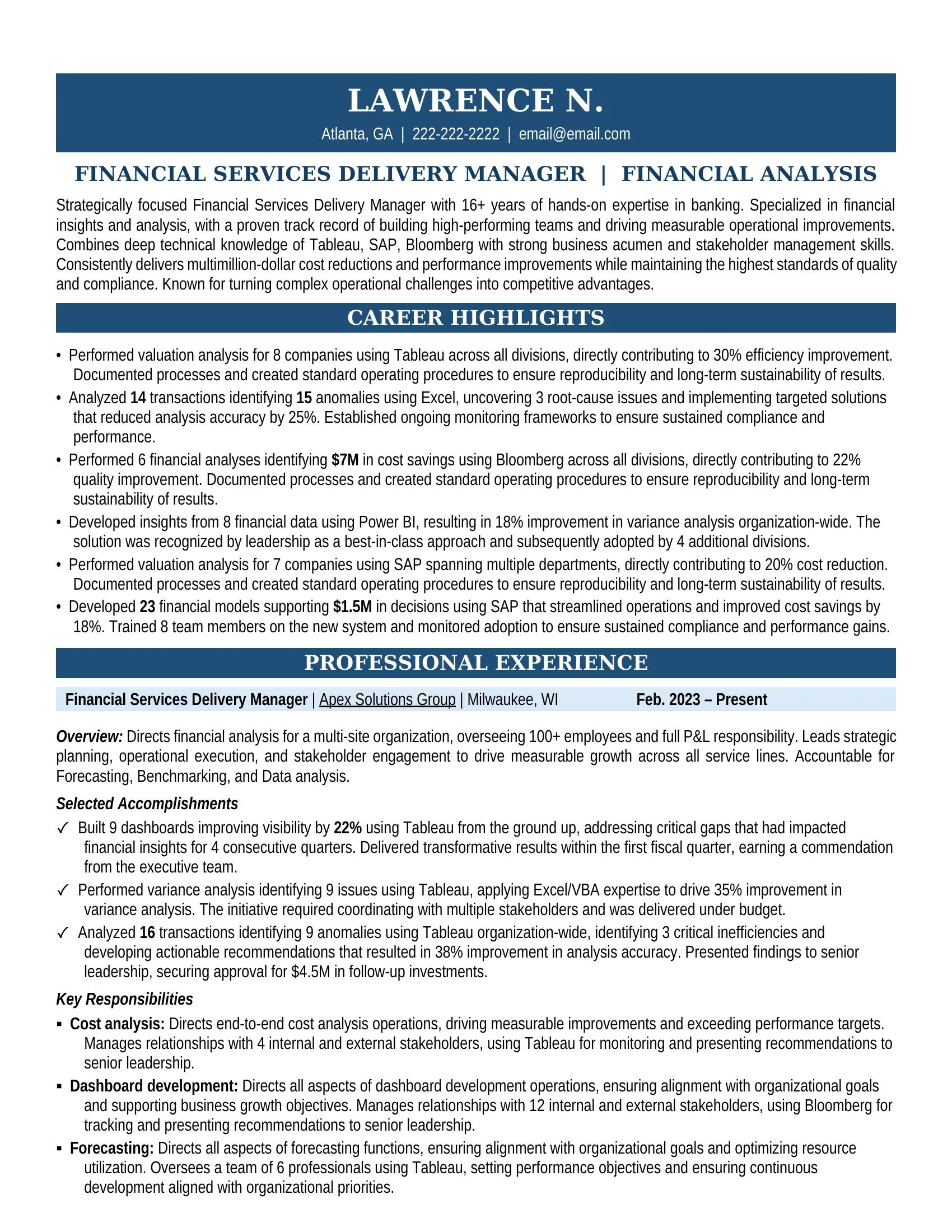

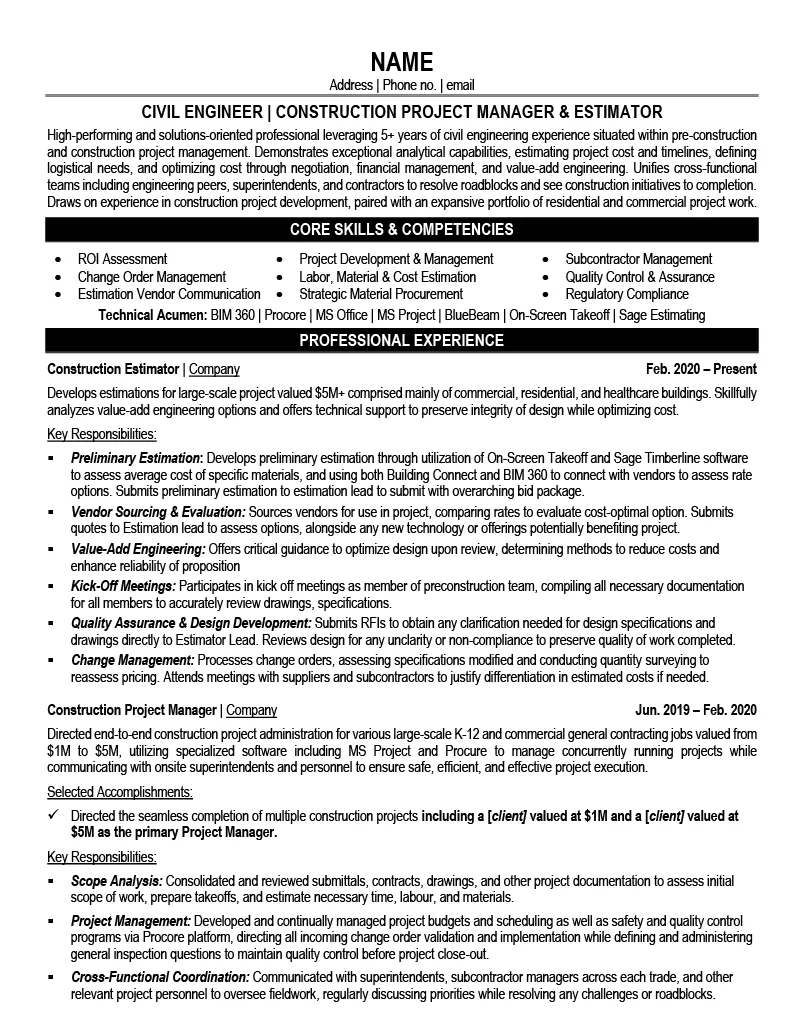

Each finance resume sample below was written through our 1-on-1 interview process. Click any finance resume example to see the full sample and learn how we transformed their experience into proof.

When a hiring manager reads your finance resume, they should think:

"This person has solved the exact problems we're facing."

What transactions have you worked on? We probe the deal size, your role, and the complexity.

"Walk me through the largest deal you closed last quarter..."What were the revenue targets? The cost savings? We connect your analysis to business outcomes.

"What was the dollar impact of your recommendations?"What financial models did you build? What tools and methodologies? This is where your expertise becomes visible.

"Tell me about the most complex model you've built..."What teams did you manage? What process improvements did you implement to drive efficiency?

"How did you improve the close process or reporting cycle?"See how our interview process uncovered achievements and turned them into interview-winning proof.

Get Your Finance Resume Written

Finance jobs average 50 applicants per position. You're competing against 1,000 candidates. Our finance resume examples show how to stand out.

Data based on LinkedIn job postings. Updated Mar 4, 2026.

Here's the math most job seekers don't do:

Your finance resume must stand out against 1,000 professionals.

What makes you different is the story behind the projects.

Get Your Finance Resume WrittenFinance Professionals Using Our Resume Templates Work At

Every finance resume example on this page was written through our 1-on-1 interview process. We extract achievements you'd never think to include.

We identify keywords and achievements that get finance resumes noticed.

Targeted questions about your finance projects and results.

Transform responsibilities into quantified achievements.

ATS-optimized resume in 3 business days + 14-day revisions.

80% of finance positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

When you purchase our Resume Distribution service, your resume goes to 450+ recruiters specializing in finance — included in Advanced & Ultimate packages.

| Agency | Location |

|---|---|

|

MI

Michael Page Finance

Banking & Finance

|

Los Angeles, CA |

|

MA

Mason Frank

FinTech

|

San Francisco, CA |

|

PH

Phaidon International

Investment Banking

|

Boston, MA |

|

HE

Heidrick & Struggles

Executive Search

|

Chicago, IL |

|

KO

Korn Ferry

Leadership

|

New York, NY |

Finance averages 50 applicants per position across 15,000 active job postings — one of the most competitive fields across all industries. Equity Research Associate positions draw 67 applicants per opening, Private Equity Analyst roles average 64, CIO positions see 58, Risk Manager roles draw 44, and Finance Manager positions average 40. Even at the senior level, VP of Financial Planning roles attract 19 highly credentialed applicants. Apply to 20 positions in a typical 30-day search and you're one of roughly 1,000 candidates competing. In finance, the resume that says "$250M capital investment secured and $421M company sale at 3.5x MOIC with 70%+ IRR" beats "led the company through growth" every time.

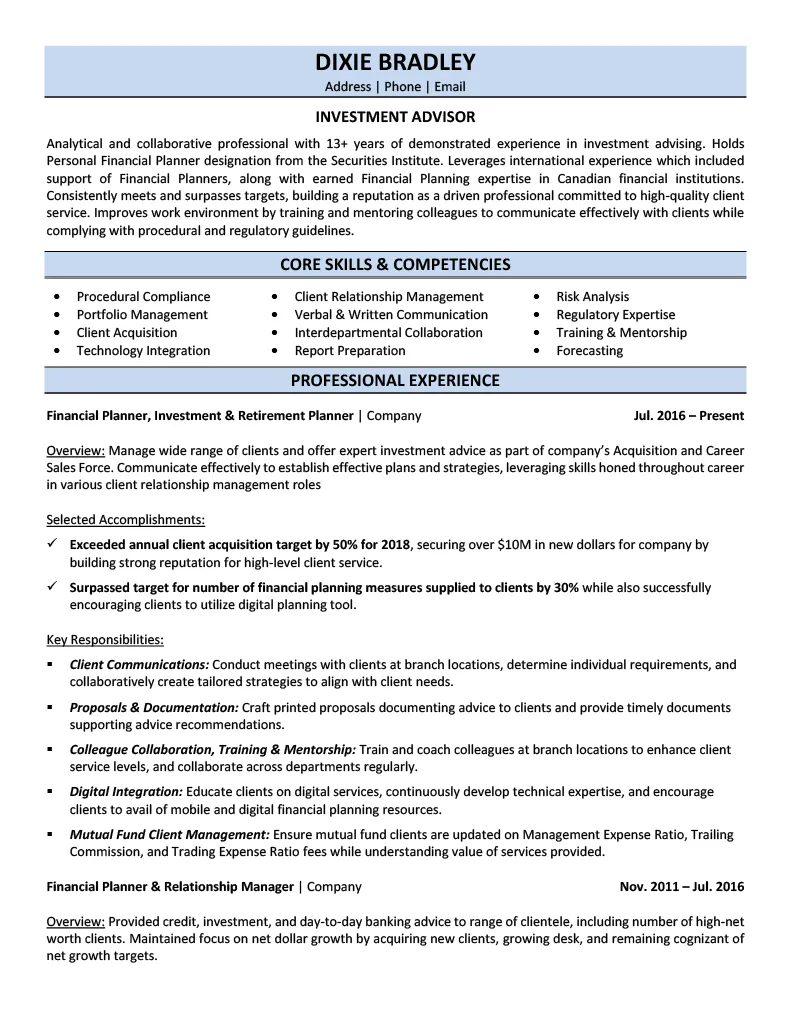

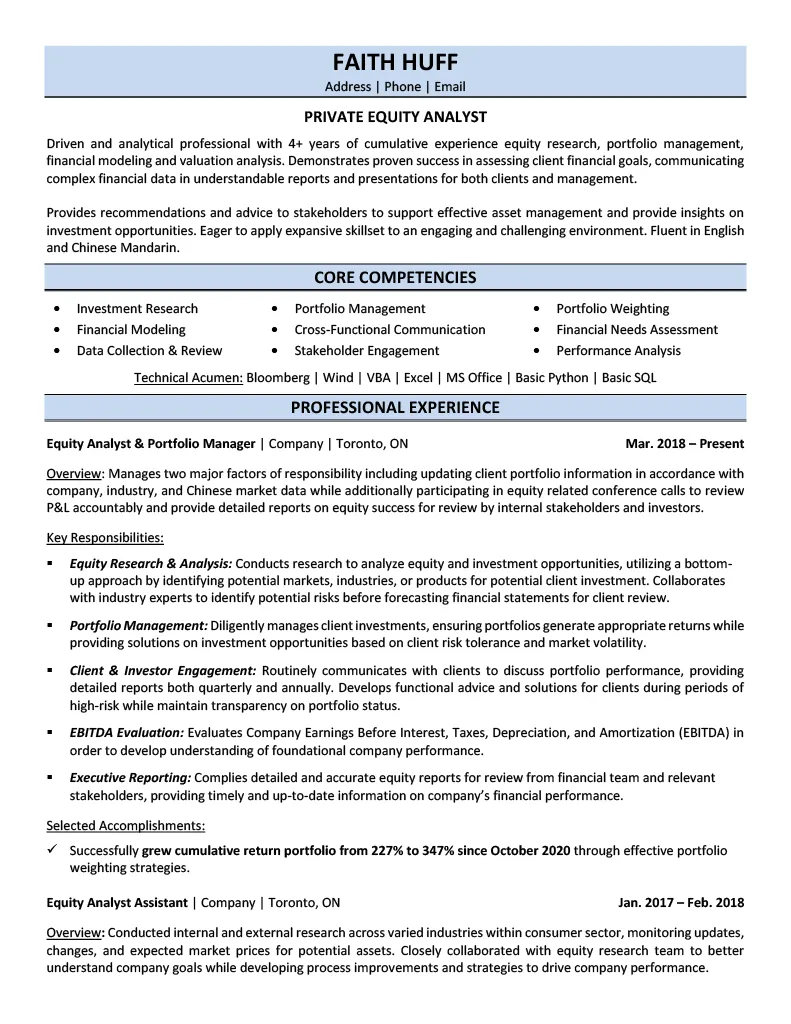

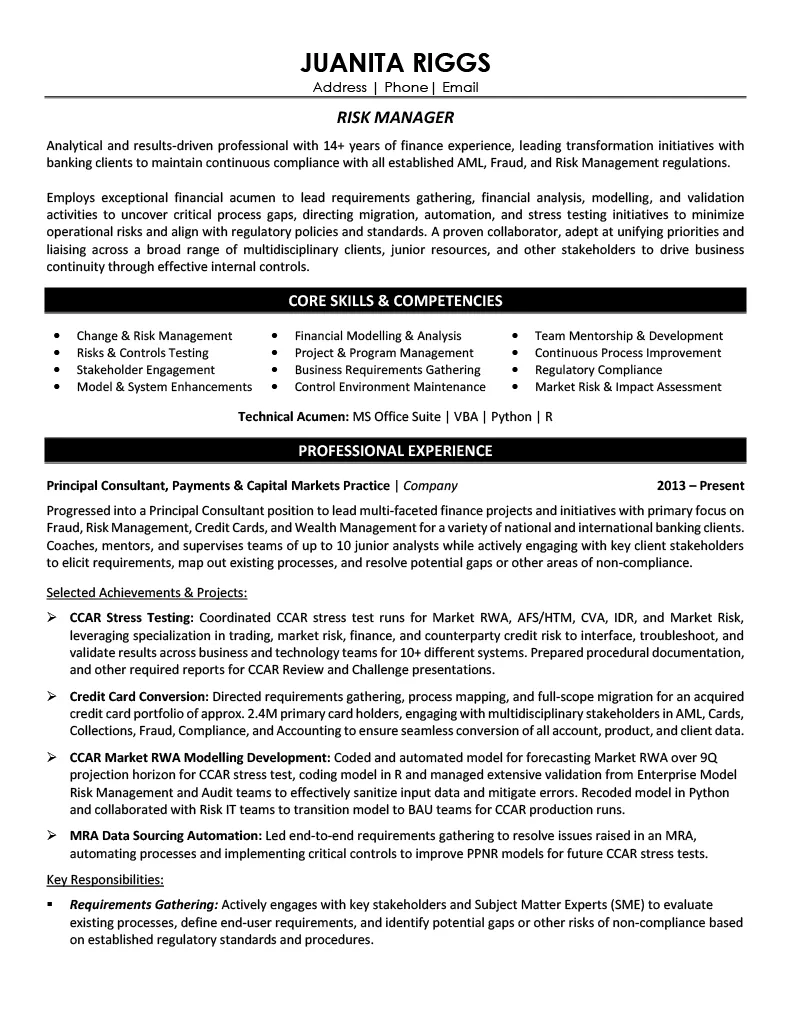

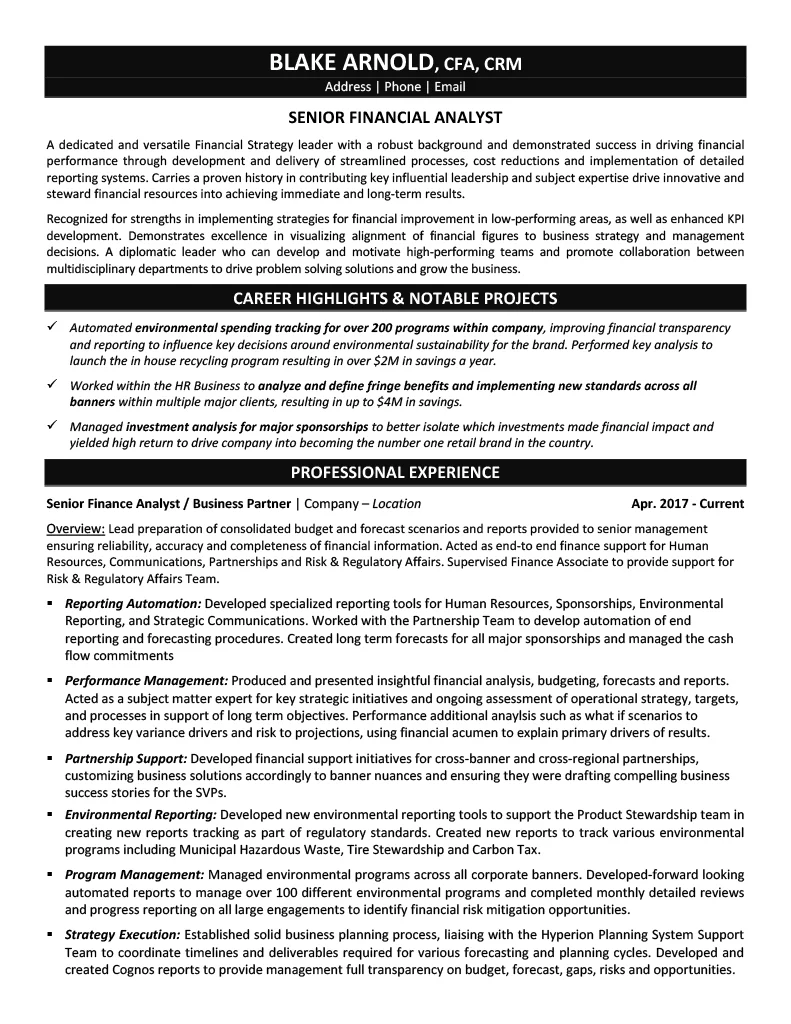

Because finance achievements are deal outcomes and portfolio metrics that questionnaires never capture. A Finance Executive who "led the company through growth" could describe any executive. Our interview uncovered one client who secured $250M in capital investment and executed a $421M company sale at 3.5x MOIC with 70%+ IRR, transforming multiple startups into profitable enterprises. A Private Equity Analyst who was an "equity analyst and portfolio manager" becomes someone who grew cumulative return from 227% to 347% through portfolio weighting strategies, with CFA Level II candidacy and Bloomberg/VBA/Python proficiency. Our Finance Manager sample revealed $450M P&L oversight across two business units, $800K operational savings with 110% performance rating, and FP&A consulting that grew revenue from $2M to $10M ARR. A questionnaire reduces all three to "finance professional with analytical skills." The interview captures the deal size, the returns, and the P&L scope.

They're screening for quantified financial impact — not years of experience or credential inventories. For Investment and Portfolio roles: AUM scale (our VP Financial Planning grew assets from $3.9B to $5.0B overseeing 223 planners across 4 provinces), returns versus benchmark, and deal execution. For Private Equity and Research: portfolio returns (227% to 347% cumulative), stock recommendation outcomes (57% increase), and CFA progression. For Corporate Finance and FP&A: P&L scope ($450M), operational savings ($800K), forecast accuracy, and close cycle improvement. For Risk and Compliance: portfolio migration scale (2.4M accounts), stress testing scope (CCAR across 10+ systems), and regulatory outcomes. For Wealth Management: book size ($140M/250 households for our Financial Planner), client acquisition (50% over target/$10M+ new for our Investment Advisor), and client experience metrics (106% LEI). ATS systems at Goldman Sachs, JPMorgan, and BlackRock keyword-scan for certifications (CFA, CFP, CIM, Series 7/63/66) and platforms (Bloomberg, FactSet, SAP) before a human reviews your resume.

It matters fundamentally — these are different professions with completely different proof points. Investment management measures AUM growth, returns versus benchmark, and team oversight — our VP Financial Planning sample shows $3.9B to $5.0B across 223 planners. Corporate finance and FP&A measures P&L scope, operational savings, and strategic growth — our Finance Manager shows $450M P&L with $2M to $10M ARR consulting growth. Private equity and research measures portfolio returns and analytical output — our PE Analyst grew returns from 227% to 347% and our Equity Research sample delivered a 57% stock increase recommendation. Risk management measures portfolio migration scope and stress testing capability — our Risk Manager sample shows 2.4M account migration with CCAR across 10+ systems. Wealth management measures book growth and client acquisition — our Investment Advisor exceeded targets by 50%/$10M+ and achieved 888% desk growth. During your interview, our writers identify your finance specialty and extract the deal metrics that matter.

Our finance resume packages are based on career level and interview depth — from a 30-minute early career session to a 90-minute executive interview. When evaluating price, consider what the number actually buys. A company charging $99: after the company takes its margin, the writer earns $40-60 — enough for about 45 minutes of total work including writing. That's a questionnaire reformat that produces "performed financial analysis and managed portfolios." Our Professional-level interview alone is 60 minutes, followed by job posting analysis, drafting, and revisions — producing "$450M P&L oversight, $800K operational savings, 110% performance rating, and FP&A consulting that grew revenue from $2M to $10M ARR." View current packages and pricing.

We offer a 90-Day Interview Guarantee. If you don't land interviews within 90 days of receiving your final finance resume, we rewrite it free of charge. We can make this guarantee because our interview-based process produces resumes built on the deal metrics, portfolio returns, and P&L outcomes that finance hiring managers respond to. Browse the resume samples on this page to see the quality of work we deliver.