Numbers tell stories, but most Financial Planner resumes fail to tell the right one. Your success in growing client wealth deserves better than a bland list of certifications and responsibilities.

Are you struggling to showcase the real value you bring to your clients' financial futures? A strategically crafted resume can transform your career trajectory by highlighting both your technical expertise and your ability to build lasting client relationships.

Resume Target specializes in helping Financial Planners translate complex achievements into compelling career stories. We'll help you create a resume that speaks directly to employers' needs while showcasing your track record of successful wealth management and client satisfaction.

As your financial GPS, a Financial Planner guides you through life's money milestones, using their expertise to help you navigate everything from buying your first home to planning for retirement, while operating under a fiduciary standard that legally requires them to put your interests first.

These money-savvy professionals analyze your entire financial picture, creating customized roadmaps that incorporate investment strategies, tax planning, insurance needs, and retirement goals - all while adjusting your plan as life throws its inevitable curveballs.

Whether you're interested in becoming a Financial Planner yourself or working with one, understanding the career path reveals how these professionals evolve from number-crunching newcomers to trusted financial advisors who can handle complex wealth management strategies and help clients achieve their dreams.

Let's talk about what's exciting in the financial planning field - your earning potential can grow substantially as you gain experience and expertise! From entry-level positions to executive roles, this career path offers impressive income opportunities that reward your professional development and client relationship skills.

Figures from: Vintti Financial Planning

Starting as a junior advisor, you can build your career in financial planning over 2-3 years. With experience, you can either launch your own firm or work your way up to partner status at established companies.

To excel beyond basic financial planning, you'll need to master both technical expertise and people skills that set top performers apart.

- Investment Analysis and Portfolio Management - Tax Strategy and Estate Planning - Risk Assessment and Insurance Planning - Client Relationship Management and CommunicationBreaking into financial planning starts with entry-level positions at financial services firms, where you'll learn the fundamentals while working alongside experienced advisors and building client relationship skills.

To advance in your financial planning career, you'll need to develop both technical expertise and strong communication skills, which are consistently ranked among the most crucial capabilities for success in this field.

Requirements from Investopedia

From Wall Street to Main Street, financial planning careers thrive in both major financial hubs and growing markets.

Figures from U.S. Bureau of Labor Statistics

Struggling to showcase your ability to manage client portfolios and financial strategies in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you create a professional financial planner resume that highlights your achievements, certifications, and client success stories.

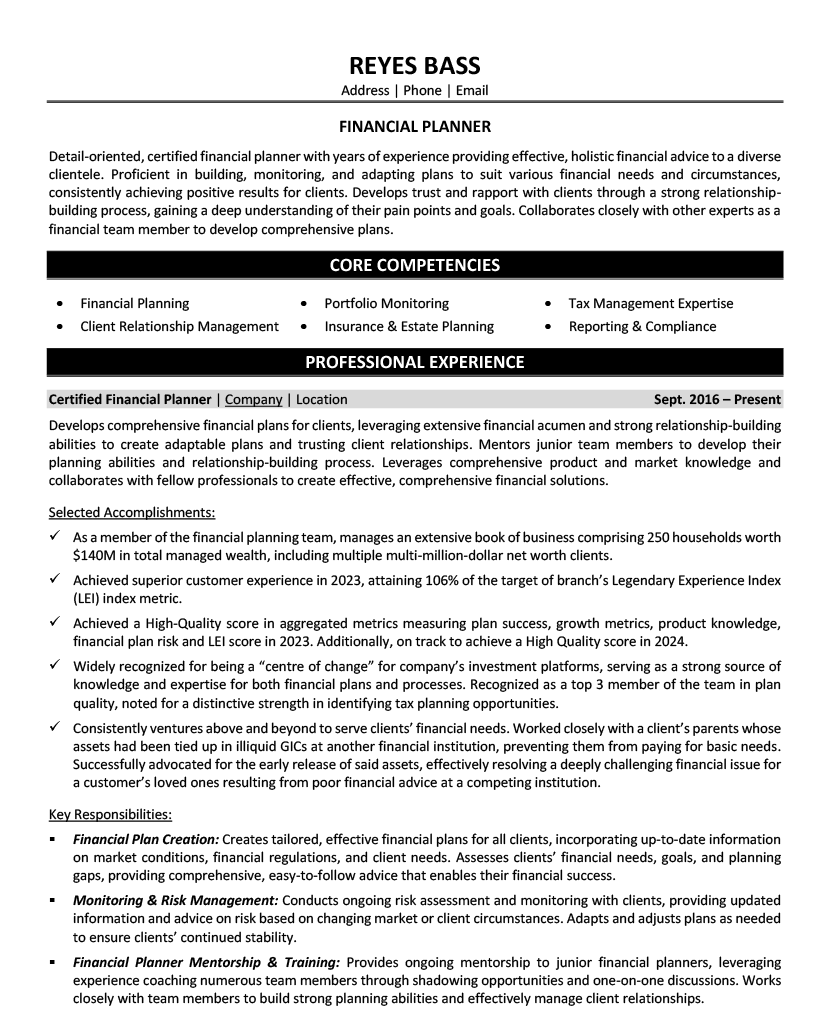

Just like helping clients map out their financial futures, crafting the perfect resume summary can feel overwhelming when you're staring at a blank page trying to condense years of experience into a few powerful lines.

While you excel at analyzing market trends and creating comprehensive financial strategies for clients, translating your wealth management expertise and client relationship skills into a compelling summary requires a different approach that immediately shows hiring managers your value proposition.

How would you describe your overall approach to financial planning and the types of clients you're most successful in helping (such as high-net-worth individuals, retirees, or young professionals)?

Reason: This helps establish your professional identity and target market immediately, allowing potential employers to quickly assess if you align with their client base and service philosophy.

What combination of financial certifications, specializations, and market knowledge best represents your professional toolkit as a Financial Planner?

Reason: Leading with your professional credentials and areas of expertise helps establish credibility and demonstrates your commitment to the profession while highlighting your unique value proposition.

How would you characterize your approach to building long-term client relationships and navigating complex financial decisions throughout market cycles?

Reason: This reveals your client service philosophy and ability to maintain relationships through various market conditions, which is crucial for employers seeking planners who can retain clients and grow their book of business.

As a financial planner, you need to showcase both your technical expertise in investment analysis and wealth management alongside your client-facing abilities and regulatory knowledge.

Your skills section should balance hard skills like portfolio management and risk assessment with essential soft skills such as client relationship management and clear communication of complex financial concepts.

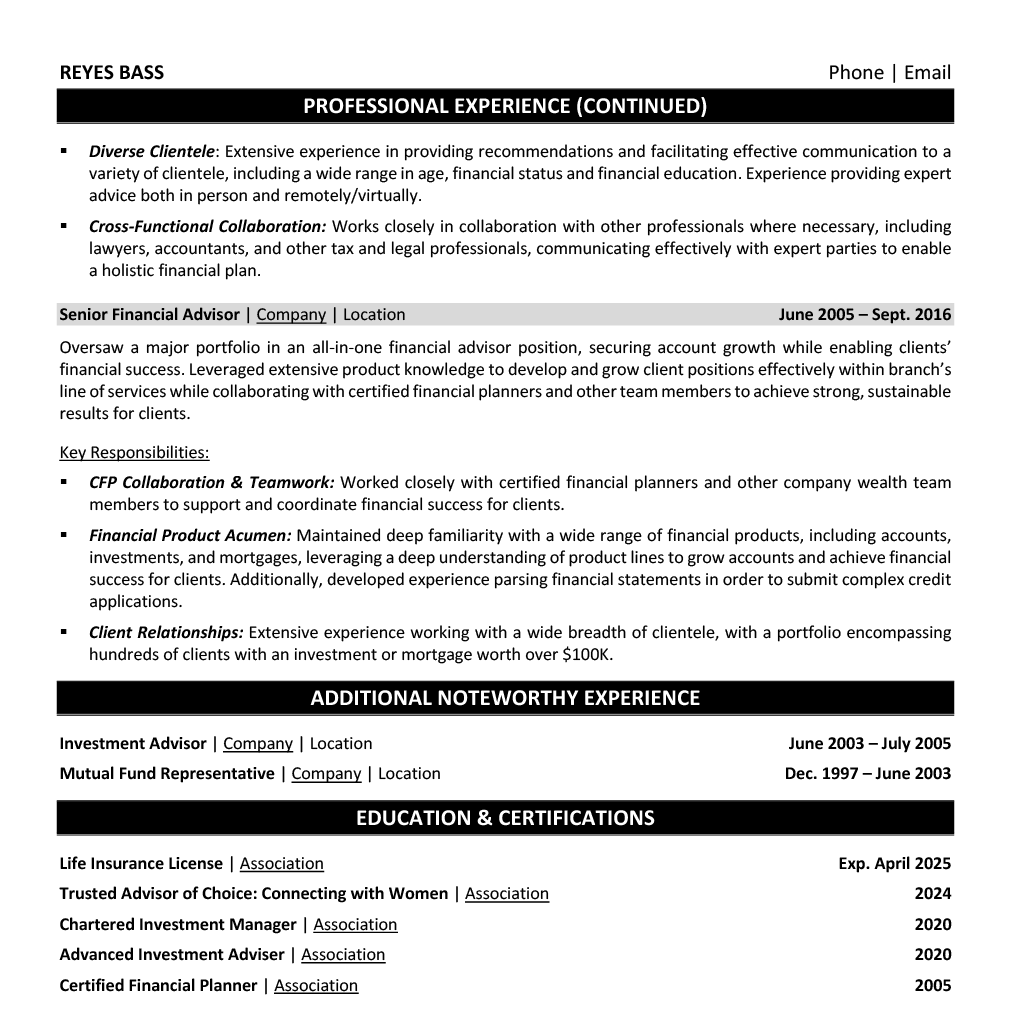

Examples of Financial Planner Skills: Investment Planning - Portfolio Management - Asset Allocation - Risk Assessment - Retirement Planning - Estate Planning - Tax Strategy Client Relations - Financial Advisory - Relationship Building - Client Education - Needs Analysis - Communication Technical Proficiencies - Financial Planning Software - CRM Systems - Investment Research Tools - Microsoft Excel - Financial Modeling Regulatory Knowledge - SEC Regulations - FINRA Compliance - Fiduciary Responsibilities - Industry Standards Certifications - CFP (Certified Financial Planner) - CFA (Chartered Financial Analyst) - Series 7, 63, 65 LicensesShowcase your financial planning expertise by organizing your experience into three powerful sections: a concise role overview that positions your advisory scope, measurable achievements that highlight client portfolio growth and retention, and core responsibilities that demonstrate your comprehensive wealth management capabilities.

Many Financial Planners struggle to translate complex portfolio management and client relationships into compelling, measurable achievements on their resumes. Transform your client success stories into powerful metrics by connecting your advisory decisions to specific financial outcomes, portfolio growth rates, and client retention percentages.

The responsibilities section demonstrates how Financial Planners create value through comprehensive wealth management and strategic financial guidance. This section should translate complex financial concepts into clear achievements while showing how your work directly impacts clients' financial well-being and long-term success.

Your credentials are crucial in establishing trust with potential clients and demonstrating your expertise in financial planning. Lead with your most prestigious certifications like CFP® or ChFC®, followed by your formal education, making sure to highlight any specialized coursework in financial markets, tax planning, or wealth management.

Now that you've created a strong foundation using Resume Target's comprehensive resume writing guidelines, you're ready to transform your resume into a powerful tool for landing your ideal financial planning position.

While many candidates focus solely on customizing their cover letters, tailoring your resume for specific financial planning roles is crucial for showcasing your relevant certifications, client management experience, and specialized investment expertise.

A customized financial planner resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers that you understand their unique needs and can deliver the exact wealth management solutions their firm requires.

Ready to stand out in the competitive financial planning industry? Let's transform your resume into a targeted marketing document that positions you as the solution to employers' needs!

Don't let a lack of professional experience hold you back from launching your career as a Financial Planner!

Your resume can shine by highlighting your relevant coursework in finance, economics, or business, along with any internships, financial modeling projects, or investment club activities you've participated in.

Focus on showcasing your analytical abilities, understanding of financial markets, and client service skills to create a compelling resume.

For detailed guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to ensure you're highlighting your potential in the best possible way.

Your resume summary is your chance to showcase your fresh financial knowledge, relevant internships, and passion for helping others achieve their financial goals.

Focus on highlighting your educational credentials, any certifications in progress, and your natural ability to explain complex financial concepts in simple terms.

"Detail-oriented and client-focused Financial Planning graduate with comprehensive knowledge of investment strategies and financial analysis tools. Completed two internships at leading wealth management firms, developing expertise in financial modeling and client relationship management. Proficient in financial planning software and holds Series 7 certification in progress. Seeking to leverage strong analytical and interpersonal skills to help clients achieve their long-term financial objectives."

Now's your chance to showcase the educational foundation that prepared you for success in financial planning and wealth management!

Transform your academic experience into compelling content by highlighting relevant coursework like "Investment Analysis"or "Estate Planning,"plus any certification programs or hands-on portfolio management projects that demonstrate your practical financial expertise.

The coursework to become a CFP includes several essential subjects necessary for financial planning.Relevant Coursework: Investment Planning | Estate Planning | Tax Planning | Retirement Planning | Risk Management | Insurance Planning

Key Projects:

Comprehensive Financial Planning Case Study: Developed a complete financial plan for a mock client family with complex retirement, estate, and tax planning needs, delivering actionable recommendations to achieve their long-term financial goals.

Investment Portfolio Management Simulation: Led a team of four students in managing a simulated $1 million investment portfolio over one semester, achieving a 12% return while maintaining compliance with investment policy guidelines.

Leverage your academic training, internship experiences, and financial certifications by showcasing the precise mix of analytical and client-focused skills that employers seek in entry-level financial planners.

As an aspiring Financial Planner, your combination of technical knowledge and interpersonal abilities positions you well for a career field projected to grow 15% over the next decade, with abundant opportunities to help clients achieve their financial goals.

Let's face it - translating years of client relationships, complex portfolio management, and financial advisory expertise into a compelling resume can feel overwhelming, especially when you're trying to showcase both your technical knowledge and people skills.

At Resume Target, we specialize in crafting resumes that speak the language of the finance industry, helping financial planners like you transform their client success stories and AUM achievements into powerful career narratives.

Our proven track record includes helping hundreds of financial advisors land roles at top firms by highlighting their unique blend of analytical expertise and relationship-building skills.

With firms actively seeking qualified financial planners in this volatile market, now is the perfect time to upgrade your resume - connect with us today to start your journey toward your next big career move.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services