Numbers tell stories, but most investment advisor resumes read like bland financial statements. Your career achievements deserve more than just a list of AUM figures and client statistics.

Are you struggling to translate complex portfolio management into compelling resume content? A strategic resume can showcase both your financial expertise and your ability to build lasting client relationships that drive real results.

Resume Target specializes in helping investment advisors transform their experience into powerful career narratives. We know how to position your track record and relationship-building skills to catch the attention of top financial firms and high-net-worth clients.

In today's complex financial landscape, Investment Advisors serve as trusted guides who help clients navigate their financial futures, working under strict regulations as registered professionals with either the SEC or state securities regulators.

These financial professionals analyze market trends, assess client risk tolerance, and create personalized investment strategies that align with your specific goals - whether you're planning for retirement, saving for your children's education, or building long-term wealth.

As you explore a career in investment advising, you'll discover a field that combines analytical expertise with relationship building, offering opportunities to advance from junior advisor roles to managing your own client portfolio or even launching an independent advisory firm.

Let's talk about what's exciting in the Investment Advisor field - your earning potential can grow substantially as you build your expertise and client portfolio. From entry-level positions to executive roles, this career path offers compelling compensation that reflects your ability to help clients build wealth and achieve their financial goals.

Figures from: Learn.org

Starting as a junior advisor, you can climb to senior positions managing major client portfolios. With the right certifications and experience, you could advance from support roles to managing entire investment teams.

Beyond basic financial knowledge, advancing in investment advising requires specialized expertise and outstanding people skills.

- Certified Financial Planner (CFP) certification - Advanced financial planning software proficiency - Investment portfolio management expertise - Client relationship building and communicationLaunch your investment advising career by starting in client service or financial planning support roles, where you'll gain essential experience while working toward required certifications and licenses.

To build your career foundation, you'll need to develop both technical expertise and people skills, including certifications like CFP or CFA that will qualify you for advancement in the field.

Note: I kept the introduction and transition sentences concise while incorporating the required elements and maintaining a professional yet accessible tone. The introduction focuses on practical entry points, while the transition sentence emphasizes the dual nature of skills needed for advancement.Requirements from Investments & Wealth Institute

From Midwest markets to coastal financial hubs, investment advisor roles are growing across securities and financial sectors.

Figures from SmartAsset

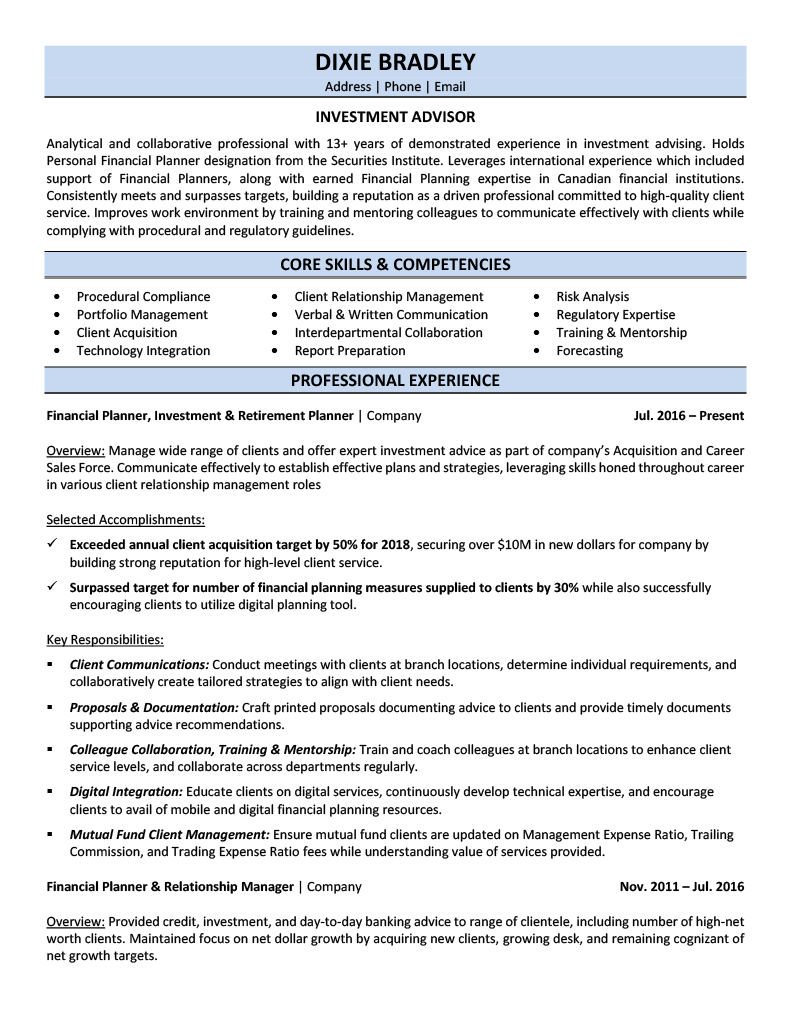

Struggling to showcase your client portfolio growth, investment strategies, and financial planning expertise in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you craft an investment advisor resume that highlights your achievements and demonstrates your value to potential employers.

As an Investment Advisor who excels at analyzing market trends and building client relationships, you might find it challenging to condense years of complex financial expertise into a few compelling lines.

While you're skilled at explaining investment strategies to clients and delivering impressive portfolio returns, translating these achievements into a powerful resume summary requires a different approach that quickly shows hiring managers your ability to drive wealth creation and maintain strong client relationships.

How would you describe your overall investment philosophy and the type of client relationships you've cultivated throughout your career?

Reason: This helps establish your professional identity and demonstrates your approach to wealth management, which is crucial for setting the tone of your resume. It also shows potential employers your client service mindset and investment strategy alignment.

What combination of investment certifications, market expertise, and wealth management experience best represents your professional brand as an Investment Advisor?

Reason: This question helps you synthesize your professional qualifications into a cohesive narrative that showcases your credibility and expertise level in the investment industry.

How do you blend your technical investment knowledge with relationship management skills to deliver value to both high-net-worth and institutional clients?

Reason: This helps articulate your balanced skill set between analytical capabilities and interpersonal abilities, which is essential for modern investment advisory roles. It demonstrates your understanding of the dual nature of the profession.

As an Investment Advisor, your skills section needs to demonstrate both your technical financial expertise and your ability to build trusted client relationships.

From portfolio management and risk assessment capabilities to interpersonal communication and regulatory compliance knowledge, your skills list should showcase how you balance analytical prowess with client service excellence.

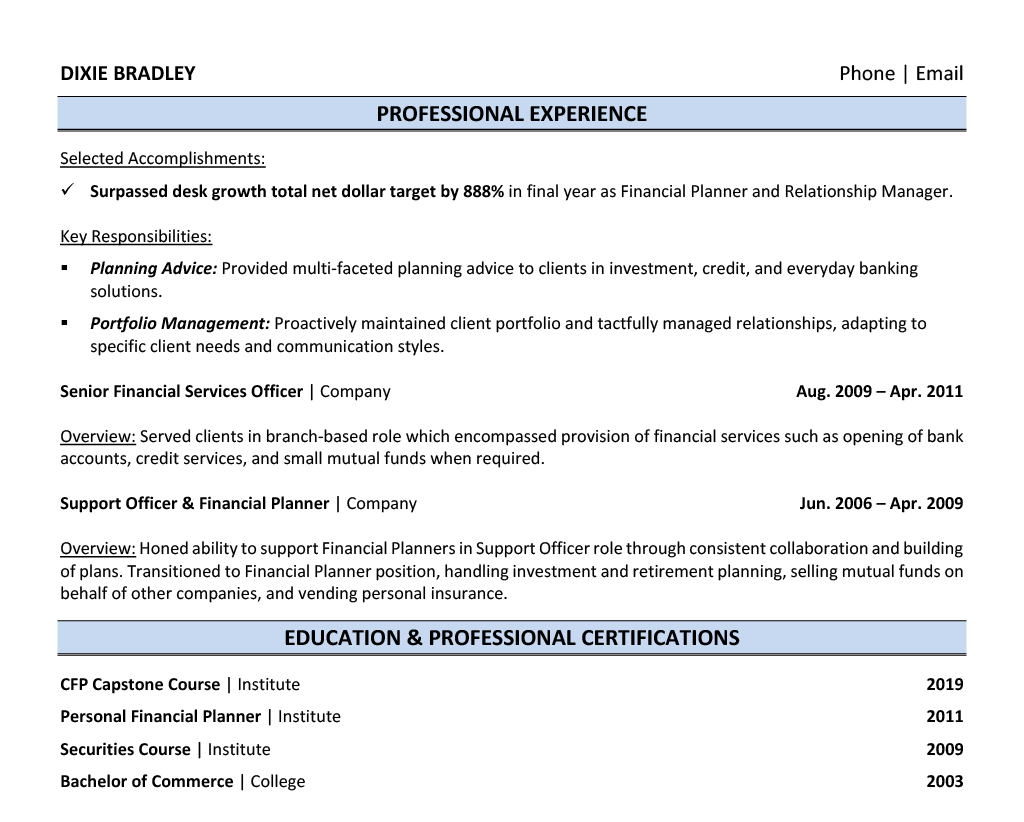

Showcase your financial expertise by organizing your experience into three powerful sections: a compelling role overview that positions you as a trusted wealth manager, quantifiable achievements that highlight your portfolio performance and client growth, and core responsibilities that demonstrate your mastery of investment strategies and client relationships.

Many Investment Advisors struggle to translate complex portfolio management and client relationship wins into clear, compelling resume achievements. Transform your track record into powerful metrics by connecting client satisfaction, AUM growth, and portfolio performance to specific revenue impacts and retention outcomes.

The responsibilities section demonstrates how you create value through financial guidance and portfolio management. Your role needs to be presented clearly to show both technical expertise and client relationship skills while highlighting how your work directly impacts clients' financial success.

Your credentials are crucial in establishing trust with clients and meeting regulatory requirements in the investment advisory field. Lead with your highest financial certifications and relevant degrees, especially those recognized by FINRA and the SEC, as these carry significant weight with both clients and employers.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing investment advisor positions.

While many financial professionals focus solely on customizing their cover letters, tailoring your resume for each investment advisor role is crucial for showcasing your specific wealth management expertise and client relationship achievements.

A customized resume not only helps you navigate through ATS systems by incorporating role-specific keywords, but it also demonstrates to hiring managers how your unique combination of financial planning experience and client success stories perfectly aligns with their firm's needs.

Ready to stand out in the competitive financial services industry? Let's transform your resume into a targeted marketing document that proves you're the investment professional they've been searching for!

Don't let a lack of professional experience hold you back from launching your career as an Investment Advisor!

Your resume can showcase your potential by highlighting your relevant coursework in finance, investment analysis skills, and any internships or portfolio management projects you've completed.

Focus on highlighting your financial knowledge, analytical capabilities, and client service abilities to create a compelling resume.

For detailed guidance on structuring your qualifications, check out the Student Resume Writing Guide to ensure you're presenting yourself as a promising investment professional.

Your resume summary is your chance to showcase your fresh perspective, analytical mindset, and passion for financial markets, even without years of professional experience.

Focus on highlighting your relevant coursework, internships, and any personal investment experience to demonstrate your readiness to help clients achieve their financial goals.

"Detail-oriented and client-focused finance graduate with comprehensive knowledge of investment strategies and portfolio management through academic excellence and internship experience. Leverages strong analytical skills and Series 7 certification preparation to evaluate market trends and investment opportunities. Demonstrated leadership as President of University Investment Club, managing a $50,000 student-run portfolio with 12% annual returns. Seeking to provide personalized investment solutions while building long-term client relationships at a respected financial institution."

Now's your chance to showcase the academic foundation that prepared you for success in financial advising and wealth management!

Transform your education section into a powerful asset by highlighting relevant coursework like Portfolio Management and Financial Planning, plus any significant projects where you analyzed investment strategies or created sample client portfolios.

unavailableRelevant Coursework: Investment Analysis | Portfolio Management | Financial Markets | Risk Management | Corporate Finance | Financial Planning

Key Projects:

Portfolio Management Simulation: Developed and managed a mock $1M investment portfolio using modern portfolio theory and strategic asset allocation principles to achieve a 12% return over benchmark.

Client Investment Strategy Case Study: Collaborated with a team of 4 to develop comprehensive financial planning solutions for a complex client scenario involving retirement planning and estate transfer.

Leverage your academic background, internship experiences, and financial certifications to create a compelling skills section that showcases your readiness to guide clients toward their investment goals.

As an entry-level Investment Advisor, your combination of technical knowledge and interpersonal abilities positions you well for a rewarding career in financial services, where demand for qualified professionals continues to grow steadily.

Let's face it - translating your complex portfolio management achievements and client relationship wins into compelling resume content can feel like trying to time the market - frustrating and uncertain.

At Resume Target, we specialize in crafting resumes for finance professionals just like you, transforming detailed investment performance metrics and wealth management strategies into powerful career narratives that resonate with employers.

We've helped hundreds of Investment Advisors showcase their unique blend of analytical expertise and relationship-building skills, consistently landing interviews at top firms.

With the financial services industry becoming increasingly competitive, don't let an outdated resume hold you back from your next career move - connect with Resume Target today to develop a resume that opens doors to premier opportunities.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services