Risk managers face a unique challenge: condensing years of complex problem-solving into a compelling career story. Your daily wins in preventing disasters often go unnoticed on paper.

Are you struggling to showcase the true value of your risk prevention expertise? A powerful resume needs to translate your behind-the-scenes victories into measurable business impacts that catch a hiring manager's attention.

Resume Target specializes in helping risk management professionals stand out in a competitive field. We know how to transform your risk mitigation achievements and strategic planning into a clear narrative that demonstrates your worth to potential employers.

At the intersection of safety and strategy, risk managers serve as organizational guardians who help protect healthcare facilities from potential threats, including clinical incidents, financial losses, and legal complications.

These professionals blend analytical expertise with strategic thinking to identify potential risks, develop mitigation strategies, and create comprehensive risk management programs that keep organizations running smoothly while protecting both patients and assets.

If you're interested in a career that combines problem-solving with organizational protection, the path to becoming a risk manager offers exciting opportunities for growth, from entry-level analyst positions to senior risk management roles where you'll shape organizational strategy and safety protocols.

Let's talk about the exciting earning potential in risk management! As a Risk Manager, you're looking at a rewarding career path with substantial compensation that reflects your expertise in protecting organizations from various threats and uncertainties. The field offers competitive salaries from entry-level positions all the way up to executive roles, with plenty of room for growth as you gain experience and expertise.

Figures from: Franklin University Career Guide

Risk management offers a clear path from entry-level analyst to executive positions. With 5-10 years of experience and the right skills, you can advance from Risk Analyst to Senior Risk Manager and beyond.

To accelerate your career growth, you'll need to master both technical expertise and leadership capabilities that go beyond basic risk management skills.

- Risk assessment and mitigation strategies - Data analysis and statistical modeling - Regulatory compliance expertise - Strategic communication and stakeholder managementBreaking into risk management starts with entry-level positions like Risk Analyst, Junior Risk Associate, or Risk Assessment Coordinator, where you'll learn fundamental risk assessment and mitigation strategies.

To advance in your risk management career, you'll need to develop key competencies including technical expertise in risk management principles and methodologies, which will help you progress from entry-level positions to more senior roles.

Requirements from Teal HQ

From NYC's financial hub to Texas' emerging markets, Risk Manager roles are expanding across finance and tech sectors.

Figures from U.S. Bureau of Labor Statistics

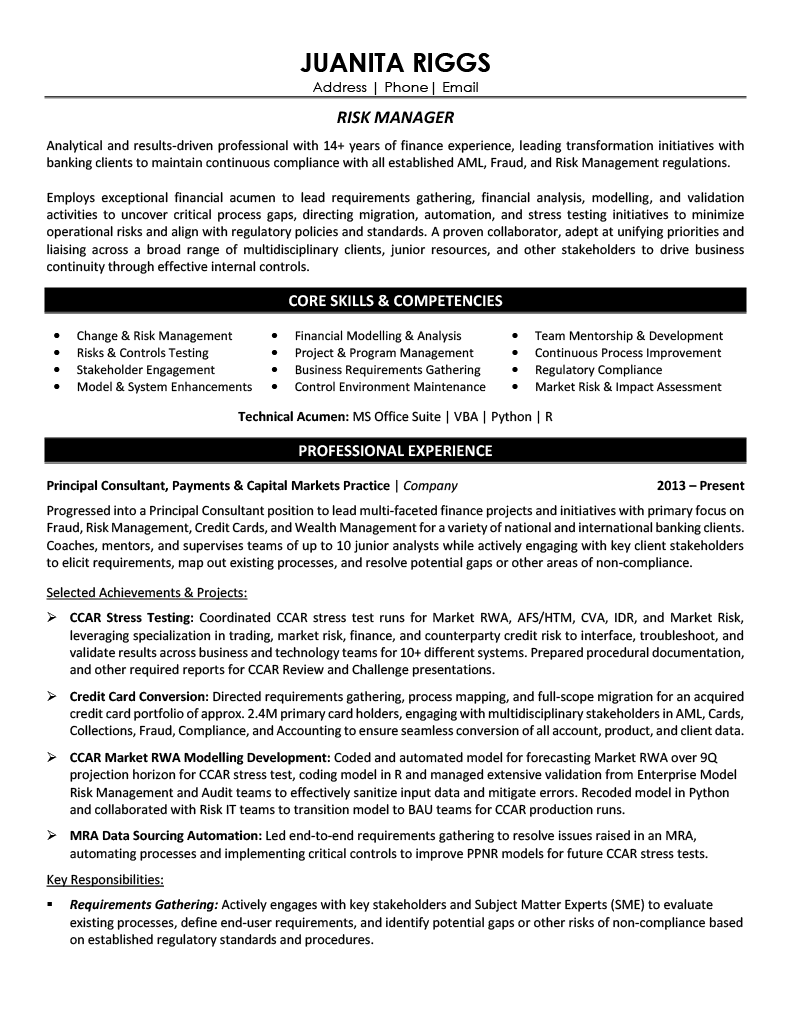

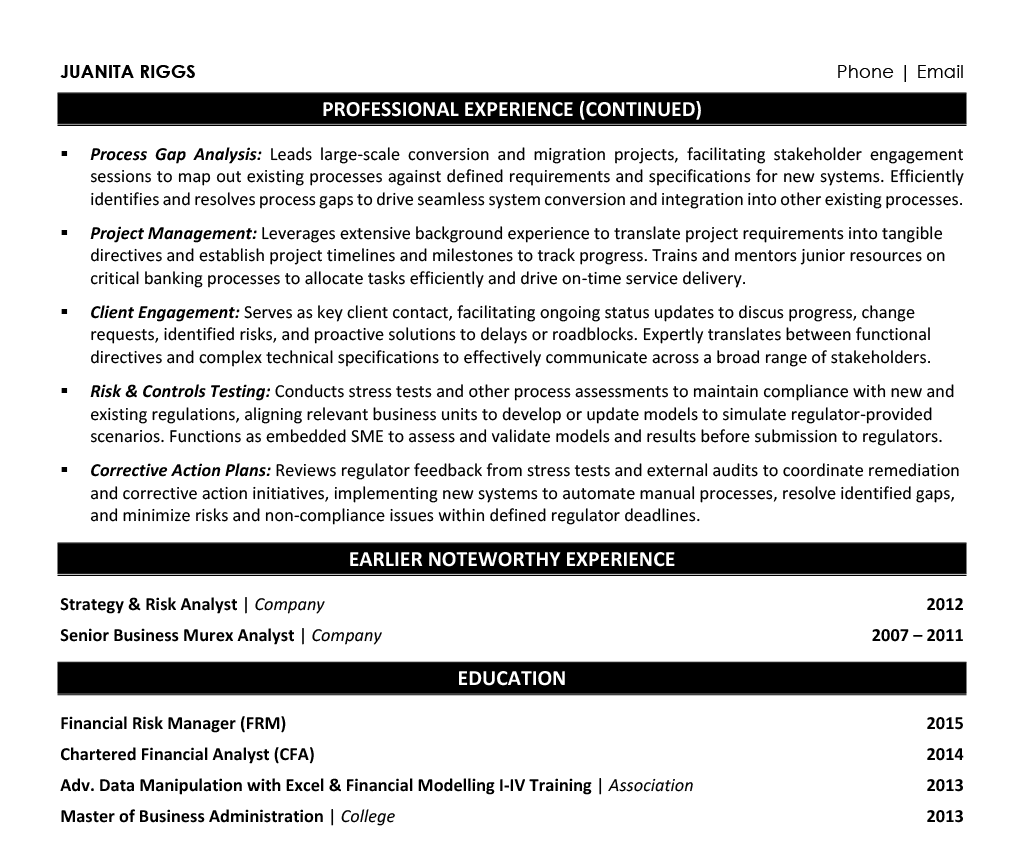

Struggling to showcase your risk assessment expertise, compliance knowledge, and leadership abilities in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will help you create a powerful risk manager resume that highlights your achievements and demonstrates your ability to protect organizations from potential threats.

As a Risk Manager, condensing years of complex analysis, strategic planning, and mitigation expertise into a few powerful sentences can feel like trying to summarize an entire risk assessment in one slide.

While you excel at identifying and managing organizational threats, translating your ability to balance risk appetite with business objectives into compelling resume language requires a different kind of strategic thinking that resonates with hiring managers looking for their next risk leadership hire.

How would you characterize your overall approach to risk management across different organizational functions (financial, operational, strategic, compliance)?

Reason: This helps establish your risk management philosophy and breadth of expertise, allowing you to craft a summary that demonstrates comprehensive understanding of enterprise-wide risk management principles.

What would you say sets you apart from other risk managers in terms of your risk assessment methodology and stakeholder communication style?

Reason: This question helps identify your unique value proposition and management style, enabling you to articulate what makes you distinctive in your summary statement.

How has your risk management expertise evolved to address emerging threats like cybersecurity, ESG requirements, and global supply chain vulnerabilities?

Reason: This helps position you as a forward-thinking risk professional who stays current with industry trends and emerging risks, which is crucial for a compelling executive summary.

As a Risk Manager, you need to showcase both your analytical expertise in risk assessment and measurement alongside your ability to implement enterprise-wide risk management strategies.

Your resume should highlight technical competencies like risk modeling and regulatory compliance, while also emphasizing essential soft skills such as stakeholder communication and crisis management leadership.

Showcase your risk management expertise by organizing your experience into three powerful sections: a concise role overview that sets the context, quantifiable achievements that demonstrate your impact on risk reduction and compliance, and core responsibilities that highlight your strategic oversight abilities.

Many Risk Managers struggle to translate complex risk mitigation strategies and compliance initiatives into clear, measurable business value. Transform your risk management accomplishments into powerful success stories by connecting your actions directly to reduced losses, improved compliance scores, and quantifiable cost savings.

The responsibilities section demonstrates how Risk Managers protect company assets and ensure regulatory compliance beyond basic monitoring tasks. Your role needs to be clearly communicated to show how risk management directly impacts business operations, financial stability, and organizational success.

Your risk management credentials demonstrate your expertise in identifying, assessing, and mitigating organizational risks across multiple domains. List your most recent and relevant certifications first, especially those from recognized bodies like RIMS or GARP, followed by your formal education and any specialized training in risk analysis or compliance frameworks.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your base resume into a powerful tool for landing risk management positions.

While many candidates stop at customizing their cover letter, successful risk managers know that personalizing their resume for each position is crucial for standing out in this competitive field.

By strategically incorporating specific risk management keywords and aligning your experience with each job description, you'll not only sail through ATS screenings but also demonstrate to hiring managers that you're precisely the risk management professional they're seeking.

Ready to turn your resume into your secret weapon? Let's make every word count and show employers why you're their ideal risk management candidate!

Don't let a lack of experience hold you back from launching your Risk Manager career! Your journey into risk management can start strong by showcasing your analytical education, relevant coursework, and any internship experience that demonstrates your understanding of risk assessment and mitigation strategies.

Focus on highlighting your quantitative skills, knowledge of risk analysis tools, and any relevant academic projects or case studies you've completed. For more guidance on crafting the perfect entry-level resume, check out the Student Resume Writing Guide to ensure you're presenting your qualifications in the best possible light.

Your resume summary is your chance to showcase how your analytical mindset, academic excellence, and internship experiences have prepared you for a career in risk management.

Focus on highlighting your quantitative skills, relevant certifications, and any project work that demonstrates your ability to identify, assess, and mitigate risks.

"Detail-oriented and analytical Risk Management graduate with comprehensive academic training and internship experience in financial risk assessment and compliance monitoring. Leverages strong statistical analysis skills and working knowledge of risk management software to identify potential threats and opportunities. Demonstrated leadership through successful completion of three risk assessment projects during university coursework. Seeking to apply strong quantitative abilities and risk evaluation expertise to drive value as an entry-level Risk Manager."

Now's your chance to showcase the academic foundation that prepared you for managing complex business risks and compliance challenges!

Transform your educational background into compelling content by highlighting specialized coursework in risk assessment methodologies, financial modeling, and regulatory compliance, along with any capstone projects where you analyzed real-world risk scenarios.

1. Courses common to a degree/certification for Risk Managers include Property/Liability Risk Management and Insurance, and Insurance Company Operations.Relevant Coursework: Property/Liability Risk Management | Enterprise Risk Analysis | Insurance Company Operations | Financial Risk Assessment | Business Continuity Planning | Risk Modeling & Analytics

Key Projects:

Enterprise Risk Assessment Framework Development: Developed a comprehensive risk assessment framework for a simulated multinational corporation, identifying and analyzing potential threats across multiple business units.

Business Continuity Planning Simulation: Led a team of four students to develop and test a business continuity plan for a regional financial institution facing multiple risk scenarios.

Transform your academic knowledge, internship experiences, and technical certifications into a compelling skills section that showcases your readiness to identify, assess, and mitigate organizational risks effectively.

As an aspiring Risk Manager, your foundation in these essential skills positions you well for a career in this growing field, where organizations increasingly prioritize robust risk management strategies to protect their assets and operations.

When you're immersed in analyzing market volatility and managing complex risk scenarios all day, it's challenging to step back and effectively communicate your strategic impact in a way that resonates with hiring managers.

At Resume Target, we specialize in crafting resumes for finance professionals like you, transforming intricate risk management achievements into compelling narratives that catch attention.

Our expert team has helped countless risk managers showcase their ability to protect assets and drive strategic growth, resulting in interviews at top financial institutions.

With financial markets evolving rapidly and new risk management opportunities emerging daily, now is the perfect time to elevate your career story - let's connect today to craft your standout resume.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services