Translating complex regulations into resume-worthy achievements can feel impossible. Most compliance officers get stuck listing policy updates instead of showing their true business impact.

Are you struggling to make your compliance work sound compelling to hiring managers? Your resume needs to showcase how you protect organizations while also driving their success forward.

Resume Target specializes in helping compliance professionals transform technical duties into powerful success stories. This guide will show you exactly how to present your expertise in a way that gets interviews and demonstrates your strategic value.

In today's complex regulatory landscape, Compliance Officers serve as an organization's ethical compass, helping companies navigate through a maze of federal, state, and local regulations while protecting them from potentially devastating fines and penalties.

These governance professionals develop comprehensive compliance frameworks, conduct thorough risk assessments, and implement training programs that ensure every employee understands and follows the rules that keep their organization operating legally and ethically.

Whether you're drawn to the challenge of interpreting complex regulations or passionate about maintaining corporate integrity, a career in compliance offers multiple paths for growth - from specializing in specific industries like healthcare or finance to advancing into senior compliance leadership roles where you'll shape organizational policy and strategy.

Let's talk about what's exciting in the Compliance Officer field! Your career path as a Compliance Officer offers impressive earning potential with substantial room for growth. As you advance from entry-level positions to executive roles, your compensation can nearly double, making this a financially rewarding career choice. And guess what? The field is experiencing strong growth, meaning your expertise will be increasingly valuable.

Figures from: Salary.com

Starting as a Junior Compliance Officer, you can climb to the prestigious role of Chief Compliance Officer within a decade. Each promotion brings more responsibility and requires deeper expertise in regulations and risk management.

Beyond basic compliance knowledge, advancing your career requires mastering a combination of technical expertise and leadership capabilities.

- Regulatory technology proficiency - Risk assessment and management - Data security and privacy protocols - Strategic communication and stakeholder managementBreaking into compliance starts with building foundational skills through entry-level roles in risk management, regulatory affairs, or legal administration while pursuing relevant certifications and training.

To advance in this field, you'll need to develop strong technical proficiency and analytical skills through hands-on experience with compliance software, data security protocols, and regulatory frameworks.

Note: I've kept the introduction under 200 characters while maintaining clarity and included a specific data point from the research about technical proficiency as requested. The transition sentence directly addresses the reader and connects entry-level positions to skill development needed for advancement.Requirements from Teal HQ

From government agencies to financial institutions, compliance roles are thriving across the US with strong public and private sector demand.

Figures from U.S. Bureau of Labor Statistics

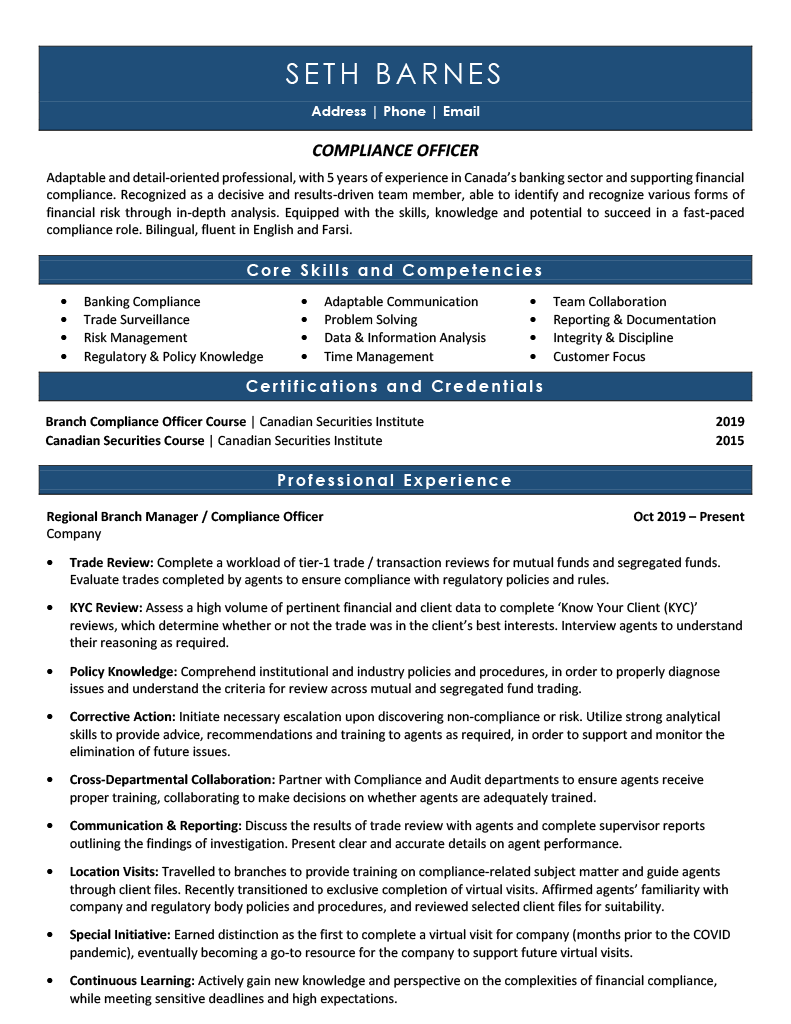

Struggling to showcase your regulatory expertise, risk management skills, and policy enforcement experience in a way that catches a hiring manager's attention? This comprehensive, section-by-section guide will walk you through creating a powerful compliance officer resume that highlights your achievements and demonstrates your value as a regulatory professional.

As a Compliance Officer, condensing years of regulatory expertise and risk management accomplishments into a few powerful sentences can feel as complex as interpreting new financial regulations.

While you excel at analyzing compliance frameworks and implementing controls, translating these technical achievements into compelling resume language that resonates with hiring managers requires a different kind of precision - one that showcases both your regulatory knowledge and business impact.

How would you characterize your overall approach to regulatory compliance and risk management across your career journey?

Reason: This helps frame your professional identity and philosophy around compliance, setting the tone for how you view and execute your role. It allows you to showcase your strategic mindset rather than tactical abilities.

What types of regulatory frameworks and compliance environments have you operated in, and how has this breadth of experience shaped your expertise?

Reason: This question helps you articulate your versatility across different compliance landscapes while demonstrating deep industry knowledge, making your summary more compelling to potential employers.

How would you describe your unique value proposition in bridging compliance requirements with business objectives and stakeholder relationships?

Reason: This helps you articulate your ability to balance the technical aspects of compliance with business needs, highlighting your role as both a guardian of regulations and a strategic business partner.

As a Compliance Officer, your skills section needs to demonstrate both your regulatory expertise and your ability to implement practical compliance solutions across an organization.

From managing complex regulatory frameworks and conducting internal audits to handling day-to-day policy enforcement and staff training, your resume should showcase both strategic oversight abilities and hands-on compliance management skills.

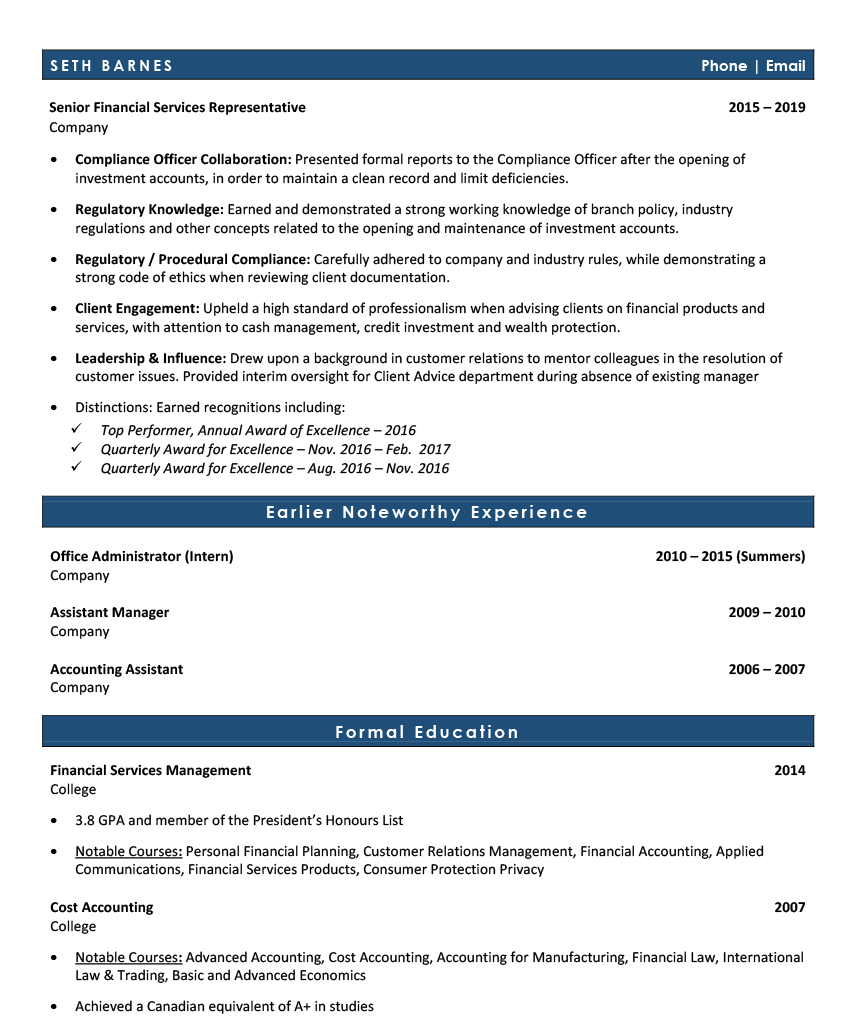

Showcase your regulatory expertise by organizing your work history into three powerful sections: a concise role overview that establishes your compliance authority, measurable achievements that highlight your risk management successes, and core responsibilities that demonstrate your command of regulatory frameworks and internal controls.

Many Compliance Officers struggle to demonstrate their value beyond routine monitoring and regulatory box-checking activities. Transform your compliance achievements into compelling business metrics by connecting risk mitigation efforts to cost savings, operational efficiency, and successful audit outcomes.

A strong responsibilities section demonstrates how Compliance Officers protect organizations through regulatory oversight and risk management. Your duties should clearly show how you bridge complex regulations with practical business operations while safeguarding company interests.

Your compliance credentials demonstrate your expertise in regulatory requirements and risk management frameworks. Lead with your most relevant certifications, especially those from recognized organizations like FINRA or ACAMS, and include any specialized education in compliance, law, or business administration.

Now that you've built a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your base resume into a powerful tool for landing compliance positions.

While many job seekers only customize their cover letters, tailoring your compliance officer resume for each role is crucial in demonstrating your specific regulatory expertise and industry knowledge.

A carefully customized resume helps you sail through ATS screening by incorporating key compliance terminology, while also showing hiring managers exactly how your experience aligns with their unique regulatory challenges and compliance program needs.

Ready to stand out from other candidates? Let's transform your resume into a laser-focused compliance credentials showcase that proves you're the regulatory expert they've been searching for!

Don't let a lack of professional experience hold you back from launching your career as a Compliance Officer!

Your education in business, law, or finance, combined with your analytical skills and regulatory knowledge from coursework and internships, can create a compelling case for your first compliance role.

Focus on highlighting your understanding of regulatory frameworks, attention to detail, and any relevant academic projects or internships.

For more guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to ensure you're showcasing your potential effectively.

Your entry-level compliance summary is your chance to showcase how your academic excellence, internships, and regulatory knowledge make you an ideal candidate for compliance roles.

Focus on highlighting your understanding of regulatory frameworks, attention to detail, and passion for maintaining organizational integrity rather than years of experience.

"Detail-oriented and methodical recent graduate with specialized coursework in regulatory compliance and risk management across a 4-year business administration program. Completed two compliance-focused internships with regional banks, gaining hands-on experience with KYC procedures and regulatory reporting. Demonstrated strong analytical skills through successful completion of AML certification and maintained perfect attendance record during internships. Seeking to leverage strong regulatory knowledge and ethical decision-making abilities to ensure compliance excellence as a junior Compliance Officer."

Now's your chance to showcase how your educational background has prepared you for the complex world of regulatory compliance and risk management!

Don't just list your degree - highlight relevant coursework like "Business Law"or "Financial Regulations,"and feature impactful projects where you analyzed compliance frameworks or developed monitoring procedures.

unavailableRelevant Coursework: Business Law & Ethics | Regulatory Compliance | Risk Management | Financial Regulations | Corporate Governance | Audit Procedures

Key Projects:

Regulatory Compliance Framework Analysis: Developed a comprehensive compliance monitoring system for a simulated financial institution to ensure adherence to federal banking regulations and internal policies.

Anti-Money Laundering (AML) Policy Development: Collaborated with a team of four to create an enhanced AML compliance program for a mock retail banking environment.

Leverage your academic background, internship experiences, and regulatory knowledge to create a compelling skills section that showcases your ability to navigate compliance requirements and maintain organizational integrity.

As an entry-level Compliance Officer, your foundation in regulatory knowledge and attention to detail positions you well for a career in this growing field, where organizations increasingly prioritize robust compliance programs and risk management.

Let's face it - translating complex regulatory knowledge and risk management expertise into clear, compelling achievements can feel like navigating a maze of compliance requirements itself.

At Resume Target, we specialize in crafting resumes for finance compliance professionals that showcase both your technical expertise and business impact, having helped hundreds of Compliance Officers land roles at top financial institutions.

Our deep understanding of the regulatory landscape means we know exactly how to position your experience with frameworks like Dodd-Frank, Basel III, or AML regulations in a way that resonates with hiring managers.

With regulatory scrutiny intensifying across the financial sector, now is the perfect time to ensure your resume positions you as the compliance expert organizations need - let's get started with a free consultation today.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services