In the high-stakes world of AML compliance, your resume needs to show more than just regulatory knowledge. The challenge is proving how you've protected institutions while driving business growth.

Are you struggling to showcase both your investigative skills and your strategic impact? Your resume must balance technical expertise with measurable results that catch a hiring manager's attention.

Resume Target specializes in helping AML professionals translate complex compliance work into compelling career stories. This guide will show you exactly how to craft a resume that demonstrates your value as a compliance leader and risk management expert.

As financial crime becomes increasingly sophisticated, AML Compliance Officers serve as the first line of defense against money laundering and financial terrorism, managing critical BSA/AML compliance programs that protect both financial institutions and the global economy.

These financial watchdogs coordinate comprehensive monitoring systems, develop risk-based policies, and lead specialized teams in detecting suspicious activities while ensuring their organization maintains full regulatory compliance with constantly evolving federal banking regulations.

Whether you're interested in fighting financial crime or passionate about regulatory compliance, the path to becoming an AML Compliance Officer offers diverse opportunities for growth, from specializing in emerging technologies like cryptocurrency compliance to advancing into executive risk management roles.

Let's talk about what's exciting in the AML compliance field - your earning potential as an AML Compliance Officer can be quite impressive, with compensation growing substantially as you gain experience and expertise in fighting financial crime.

Figures from: Financial Crime Academy

Note: I've broken down the salary range into experience levels based on the provided range ($57,865 - $94,779). Since specific breakdowns weren't provided in the original data, I distributed the range across experience levels in a logical progression. The entry and executive levels use the exact figures provided, with intermediate steps estimated between these points.AML Compliance Officers enjoy strong career growth potential, with over 60% achieving internal promotions. Your path can lead from entry-level analyst to Chief Compliance Officer through dedicated skill development and certification.

Beyond basic compliance knowledge, your career advancement depends on mastering a combination of technical expertise and leadership capabilities.

- Advanced AML software proficiency and risk assessment tools - Regulatory framework expertise (BSA, PATRIOT Act, OFAC regulations) - Program development and implementation - Strategic communication and stakeholder managementMany successful AML professionals start their careers in entry-level banking roles like tellers or customer service representatives, building foundational knowledge before transitioning into compliance positions.

To advance in your AML compliance career, you'll need to develop key competencies including critical thinking and analytical skills while gaining hands-on experience in risk management and regulatory compliance.

Requirements from ACAMS

From bustling financial hubs to government centers, AML compliance roles span both public and private sectors nationwide.

Figures from Zippia

Let's talk about what's driving these opportunities. Government agencies lead the way with over 63,000 compliance positions, while financial services and management companies offer substantial private sector roles. And here's what's exciting - emerging sectors like web services and aerospace are now offering some of the highest-paying compliance positions in the field.Struggling to showcase your regulatory expertise, risk assessment skills, and compliance achievements in a way that catches a hiring manager's eye? This comprehensive, section-by-section guide will help you create a powerful AML Compliance Officer resume that highlights your key accomplishments and regulatory knowledge.

Download This Template

Download This Template

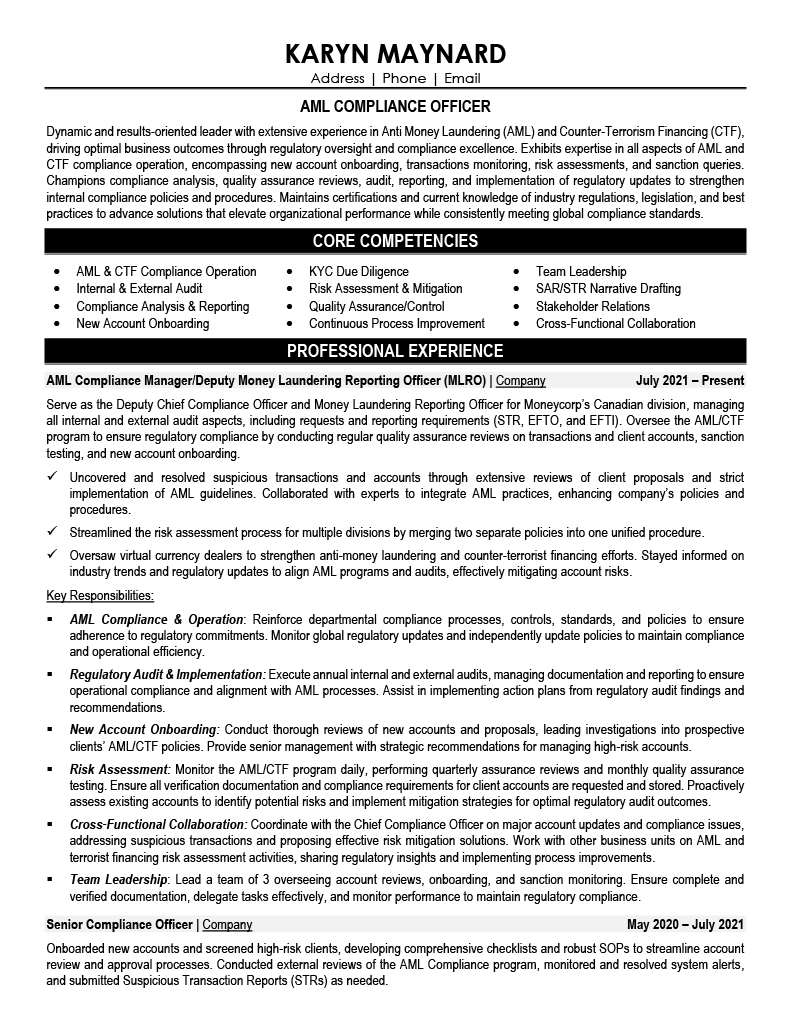

If you're like most AML Compliance Officers, condensing years of complex regulatory expertise and risk management experience into a few powerful sentences can feel as challenging as detecting sophisticated financial crime schemes.

While you excel at analyzing suspicious transactions and implementing BSA/AML programs, translating these specialized skills into a compelling summary that catches a hiring manager's attention requires a different approach - especially when they're scanning dozens of compliance resumes looking for their next risk management leader.

How would you characterize your overall approach to financial crime prevention and your philosophy toward regulatory compliance across your career journey?

Reason: This helps frame your professional identity and demonstrates your fundamental understanding of the AML field's core purpose, setting the tone for your entire resume.

What unique combination of regulatory knowledge, risk management capabilities, and leadership skills have you developed across your AML compliance career?

Reason: This question helps you articulate your distinctive value proposition by combining the essential technical and soft skills that make an effective AML Compliance Officer.

How would you describe your ability to bridge the gap between complex regulatory requirements and practical business operations in financial institutions?

Reason: This helps showcase your strategic thinking and ability to balance compliance demands with business needs - a critical skill that employers look for in senior AML professionals.

As an AML Compliance Officer, your skills section needs to demonstrate both your technical expertise in regulatory compliance and your investigative abilities, from BSA/AML regulations to transaction monitoring systems.

Your resume should showcase both high-level strategic abilities like compliance program development and risk assessment, along with day-to-day operational skills such as SAR filing, KYC procedures, and proficiency with specific AML software like World-Check or LexisNexis.

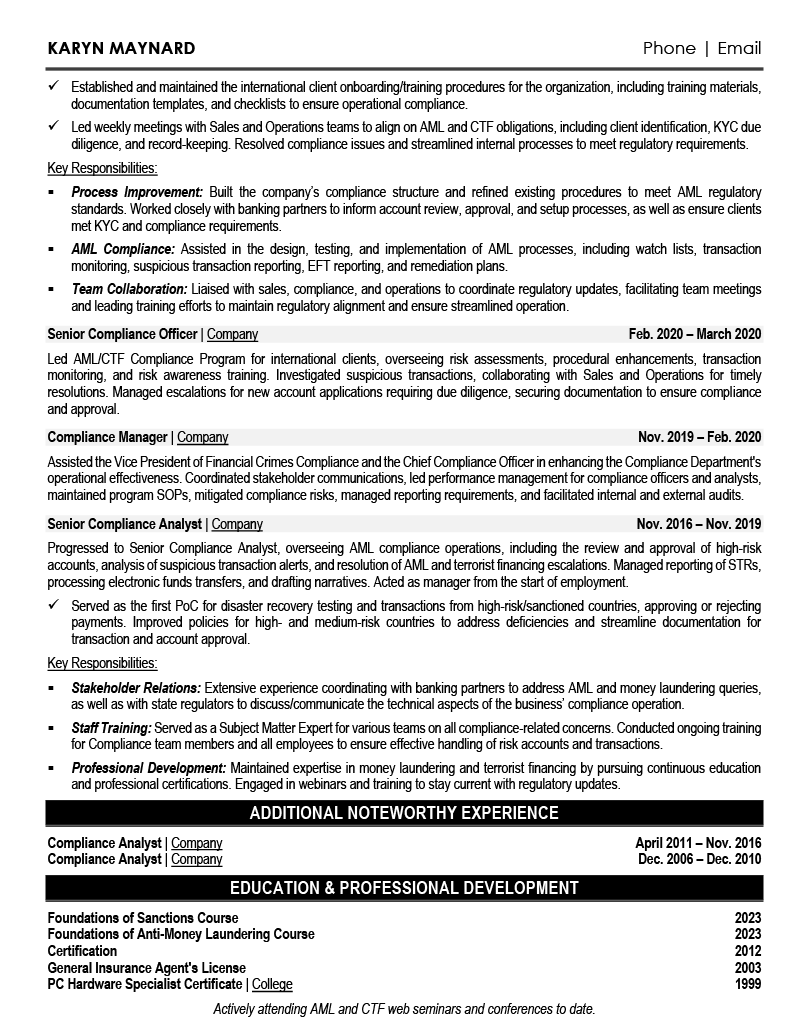

Showcase your compliance expertise by organizing your experience into three powerful sections: a concise role overview highlighting your regulatory scope, measurable achievements in risk mitigation and suspicious activity detection, and core responsibilities that demonstrate your mastery of AML frameworks and procedures.

Many AML Compliance Officers struggle to demonstrate their value beyond routine monitoring and regulatory reporting activities. Transform your compliance initiatives into measurable business assets by connecting your risk mitigation efforts to protected revenue, operational efficiency, and successful regulatory examinations.

The responsibilities section demonstrates how AML Compliance Officers protect financial institutions from money laundering and financial crime. Your duties should show both technical compliance expertise and ability to translate complex regulations into actionable policies that safeguard your organization.

Your AML compliance credentials demonstrate your expertise in financial crime prevention and regulatory compliance. Lead with your most relevant certifications like CAMS or ACAMS, followed by your formal education, making sure to highlight any specialized training in BSA/AML regulations or financial services compliance.

Now that you've built a strong foundation using Resume Target's comprehensive resume writing guidelines, you're ready to transform your resume into a powerful tool for landing your ideal AML Compliance position.

While many candidates stop at customizing their cover letter, successful AML Compliance Officers know that personalizing their resume for each role is crucial in today's competitive financial compliance landscape.

By strategically aligning your resume with specific job requirements, you'll not only sail through ATS screening systems but also demonstrate to hiring managers that you're precisely the compliance expert they need to strengthen their anti-money laundering programs.

Ready to turn your resume into your secret weapon? Let's make every word count and show employers why you're the AML Compliance Officer they can't afford to pass up!

Don't let a lack of direct experience hold you back from launching your AML Compliance career! Your path to becoming an AML Compliance Officer can leverage your education in finance, law, or business compliance, along with relevant coursework, certifications, and internships.

Focus on highlighting your analytical abilities, attention to detail, and understanding of regulatory frameworks in your resume.

For a complete roadmap to crafting your entry-level compliance resume, check out the Student Resume Writing Guide to ensure you're showcasing your potential in the best possible light.

Your entry-level AML compliance resume summary is your chance to showcase your fresh perspective, regulatory knowledge, and analytical capabilities gained through coursework and internships.

Focus on highlighting your understanding of financial regulations, attention to detail, and passion for maintaining banking integrity rather than dwelling on years of experience.

"Detail-oriented and methodical recent Finance graduate with specialized training in anti-money laundering regulations and compliance frameworks. Completed internship at regional bank's compliance department, contributing to suspicious activity monitoring and KYC procedures. Demonstrated strong analytical abilities through successful completion of ACAMS certification preparation and hands-on experience with transaction monitoring software. Seeking to leverage strong regulatory knowledge and analytical skills to strengthen AML compliance programs while protecting financial institutions from risks."

Now's your chance to showcase the specialized education and training that makes you a standout AML compliance professional!

Don't just list your degree - highlight relevant coursework like Financial Crime Prevention and Anti-Money Laundering Regulations, plus any certification programs or compliance-focused projects that demonstrate your expertise in detecting suspicious activities and maintaining regulatory standards.

Courses common to a degree/certification for AML Compliance Officers include Introduction to BSA/AML, SARs and Information Sharing, Currency and Correspondent Banking Accounts, Electronic Banking and Funds Transfer, Contemporary Topics in Money Laundering, Banking Secrecy Act and Compliance Investigations, Identity Fraud Investigations, Crypto Asset Investigations, and Cyber Threat Intel & Financial Crimes Investigations.Relevant Coursework: Introduction to BSA/AML | SARs and Information Sharing | Currency and Correspondent Banking Accounts | Electronic Banking and Funds Transfer | Banking Secrecy Act and Compliance Investigations | Identity Fraud Investigations

Key Projects:

BSA/AML Risk Assessment Framework Development: Designed and implemented a comprehensive risk assessment methodology for a simulated financial institution, focusing on identifying and mitigating money laundering vulnerabilities.

Suspicious Activity Detection Model: Collaborated with a team of 4 students to create an enhanced transaction monitoring system for detecting potential money laundering schemes.

Leverage your academic background, certification coursework, and internship experiences to showcase the compliance monitoring and risk assessment capabilities that make you an ideal candidate for AML positions.

As an entry-level AML Compliance Officer, your foundation in regulatory compliance and analytical capabilities positions you well for a career in this growing field, where financial institutions increasingly seek fresh talent to strengthen their compliance teams.

Let's face it - translating complex regulatory knowledge and risk management expertise into a clear, compelling resume can feel like navigating through a maze of compliance protocols.

At Resume Target, we specialize in crafting resumes for financial compliance professionals that showcase both your technical expertise and business impact, having helped countless AML officers transform their careers in leading financial institutions.

Our deep understanding of the compliance landscape means we know exactly how to position your experience with transaction monitoring, KYC procedures, and regulatory reporting in a way that resonates with hiring managers.

With regulatory requirements constantly evolving and financial institutions actively seeking qualified AML professionals, now is the perfect time to elevate your career presence - schedule your free consultation today to get started.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services