Standing out in the competitive private equity world takes more than just listing your deals and Excel skills. Your resume needs to showcase the real financial impact you've delivered and your ability to spot winning investments.

Are you struggling to quantify your contributions on paper? A strategically crafted resume can transform complex deal experience into compelling proof of your value-creation abilities. Your next career-defining opportunity depends on how well you tell your story.

Resume Target specializes in helping private equity analysts translate their complex work into clear, powerful narratives. We know how to position your financial modeling expertise, deal execution experience, and investment insights in language that catches a hiring manager's attention and lands interviews.

As the financial detectives of the investment world, Private Equity Analysts play a crucial role in identifying and evaluating potential investment opportunities, with their research and analysis directly influencing multi-million dollar investment decisions that can transform entire companies.

In this dynamic role, you'll dive deep into financial statements, build complex financial models, and conduct thorough due diligence investigations - essentially becoming the firm's go-to expert for understanding the nuts and bolts of potential investment targets.

Whether you're fresh out of college or transitioning from investment banking, the Private Equity Analyst position serves as your launching pad into the competitive world of private equity, where your analytical skills and financial acumen can propel you toward senior investment roles with increasing deal responsibility and portfolio management opportunities.

Let's talk about the exciting earning potential in private equity analysis! Your career in this dynamic field offers impressive compensation packages that reward your analytical skills and financial expertise. And guess what? The opportunities for growth are substantial as you advance through the ranks.

Figures from: Salary.com

Starting as a Private Equity Analyst opens doors to rapid career growth, with most analysts advancing to associate roles within 2-3 years. Your journey begins with deal sourcing and investment analysis, setting the foundation for higher positions.

To accelerate your advancement in private equity, you'll need to master both technical expertise and interpersonal abilities that set you apart from your peers.

- Advanced Financial Modeling - Complex Valuation Analysis - Strategic Due Diligence - Executive CommunicationBreaking into private equity typically starts with gaining experience in investment banking or consulting, where you'll develop crucial financial modeling and deal analysis skills needed for PE roles.

To build your foundation for a private equity career, you'll need to master financial modeling proficiency and sophisticated investment forecasting, which you can develop through these common entry points:

• Investment Banking Analyst • Management Consultant • Corporate Development Associate • Big 4 Transaction Services Associate • Research Analyst at Asset Management FirmsRequirements from Vocal Media

From FIRE services to consumer goods, PE firms are actively recruiting analysts across diverse industry sectors.

Figures from Altus Partners

Note: While specific geographic data is limited, these locations represent traditional private equity hubs where analyst opportunities are typically concentrated. The industry distribution shows promising opportunities across multiple sectors, particularly in FIRE services, industrial technologies, and consumer-focused businesses. Your career path might lead you to any of these dynamic markets where PE firms are actively investing and growing their teams.Struggling to distill your complex financial modeling skills, deal experience, and investment acumen into a compelling private equity analyst resume that catches a hiring manager's attention? This comprehensive, section-by-section guide will show you exactly how to craft a resume that highlights your PE expertise and gets you noticed by top firms.

As a Private Equity Analyst, you know how to analyze complex financial data and spot promising investment opportunities, but condensing your expertise into a compelling resume summary can feel more challenging than building the most sophisticated financial model.

While you excel at conducting due diligence and evaluating potential deals, translating these specialized skills into a concise narrative that resonates with hiring managers requires a strategic approach that highlights both your analytical capabilities and your ability to drive investment decisions.

How would you characterize your investment philosophy and approach to deal evaluation across the various sectors you've analyzed?

Reason: This helps establish your professional identity and investment mindset upfront, giving potential employers insight into how you think about opportunities and risk assessment.

What combination of financial modeling, due diligence, and portfolio management capabilities best defines your value to a private equity firm?

Reason: This question helps you articulate your core technical competencies in a way that aligns with what PE firms specifically look for in analysts, while highlighting your full-cycle investment experience.

How would you describe your evolution from your first PE role to your current level of expertise in terms of deal complexity and responsibility?

Reason: This helps frame your career progression and growing sophistication in private equity work, demonstrating both your current capabilities and potential for growth within a new firm.

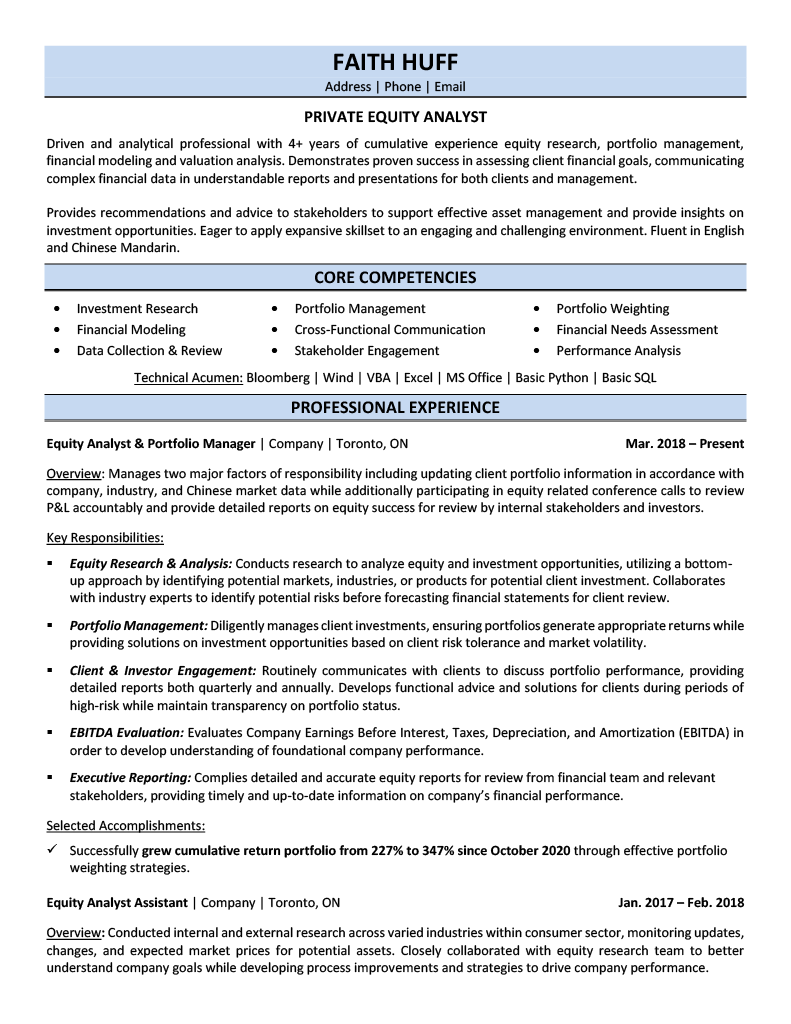

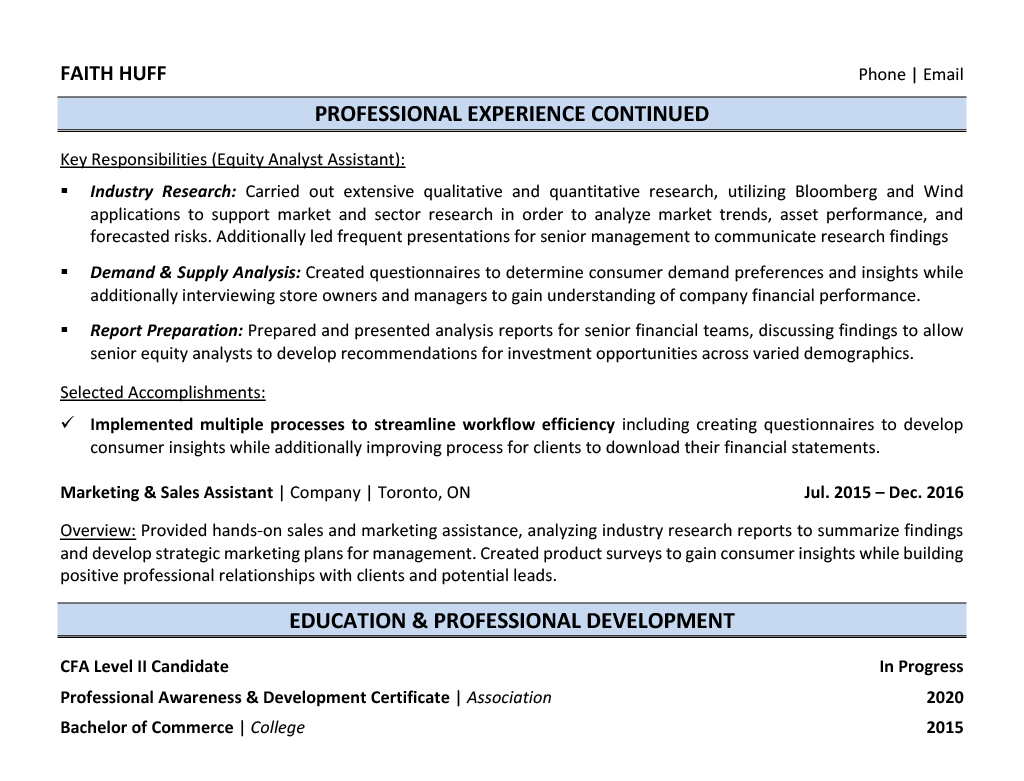

As a Private Equity Analyst, your resume needs to showcase both your financial modeling expertise and your deal execution capabilities, while demonstrating the analytical prowess that firms demand.

From complex LBO modeling and due diligence coordination to industry research and portfolio monitoring, your skill set must reflect both the technical sophistication and practical business acumen required in private equity.

Examples of Private Equity Analyst Skills: Financial Modeling & Analysis - LBO Modeling - Valuation Analysis - Financial Statement Analysis - DCF Modeling - Comparable Company Analysis - Merger Modeling Deal Execution - Due Diligence Management - Deal Sourcing - Investment Memorandum Creation - Portfolio Company Monitoring - Industry Research - Market Analysis Technical Skills - Excel (Advanced) - PowerPoint - FactSet - Capital IQ - Bloomberg Terminal - Pitchbook Soft Skills - Analytical Thinking - Project Management - Communication - Time Management - Attention to Detail - Team CollaborationShowcase your deal experience, financial modeling expertise, and value creation impact by organizing your private equity career into three powerful sections: a high-level role overview, quantifiable investment achievements, and core analytical responsibilities.

Many Private Equity Analysts struggle to effectively communicate their deal execution experience and value-creation impact beyond basic transaction values. Transform your achievements into compelling investment narratives by connecting your analytical contributions to successful exits, IRR improvements, and portfolio company growth metrics.

The responsibilities section demonstrates how Private Equity Analysts create value through financial analysis, due diligence, and portfolio management. Your role description should translate complex financial work into clear achievements that showcase your impact on investment decisions and portfolio company performance.

Your educational background and professional certifications are crucial differentiators in private equity, where analytical expertise and financial acumen are highly valued. Focus on highlighting your most prestigious degrees and industry-recognized certifications that demonstrate your competency in financial modeling, valuation, and investment analysis.

Now that you've built a strong foundation using Resume Target's comprehensive resume writing guidelines, you're ready to transform your resume into a powerful tool for private equity positions.

While many candidates focus solely on customizing their cover letters, tailoring your resume for specific private equity analyst roles is absolutely crucial in this highly competitive field.

A customized resume not only helps you navigate through sophisticated ATS systems used by top private equity firms, but it also demonstrates to hiring managers that you understand their unique investment strategies and can align your experience with their specific needs.

Ready to stand out in the private equity world? Let's transform your resume from a standard document into a compelling pitch that showcases exactly why you're the ideal candidate for each specific role!

Don't let a lack of direct experience hold you back from pursuing your dream career as a Private Equity Analyst!

Your resume can showcase your potential by highlighting your financial coursework, analytical skills, and relevant internships or case competitions that demonstrate your understanding of deal analysis and financial modeling.

Focus on highlighting your quantitative abilities, financial knowledge, and any experience with valuation or deal analysis - even if from academic projects.

For detailed guidance on structuring your resume, check out the Student Resume Writing Guide to ensure you're positioning yourself effectively for this competitive field.

Your resume summary is your chance to showcase your financial acumen, analytical capabilities, and relevant internships that make you an ideal candidate for private equity.

Focus on highlighting your educational excellence, investment-related projects, and any experience with financial modeling or deal analysis to demonstrate your readiness for this competitive field.

"Detail-oriented and highly analytical finance graduate with comprehensive experience in investment analysis and financial modeling through prestigious internships and academic projects. Demonstrated expertise in conducting due diligence, building complex financial models, and performing market research across multiple industries. Leverages strong quantitative skills and a deep understanding of valuation methodologies to identify investment opportunities. Seeking to apply my analytical capabilities and passion for deal-making as a Private Equity Analyst."

Now's your chance to showcase the rigorous academic foundation that makes you an exceptional Private Equity Analyst candidate!

Transform your educational background into compelling content by highlighting relevant coursework like "Advanced Financial Modeling"and impactful projects such as your investment thesis presentations or deal analysis case studies.

unavailableRelevant Coursework: Investment Analysis | Financial Modeling | Corporate Finance | Mergers & Acquisitions | Private Markets | Valuation Methods

Key Projects:

Private Equity Investment Analysis Case Study: Led a comprehensive valuation and due diligence project on a mid-market healthcare company, developing a complete investment thesis and recommendation for potential acquisition.

Portfolio Company Optimization Project: Collaborated with a team of four to develop strategic initiatives for value creation in a simulated portfolio company scenario.

Leverage your academic foundation, internship experiences, and financial modeling expertise to create a compelling skills section that showcases your readiness for private equity analysis through both technical capabilities and analytical prowess.

As an aspiring Private Equity Analyst, your combination of technical skills and analytical capabilities positions you well for a career in this dynamic field, where opportunities for growth and advancement are abundant for those who demonstrate strong foundational knowledge.

Let's face it - translating complex deal experience, financial modeling expertise, and investment outcomes into a compelling career story isn't easy, especially when you're competing against other top-tier candidates.

At Resume Target, we specialize in crafting resumes that make Private Equity Analysts stand out in this ultra-competitive field, having helped hundreds of finance professionals land roles at leading firms.

Our deep understanding of PE recruiting cycles means we know exactly how to position your deal experience, quantitative skills, and strategic insights to catch a hiring manager's attention.

With year-end recruiting season approaching fast and firms already building their candidate pipelines, now is the perfect time to elevate your resume - let's connect for a free consultation today.

Impress any hiring manager with our Finance resume writing service. We work with all career levels and types of Finance professionals.

Learn More → Finance Resume Writing Services