Standing out in banking takes more than just counting money accurately. Many bank tellers struggle to showcase their customer service excellence and financial expertise on paper.

Are you finding it hard to get noticed by hiring managers? Your resume needs to highlight both your technical skills and your ability to build trust with customers. A well-crafted resume can transform your job search from frustrating to successful.

Resume Target specializes in helping bank tellers demonstrate their true value to employers. We'll show you how to present your cash handling expertise, customer service skills, and banking knowledge in a way that gets you more interviews.

As the frontline financial professionals of the banking world, bank tellers handle over $126 billion in daily transactions while serving as the friendly face of their financial institution.

Your role combines precise transaction processing—from cashing checks to handling foreign currency exchanges—with exceptional customer service skills, ensuring each client's banking needs are met with accuracy and professionalism.

While many start their financial careers as tellers, this position offers valuable exposure to banking operations and can lead to advancement opportunities in personal banking, loan processing, or branch management—making it an excellent stepping stone for your future in finance.

Let's talk about what's exciting in the world of banking careers! As a Bank Teller, your earning potential can grow significantly as you gain experience and expand your expertise. The financial services industry values dedicated professionals who combine customer service excellence with precise money handling skills, and your compensation will reflect your growing capabilities.

Figures from: U.S. Bureau of Labor Statistics

Starting as a bank teller opens doors to exciting financial career paths. With experience and dedication, you can progress from teller to leadership roles like branch manager or financial advisor.

To accelerate your banking career, you'll need to master both technical and interpersonal skills that go beyond basic transaction processing.

- Financial software proficiency - Cash handling and balancing expertise - Risk assessment and fraud detection - Customer relationship managementBreaking into a bank teller career is accessible with a high school diploma and strong math skills, plus many banks offer paid training programs to help you master the essential banking procedures.

To succeed as a bank teller, you'll need to develop key competencies including attention to detail and customer service skills, which you can build through entry-level retail or cash-handling positions.

Requirements from Teal HQ

From bustling city centers to local branches, bank teller positions are abundant across major financial hubs and growing communities.

Figures from Bureau of Labor Statistics

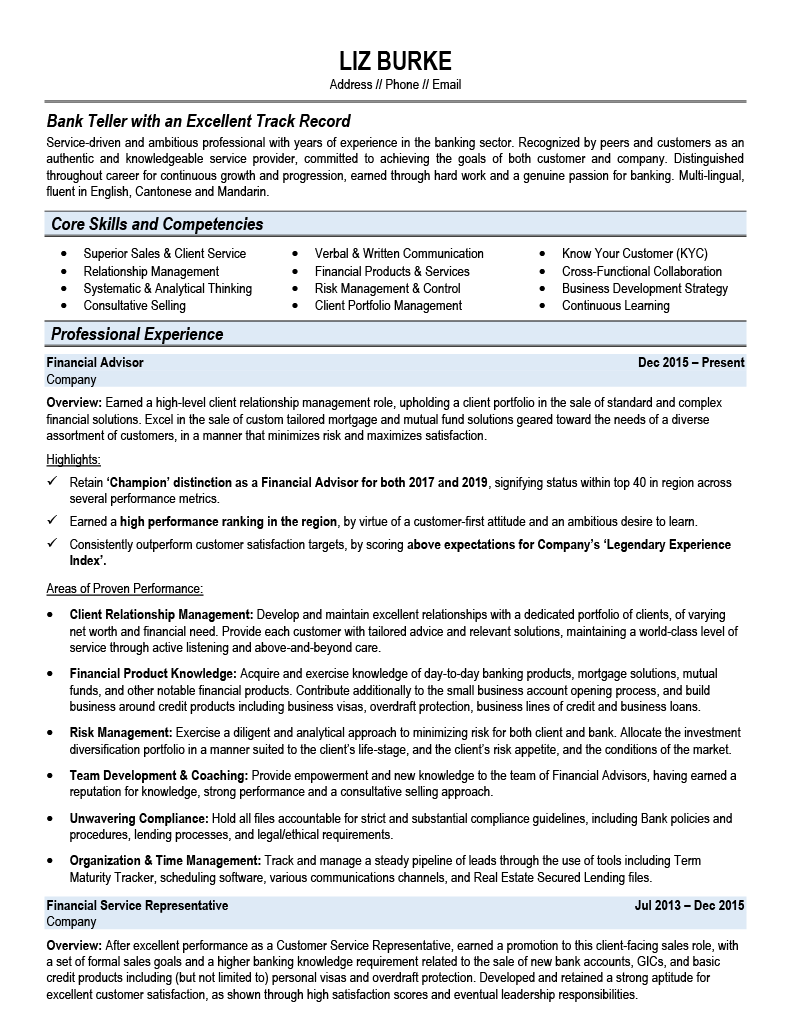

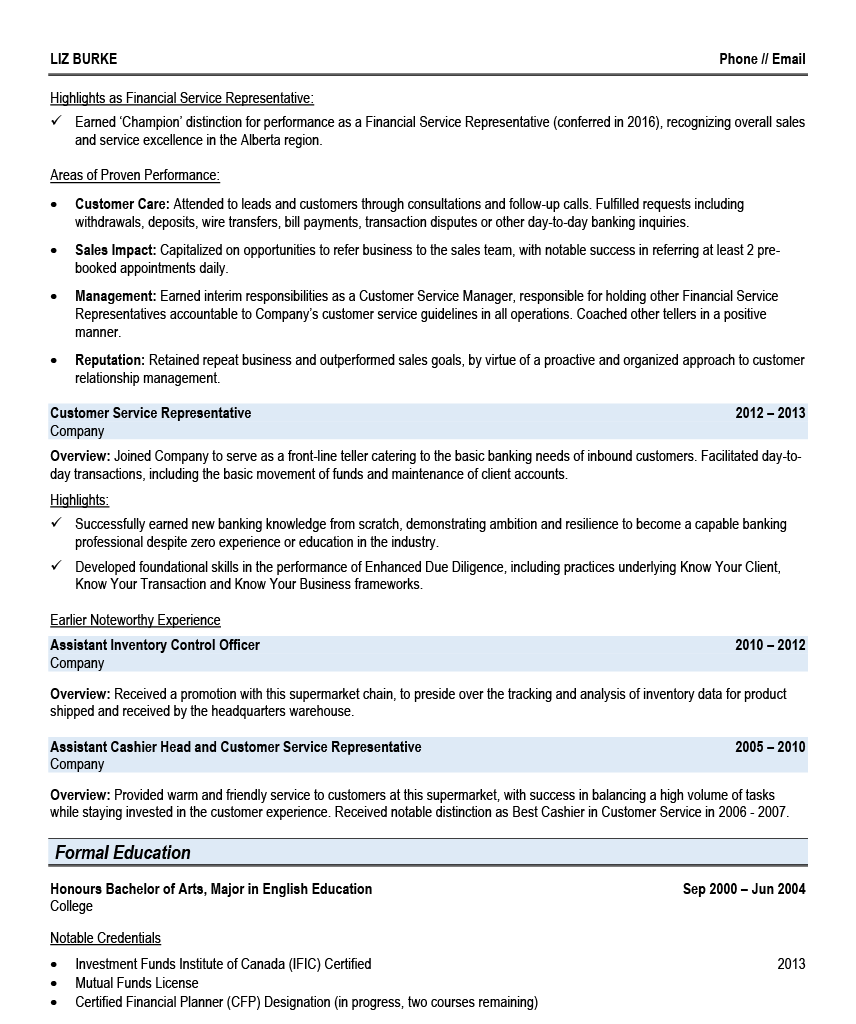

Struggling to showcase your cash handling expertise, customer service skills, and banking knowledge in a way that catches a hiring manager's eye? This comprehensive, section-by-section guide will walk you through creating a professional bank teller resume that highlights your most relevant achievements and capabilities.

Writing a compelling resume summary can feel as challenging as balancing a complex transaction, especially when you're trying to showcase your customer service excellence and financial accuracy in just a few sentences.

While you may handle thousands of dollars and countless customer interactions with ease each day, translating those valuable banking skills into a powerful written summary requires a different approach that helps hiring managers immediately recognize your potential.

How would you describe your overall approach to providing financial services and maintaining customer relationships in a banking environment?

Reason: This helps establish your service philosophy and customer-centric mindset, which are fundamental to the banking industry. It sets the tone for your entire summary by highlighting your understanding of the role's core purpose.

What combination of financial accuracy, compliance awareness, and interpersonal skills best defines your value as a Bank Teller?

Reason: This question helps you articulate your unique blend of technical and soft skills that are essential in banking, allowing you to create a well-rounded professional profile in your summary.

How has your experience in handling various banking transactions and resolving customer concerns shaped your professional identity in the financial sector?

Reason: This helps you reflect on your overall growth and expertise in the banking industry, enabling you to craft a summary that positions you as a seasoned professional rather than just listing job duties.

As a bank teller, you need to showcase both your financial transaction expertise and your customer service abilities, making it crucial to strike the right balance between technical and interpersonal skills on your resume.

From operating specialized banking software and handling large cash transactions to maintaining security protocols and building customer relationships, your skill set should reflect the diverse responsibilities you manage daily at the teller window.

Showcase your financial service excellence by organizing your experience into three powerful sections: a concise role overview highlighting your banking environment, measurable achievements that demonstrate your cash handling and customer service wins, and core responsibilities that reflect your technical and interpersonal banking skills.

Many bank tellers struggle to demonstrate their value beyond basic transaction processing and customer service duties. Transform your daily responsibilities into powerful achievements by connecting your accuracy rates, sales figures, and customer satisfaction metrics to measurable improvements in branch performance.

A strong responsibilities section demonstrates how Bank Tellers do more than just handle cash transactions. Your role directly impacts customer satisfaction and financial accuracy, so describe your duties in ways that show both technical skills and customer service excellence.

Your education and certifications demonstrate your expertise in handling financial transactions and maintaining banking security protocols. As a Bank Teller, you should highlight relevant financial certifications and any formal education in business, finance, or related fields, listing your most recent credentials first.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing bank teller positions.

While many job seekers only customize their cover letters, tailoring your bank teller resume for each position is crucial for showcasing your specific cash handling, customer service, and financial transaction skills that match what each bank is seeking.

This targeted approach not only helps your resume successfully navigate ATS systems that screen for specific banking keywords, but it also demonstrates to hiring managers that you understand their unique needs and have the exact experience they're looking for in their next bank teller.

Ready to stand out from other candidates? Let's turn your resume into a laser-focused presentation that proves you're the perfect fit for each bank teller position you target!

Don't let a lack of banking experience hold you back! Your journey to becoming a Bank Teller can start with highlighting your customer service background, cash handling skills, and relevant coursework.

Even without direct banking experience, you can create an impressive resume by showcasing your attention to detail, mathematical accuracy, and any retail or customer-facing roles you've held.

Focus on highlighting your numerical abilities, customer service excellence, and security awareness in your resume.

For a complete breakdown of how to present your qualifications, check out the Student Resume Writing Guide to create a resume that banks will notice.

Your resume summary is your chance to showcase your customer service mindset, cash handling experience, and relevant coursework in finance or business.

Even without direct banking experience, you can highlight your trustworthiness, attention to detail, and passion for helping customers with their financial needs.

"Detail-oriented and customer-focused professional with hands-on experience in cash handling and transaction processing through retail and volunteer work. Demonstrated track record of accuracy in money handling, basic accounting, and delivering exceptional customer service. Completed coursework in business mathematics and financial services fundamentals. Seeking to leverage strong mathematical aptitude and interpersonal skills to provide outstanding service as a Bank Teller while ensuring precise transaction processing and regulatory compliance."

Now's your chance to showcase how your educational background has prepared you for success in banking and financial services!

Don't just list your degree - highlight relevant coursework like Business Math or Money Management, and include any banking certifications, cash handling training, or customer service projects that demonstrate your readiness to excel as a bank teller.

Common courses for Bank Teller certifications include specific required courses from the ABA Bank Teller Certificate and the ICBA Teller Specialist Certificate Program.Relevant Coursework: Banking Operations Fundamentals | Cash Handling Procedures | Customer Service Excellence | Financial Transaction Processing | Fraud Detection & Prevention | Regulatory Compliance

Key Projects:

Banking Simulation Project: Participated in a comprehensive banking operations simulation that replicated real-world transaction scenarios and customer service challenges, resulting in 100% accuracy in cash handling and compliance procedures.

Customer Service Excellence Workshop: Led a team-based project focused on improving customer interaction scenarios and resolving complex banking inquiries efficiently.

Transform your academic knowledge, cash handling experience, and customer service background into compelling skills that showcase your readiness for a banking career, drawing from coursework, part-time jobs, or volunteer experience.

As an aspiring Bank Teller, your combination of customer service abilities and attention to detail positions you well for a rewarding career in banking, where opportunities for advancement are abundant as you gain experience.

Let's face it - trying to showcase your customer service excellence and cash handling expertise on paper can feel like trying to fit your whole career into a tiny deposit slip. It's frustrating when you know you're great with people and numbers, but struggle to make those daily interactions sound meaningful on your resume.

At Resume Target, we specialize in crafting resumes for banking professionals that highlight both your technical accuracy and your human touch.

We've helped countless bank tellers transform their daily transactions and customer interactions into powerful success stories that hiring managers love to see.

With banks actively seeking qualified tellers who can deliver exceptional service while maintaining strict compliance standards, now is the perfect time to upgrade your resume - let's schedule your free consultation today.

Impress any hiring manager with our banking resume writing service. We work with all career levels and types of banking professionals.

Learn More → Banking Resume Writing Services