Numbers tell stories, but most investment banking resumes read like bland financial statements. Your deal experience deserves more than a basic transaction list.

Are you struggling to stand out in a sea of identical banking resumes? You need a document that showcases both your technical expertise and your ability to drive successful deals.

Resume Target helps investment bankers transform complex deal histories into compelling career stories. We'll help you craft a resume that speaks directly to what managing directors want to see, turning your experience into your next career-defining opportunity.

At the intersection of corporate strategy and financial markets, investment bankers serve as the architects of major business deals, helping companies raise critical capital through securities issuance and mergers and acquisitions.

These financial strategists spend their days analyzing market conditions, structuring complex deals, and building detailed financial models while working closely with corporate executives to understand their strategic goals and craft solutions that align with their business objectives.

If you're interested in a career that combines high-stakes decision-making with sophisticated financial analysis, the path to becoming an investment banker offers tremendous growth potential, typically progressing from analyst to associate, vice president, and eventually managing director roles.

Let's talk about what makes Investment Banking such an exciting career path - the earning potential is truly remarkable! Your compensation can grow substantially as you advance, with entry-level positions offering competitive base salaries that can multiply several times over as you gain experience and expertise in the field.

Figures from: PayScale

Starting as an analyst, you can climb the investment banking ladder through dedication and proven deal-making abilities. Your path can lead from junior roles to managing major transactions and leading teams within 10-15 years.

Beyond basic financial knowledge, your success in investment banking depends on mastering advanced technical skills and building strong client relationships.

- Financial Modeling and Valuation - Risk Assessment and Management - Deal Structuring and Execution - Leadership and Client Relationship ManagementLaunch your investment banking career by combining strong financial analysis skills with key certifications like the CFA, while building valuable experience through internships at major financial institutions.

To position yourself for success in investment banking, you'll need to develop strong financial analysis and modeling skills while pursuing essential licenses and certifications.

• Investment Banking Analyst • Junior Financial Analyst • Research Associate • Investment Banking Summer Associate • Credit Analyst • Junior Portfolio Manager • Investment Banking Operations Associate • Risk Management Analyst • Corporate Banking Analyst • Private Equity AnalystRequirements from Teal HQ

From Wall Street to emerging financial hubs, investment banking opportunities span major metros and key industry sectors.

Figures from Selby Jennings

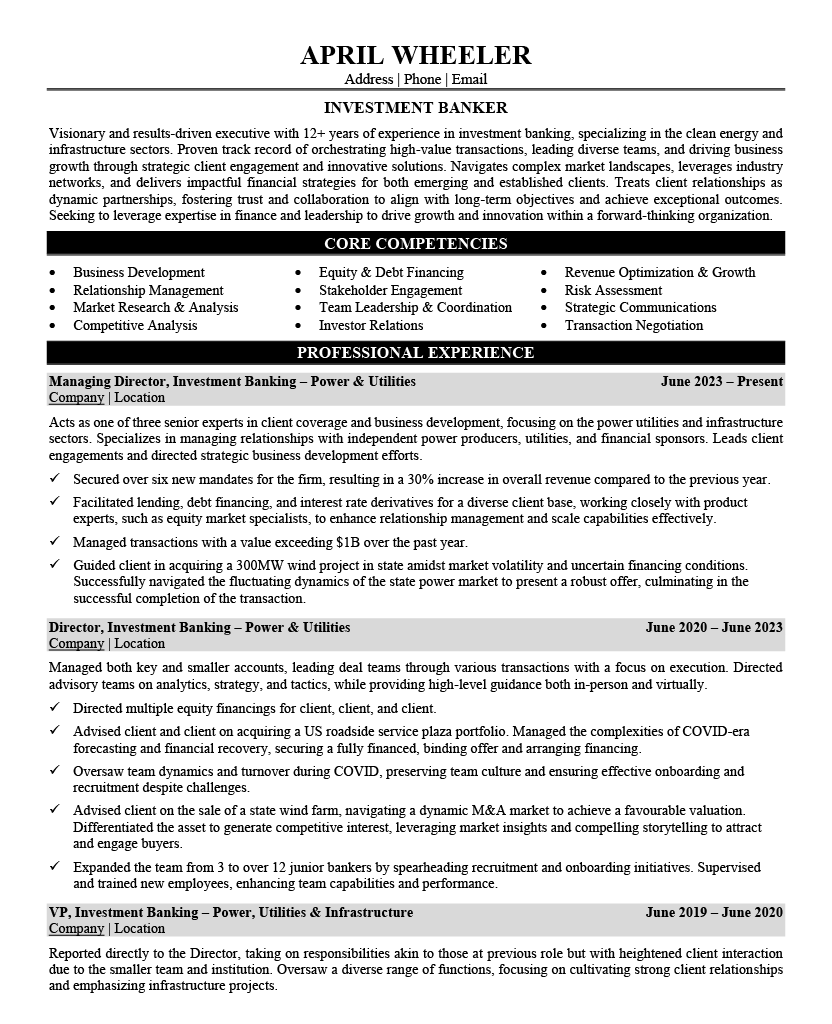

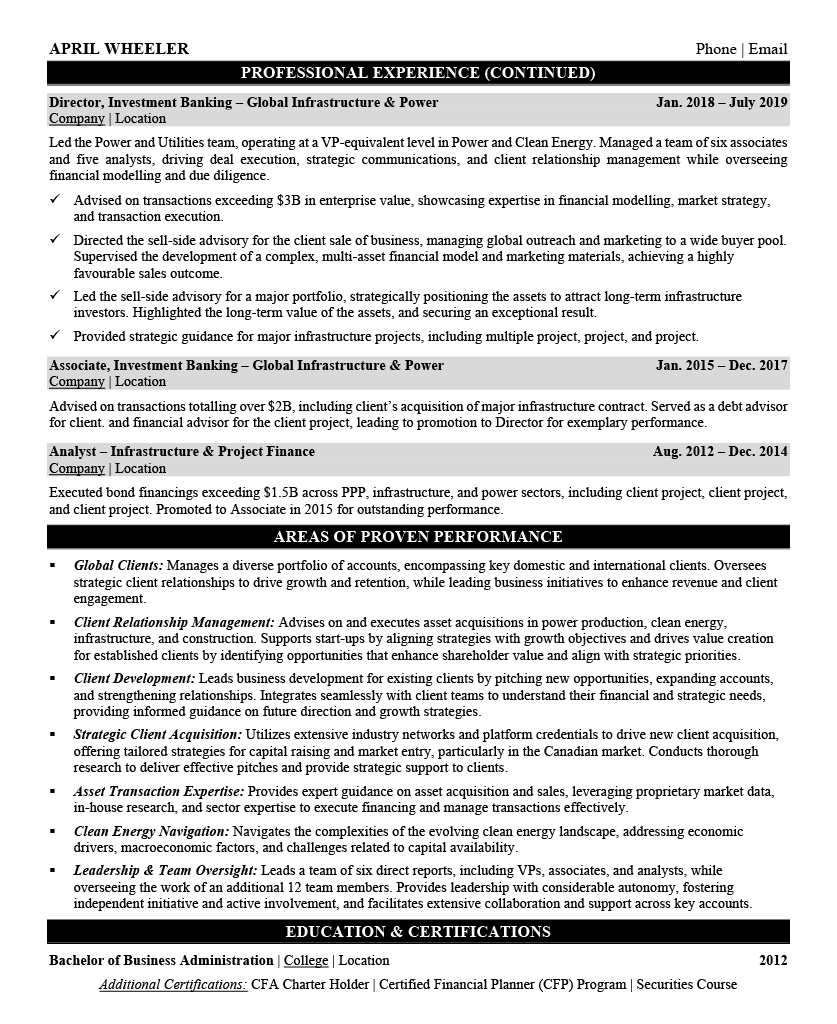

Struggling to distill years of complex financial deals, market analysis, and client relationships into a compelling investment banker resume that stands out to top firms? This comprehensive, section-by-section guide will walk you through exactly how to showcase your deal experience, quantify your achievements, and present your skills in a format that hiring managers at leading investment banks want to see.

If you're like most investment banking professionals, crafting the perfect resume summary feels more challenging than building complex financial models or closing major M&A deals.

While you excel at analyzing market trends, valuing companies, and executing high-stakes transactions, translating these sophisticated skills into a compelling 3-4 line summary requires a strategic approach that speaks directly to what hiring managers at top firms are seeking.

How would you characterize your expertise across different types of financial transactions (M&A, IPOs, debt offerings) and what is your primary market focus (regional, national, or global deals)?

Reason: This establishes your scope of practice and deal expertise immediately, helping readers understand your market positioning and transaction capabilities within investment banking.

What would you say distinguishes your approach to client relationships and deal execution from other investment banking professionals in your space?

Reason: This helps articulate your unique value proposition and professional philosophy, setting the tone for how you deliver results in a highly competitive industry.

How would you describe your progression through increasingly complex deal structures and your development of industry sector expertise throughout your career?

Reason: This demonstrates your professional evolution and depth of expertise, showing how you've grown to handle more sophisticated transactions and developed valuable industry knowledge.

As an investment banking professional, you'll need to showcase both your technical financial expertise and your deal execution capabilities, while demonstrating the soft skills that make you effective in high-pressure client situations.

Your skills section should highlight your proficiency in financial modeling and valuation, alongside your experience with specific transaction types (M&A, IPOs, debt offerings) and your command of essential tools like Excel, Bloomberg, and FactSet.

Examples of Investment Banker Skills: Financial Modeling & Valuation - DCF Analysis - LBO Modeling - Comparable Company Analysis - Precedent Transaction Analysis Deal Execution - Mergers & Acquisitions - IPO Execution - Debt Offerings - Due Diligence - Deal Structuring Technical Skills - Advanced Excel - Bloomberg Terminal - FactSet - Capital IQ - PowerPoint Soft Skills - Client Relationship Management - Team Leadership - Project Management - Strategic Thinking - Communication - Time Management - Attention to Detail Industry Knowledge - Market Analysis - Industry Research - Financial Markets - Regulatory Compliance - Risk AssessmentShowcase your financial expertise by structuring your experience into three powerful segments: a high-level deal overview, quantifiable transaction achievements, and core banking responsibilities that highlight your ability to drive value for clients and execute complex financial transactions.

Many investment banking professionals struggle to distinguish themselves in a competitive field where deal values and transaction volumes often look similar on paper. Transform your experience into compelling proof of value by connecting each achievement to specific revenue gains, cost savings, and successful deal completions that showcase your strategic advisory capabilities.

The responsibilities section demonstrates how Investment Bankers create value through complex financial transactions and strategic advisory services. Your role description should translate technical financial work into clear business impacts while showing how you contribute to successful deals and client relationships.

Your educational background and professional certifications are crucial differentiators in investment banking, where top-tier credentials often open doors to premier opportunities. Focus on highlighting your relevant financial certifications and degrees from accredited institutions, especially those that demonstrate your expertise in financial modeling, valuation, and deal structuring.

Now that you've created a strong foundation using Resume Target's proven resume writing guidelines, you're ready to transform your resume into a powerful tool for landing investment banking interviews.

While many candidates focus solely on customizing their cover letters, tailoring your resume for specific investment banking positions is crucial for standing out in this highly competitive field.

A customized resume not only helps you navigate through sophisticated ATS systems used by top financial institutions but also demonstrates to hiring managers that you understand their unique needs and can align your experience with their specific investment banking requirements.

Ready to turn your resume into your secret weapon? Let's make every word count and position you as the standout candidate investment banks are searching for!

Don't let a lack of Wall Street experience hold you back! You can launch your career as an Investment Banker by crafting a resume that showcases your analytical mindset and financial acumen.

Instead of dwelling on unrelated work history, focus on highlighting your relevant coursework, internships, and any financial modeling or valuation projects you've completed.

Your resume should emphasize three key elements: your quantitative skills, financial knowledge, and leadership potential.

For more detailed guidance on structuring your entry-level resume, check out the Student Resume Writing Guide to ensure you're presenting yourself as a promising candidate.

Your resume summary is your chance to showcase your financial acumen, analytical capabilities, and relevant internships that make you an ideal candidate for investment banking.

Focus on highlighting your academic excellence, financial modeling skills, and any experience with valuation or deal analysis to demonstrate your readiness for this demanding role.

"Detail-oriented and highly analytical finance graduate with comprehensive training in financial modeling and investment analysis through prestigious internships at leading investment banks. Demonstrated excellence in valuation analysis, financial statement modeling, and pitch book creation during summer analyst role. Proven track record of working effectively under pressure with cross-functional teams on multiple deals simultaneously. Seeking to leverage strong quantitative skills and passion for M&A to deliver exceptional value as an Investment Banking Analyst."

Now's your chance to showcase the rigorous financial education that prepared you for investment banking success - don't just list your degree, bring your academic achievements to life!

Transform your coursework and projects into compelling content by highlighting relevant classes like "Financial Modeling"or "Mergers & Acquisitions,"and featuring team projects where you analyzed real companies or built complex valuation models.

The following courses are common for a degree/certification for Investment Bankers: Advanced Valuation and Strategy - M&A, Private Equity, and Venture Capital, Private Equity and Venture Capital, Wall Street Mojo Free Investment Banking Course, Essential Career Skills for Investment Banking and Finance, Introduction to Valuation and Investing, M&A Science Academy, Certified Financial Model and Valuation Analyst Certification (FMVA), International Mergers and Acquisitions Expert, Investment Banking Certification: Online, Alternative Investments, Financial analysis, Accounting, Economics, Corporate finance, Financial modeling, and Investment theory [1] [2].Relevant Coursework: Advanced Valuation and Strategy | Financial Modeling | Corporate Finance | Investment Theory | Financial Analysis | Alternative Investments

Key Projects:

M&A Valuation Analysis Project: Led a comprehensive valuation study of a mid-cap technology company acquisition, developing detailed financial models and presenting strategic recommendations for the transaction.

Private Equity Investment Case Study: Collaborated with a team of four to evaluate a potential leveraged buyout opportunity in the healthcare sector, focusing on market analysis and financial structuring.

Leverage your academic foundation, internship experiences, and technical proficiencies to create a compelling skills section that showcases your readiness for investment banking, incorporating both financial expertise and analytical capabilities gained through coursework and practical training.

As an aspiring investment banker, your combination of technical skills and analytical capabilities positions you well for a career in investment banking, where continuous learning and professional growth opportunities abound in this dynamic financial sector.

Let's face it - translating complex deal structures, financial models, and transaction values into compelling career achievements can feel like trying to explain quantum physics to a five-year-old.

At Resume Target, we specialize in crafting powerful narratives for investment banking professionals, having helped hundreds of analysts and associates land roles at top-tier institutions.

Our deep understanding of the banking industry means we know exactly how to position your experience with M&A deals, LBOs, and IPOs in a way that resonates with hiring managers.

With bonus season approaching and banks actively recruiting, now is the perfect time to ensure your resume stands out from the crowd - let's connect today to transform your banking experience into a compelling career story.

Impress any hiring manager with our banking resume writing service. We work with all career levels and types of banking professionals.

Learn More → Banking Resume Writing Services