Bank Clerk

Resume Sample

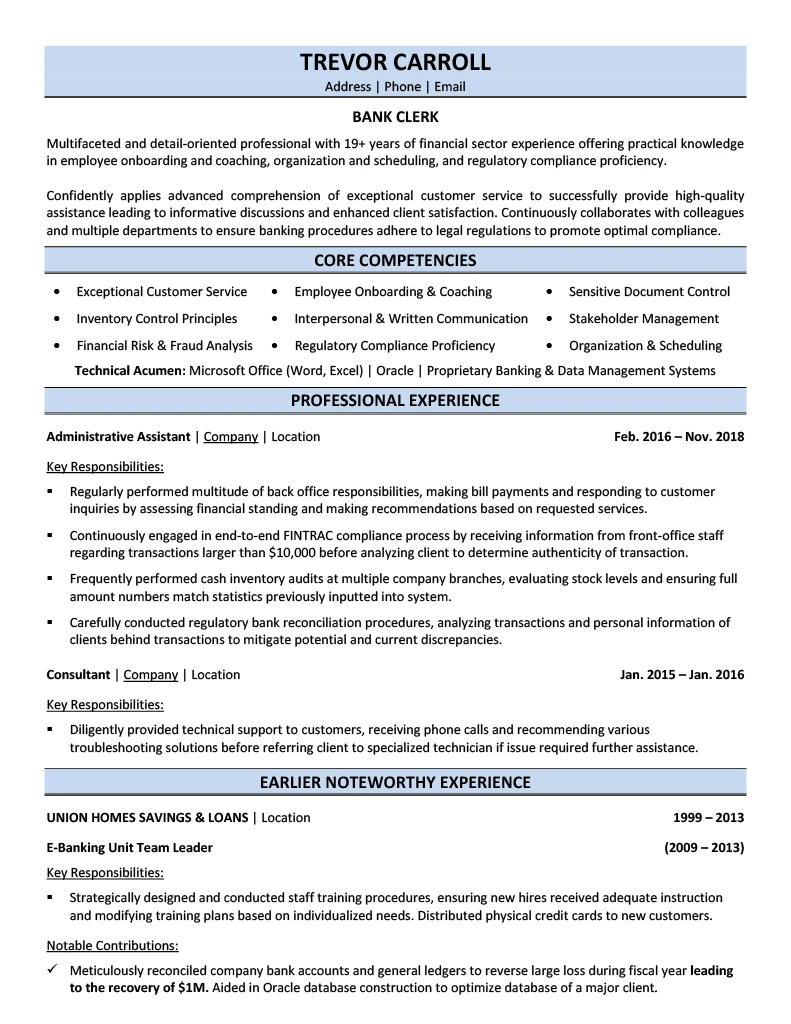

A real resume example showing how we transform experience into interview-winning proof.

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Bank Clerk Resume?

Hiring managers reading Bank Clerk resumes want proof of impact that matters for this role. They scan for evidence of Organization, discretion, communication that show you have moved the needle in previous roles. Sara's resume works because every bullet connects an action to a measurable business outcome. That is what separates a resume that gets interviews from one that gets filed away.

Why Do Bank Clerk Resumes

Get Rejected?

Most bank clerk resumes get rejected not because of ATS software, but because they don't prove you're better than the other 56 applicants. Generic bullets like "Worked in the field" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

This bullet works because it connects a specific action to a measurable result. Hiring managers can immediately see the scope of the challenge, the approach taken, and the business impact delivered. It answers the question: what changed because Sara was there?

This bullet works because it connects a specific action to a measurable result. Hiring managers can immediately see the scope of the challenge, the approach taken, and the business impact delivered. It answers the question: what changed because Sara was there?

This bullet works because it connects a specific action to a measurable result. Hiring managers can immediately see the scope of the challenge, the approach taken, and the business impact delivered. It answers the question: what changed because Sara was there?

How Do Administrative Resume Writers Transform a Bank Clerk Resume?

Professional resume writers transform bank clerk resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Bank Clerk Job Postings

We identify exactly what hiring managers search for:

- Core technical skills and domain expertise required

- Leadership and team management expectations

- Industry certifications and compliance standards

- Tools, systems, and methodologies employers mention

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Specific results and outcomes you've delivered

- Team sizes and stakeholders you've managed

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Revenue generated, costs saved, or budgets managed

- Percentage improvements in efficiency or quality

- Scale of operations, projects, or portfolios

- Time saved or deadlines consistently met

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering results under pressure and tight deadlines

- Leading teams and managing cross-functional stakeholders

- Driving improvements in processes and outcomes

- Bringing specialized expertise competitors lack

What Does a Bank Clerk Resume Interview Look Like?

A bank clerk resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Implemented Microsoft Office resulting in 45% efficiency gain using Microsoft Office, resulting in 15% improvement in exec satisfaction department-wide.

Every bullet on this resume was created through this same process.

Schedule Your InterviewHave questions? 1-877-777-6805

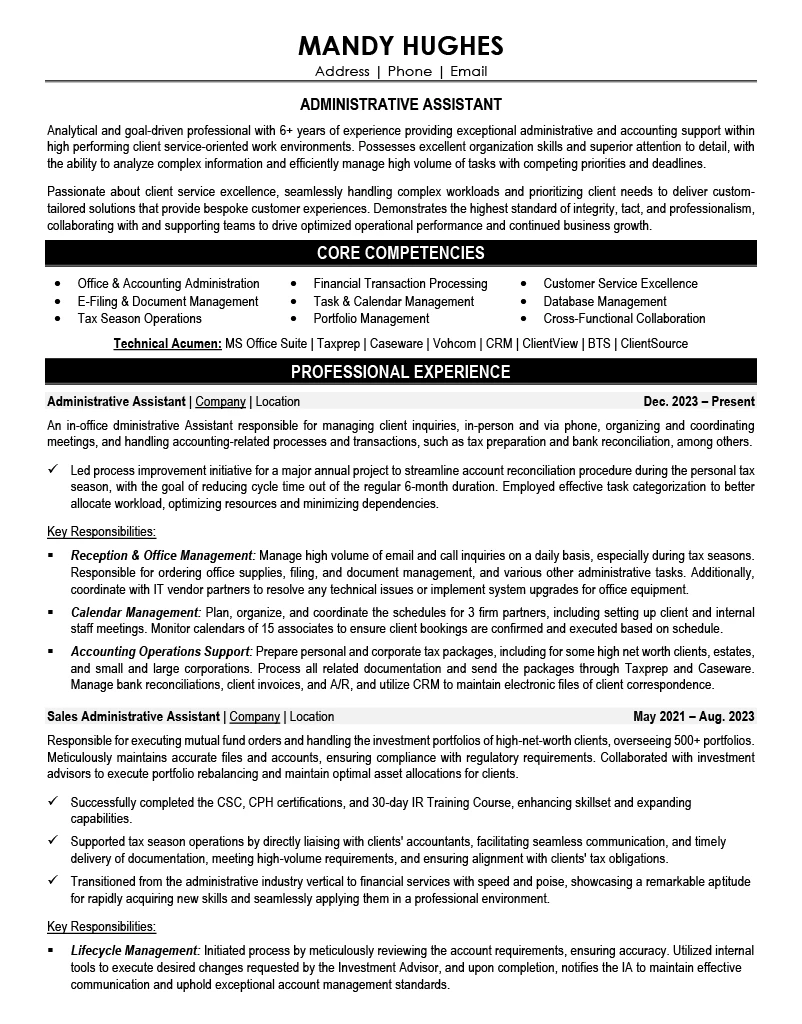

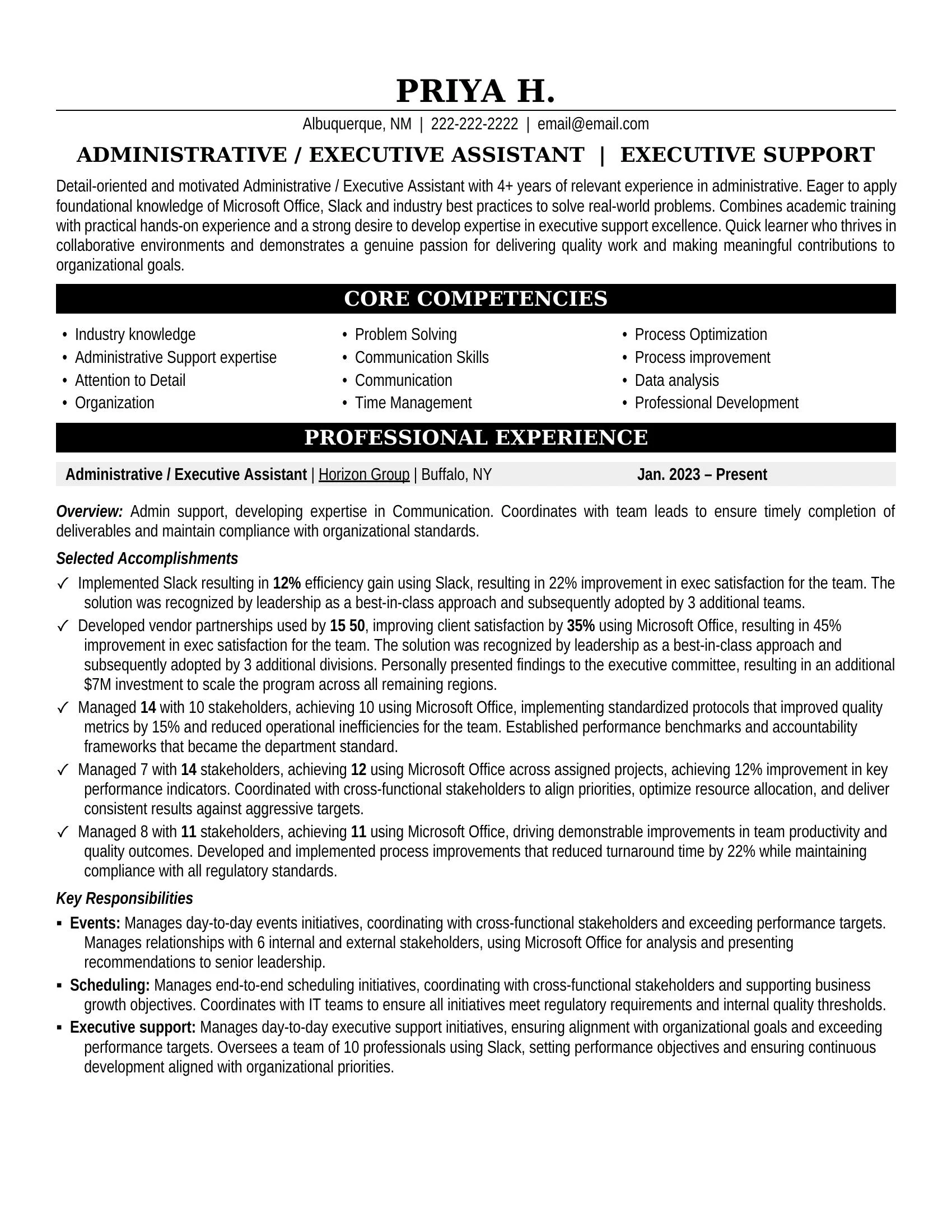

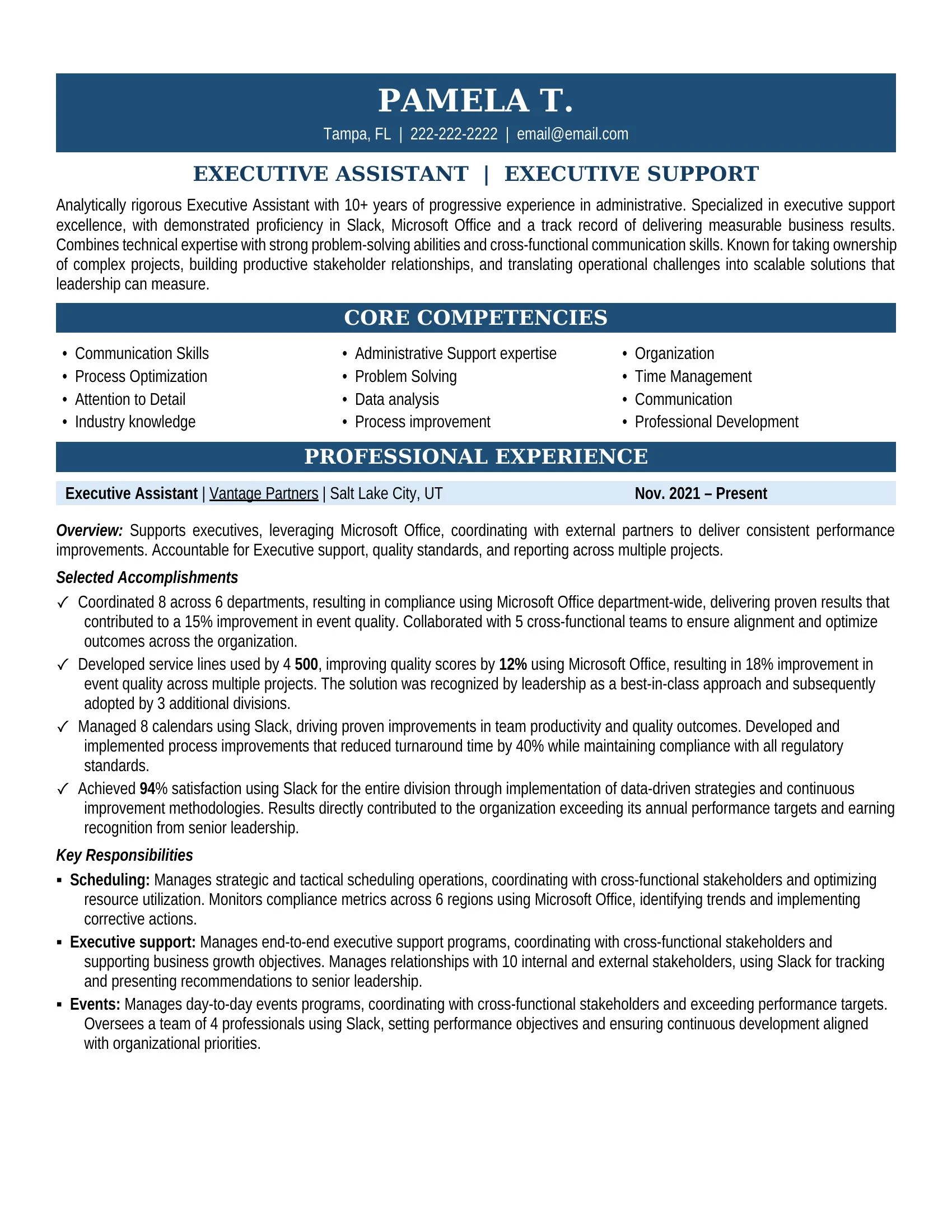

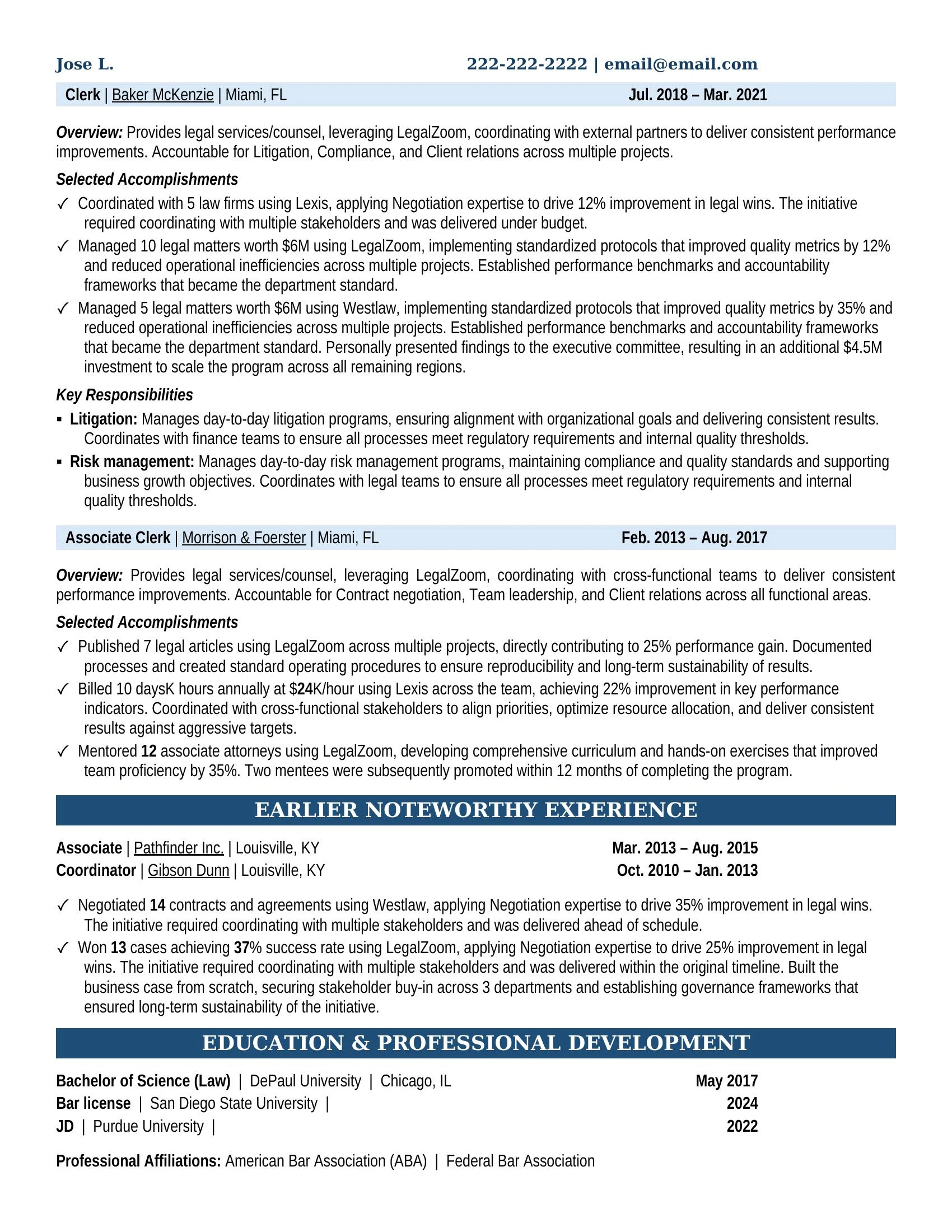

What a Bank Clerk Resume Example That Gets Interviews Looks Like

A complete bank clerk resume is typically 2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's both pages of an actual resume created through our interview process.

Which Bank Clerk Resume Example

Do You Need?

The bank clerk resume you need depends on your career stage:

Moving INTO a Bank Clerk Role

Your resume needs to prove event quality through projects and early wins.

Questions We Ask in Your Interview:

- What is the largest project or team you have had responsibility for?

- Which parts of the bank clerk role have you already been doing informally?

- What does your current manager trust you to handle independently?

- When have you stepped in to solve a problem above your current level?

What We Highlight on Your Resume:

- Data analysis

- Time Management

- Communication

- Attention to Detail

Advancing as a Bank Clerk

Your resume needs to demonstrate event quality and team leadership.

Questions We Ask in Your Interview:

- What is your specialty—the area where you are THE go-to person?

- What is the most complex challenge you have handled?

- If I called your best reference, what would set you apart?

- What can you do that other bank clerks at your level cannot?

What We Highlight on Your Resume:

- Strategic leadership

- Team development

- Process optimization

- Business impact

How Do You Write a Bank Clerk Resume That Gets Interviews?

To write a bank clerk resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Most "how to write a resume" guides give you generic templates. We show you the exact questions our expert writers ask to extract achievements you would never think to include.

What Should A Bank Clerk Put in Their Professional Summary?

Your summary must immediately signal your level, specialization, and biggest proof points in 3-4 lines.

A Bank Clerk professional summary should include your years of experience, core area of specialization, scope of responsibility, and your biggest proof point. Lead with what makes you different from every other bank clerk with similar tenure.

For someone moving into a bank clerk role, we position you as ready for increased responsibility.

Expert Questions We Ask:

- "What is the largest project, team, or budget you have had significant responsibility for?"

- "Which parts of the bank clerk role have you already been doing informally?"

- "What has your current manager trusted you to handle independently?"

- "When have you stepped in to solve a problem above your current level?"

For an experienced bank clerk, we differentiate you from every other candidate with similar tenure.

Expert Questions We Ask:

- "What is your specialty - the area where you are the go-to person?"

- "What is the most complex challenge you have handled and what made it complex?"

- "If I called your best reference, what would they say sets you apart?"

- "What can you do that most bank clerks at your level cannot?"

What Skills Should A Bank Clerk Resume Include?

Skills sections fail when they are generic lists. We identify the specific technical and leadership skills that match your target roles.

A Bank Clerk resume should balance technical expertise with leadership and business skills. Include Slack, Microsoft Office alongside evidence of communication, problem-solving, and strategic thinking.

For advancement, we show you already have bank clerk skills - just applied in a different capacity.

Expert Questions We Ask:

- "What tools and software have you used in your administrative work?"

- "What certifications do you have or are you working toward?"

- "What business skills complement your technical expertise?"

- "How do you communicate complex concepts to non-technical stakeholders?"

For senior bank clerk roles, we focus on strategic and leadership competencies beyond technical skills.

Expert Questions We Ask:

- "What is the largest team size and budget you have managed simultaneously?"

- "Have you been involved in business development or strategic planning?"

- "What leadership methodologies or frameworks do you apply?"

- "Do you have experience with P&L responsibility or profit accountability?"

How Do You Write Bank Clerk Work Experience?

Every bullet must prove impact with specific projects, dollar values, and measurable outcomes.

Write Bank Clerk work experience using the Problem-Solution-Result format. Each bullet should include: the challenge faced, the action you took, and the measurable result. Every bullet must answer the question: what changed because I was there?

We extract achievements that prove you have already been doing bank clerk work - just without the title.

Expert Questions We Ask:

- "Tell me about a project where you influenced the outcome beyond your formal role."

- "When did you resolve conflicts or navigate competing priorities?"

- "What is an example of a problem you identified before your supervisor did?"

- "Have you ever trained new team members or led others through a complex initiative?"

- "What process or system improvement have you led or contributed to?"

We dig for strategic achievements that separate you from bank clerks who just list responsibilities.

Expert Questions We Ask:

- "What is a situation you rescued - one that was failing when you took it over?"

- "How have you improved processes that benefited the whole organization?"

- "Tell me about a difficult stakeholder relationship you turned around."

- "What is your track record on delivering results - can we quantify it?"

- "Have you mentored others who were later promoted or recognized?"

What Certifications Do Bank Clerks Need on Their Resume?

Beyond degrees, we identify credentials and training that signal expertise to hiring managers in your field.

Bank Clerk resumes should feature relevant certifications and credentials prominently. Industry-specific certifications signal expertise to hiring managers and can differentiate you from candidates with similar experience.

For advancement, certifications often matter more than degrees - they show career investment.

Expert Questions We Ask:

- "What is your highest level of education and was it related to your field?"

- "Do you have any industry-specific certifications?"

- "Have you taken any professional development courses through your employer?"

- "Are you working toward any advanced certifications or credentials?"

For senior roles, we highlight credentials that demonstrate strategic capability.

Expert Questions We Ask:

- "Do you have advanced certifications relevant to your target roles?"

- "Have you completed any executive education or leadership development programs?"

- "Do you hold any board positions, committee memberships, or industry affiliations?"

- "What continuing education have you completed recently?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Bank Clerk Achievements?

A professional resume interview extracts bank clerk achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Bank Clerk Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

- Students / New Grads

- Specialists, Analysts, Coordinators

- Targeting mid-level positions

Telephone Interview

- Individual Contributors

- Managers

- Career Changers

- Seeking Promotions

- Masters / Ph.D Holders

Telephone Interview

- Senior Managers

- Directors

- Department Heads

- Senior Writer Assigned

Telephone Interview

- Vice Presidents

- C-Suite Executives

- Business Owners

- Senior Writer Assigned

- Executive Resume Format

How Competitive Is the

Bank Clerk Job Market?

Bank Clerk jobs are Moderately competitive, averaging 57 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 1,140 candidates for the same jobs.

Bank Clerk Job

Jobs Posted (30 Days)

Per 20 Applications

Hardest to Land

Most competitive administrative rolesEasier to Land

Less competitive administrative rolesData based on LinkedIn job postings, updated February 2026. View full job market data →

Here's the math most job seekers don't do:

Your resume needs to stand out against 1,140 other administrative professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Reach Administrative's Hidden Job Market

80% of administrative positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Administrative Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 400+ recruiters specializing in administrative — included in Advanced & Ultimate packages.

Robert Half

Nationwide

Hays Recruitment

Nationwide

Sample Administrative Recruiters

400+ Total| Agency | Location |

|---|---|

RH Robert Half |

Nationwide |

HR Hays Recruitment |

Nationwide |

KF Korn Ferry |

Nationwide |

SS Spencer Stuart |

Nationwide |

AG Apex Group |

Nationwide |

Frequently Asked Questions About

Bank Clerk Resumes

Ready to Transform Your Resume?

Schedule your 60-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an Advisor 1-877-777-6805