Bank Teller

Resume Sample

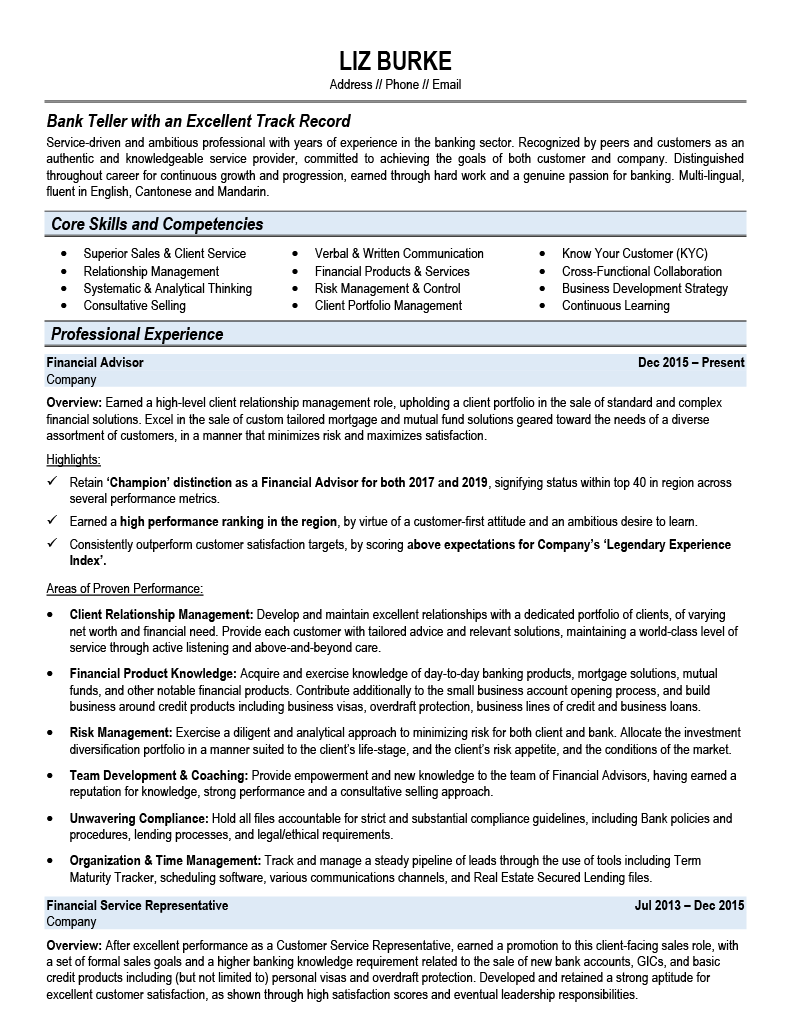

A real resume example showing customer service excellence

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Bank Teller Resume?

A Bank Teller resume must prove customer service excellence, sales capability, and compliance awareness. This sample demonstrates Champion distinction with top 40 regional ranking and Legendary Experience Index scores.

Why Do Bank Teller Resumes

Get Rejected?

Most bank teller resumes get rejected not because of ATS software, but because they don't prove you're better than the other 24.2 applicants. Generic bullets like "managed construction projects" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

Earned a high performance ranking in the region, by virtue of a customer-first attitude and an ambitious desire to learn."

Champion distinction with specific years provides undeniable proof of performance.

Client Relationship Management: Develop and maintain excellent relationships with a dedicated portfolio of clients through active listening and above-and-beyond care."

Named metric with "above expectations" shows measurable excellence.

Contribute to small business account opening and build business around credit products including business visas, overdraft protection, and business loans."

Shows breadth from personal to small business banking.

How Do Banking Resume Writers Transform a Bank Teller Resume?

Professional resume writers transform bank teller resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Bank Teller Job Postings

We identify exactly what hiring managers search for:

- Budget management and cost control requirements

- Schedule recovery and timeline management skills

- Site safety compliance and OSHA standards

- Subcontractor coordination and vendor management

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Project values and budgets you've managed

- Team sizes and subcontractors you've coordinated

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Dollar values of projects completed on time

- Percentage of schedule improvements achieved

- Cost savings from value engineering decisions

- Safety record improvements and incident reductions

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering projects on time despite site challenges

- Managing subcontractors and maintaining quality

- Controlling costs while meeting specifications

- Leading teams through complex project phases

What Does a Bank Teller Resume Interview Look Like?

A bank teller resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Retain 'Champion' distinction as a Financial Advisor for both 2017 and 2019, signifying status within top 40 in region across several performance metrics.

Earned a high performance ranking in the region, by virtue of a customer-first attitude and an ambitious desire to learn.

Every bullet on this resume was created through this same process.

Schedule Your InterviewHave questions? Array

What a Bank Teller Resume Example That Gets Interviews Looks Like

A complete bank teller resume is typically 1-2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's an actual resume created through our interview process.

Which Bank Teller Resume Example

Do You Need?

The bank teller resume you need depends on your career stage:

Career Entry

Prove customer service aptitude and numerical accuracy.

Questions We Ask in Your Interview:

- What cash handling experience?

What We Highlight on Your Resume:

- Customer service

- Cash handling

Senior Transition

Differentiate through sales performance and product knowledge.

Questions We Ask in Your Interview:

- What sales achievements?

What We Highlight on Your Resume:

- Performance rankings

- Client relationships

How Do You Write a Bank Teller Resume That Gets Interviews?

To write a bank teller resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Bank teller resumes must balance customer service with sales capability.

What Should a Bank Teller Put in Their Summary?

Signal customer focus and sales capability.

Lead with service orientation and key achievements.

Entry-level...

Expert Questions We Ask:

- "What customer service experience?"

Experienced...

Expert Questions We Ask:

- "What rankings achieved?"

What Skills Should a Bank Teller Highlight?

Show service and sales capability.

Lead with Superior Sales, Relationship Management, Financial Products, Risk Management.

Entry-level...

Expert Questions We Ask:

- "What customer service skills?"

Experienced...

Expert Questions We Ask:

- "What sales skills?"

How Should Experience Be Described?

Performance rankings are essential.

Lead with role overview, then achievements with metrics.

Building...

Expert Questions We Ask:

- "What transactions handled?"

Experienced...

Expert Questions We Ask:

- "What rankings?"

What Education Matters?

Certifications demonstrate commitment.

List banking certifications and relevant education.

New...

Expert Questions We Ask:

- "What education?"

Established...

Expert Questions We Ask:

- "What certifications?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Bank Teller Achievements?

A professional resume interview extracts bank teller achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Bank Teller Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

How Competitive Is the

Bank Teller Job Market?

Bank Teller jobs are lowly competitive, averaging 25.2 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 504 candidates for the same jobs.

Bank Teller Job

Jobs Posted (30 Days)

Per 20 Applications

Hardest to Land

Most competitive banking rolesEasier to Land

Less competitive banking rolesData based on LinkedIn job postings, updated January 2026. View full job market data →

Here's the math most job seekers don't do:

Your resume needs to stand out against 504 other banking professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Banking Professionals We've Helped Are Now Working At

From general contractors to specialty trades, our clients land roles at top banking firms across North America.

Reach Banking's Hidden Job Market

80% of banking positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Banking Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 450+ recruiters specializing in banking — included in Advanced & Ultimate packages.

Banking Recruiters

Nationwide

Sample Banking Recruiters

450+ Total| Agency | Location |

|---|---|

BR Banking Recruiters |

Nationwide |

Frequently Asked Questions About

Bank Teller Resumes

Highlight customer service excellence, cash handling, sales performance, and compliance awareness.

Track performance rankings, satisfaction scores, and accuracy rates.

Essential: Customer Service, Cash Handling, Sales, Compliance, Product Knowledge.

Multi-lingual capability is a significant differentiator.

Bank tellers can advance to Personal Banker, Financial Advisor, or Branch Manager.

Bank teller roles are moderately competitive.

Ready to Transform Your Resume?

Schedule your 30-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an Advisor Array