Liability & Insurance Lawyer

Resume Sample

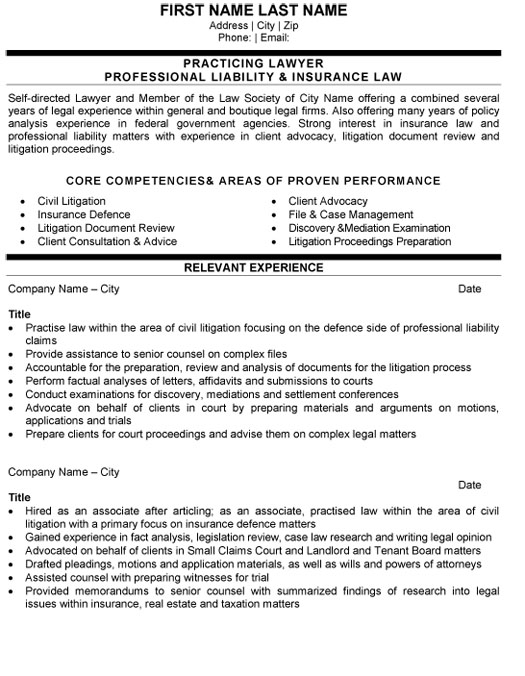

A real resume example showing how we transform litigation experience and insurance defence into proof firms trust

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Liability & Insurance Lawyer Resume?

A Liability & Insurance Lawyer resume must prove you can defend professional liability claims, conduct discovery examinations, and prepare cases for trial. Employers scan for civil litigation experience, insurance defence focus, and court advocacy. This sample demonstrates how interview-extracted achievements showcase insurance law expertise.

Why Do Liability & Insurance Lawyer Resumes

Get Rejected?

Most liability & insurance lawyer resumes get rejected not because of ATS software, but because they don't prove you're better than the other 43 applicants. Generic bullets like "managed construction projects" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

Accountable for the preparation, review and analysis of documents for the litigation process.

Perform factual analyses of letters, affidavits and submissions to courts.

Conduct examinations for discovery, mediations and settlement conferences."

This shows complete litigation capability: "defence side" establishes practice area positioning. Document preparation demonstrates file management. "Factual analyses" shows analytical skill. Discovery examinations and mediations show independent practice capability. Settlement conferences demonstrate negotiation exposure.

Prepare clients for court proceedings and advise them on complex legal matters.

Advocated on behalf of clients in Small Claims Court and Landlord and Tenant Board matters.

Assisted counsel with preparing witnesses for trial."

This shows courtroom capability: motions, applications, and trials demonstrate full litigation exposure. "Prepare clients" shows client management. Small Claims Court and Landlord and Tenant Board provide specific venues. Witness preparation shows trial preparation experience. Range of courts demonstrates versatility.

Gained experience in fact analysis, legislation review, case law research and writing legal opinion.

Drafted pleadings, motions and application materials, as well as wills and powers of attorneys.

Provide assistance to senior counsel on complex files."

This shows research and drafting capability: memorandums demonstrate synthesis skills. Multiple practice areas (insurance, real estate, taxation) show versatility. "Legal opinion" writing shows analytical depth. Drafting pleadings and motions shows procedural knowledge. Senior counsel assistance positions for advancement.

How Do Legal Resume Writers Transform a Liability & Insurance Lawyer Resume?

Professional resume writers transform liability & insurance lawyer resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Liability & Insurance Lawyer Job Postings

We identify exactly what hiring managers search for:

- Budget management and cost control requirements

- Schedule recovery and timeline management skills

- Site safety compliance and OSHA standards

- Subcontractor coordination and vendor management

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Project values and budgets you've managed

- Team sizes and subcontractors you've coordinated

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Dollar values of projects completed on time

- Percentage of schedule improvements achieved

- Cost savings from value engineering decisions

- Safety record improvements and incident reductions

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering projects on time despite site challenges

- Managing subcontractors and maintaining quality

- Controlling costs while meeting specifications

- Leading teams through complex project phases

Listen to a Real Resume Interview

Hear how our writers extract legal practice achievements through targeted questions.

What Does a Liability & Insurance Lawyer Resume Interview Look Like?

A liability & insurance lawyer resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Practise law within the area of civil litigation focusing on the defence side of professional liability claims.

Accountable for the preparation, review and analysis of documents for the litigation process.

Perform factual analyses of letters, affidavits and submissions to courts.

Conduct examinations for discovery, mediations and settlement conferences.

Every bullet on this resume was created through this same process.

Schedule Your InterviewHave questions? 1-877-777-6805

Watch How We Transformed Khoi's Resume

See how our interview process uncovered achievements that generic templates miss.

Get Your Resume Transformed

What a Liability & Insurance Lawyer Resume Example That Gets Interviews Looks Like

A complete liability & insurance lawyer resume is typically 1-2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's an actual resume created through our interview process.

Which Liability & Insurance Lawyer Resume Example

Do You Need?

The liability & insurance lawyer resume you need depends on your career stage:

Career Advancement

Your resume needs to prove litigation capability, independent file management, and courtroom advocacy.

Questions We Ask in Your Interview:

- What litigation experience have you gained?

- What court appearances have you made?

What We Highlight on Your Resume:

- Professional liability defence focus

- Discovery and mediation examinations

- Small Claims Court advocacy

Senior Advancement

Your resume needs to demonstrate complex file management, senior counsel support, and specialized expertise.

Questions We Ask in Your Interview:

- What complex matters have you handled?

- What specialized expertise have you developed?

What We Highlight on Your Resume:

- Assistance to senior counsel on complex files

- Trial preparation and witness preparation

- Research memorandums on specialized issues

How Do You Write a Liability & Insurance Lawyer Resume That Gets Interviews?

To write a liability & insurance lawyer resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Most "how to write a resume" guides give you generic templates. We interview you to extract specific achievements. Here's what we focus on for Liability & Insurance Lawyers:

What Should a Liability & Insurance Lawyer Put in Their Summary?

Your summary must establish credentials, experience breadth, and practice area focus. Law Society membership confirms good standing. Both firm types (general and boutique) show versatility. Government policy experience adds unique perspective. Practice area focus (insurance law, professional liability) positions for specialized roles.

Include professional status (Self-directed Lawyer and Member of the Law Society), experience scope (combined several years of legal experience within general and boutique legal firms), additional background (many years of policy analysis experience in federal government agencies), and practice focus (strong interest in insurance law and professional liability matters with experience in client advocacy, litigation document review and litigation proceedings).

For associates seeking advancement:

Expert Questions We Ask:

- "What litigation experience have you gained?"

- "What practice areas have you developed?"

For lawyers seeking partnership or in-house:

Expert Questions We Ask:

- "What complex matters have you handled?"

- "What client relationships have you developed?"

What Competencies Should Insurance Lawyers Highlight?

Your competencies must demonstrate complete litigation capability. Insurance Defence establishes practice focus. Discovery & Mediation Examination shows procedural experience. Client Advocacy validates court presence. File & Case Management demonstrates organizational capability essential for growing responsibility.

Lead with practice areas (Civil Litigation, Insurance Defence), then litigation skills (Litigation Document Review, Litigation Proceedings Preparation, Discovery & Mediation Examination), then client skills (Client Advocacy, Client Consultation & Advice, File & Case Management).

Litigation skills establish foundation:

Expert Questions We Ask:

- "What discovery have you conducted?"

- "What court appearances have you made?"

Client skills enable advancement:

Expert Questions We Ask:

- "What client relationships do you manage?"

- "What complex files have you led?"

How Should Insurance Lawyers Structure Experience?

Insurance lawyer experience must show complete litigation capability from research through trial. Practice area focus establishes specialization. Specific litigation activities demonstrate hands-on experience. Multiple court venues show versatility. Senior counsel support positions for advancement.

Lead with practice area focus (civil litigation, professional liability defence). Document litigation activities (document preparation, factual analysis, discovery examinations). Include court advocacy (motions, applications, trials, Small Claims Court). Show research capability (memorandums, legal opinions). Note senior counsel support (complex files, witness preparation).

Show litigation range:

Expert Questions We Ask:

- "What proceedings have you handled?"

- "What courts have you appeared in?"

Demonstrate leadership:

Expert Questions We Ask:

- "What files have you managed independently?"

- "What mentoring have you provided?"

What Credentials Matter for Insurance Lawyers?

For practising lawyers, credentials confirm eligibility to practise. Law Society membership establishes good standing. Articling completion shows Canadian qualification path. Jurisdiction matters for cross-border practice. Specialized insurance training (if any) adds credibility for practice area focus.

Include Law Society membership (Member of the Law Society). Note articling completion (hired as associate after articling). Document call to the bar jurisdiction. Include law school and any specialized training in insurance or professional liability.

Credentials establish eligibility:

Expert Questions We Ask:

- "Which Law Society are you a member of?"

- "What specialized training have you completed?"

Advanced credentials support advancement:

Expert Questions We Ask:

- "What designations have you earned?"

- "What jurisdictions are you called in?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Liability & Insurance Lawyer Achievements?

A professional resume interview extracts liability & insurance lawyer achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Liability & Insurance Lawyer Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

How Competitive Is the

Liability & Insurance Lawyer Job Market?

Liability & Insurance Lawyer jobs are moderately competitive, averaging 44 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 880 candidates for the same jobs.

Liability & Insurance Lawyer Job

Jobs Posted (30 Days)

Per 20 Applications

Hardest to Land

Most competitive legal rolesEasier to Land

Less competitive legal rolesData based on LinkedIn job postings, updated January 2026. View full job market data →

Here's the math most job seekers don't do:

Your resume needs to stand out against 880 other legal professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Legal Professionals We've Helped Are Now Working At

From general contractors to specialty trades, our clients land roles at top legal firms across North America.

Reach Legal's Hidden Job Market

80% of legal positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Legal Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 120+ recruiters specializing in legal — included in Advanced & Ultimate packages.

Legal Recruitment Partners

Toronto, ON

Insurance Law Search

New York, NY

Sample Legal Recruiters

120+ Total| Agency | Location |

|---|---|

LRP Legal Recruitment Partners |

Toronto, ON |

ILS Insurance Law Search |

New York, NY |

LCR Litigation Counsel Recruiters |

Chicago, IL |

Frequently Asked Questions About

Liability & Insurance Lawyer Resumes

A strong insurance lawyer resume should highlight practice area focus (professional liability defence, insurance defence), litigation skills (discovery examinations, mediations, trial preparation), court advocacy (motions, applications, Small Claims Court), and research capability (memorandums, legal opinions). Include Law Society membership and articling completion.

Document specific litigation activities: "conduct examinations for discovery, mediations and settlement conferences." Show document work: "preparation, review and analysis of documents for the litigation process." Include court advocacy: "preparing materials and arguments on motions, applications and trials." Range of activities demonstrates complete litigation capability.

Insurance defence positions see moderate competition. Practice area focus on professional liability differentiates from general litigators. Government policy experience adds unique perspective. Court advocacy experience validates trial readiness. Research and writing samples demonstrate analytical capability for interviews.

Yes—policy analysis transfers to legal practice. "Many years of policy analysis experience in federal government agencies" demonstrates legislative understanding. Insurance law involves regulatory compliance and policy interpretation. Government experience shows analytical skills and understanding of administrative processes that inform insurance defence strategy.

Document complex file involvement: "provide assistance to senior counsel on complex files." Show research contribution: "memorandums to senior counsel with summarized findings of research." Include witness preparation: "assisted counsel with preparing witnesses for trial." Supporting senior counsel demonstrates partnership track potential.

Balance litigation skills (Civil Litigation, Insurance Defence, Litigation Document Review, Litigation Proceedings Preparation) with advocacy skills (Client Advocacy, Discovery & Mediation Examination) and client skills (Client Consultation & Advice, File & Case Management). This demonstrates complete insurance defence practice capability.

Ready to Transform Your Resume?

Schedule your 45-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an Advisor 1-877-777-6805