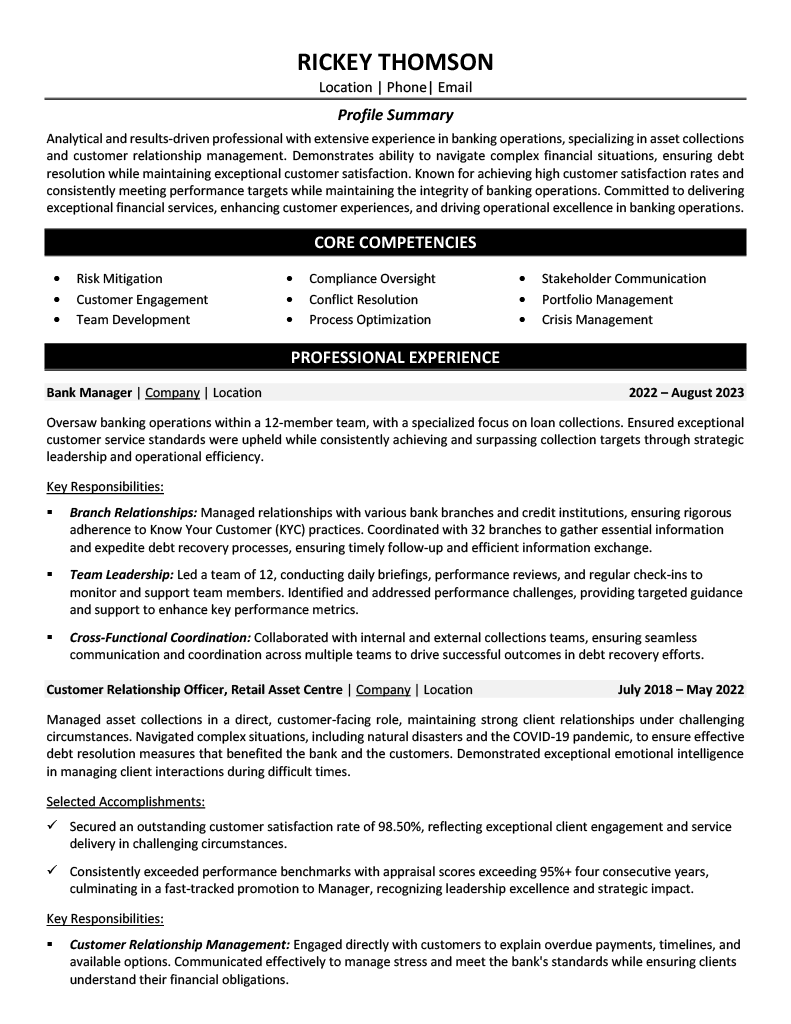

Bank Manager

Resume Sample

A real resume example showing how we transform banking leadership into proof employers trust

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Bank Manager Resume?

A Bank Manager resume must prove both operational leadership and customer service excellence. Hiring managers scan for team management experience, compliance knowledge, and performance metrics. This sample demonstrates 98.50% customer satisfaction, 12-member team leadership, and coordination across 32 branches.

Why Do Bank Manager Resumes

Get Rejected?

Most bank manager resumes get rejected not because of ATS software, but because they don't prove you're better than the other 41 applicants. Generic bullets like "managed construction projects" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

Navigated complex situations, including natural disasters and the COVID-19 pandemic, to ensure effective debt resolution measures that benefited the bank and the customers."

We quantified the satisfaction rate (98.50%) and contextualized the difficulty — collections is inherently challenging, and COVID-19 amplified that. This shows the candidate can maintain service excellence under pressure, a critical trait for bank managers.

We documented four years of 95%+ performance — this shows sustained excellence, not a single good quarter. The "fast-tracked promotion" language signals that senior leadership identified high potential. This positions the candidate for further advancement.

Coordinated with 32 branches to gather essential information and expedite debt recovery processes, ensuring timely follow-up and efficient information exchange."

We quantified the coordination scope (32 branches) and tied it to compliance (KYC). This demonstrates ability to manage at scale while maintaining regulatory standards — exactly what regional manager roles require. The debt recovery context adds revenue impact.

How Do Management Resume Writers Transform a Bank Manager Resume?

Professional resume writers transform bank manager resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Bank Manager Job Postings

We identify exactly what hiring managers search for:

- Budget management and cost control requirements

- Schedule recovery and timeline management skills

- Site safety compliance and OSHA standards

- Subcontractor coordination and vendor management

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Project values and budgets you've managed

- Team sizes and subcontractors you've coordinated

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Dollar values of projects completed on time

- Percentage of schedule improvements achieved

- Cost savings from value engineering decisions

- Safety record improvements and incident reductions

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering projects on time despite site challenges

- Managing subcontractors and maintaining quality

- Controlling costs while meeting specifications

- Leading teams through complex project phases

Listen to a Real Resume Interview

Hear how our writers extract team leadership and performance metrics from banking managers.

What Does a Bank Manager Resume Interview Look Like?

A bank manager resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Secured an outstanding customer satisfaction rate of 98.50%, reflecting exceptional client engagement and service delivery in challenging circumstances.

Navigated complex situations, including natural disasters and the COVID-19 pandemic, to ensure effective debt resolution measures that benefited the bank and the customers.

Every bullet on this resume was created through this same process.

Schedule Your InterviewWatch How We Transformed This Manager Resume

See how our interview process uncovered leadership achievements and customer service excellence.

Get Your Resume Transformed

What a Bank Manager Resume Example That Gets Interviews Looks Like

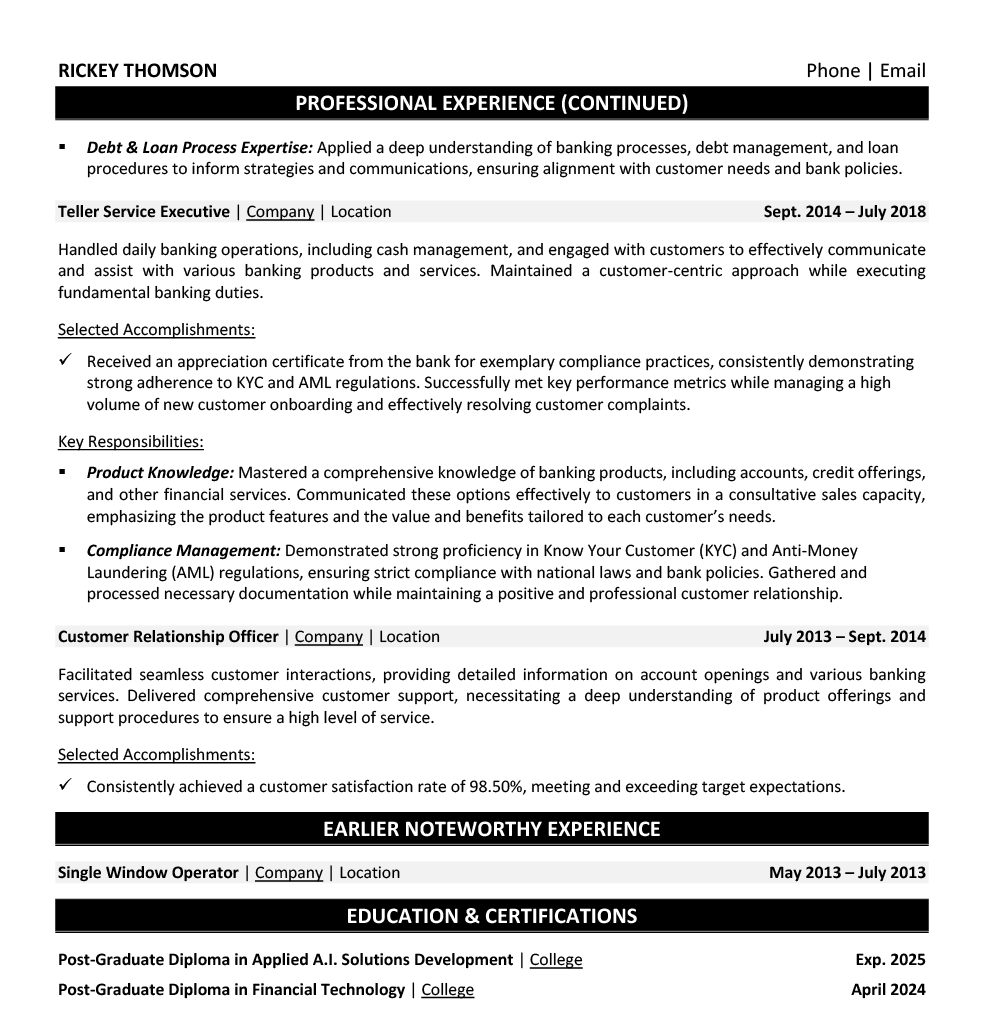

A complete bank manager resume is typically 2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's both pages of an actual resume created through our interview process.

Which Bank Manager Resume Example

Do You Need?

The bank manager resume you need depends on your career stage:

Career Advancement

Your resume needs to prove readiness for team leadership, compliance oversight, and P&L accountability.

Questions We Ask in Your Interview:

- What customer satisfaction metrics have you achieved?

- How have you demonstrated leadership potential in your current role?

What We Highlight on Your Resume:

- Consistent performance exceeding targets

- Compliance knowledge and customer relationship management

Senior Transition

Your resume needs to differentiate you through multi-branch oversight, strategic initiatives, and business development.

Questions We Ask in Your Interview:

- What cross-branch coordination or regional initiatives have you led?

- How have you contributed to revenue growth or operational efficiency?

What We Highlight on Your Resume:

- Multi-branch coordination and cross-functional leadership

- Strategic impact on collections, compliance, or customer acquisition

How Do You Write a Bank Manager Resume That Gets Interviews?

To write a bank manager resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Most bank manager resumes list responsibilities without proving impact. Our interview process extracts the specific metrics, team achievements, and compliance successes that differentiate you for leadership positions.

What Should a Bank Manager Put in Their Profile Summary?

Your summary must signal leadership capability. This manager describes themselves as "Analytical and results-driven professional with extensive experience in banking operations, specializing in asset collections and customer relationship management."

Lead with your banking specialization and results orientation. Highlight customer satisfaction track record, compliance expertise, and commitment to operational excellence.

For officers seeking their first manager role...

Expert Questions We Ask:

- "What customer satisfaction metrics have you achieved?"

- "How have you demonstrated leadership in your current position?"

For managers targeting regional or director roles...

Expert Questions We Ask:

- "What multi-branch coordination have you led?"

- "How have you contributed to strategic initiatives beyond your branch?"

What Skills Should a Bank Manager Highlight?

Skills must show you can lead both operations and people. This resume includes Stakeholder Communication and Portfolio Management alongside Team Development — demonstrating readiness for senior roles.

Balance operational skills with leadership: Risk Mitigation, Compliance Oversight, Process Optimization. Include people skills: Customer Engagement, Team Development, Conflict Resolution, Crisis Management.

Customer-facing skills prove relationship management ability...

Expert Questions We Ask:

- "What product knowledge do you have across banking services?"

- "How do you handle difficult customer situations?"

Strategic skills differentiate senior managers...

Expert Questions We Ask:

- "What cross-functional coordination have you led?"

- "How do you optimize branch or regional performance?"

How Should a Bank Manager Describe Their Experience?

Every role needs specific achievements. This resume shows "98.50% customer satisfaction," "12-member team," "32 branches coordinated," and "95%+ appraisals for four consecutive years." Numbers prove impact.

Structure each role with overview, selected accomplishments (with checkmarks), and key responsibilities. Quantify team size, branch coordination scope, and performance metrics.

Show progression in responsibility and scope...

Expert Questions We Ask:

- "What increasingly complex portfolios have you managed?"

- "How has your customer base or team size grown?"

Demonstrate strategic and cross-functional impact...

Expert Questions We Ask:

- "What process improvements have you implemented?"

- "How have you contributed to compliance or efficiency initiatives?"

What Education Matters for Bank Managers?

Education should signal both foundational knowledge and continuous learning. Pursuing emerging technology credentials (AI, fintech) demonstrates forward-thinking leadership appropriate for evolving banking environments.

Include relevant degrees and industry certifications. Modern banking values fintech knowledge — this resume shows Post-Graduate Diplomas in Financial Technology and Applied A.I. Solutions Development.

Entry credentials establish baseline qualification...

Expert Questions We Ask:

- "What banking or finance degrees do you hold?"

- "Have you completed compliance or product certifications?"

Advanced credentials differentiate senior candidates...

Expert Questions We Ask:

- "What leadership or management certifications do you have?"

- "How are you staying current with fintech and digital banking?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Bank Manager Achievements?

A professional resume interview extracts bank manager achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Bank Manager Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

How Competitive Is the

Bank Manager Job Market?

Bank Manager jobs are moderately competitive, averaging 42 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 840 candidates for the same jobs.

Bank Manager Job

Jobs Posted (30 Days)

Per 20 Applications

Here's the math most job seekers don't do:

Your resume needs to stand out against 840 other management professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Management Professionals We've Helped Are Now Working At

From general contractors to specialty trades, our clients land roles at top management firms across North America.

Reach Management's Hidden Job Market

80% of management positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Management Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 400+ recruiters specializing in management — included in Advanced & Ultimate packages.

Robert Half Finance

New York, NY

Banking Recruiters

Charlotte, NC

Sample Management Recruiters

400+ Total| Agency | Location |

|---|---|

RH Robert Half Finance |

New York, NY |

BR Banking Recruiters |

Charlotte, NC |

MP Michael Page Banking |

Chicago, IL |

Frequently Asked Questions About

Bank Manager Resumes

Your resume must demonstrate team leadership, customer service excellence, and compliance expertise. Include specific metrics like this sample's 98.50% customer satisfaction rate, team size (12 members), and coordination scope (32 branches). Highlight KYC/AML compliance knowledge and crisis management experience.

The bank manager market shows 42 applicants per position. Competition is highest at major banks in financial centers. Differentiate yourself through documented performance metrics, compliance certifications, and demonstrated career progression like this candidate's fast-tracked promotion.

Quantify your team scope and management activities. This resume specifies led a team of 12, conducting daily briefings, performance reviews, and regular check-ins. Include how you identified and addressed performance challenges and provided targeted guidance to enhance team metrics.

KYC (Know Your Customer) and AML (Anti-Money Laundering) are essential. This resume highlights receiving an appreciation certificate for exemplary compliance practices and demonstrating strong proficiency in KYC and AML regulations. Show you understand national laws and bank policies.

Absolutely — it demonstrates resilience and adaptability. This resume specifically mentions navigating natural disasters and the COVID-19 pandemic while maintaining customer satisfaction and effective debt resolution. Crisis management capability is highly valued in banking leadership.

Very important — banks want to see you've grown within the industry. This resume shows clear progression from Single Window Operator → Customer Relationship Officer → Teller Service Executive → CRO (Retail Asset Centre) → Bank Manager. The fast-tracked promotion from sustained 95%+ performance is particularly compelling.

Ready to Transform Your Resume?

Schedule your 60-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an AdvisorNotice: Array to string conversion in /mnt/stor7-wc2-dfw1/515502/2032202/www.resumetarget.com/web/content/includes/templates/industry-sample.php on line 1269

Array