Urban & Real Estate Economics

Resume Sample

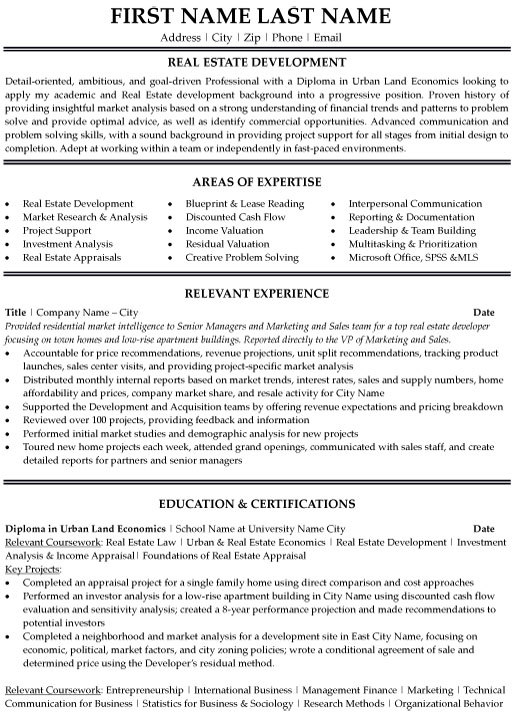

A real resume example showing how we transform academic training and market analysis experience into proof employers trust

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Urban & Real Estate Economics Resume?

An Urban & Real Estate Economics resume must prove you can analyze markets, model investments, and support development decisions. Hiring managers scan for valuation methodologies, analytical tools proficiency, and real-world project experience. This sample demonstrates how interview-extracted academic projects and internship work showcase analytical readiness.

Why Do Urban & Real Estate Economics Resumes

Get Rejected?

Most urban & real estate economics resumes get rejected not because of ATS software, but because they don't prove you're better than the other 41 applicants. Generic bullets like "managed construction projects" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

Performed initial market studies and demographic analysis for new projects. Toured new home projects each week, attended grand openings, communicated with sales staff, and created detailed reports for partners and senior managers."

This bullet quantifies scope (100+ projects) while showing the analytical depth behind the number. The combination of revenue modeling, market studies, and field research demonstrates well-rounded analytical capability. Creating reports for senior managers shows the work had real business impact.

Accountable for price recommendations, revenue projections, unit split recommendations, tracking product launches, sales center visits, and providing project-specific market analysis."

This shows the candidate wasn't just compiling data—they were synthesizing multiple market factors into strategic recommendations. Reporting to the VP of Marketing and Sales demonstrates the work reached executive level. Being "accountable for" recommendations shows ownership, not just support.

Completed a neighborhood and market analysis for a development site, focusing on economic, political, market factors, and city zoning policies; wrote a conditional agreement of sale and determined price using the Developer's residual method."

This transforms an academic project into demonstrated professional capability. The specific methodologies (DCF, sensitivity analysis, residual method) signal technical proficiency. The 8-year projection and investor recommendations show the candidate can deliver actionable outputs, not just academic exercises.

How Do Real Estate Resume Writers Transform a Urban & Real Estate Economics Resume?

Professional resume writers transform urban & real estate economics resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Urban & Real Estate Economics Job Postings

We identify exactly what hiring managers search for:

- Budget management and cost control requirements

- Schedule recovery and timeline management skills

- Site safety compliance and OSHA standards

- Subcontractor coordination and vendor management

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Project values and budgets you've managed

- Team sizes and subcontractors you've coordinated

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Dollar values of projects completed on time

- Percentage of schedule improvements achieved

- Cost savings from value engineering decisions

- Safety record improvements and incident reductions

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering projects on time despite site challenges

- Managing subcontractors and maintaining quality

- Controlling costs while meeting specifications

- Leading teams through complex project phases

Listen to a Real Resume Interview

Hear how our writers extract real estate economics achievements through targeted questions.

What Does a Urban & Real Estate Economics Resume Interview Look Like?

A urban & real estate economics resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Supported the Development and Acquisition teams by offering revenue expectations and pricing breakdown. Reviewed over 100 projects, providing feedback and information.

Performed initial market studies and demographic analysis for new projects. Toured new home projects each week, attended grand openings, communicated with sales staff, and created detailed reports for partners and senior managers.

Every bullet on this resume was created through this same process.

Schedule Your InterviewHave questions? 1-877-777-6805

Watch How We Transformed Khoi's Resume

See how our interview process uncovered achievements that generic templates miss.

Get Your Resume Transformed

What a Urban & Real Estate Economics Resume Example That Gets Interviews Looks Like

A complete urban & real estate economics resume is typically 1-2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's an actual resume created through our interview process.

Which Urban & Real Estate Economics Resume Example

Do You Need?

The urban & real estate economics resume you need depends on your career stage:

Entry-Level Positioning

Your resume needs to prove analytical capability through academic projects, internship experience, and demonstrated understanding of valuation methodologies.

Questions We Ask in Your Interview:

- What real estate analysis projects have you completed in your coursework?

- Have you used DCF, residual valuation, or other investment analysis methods?

What We Highlight on Your Resume:

- Academic projects with real-world applications (appraisals, market studies)

- Internship or work experience with developers, investors, or appraisers

- Technical skills in Excel, SPSS, MLS, and financial modeling

Career Advancement

Your resume needs to demonstrate independent analysis capability, client-facing deliverables, and influence on investment or development decisions.

Questions We Ask in Your Interview:

- What recommendations have you made that influenced investment or development decisions?

- How many projects or transactions have you analyzed?

What We Highlight on Your Resume:

- Volume of projects analyzed (100+ projects)

- Recommendations that influenced senior leadership decisions

- Reports delivered to executives or external stakeholders

How Do You Write a Urban & Real Estate Economics Resume That Gets Interviews?

To write a urban & real estate economics resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Most "how to write a resume" guides give you generic templates. We interview you to extract specific achievements. Here's what we focus on for Urban & Real Estate Economics professionals:

What Should an Urban & Real Estate Economics Professional Put in Their Professional Summary?

Your summary must signal analytical capability immediately. Generic phrases like "detail-oriented professional" waste space—specific methodologies, project volume, and deliverable types differentiate you from other economics graduates.

Include your credential (Diploma in Urban Land Economics), analytical focus (market analysis, investment analysis), relevant experience (developer, appraiser, research firm), and key differentiator (100+ projects analyzed, DCF modeling, executive-level reporting).

For new graduates entering the field:

Expert Questions We Ask:

- "What real estate analysis methodologies have you applied?"

- "What internship or project experience demonstrates your analytical capability?"

For analysts seeking advancement:

Expert Questions We Ask:

- "How many projects or transactions have you analyzed?"

- "What recommendations have you made that influenced decisions?"

What Skills Should an Urban & Real Estate Economics Professional Highlight?

Your skills must signal both technical proficiency and domain expertise. Include specific valuation methods (DCF, residual, income approach) and software platforms that show you can work in professional real estate environments.

Lead with analytical skills (investment analysis, market research, valuation methodologies), then technical tools (Excel modeling, SPSS, MLS, Argus), then domain knowledge (real estate development, appraisal, urban economics), and soft skills (reporting, communication, team collaboration).

Technical foundations establish credibility:

Expert Questions We Ask:

- "What valuation methodologies have you applied?"

- "What analytical software and tools are you proficient with?"

Advanced capabilities enable progression:

Expert Questions We Ask:

- "Have you developed proprietary models or analysis frameworks?"

- "What client-facing or executive presentations have you delivered?"

How Should an Urban & Real Estate Economics Professional Describe Their Experience?

Real estate economics experience bullets must demonstrate analytical impact. Show the chain from analysis to recommendation to decision-maker. Even entry-level work can show this progression if framed correctly.

Lead with scope (100+ projects reviewed, monthly reports to VP). Include methodologies applied (DCF, market analysis, demographic studies). Show who used your work (Senior Managers, Development team, investors). Quantify deliverables (8-year projections, price recommendations).

Show analytical capability through any relevant experience:

Expert Questions We Ask:

- "What analysis did you perform and who used the results?"

- "What recommendations did you make based on your analysis?"

Demonstrate influence on business decisions:

Expert Questions We Ask:

- "What decisions have been made based on your analysis?"

- "How has your work influenced pricing, acquisition, or development choices?"

What Education Matters for Urban & Real Estate Economics Careers?

For economics roles, your academic projects often matter as much as your degree. Present significant projects with methodology, scope, and deliverables to demonstrate you can produce professional-quality analysis.

List your degree or diploma with specialization (Urban Land Economics). Include relevant coursework that signals domain knowledge. Feature Key Projects separately—these are often more important than coursework for demonstrating practical capability.

Academic projects demonstrate capability:

Expert Questions We Ask:

- "What real estate analysis projects have you completed?"

- "What methodologies did you apply in your coursework?"

Continuing education adds credibility:

Expert Questions We Ask:

- "Are you pursuing MAI, CCIM, or other industry designations?"

- "What advanced training have you completed?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Urban & Real Estate Economics Achievements?

A professional resume interview extracts urban & real estate economics achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Urban & Real Estate Economics Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

How Competitive Is the

Urban & Real Estate Economics Job Market?

Urban & Real Estate Economics jobs are moderately competitive, averaging 42 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 840 candidates for the same jobs.

Urban & Real Estate Economics Job

Jobs Posted (30 Days)

Per 20 Applications

Hardest to Land

Most competitive real estate rolesEasier to Land

Less competitive real estate rolesData based on LinkedIn job postings, updated January 2026. View full job market data →

Here's the math most job seekers don't do:

Your resume needs to stand out against 840 other real estate professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Real Estate Professionals We've Helped Are Now Working At

From general contractors to specialty trades, our clients land roles at top real estate firms across North America.

Reach Real Estate's Hidden Job Market

80% of real estate positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Real Estate Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 220+ recruiters specializing in real estate — included in Advanced & Ultimate packages.

Real Estate Analytics Recruiters

New York, NY

Development Talent Partners

Los Angeles, CA

Sample Real Estate Recruiters

220+ Total| Agency | Location |

|---|---|

RAR Real Estate Analytics Recruiters |

New York, NY |

DTP Development Talent Partners |

Los Angeles, CA |

CAN CRE Analyst Network |

Chicago, IL |

Frequently Asked Questions About

Urban & Real Estate Economics Resumes

A strong Urban & Real Estate Economics resume should highlight analytical methodologies (DCF, residual valuation, sensitivity analysis), project volume (100+ projects reviewed), deliverables created (market reports, investor recommendations), and technical tools (Excel, SPSS, MLS, Argus). Include academic projects that demonstrate real-world application of economic analysis to real estate decisions.

Entry-level real estate economics positions see moderate competition, with stronger demand in major markets (NYC, LA, Chicago, Toronto). Candidates with internship experience at developers, investment firms, or appraisal companies have significant advantages. Proficiency in financial modeling and familiarity with industry software (Argus, CoStar) differentiates new graduates.

Present academic projects like professional work: state the objective (investor analysis for apartment building), methodology (DCF, sensitivity analysis), scope (8-year projection), and deliverable (recommendations to investors). Use active language and quantify where possible. Group significant projects under "Key Projects" to give them visibility separate from coursework lists.

Essential skills include Excel financial modeling (DCF, pro forma), statistical analysis (SPSS, R), and industry platforms (MLS, CoStar, Argus Enterprise). Understanding of valuation approaches (income, sales comparison, cost, residual) is fundamental. GIS mapping skills add value for urban economics roles. SQL and data visualization tools are increasingly important.

It depends on your target path. Appraisal licensure is essential if you want to sign appraisal reports and is valuable for valuation-focused roles. For development or investment analysis, licensure is less critical but demonstrates valuation competency. Many analysts work under licensed appraisers initially. Consider the MAI designation from the Appraisal Institute for long-term credentialing.

Translate academic work into business language: "completed thesis" becomes "performed comprehensive market analysis." Seek internships during your program—even part-time exposure to developers, REITs, or brokerage research teams provides credibility. Join industry organizations (ULI, NAIOP) for networking. Build a portfolio of analysis samples you can discuss in interviews, demonstrating your ability to deliver professional-quality work.

Ready to Transform Your Resume?

Schedule your 15-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an Advisor 1-877-777-6805