Accounts Payable Receivable

Resume Sample

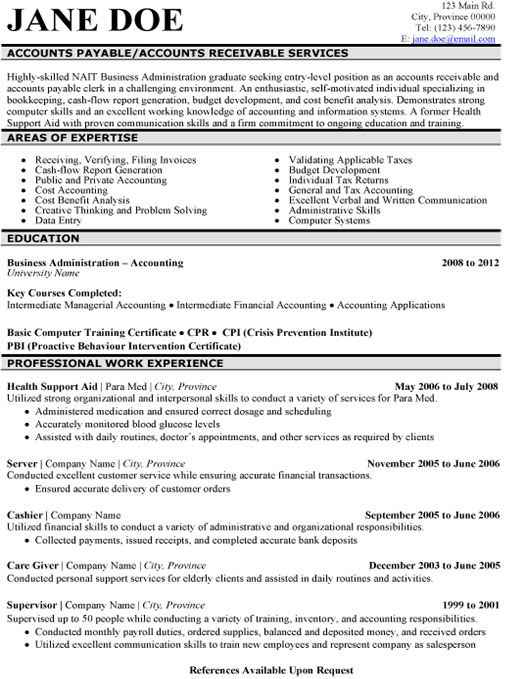

A real resume example showing how we transform accounting education and transferable experience into proof employers trust

Being qualified isn't enough — you need to be the obvious choice.

We fix your resume with one conversation

What Makes a Strong Accounts Payable Receivable Resume?

An entry-level Accounts Payable Receivable resume must connect academic training to practical job requirements. Hiring managers scan for accounting coursework, attention to detail, and any financial transaction experience. This sample demonstrates how a Business Administration graduate leverages supervisory payroll experience, cash handling from service roles, and relevant accounting coursework to position for entry-level AP/AR opportunities.

Why Do Accounts Payable Receivable Resumes

Get Rejected?

Most accounts payable receivable resumes get rejected not because of ATS software, but because they don't prove you're better than the other 51 applicants. Generic bullets like "managed construction projects" don't differentiate you — quantified achievements do.

See how we transform generic statements into interview-winning proof:

Conducted monthly payroll duties, ordered supplies, balanced and deposited money, and received orders."

This bullet establishes scope (50 employees) while pivoting to the accounting responsibilities that matter for AP/AR roles. Listing specific duties—payroll, balancing, deposits, orders—proves hands-on financial transaction experience that directly transfers to accounts payable/receivable functions.

Collected payments, issued receipts, and completed accurate bank deposits."

This transformation shows cashier experience as professional financial transaction handling. The specific duties—payments, receipts, deposits—are exactly what AP/AR clerks do daily. "Accurate bank deposits" signals the attention to detail employers need.

Ensured accurate delivery of customer orders."

This bullet repositions service industry experience as relevant financial transaction handling. For entry-level AP/AR, employers value candidates who can balance accuracy with professional communication—this bullet proves both capabilities in a fast-paced environment.

How Do Student Resume Writers Transform a Accounts Payable Receivable Resume?

Professional resume writers transform accounts payable receivable resumes by analyzing job postings for required keywords, extracting specific achievements through targeted questions, quantifying impact with dollar values and percentages, and positioning you as the solution to employer problems.

We Analyze Accounts Payable Receivable Job Postings

We identify exactly what hiring managers search for:

- Budget management and cost control requirements

- Schedule recovery and timeline management skills

- Site safety compliance and OSHA standards

- Subcontractor coordination and vendor management

We Extract Your Achievements

Our 1-on-1 interview uncovers:

- Project values and budgets you've managed

- Team sizes and subcontractors you've coordinated

- Problems you've solved that others couldn't

- Metrics you didn't think to track or quantify

We Quantify Your Impact

We find the numbers that prove ROI:

- Dollar values of projects completed on time

- Percentage of schedule improvements achieved

- Cost savings from value engineering decisions

- Safety record improvements and incident reductions

We Position You as the Solution

Your resume proves you solve employer problems:

- Delivering projects on time despite site challenges

- Managing subcontractors and maintaining quality

- Controlling costs while meeting specifications

- Leading teams through complex project phases

Listen to a Real Resume Interview

Hear how our writers extract transferable skills through strategic questioning.

What Does a Accounts Payable Receivable Resume Interview Look Like?

A accounts payable receivable resume interview is a conversation where our writer asks targeted questions about your projects, probes for specific details, and extracts achievements you'd never think to include.

Supervised up to 50 people while conducting a variety of training, inventory, and accounting responsibilities.

Conducted monthly payroll duties, ordered supplies, balanced and deposited money, and received orders.

Every bullet on this resume was created through this same process.

Schedule Your InterviewHave questions? 1-877-777-6805

Watch How We Transformed Khoi's Resume

See how our interview process uncovered achievements that helped Khoi land their first professional role.

Get Your Resume Transformed

What a Accounts Payable Receivable Resume Example That Gets Interviews Looks Like

A complete accounts payable receivable resume is typically 1-2 pages and includes a professional summary, core competencies, detailed work experience with quantified achievements, education, and certifications. Here's an actual resume created through our interview process.

Which Accounts Payable Receivable Resume Example

Do You Need?

The accounts payable receivable resume you need depends on your career stage:

Career Entry

Your resume needs to prove you have the foundational accounting knowledge, attention to detail, and reliability that employers require for handling financial transactions.

Questions We Ask in Your Interview:

- What accounting coursework have you completed that applies to AP/AR functions?

- What experience do you have handling money, payments, or financial records?

What We Highlight on Your Resume:

- Relevant accounting education and coursework

- Any experience with cash handling, payments, or financial documentation

Career Growth

Your resume needs to differentiate you through volume handled, accuracy metrics, and process improvement contributions.

Questions We Ask in Your Interview:

- What invoice or payment volumes have you processed monthly?

- What process improvements have you contributed to in AP/AR functions?

What We Highlight on Your Resume:

- Transaction volumes and accuracy rates

- Process improvements and system proficiencies

How Do You Write a Accounts Payable Receivable Resume That Gets Interviews?

To write a accounts payable receivable resume that gets interviews, focus on four key sections:

- Professional Summary — highlighting your experience level and specialty areas

- Skills Section — matching keywords from your target job postings

- Work Experience — quantified achievements using the Problem-Solution-Result format

- Credentials — relevant certifications and education

Most entry-level AP/AR resume guides give you generic templates that bury your potential. Our approach extracts your transferable skills, relevant education, and financial experience through targeted interview questions—revealing the accuracy, reliability, and accounting foundation that employers actually want to see.

What Should an Entry-Level AP/AR Candidate Put in Their Professional Summary?

Your summary must establish credibility despite limited experience. Education carries significant weight for entry-level roles. Signal enthusiasm, reliability, and relevant knowledge to overcome the experience gap.

Lead with your education—degree, major, institution. Include your target position and key qualifications: accounting coursework, relevant skills (bookkeeping, cash-flow analysis, tax preparation), and work ethic descriptors. Mention any hands-on financial experience even if from non-accounting roles.

Students and recent graduates need to emphasize education and transferable experience.

Expert Questions We Ask:

- "What accounting coursework have you completed?"

- "What hands-on experience do you have with financial transactions or record-keeping?"

Entry-level employees moving to senior roles should emphasize volume and accuracy metrics.

Expert Questions We Ask:

- "What invoice or payment volumes do you process monthly?"

- "What systems or processes have you helped improve?"

What Skills Should an Entry-Level AP/AR Candidate Highlight?

Skills should reflect both what you've learned (coursework) and what you've practiced (work experience). Don't list skills you can't demonstrate—employers will test your proficiency. Prioritize skills mentioned in job postings.

Lead with accounting-specific skills: invoice processing, cash-flow reporting, cost accounting, tax validation. Include technical skills: data entry, computer systems, Excel. Add soft skills that matter for AP/AR: attention to detail, problem-solving, communication.

Entry-level candidates should include both learned and practiced skills.

Expert Questions We Ask:

- "What accounting software or systems have you used?"

- "What skills from your coursework can you apply immediately?"

Those with experience should emphasize advanced skills.

Expert Questions We Ask:

- "What accounting software are you most proficient in?"

- "What specialized AP/AR functions have you mastered?"

How Should Entry-Level Candidates Describe Their Work Experience?

Every bullet should connect to AP/AR functions. "Collected payments, issued receipts, and completed accurate bank deposits" is better than "worked cash register." Find the accounting in every role.

Reframe every role to highlight AP/AR-relevant responsibilities: financial transactions, record-keeping, balancing, deposits, customer communication. Quantify where possible—number of people supervised, transactions handled. Lead with responsibilities, not job titles.

Candidates from non-accounting roles should emphasize transferable duties.

Expert Questions We Ask:

- "What financial responsibilities did you have in previous roles?"

- "How have you demonstrated attention to detail and accuracy?"

Those with AP/AR experience should quantify their contributions.

Expert Questions We Ask:

- "What volumes and accuracy rates can you document?"

- "What process improvements have you contributed to?"

How Should Entry-Level Candidates Present Their Education?

Education should demonstrate you have the foundational knowledge to succeed. Include certifications (even CPR or computer training) to show professionalism. GPA only if strong (3.5+). Relevant coursework fills space that experience will occupy later in your career.

Position education prominently—for entry-level, it's your primary qualification. Include degree, major, institution, and graduation date. List relevant coursework (financial accounting, managerial accounting, accounting applications) to show specific preparation.

Students and recent graduates should maximize their education section.

Expert Questions We Ask:

- "What courses most directly prepared you for AP/AR work?"

- "What certifications or additional training have you completed?"

Experienced candidates can condense education as experience grows.

Expert Questions We Ask:

- "What continuing education have you pursued in accounting?"

- "Are you pursuing any additional certifications?"

Skip the guesswork — let our expert resume writers ask these questions for you.

Schedule Your Resume InterviewHow Does a Resume Interview Extract

Your Accounts Payable Receivable Achievements?

A professional resume interview extracts accounts payable receivable achievements by probing into specific projects, uncovering the goals you were trying to achieve, documenting the systems and processes you implemented, and surfacing challenges you overcame.

What Projects Should You Include

on a Accounts Payable Receivable Resume?

Include projects that demonstrate scope, stakes, and significance. We probe to understand the project value, team size, and your specific role.

How Do You Show Business Impact

on a Resume?

Connect your work to business outcomes by documenting the company's objectives and how your contributions achieved them.

What Systems and Processes

Should You Highlight?

Document the specific systems, processes, and strategies you implemented. This is where your expertise becomes visible.

How Do You Present

Challenges Overcome?

Describe challenges you faced and how you solved them. Problem-solving examples prove you can handle obstacles.

The Power of a 1-on-1 Resume Interview

No cookie-cutter calls. Your interview length matches your career complexity. We ask the questions you can't ask yourself.

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

Telephone Interview

How Competitive Is the

Accounts Payable Receivable Job Market?

Accounts Payable Receivable jobs are highly competitive, averaging 52 applicants per position. With most job seekers applying to 20+ roles, you're competing against approximately 1,040 candidates for the same jobs.

Accounts Payable Receivable Job

Jobs Posted (30 Days)

Per 20 Applications

Here's the math most job seekers don't do:

Your resume needs to stand out against 1,040 other student professionals.

Most of them list the same projects. The same certifications. The same responsibilities.

What makes you different is the story behind the projects.

Student Professionals We've Helped Are Now Working At

From general contractors to specialty trades, our clients land roles at top student firms across North America.

Reach Student's Hidden Job Market

80% of student positions are never advertised. Get your resume directly into the hands of recruiters filling confidential searches.

Student Recruiter Network

When you purchase our Resume Distribution service, your resume goes to 520+ recruiters specializing in student — included in Advanced & Ultimate packages.

Amanda Chen

Toronto, ON

Marcus Williams

New York, NY

Sample Student Recruiters

520+ Total| Agency | Location |

|---|---|

AC Amanda Chen |

Toronto, ON |

MW Marcus Williams |

New York, NY |

JP Jennifer Patel |

Chicago, IL |

RK Robert Kim |

Los Angeles, CA |

Frequently Asked Questions About

Accounts Payable Receivable Resumes

An entry-level AP/AR resume must demonstrate foundational accounting knowledge and attention to detail. Include your accounting education—degree, relevant coursework (financial accounting, managerial accounting), and any certifications. Highlight any experience handling money, processing payments, or maintaining financial records.

Emphasize transferable skills from any work experience: cash handling from cashier roles, data entry accuracy, customer communication, and organizational abilities. Software proficiency in Excel and any accounting programs (QuickBooks, Sage) adds value.

Entry-level AP/AR positions see high competition with approximately 52 applicants per position. These roles are accessible entry points to accounting careers, attracting both recent graduates and career changers.

Stand out by emphasizing accuracy and reliability—employers prioritize candidates who won't make costly errors. Any quantifiable experience (transactions processed, accuracy rates) helps. Candidates with both education and practical cash handling experience have advantages over those with only one.

Essential skills include attention to detail for accurate data entry and transaction processing, basic accounting knowledge (debits/credits, reconciliation), and proficiency with spreadsheets. Communication skills matter for vendor and customer interactions, especially in collections.

Technical skills should include accounting software familiarity (QuickBooks, Sage, SAP) and strong Excel abilities (VLOOKUP, pivot tables). Organizational skills for managing multiple invoices and deadlines, plus problem-solving for discrepancy resolution, round out the profile.

Reframe cashier experience as financial transaction handling. Instead of "worked as cashier," describe specific duties: processing payments, balancing cash drawers, preparing deposits, handling discrepancies. These are directly relevant to AP/AR functions.

Emphasize accuracy and accountability—if you consistently balanced your drawer or handled high transaction volumes without errors, that's exactly what AP/AR employers need. Customer service skills also transfer to accounts receivable collections and vendor communications.

Prioritize courses directly relevant to AP/AR functions: Financial Accounting, Managerial Accounting, Cost Accounting, and any bookkeeping or accounting applications courses. Tax accounting coursework adds value, as does any exposure to accounting software or ERP systems.

If you took courses in business communications, business math, or computer applications, include those too—they support the soft skills and technical abilities AP/AR roles require. List specific courses only if you lack professional experience to fill the space.

Yes—reframe non-accounting experience to highlight transferable skills. Supervisory roles show responsibility and accountability. Customer service demonstrates communication skills essential for AR collections. Any role involving money handling, record-keeping, or data entry directly applies.

Focus on responsibilities, not job titles. A server who "ensured accurate financial transactions" is more relevant than one who "took orders." Find the accounting-adjacent duties in every role and emphasize those for your AP/AR application.

Ready to Transform Your Resume?

Schedule your 15-minute interview and get a resume that proves you're the obvious choice.

Choose Your Interview LengthHave Questions?

Talk to an advisor who can recommend the right package for your situation.

Talk to an Advisor 1-877-777-6805